Tested the Golden Ratio Strategy that was doing rounds on Twitter since last month.

Instrument: Bank Nifty

Calculate:

(Previous Day High - Previous Day Low + Opening 10m Range)*61.8%

Break above (PDC + calculated number) -> buy.

Break below PDC-Calculated num -> sell.

Instrument: Bank Nifty

Calculate:

(Previous Day High - Previous Day Low + Opening 10m Range)*61.8%

Break above (PDC + calculated number) -> buy.

Break below PDC-Calculated num -> sell.

Stop loss is 0.5% from the entry point.

Trail the stop loss until SL is hit or end of day.

I tested it like this:

1. Check the entry conditions on Spot. Take the trade on futures.

2. Check the entry and take the trade - both on futures.

Only 1 lot fixed trade size.

Trail the stop loss until SL is hit or end of day.

I tested it like this:

1. Check the entry conditions on Spot. Take the trade on futures.

2. Check the entry and take the trade - both on futures.

Only 1 lot fixed trade size.

If you started with 1 lakh and added no further capital, it's most likely you started and weren't able to trade after a couple months at all. You most likely needed to put in additional money to keep trading. If you used intraday leverage, this shouldn't have been an issue.

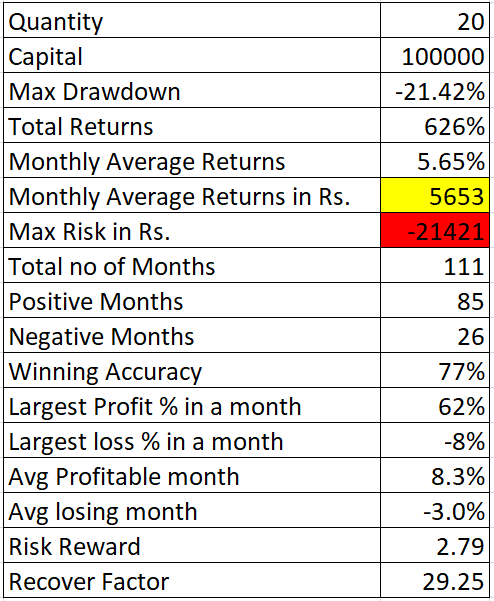

This particular screenshot shows a very optimistic statistic. I am not sure if the returns are as optimistic.

1.a) Here are the parameters I have got for the strategy - with NO RE-ENTRY:

Starting capital 1L

Ending capital 390512 (kept required margin as 50k as MIS leverage would be another 50k)

Monthly average points - 33.

Max DD - 26.31%

Total trades - 2065

Won - 803

Lost - 1262

Starting capital 1L

Ending capital 390512 (kept required margin as 50k as MIS leverage would be another 50k)

Monthly average points - 33.

Max DD - 26.31%

Total trades - 2065

Won - 803

Lost - 1262

Average win: 2316.96 rupees

Average loss: -1243.85 rupees

Risk-Reward ratio: 1.86

Total max dd in amount - 42592 (through a series of trades)

CAGR: 15.42%

CAGR/max DD - 0.58

This was done by taking commissions to be 0.1 of turnover.

Average loss: -1243.85 rupees

Risk-Reward ratio: 1.86

Total max dd in amount - 42592 (through a series of trades)

CAGR: 15.42%

CAGR/max DD - 0.58

This was done by taking commissions to be 0.1 of turnover.

1.b) WITH RE-ENTRY

Starting capital 1L.

Ending capital 281711

Total trades: 6353

Won: 2456

Lost: 3897

Max DD: 51%

Win Rate: 38.65%

Avg win: 2015

Avg loss: -1223

Risk VS Reward: 1.64

CAGR: 11.51%

CAGR/MaxDD - 0.22

Starting capital 1L.

Ending capital 281711

Total trades: 6353

Won: 2456

Lost: 3897

Max DD: 51%

Win Rate: 38.65%

Avg win: 2015

Avg loss: -1223

Risk VS Reward: 1.64

CAGR: 11.51%

CAGR/MaxDD - 0.22

Tested with BN Futures, yielded more or less similar results. No-re-entry strategy was better than with re-entry. But still, the results are far-cry from what was given as actual backtest result on the sheet. If you're interested to backtest, code it up and backtest yourself.

If you want to trade this system, proceed with caution. My advise - don't. It's useless. You'd only be blowing your money away. Either way, 15% CAGR is something you could achieve with mutual fund investments. Why bother with active trading?

This is the case with most of the systems sold by these jobless failed traders. Either they share the system without the optimisations or parameters that are required to get the performance they claim, or they know that the system is worthless and sell it to you for thousands.

Just indulge in some imagination. If this system was very profitable, they could run a system/fund for you, or at least trade and scale the system themselves. If they are selling, it means the system is either unscalable, or has bad risk parameters.

Nobody gives out strategies with real edge, at least not for a paltry sum of 7500 rupees. If they are giving, it means it doesn't have an edge and you have to optimise it and finetune it (if it is even possible) without curve fitting. That's a difficult task in itself.

So, before you even buy a strategy, instead of falling for excel screenshots of claimed backtest report parameters, ask for LIVE trading record of that strategy - for at least 2 months. The person selling must show his/her broker verified statement taking trades profitably.

Just don't be too dumb to fall for faked up backtest reports and pour money over snake oil sellers. On one hand there's the guy driving Jaguar making crores through workshop and premium following, another hand you have someone selling garbage like this and making money.

There's nothing wrong in selling strategies. He sold a strategy. The strategy does give a decent 15%-ish CAGR in historical backtest (without accounting for slippage and spread). If you accounted for slippage and spread, this strategy will probably go negative.

He's doing the hard work of selling the strategy and showing cooked up reports. When I saw 77% win rate and 2.79 risk reward, I knew it screamed fake. I just didn't wanna be too cynical and wanted to test. Just do your testing guys. Don't hand over your money just like that.

* The backtests were run for the period from 2011 January till 2020 May.

* First two runs were checking conditions on Banknifty spot and taking trades on futures. Thereafter I took trade based on conditions checked with futures only (which yielded similar results).

* First two runs were checking conditions on Banknifty spot and taking trades on futures. Thereafter I took trade based on conditions checked with futures only (which yielded similar results).

So, one minor correction. The backtest system took 0.1% of the margin as defined (1 lakh in this case) as the cost of each round trip trade in commissions. With that, we got the results posted above. With 0% comms, we get 15.91% CAGR with max drawdown of 25.26%.

This still doesn't account for bid-ask spread and slippage. So, the results in real time would be much worse. Expect a max drawdown of at least 1.5x from this backtest.

I don't mean to piss or rain on anyone's parade. If this strategy was a result of honest hard work and reflected the actual reality of the backtests, I wouldn't have even posted this. But selling something without integrity or dignity, just fooling people isn't respectable.

Read on Twitter

Read on Twitter