ITT $YFI and yield farming on a whole other galaxy summarised

While everyone was busy with $MTA last night @AndreCronjeTech went ahead and shipped out a token for @iearnfinance $YFI and with it 2 governance proposals with huge implications

While everyone was busy with $MTA last night @AndreCronjeTech went ahead and shipped out a token for @iearnfinance $YFI and with it 2 governance proposals with huge implications

If you've been living under a rock

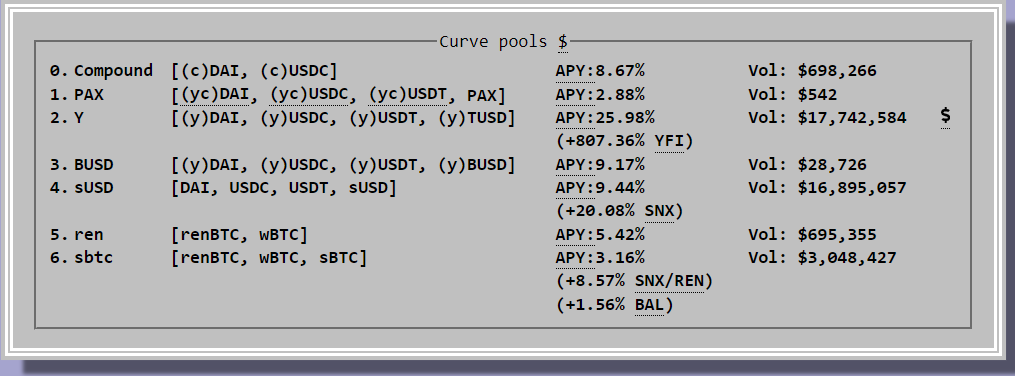

@iearnfinance was the OG of yield-aggregators and what the y Pool on @CurveFinance is built on top off.

TLDR It finds the best on-chain rates for yields and automates it. Had around $8m AUMs with ~10.5% yields on aggregate before $YFI Launch

@iearnfinance was the OG of yield-aggregators and what the y Pool on @CurveFinance is built on top off.

TLDR It finds the best on-chain rates for yields and automates it. Had around $8m AUMs with ~10.5% yields on aggregate before $YFI Launch

Time

TimeIf you own yCurve Tokens it's a no brainer to stake it onto the yearn staking contract to earn ~800% APR

Why the high rates?

It's based on the value of the $YFI Token which has skyrocketed to ~$20m FD Valuation.

You earn *at least* Interest + Swap Fees + $YFI + $CRV

AUMs of @iearnfinance has 10x-ed since the launch of the token to ~$80m

$YFI's Balancer Pools with a 98% DAI 2% YFI structure has more DAI than next 5 holders COMBINED

Literally a DAI Supply Side Liquidity Crisis right now as LPs rush for $YFI Rewards

$YFI's Balancer Pools with a 98% DAI 2% YFI structure has more DAI than next 5 holders COMBINED

Literally a DAI Supply Side Liquidity Crisis right now as LPs rush for $YFI Rewards

Is there value to $YFI ?

As @AndreCronjeTech puts it, no. But yield bros think otherwise

Theories like Valuation > AUM create pseudo ponzinomics

Stake -> AUM Up <> Price up as people buy to stake

$YFI can be also burnt to claim fees generated

As @AndreCronjeTech puts it, no. But yield bros think otherwise

Theories like Valuation > AUM create pseudo ponzinomics

Stake -> AUM Up <> Price up as people buy to stake

$YFI can be also burnt to claim fees generated

Read on Twitter

Read on Twitter