Pressing question is was the land over valued earlier based upon its fertility to yield throughout seasons & ample water availability but reality turned out to be different ? https://twitter.com/jatin_khemani/status/1266682609251291136

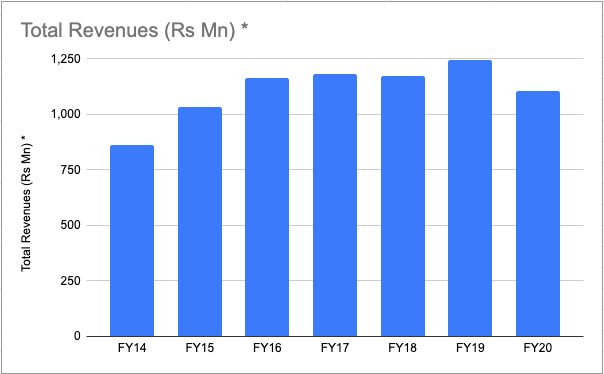

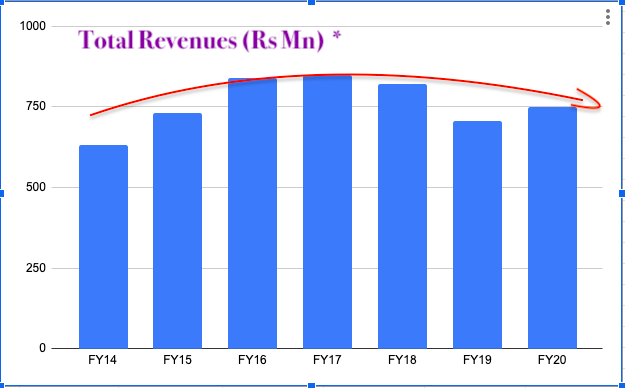

Post IPO wonderla existing parks reached the point of diminishing return.

Bangalore-

Diminishing growth in revenue last 6-7 years.

No. of visitors have actually declined.

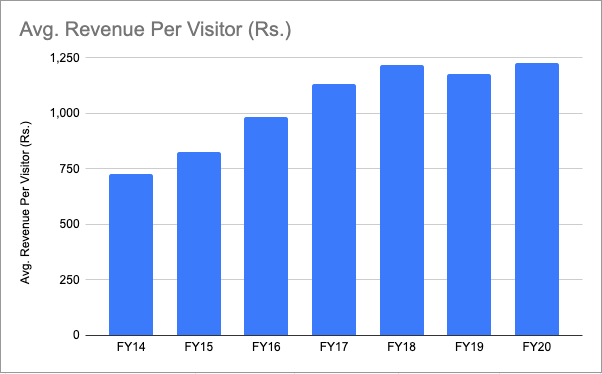

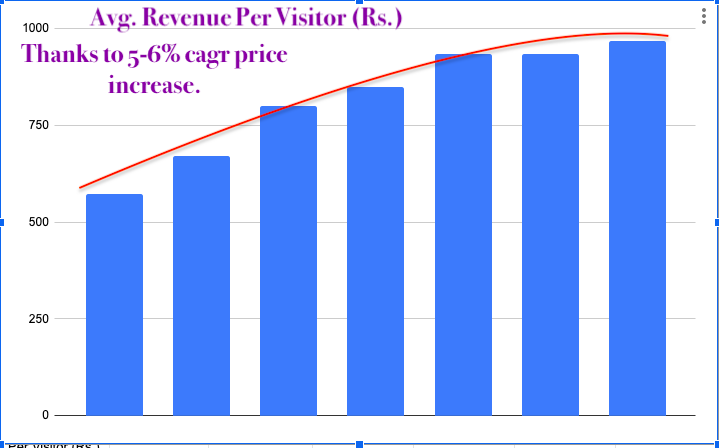

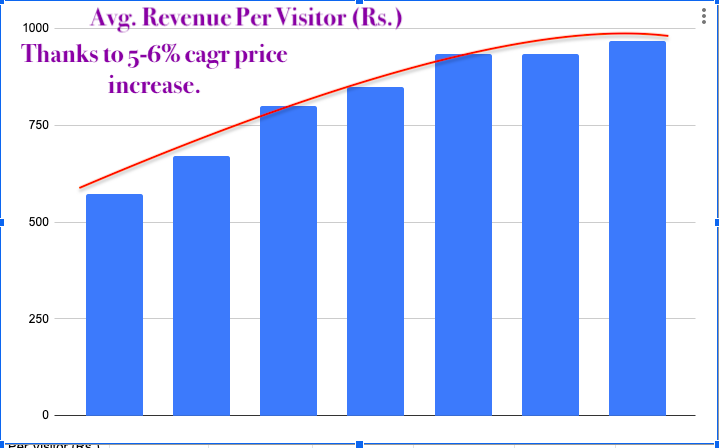

Thanks to some pricing power 5% increase yoy their revenue didn't de-grow but de-grew in inflation terms

Bangalore-

Diminishing growth in revenue last 6-7 years.

