~2 months ago I pitched to @SpartanBlack_1 that $LEND market cap will overtake $MKR.

A walk through my reasoning: https://twitter.com/StaniKulechov/status/1284723736571252741

A walk through my reasoning: https://twitter.com/StaniKulechov/status/1284723736571252741

1/ While most consider @MakerDAO to be a stablecoin, it is at its core a credit facility.

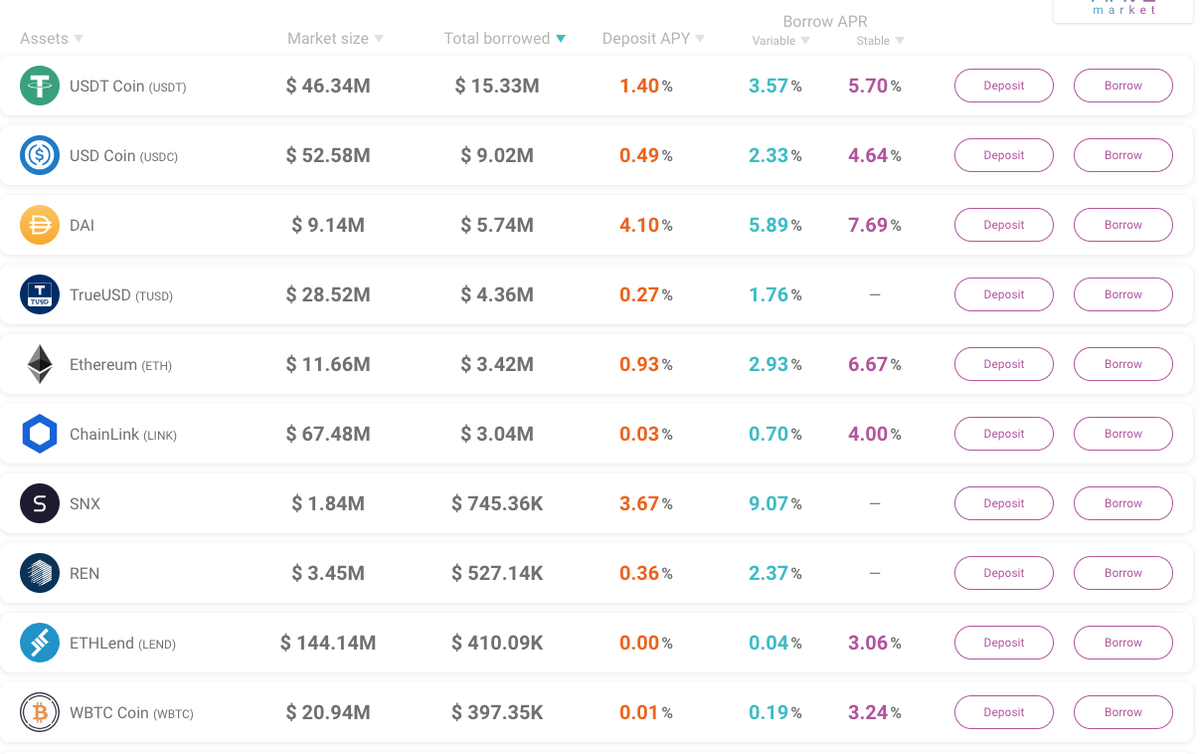

Today, I'd venture to say 90%+ of demand for DeFi borrowing is for leverage, which means stablecoins are naturally the most borrowed assets.

Today, I'd venture to say 90%+ of demand for DeFi borrowing is for leverage, which means stablecoins are naturally the most borrowed assets.

2/ While $DAI is a critical pillar for DeFi, traders today prefer liquidity over trust minimization. It's *much* harder to trade against DAI than USDT.

