Currently there are 2 ways of Farming YFI, a governance token that you can burn to get aDAI generated by @iearnfinance

Read this post for how to get 1500% APY with Curve pool tokens or 5000% APY with Balancer pool tokens! /1 https://twitter.com/ChainLinkGod/status/1284562608599654405

Read this post for how to get 1500% APY with Curve pool tokens or 5000% APY with Balancer pool tokens! /1 https://twitter.com/ChainLinkGod/status/1284562608599654405

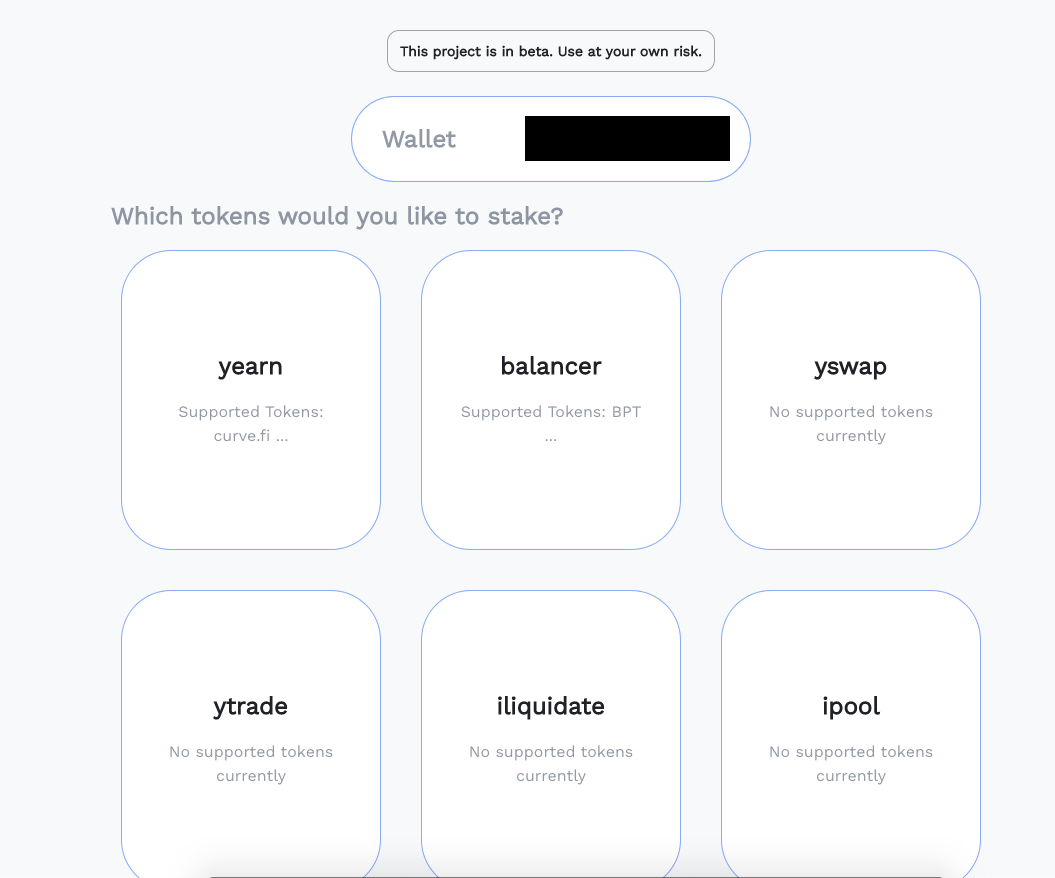

There are currently 2 pools supported

- Curve y pool https://beta.curve.fi/iearn/deposit

- Balancer YFI/DAI pool https://pools.balancer.exchange/#/pool/0x60626db611a9957C1ae4Ac5b7eDE69e24A3B76c5

First you need to provide liquidity in either contract. This will allow you to prove that you are a liquidity provider in these pools.

/2

- Curve y pool https://beta.curve.fi/iearn/deposit

- Balancer YFI/DAI pool https://pools.balancer.exchange/#/pool/0x60626db611a9957C1ae4Ac5b7eDE69e24A3B76c5

First you need to provide liquidity in either contract. This will allow you to prove that you are a liquidity provider in these pools.