No. of visitors have actually declined.

Thanks to some pricing power 5% increase yoy their revenue didn't de-grow but de-grew in inflation terms

Pre IPO company was growing 25% CAGR , proven business model in two cities Kochi & Bangalore, Fund was raised to open two more park hyderabad & chennai, then analysts extrapolated 4 parks cash flows = 2 more parks leads to 6 parks cash flows = 3 more parks so on ...

6 Flags,

Unorganized to organized,

Proven management,

Young passionate promoter (visited theme parks all over the world),

Theme park industry in India Vs US comparison,

In house facility to make rides.

Great narrative leads to over pricing ?

Unorganized to organized,

Proven management,

Young passionate promoter (visited theme parks all over the world),

Theme park industry in India Vs US comparison,

In house facility to make rides.

Great narrative leads to over pricing ?

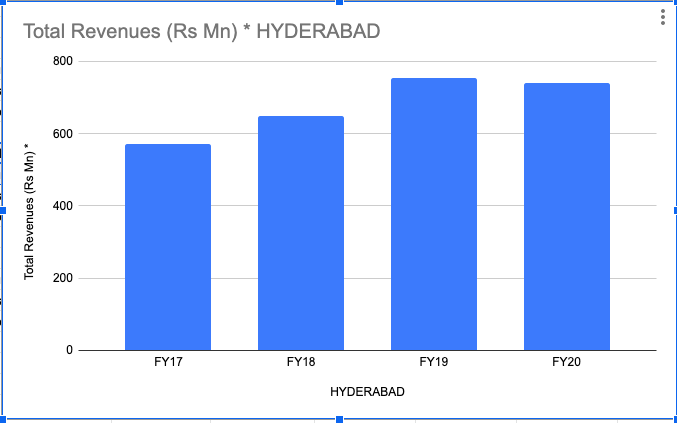

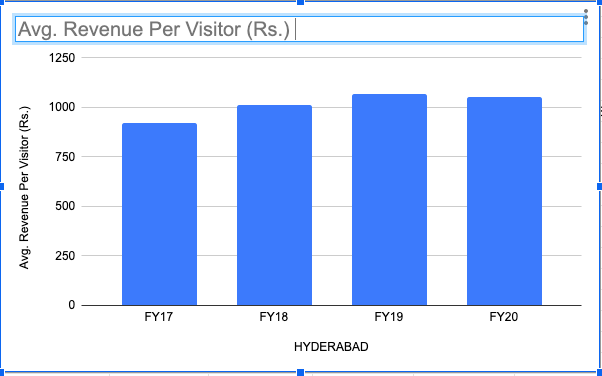

What is the reality - they started building hybd park in 2014, invested Rs 250 Cr, generated 57 Cr revenue in Fy17, then 64,75,72 Cr in next 3 years, from paper planning Fy14 to Fy20 they were able to earn capital they invested Rs 250 in 7 years.

That is 10% cagr returns ( revenue / invested capital), if you consider their 40% EBITA margin then ROCEs going to look really bad.

and the chennal plant is still on papers, Rs 120 of cash is doing better than business as invested in debt funds.

and the chennal plant is still on papers, Rs 120 of cash is doing better than business as invested in debt funds.

Question is why in the country like India their parks are reaching out to the point of diminishing returns so early ?

concalls are full of external reasoning like -

Extended Rains, floods in kerala, Nipah Virus, Exams postponed for kids etc. every year something new.

concalls are full of external reasoning like -

Extended Rains, floods in kerala, Nipah Virus, Exams postponed for kids etc. every year something new.

There has to something else causing footfalls to top out at around 10% of city population.

I think it more to do with affordability than external factors, As going to park with family of 4 will cost you around 5000 in tickets + 2000 of food / travel etc.

and 1 full day of time.

I think it more to do with affordability than external factors, As going to park with family of 4 will cost you around 5000 in tickets + 2000 of food / travel etc.

and 1 full day of time.

Good thing about the wonderla business is it works and when something works you need to add leverage to it to maximize returns. which for some reason management shy away from doing it.

Although they can build park in 18 months but buying land, getting all approvals etc takes 2-3 years + 18 months to get the capex done (Eg- chennai) which really diminish the returns for the shareholders.

They can get land on long term lease rather than buying to maximize the returns for their shareholders & expand into few more many cities early as there is lag when they get approvals. so, by the time they get it they will have the cash reserve ready for expansion.

Overall if foot falls going to remain same in existing parks and new parks going to show same pattern of topping out at 10% of city population then this "land" is probably over valued even today.

Read on Twitter

Read on Twitter