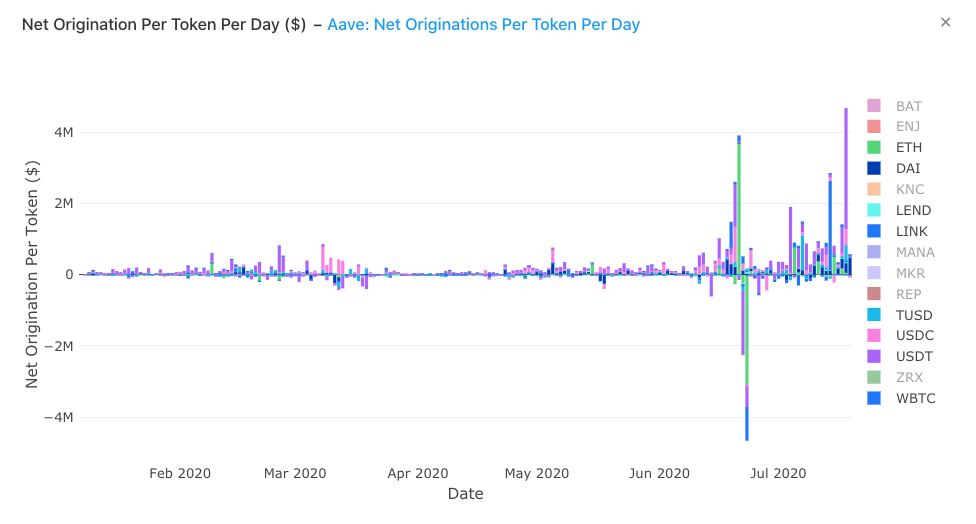

As a venue that provides USDT/C, + other stablecoins, @AaveAave was the natural place to absorb the demand for leverage.

As a venue that provides USDT/C, + other stablecoins, @AaveAave was the natural place to absorb the demand for leverage.

3/ For the first half of May, $LEND's market cap:TVL ratio was converging with that of $MKR.

If collateral is a lending protocol's unforkable moat (for now), it meant the market was starting to price the value locked in Maker and Aave as the same.

If collateral is a lending protocol's unforkable moat (for now), it meant the market was starting to price the value locked in Maker and Aave as the same.

4/ As a newer platform with a more aggressive shipping schedule, more features (flash loans, more asset pairs) and a higher growth rate, $LEND's collateral should be priced higher per $.

This was the signal to start paying attention.

This was the signal to start paying attention.

5/ At first @SpartanBlack_1 and I disagreed - compared to Compound's last equity value (~$100m) and on a fee multiples basis, $LEND at $75m looked fairly priced to moderately expensive.

Maker's native stablecoin also warranted a premium in val.

This changed when $COMP launched.

Maker's native stablecoin also warranted a premium in val.

This changed when $COMP launched.

6/ Even after an initial correction, $COMP's value *far* exceeded our estimates (~$30).

Introduction of liquidity mining clearly reignited risk in DeFi markets, and hints at a token model revamp likely meant better value capture for $LEND token as well.

Introduction of liquidity mining clearly reignited risk in DeFi markets, and hints at a token model revamp likely meant better value capture for $LEND token as well.

7/ Side note: In a bear cycle, I used fee multiples to identify undervalued assets like $KNC back in Dec 2019.

In a bull cycle, using LTM/ NTM fee multiples or DCFs to justify fair valuation means I will miss out on every move.

Relevant... https://twitter.com/chamath/status/1280531290635157505?lang=en

In a bull cycle, using LTM/ NTM fee multiples or DCFs to justify fair valuation means I will miss out on every move.

Relevant... https://twitter.com/chamath/status/1280531290635157505?lang=en

8/ I've received messages when $LEND traded at $90m, $150m, $200m - typically along the lines of "seems overbought, should wait for correction".

At $80m, I had my reservations against val as well, before diving more into Aave's plans.

$LEND is currently valued at $400M.

At $80m, I had my reservations against val as well, before diving more into Aave's plans.

$LEND is currently valued at $400M.

9/ For those less sensitive to short term vol, here's a longer term outlook.

Lending Club mcap: 1B, most activity in US

Transferwise last private val: 3B

With more DeFi tokens resembling pseudo equity, I won't be surprised to see a few of the lending protocols valued at $1B+

Lending Club mcap: 1B, most activity in US

Transferwise last private val: 3B

With more DeFi tokens resembling pseudo equity, I won't be surprised to see a few of the lending protocols valued at $1B+

fin/ cc My fellow DeFi heads @Arthur_0x @Rewkang @QWQiao and kudos to the relentless team at @AaveAave @StaniKulechov !

Read on Twitter

Read on Twitter