/2

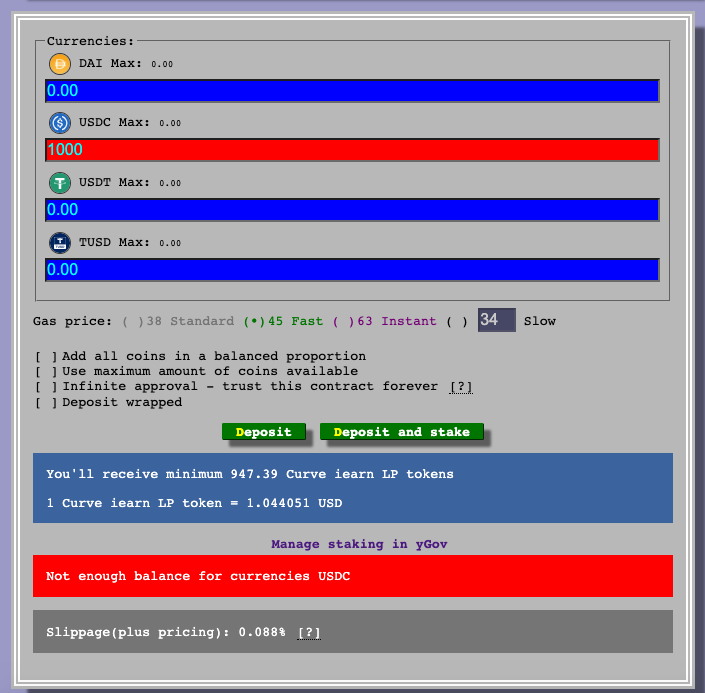

For curve, you can deposit DAI, USDC, USDT, or TUSD. There are some +/- slippage depending on which token you provide but usually they are within 1%

/3

/3

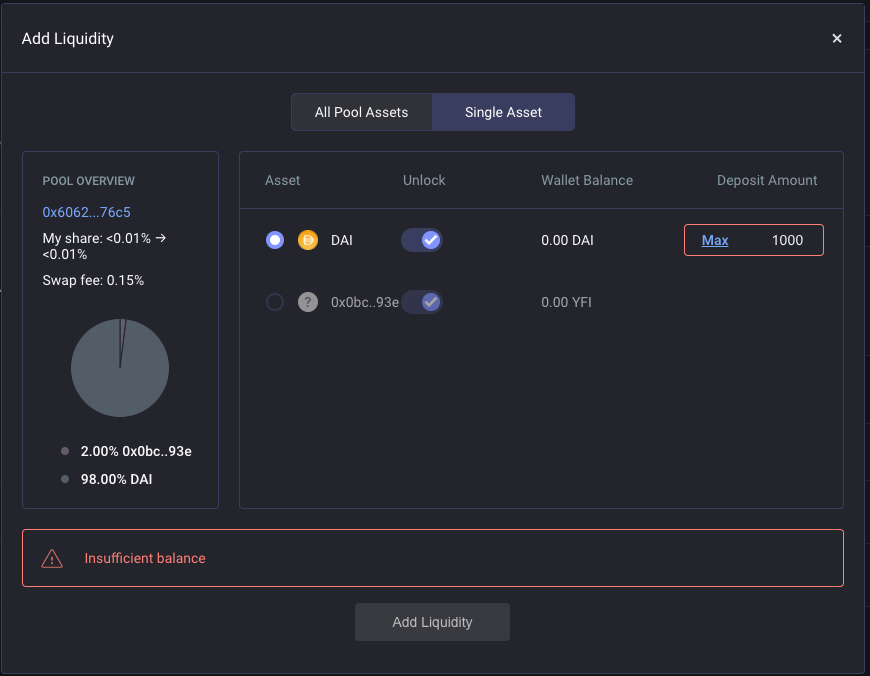

For balancer, you can deposit DAI and it will automatically balance the deposit into correct ratio.

/4

/4

For easier tracking of your asset values I will be adding APY estimates on http://yieldfarming.info over the next week. The staking contracts are basically synthetix's staking contract so it shouldnt take me that long to integrate.

/ 6

/ 6

For more info about what YFI is and does you can check out @AndreCronjeTech 's medium posts

https://medium.com/iearn/yfi-df84573db81

Happy yield farming everyone! and also DYOR!

/ final

https://medium.com/iearn/yfi-df84573db81

Happy yield farming everyone! and also DYOR!

/ final

Read on Twitter

Read on Twitter