The unreasonable ineffectiveness of macroeconomics in political science

Is economics a science?

While the scientific method suggests itself to the hardest of soft sciences—through empirical testing, rejection or acceptance of hypotheses, the winnowing and sifting of ideas—

Is economics a science?

While the scientific method suggests itself to the hardest of soft sciences—through empirical testing, rejection or acceptance of hypotheses, the winnowing and sifting of ideas—

macroeconomics falls woefully short of such enlightenment hopes.

Among the many reasons for this, here are three:

First, most obviously, there are no “givens” or the equivalent to unchanging physical or slow-moving biological backdrop;

Among the many reasons for this, here are three:

First, most obviously, there are no “givens” or the equivalent to unchanging physical or slow-moving biological backdrop;

technological progress and changing financial structure means the impact of a policy action tomorrow will vary from it’s equivalent yesterday; expectations matter, the Lucas Critique and Goodhart’s Law are real, if sometimes overstated.

Second, most disappointing, there is no body of knowledge—or system of fundamental truths—passed through generations upon which the profession can call to address particular questions. Instead the subject moves through fads and phases,

emphasizes particular techniques or schools of thought, forgets past discoveries in favour of new, less useful, ideas.

In part this is because the teaching of macroeconomics leans heavily on those academically inclined, obsessed with abstract analysis for the purpose

In part this is because the teaching of macroeconomics leans heavily on those academically inclined, obsessed with abstract analysis for the purpose

of top journal publication. But such esoteric lucubration is seldom useful to the issues on the frontline of policymaking. Yet these are the tools the modern macroeconomist carries from classroom to boardroom, arriving ill-equipped to supply answers to questions asked.

And third, though probably most important, the practice of macroeconomics is fundamentally embedded in the political process—to the point where it does not provide advice or guidance objectively, allowing politicians to draw as necessary on this, rather contorting ...

policy advice based on what political necessity. Or, alternatively, those “macroeconomists” who rise to the top in public policymaking are the most sycophantic, analytically and ethically flawed.

The above observations can only be understood when witnessed up close, of course.

And there is perhaps no greater example of the unreasonable ineffectiveness of macroeconomics in political science than the evolution and atrophy of IMF macroeconomics.

And there is perhaps no greater example of the unreasonable ineffectiveness of macroeconomics in political science than the evolution and atrophy of IMF macroeconomics.

Let’s skim over three specific examples.

https://thegeneraltheorist.com/myth-of-imf-macro/

First, the Latvia program, where I was the most junior IMF team member, and so an insider for the first time in terms of reflecting on these events.

https://thegeneraltheorist.com/myth-of-imf-macro/

First, the Latvia program, where I was the most junior IMF team member, and so an insider for the first time in terms of reflecting on these events.

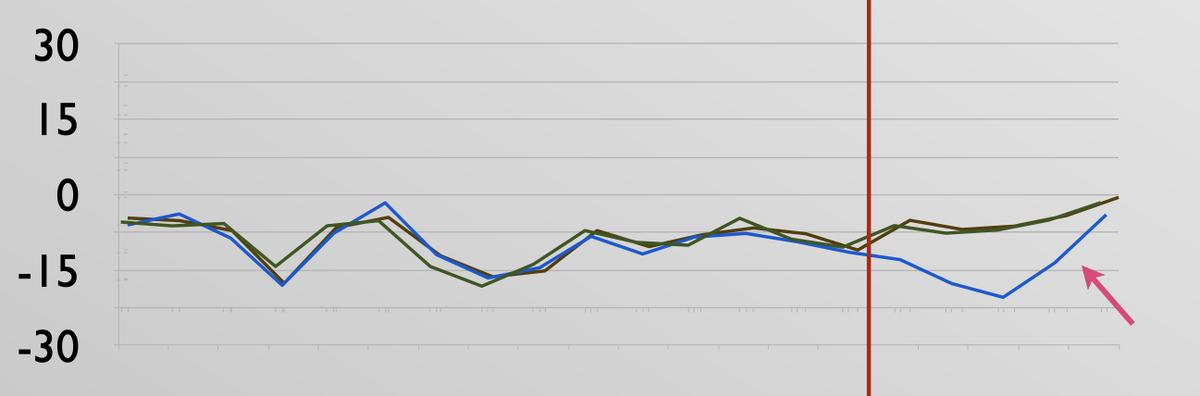

What I witnessed was an act of fraud by senior officials I never imagined I would witness in my professional life. This can be seen in one chart, as below.

There are three lines in this chart and these three lines should move perfectly together. Historically minor deviations are due to errors and omissions in data from various sectors of the economy.

But in prospect, in the forecast horizon (to the right of the red vertical line) they deviate. Why? Because IMF staff committed fraud and the program was a nonsense.

If the IMF happily signs off on forward looking accounting irregularities, what world are we in?

This is not Martin Wolf’s characterisation of the IMF as “the queen of international economic organisations: the most influential, most respected and most professional.”

This is not Martin Wolf’s characterisation of the IMF as “the queen of international economic organisations: the most influential, most respected and most professional.”

The detailed consequences of this fraud we need not deal with here, except to note that the most basic of “scientific” constraints—those basic accounting constraints—were compromised in favour of political necessity. Twenty years of schooling and they put you on the day shift.

The second example is Greece, a much more consequential case of course. But the pattern of behaviour was the same. IMF staff produced a program that didn’t even obey the most basic adding up constraints, the Greek people were ...

subjected to depression long before debt restructuring was belatedly and inadequately enforced.

This crucifixion of the Greeks initially involved the Fund assuming that the Greeks could generate substantial external income—of more than €30 billion per year by 2015, or

This crucifixion of the Greeks initially involved the Fund assuming that the Greeks could generate substantial external income—of more than €30 billion per year by 2015, or

roughly 13% of initial GDP—to replace fiscal compression and shoulder the burden of growing burden of external debt.

Moreover, as the program evolved, the ECB wanted her money back, and so the banks were additionally required to compress credit to the Greek private sector...

Moreover, as the program evolved, the ECB wanted her money back, and so the banks were additionally required to compress credit to the Greek private sector...

—on top of the fiscal contraction—and was now asked to find a further €16 billion per year from abroad to repay the ECB—on top of the original €30 billion per year to sustain spending in the economy. https://thegeneraltheorist.com/2020/05/24/the-imf-and-the-crucifixion-of-the-greeks/

The third example is Argentina’s Ponzi Program, yet another example of IMF staff putting at risk international taxpayer money while creating additional unnecessary damage to those least capable of shouldering the burden of adjustment.

The case of Argentina involved signing off on a program that involved Ponzi financing of the central bank—perpetual monetary financing of the cost of monetary policy without factoring in fiscal support.

This meant the true consolidated government deficit was at least 2% of GDP worse than the official Federal government numbers implied, and the true debt position less favorable.

Without challenging the political incentive to lend to the Macri administration, but put public money on the line to prop up a Ponzi scheme, the IMF created the monster it was intended to avoid—a populist administration in Buenos Aries once more.

All this was easily foreseen to those following from afar. https://thegeneraltheorist.com/2020/07/16/argentinas-ponzi-program-revisited-presentations/

In this way we are led back to contemplate the unreasonable ineffectiveness of macroeconomics in political science. How is it that macroeconomics is so divorced from the real world? Why is this acceptable?

One reason this is acceptable is that the macroeconomics community continually denies responsibility and refuses to accept responsibility. This is not their concern, it’s someone else’s fault.

But more important, macroeconomists continue to be useful idiots to those in power. Someone is needed to justify their nonsense policies, regardless of the damage that is being done.

And so those inflicted by unnecessary poverty from Athens to Buenos Aries are united as pawns in the game of chess of the modern macroeconomist—and the ineffectiveness of their subject in modern political science.

But you can read more about it in the near future: https://thegeneraltheorist.com/myth-of-imf-macro/

Read on Twitter

Read on Twitter