VOLATILITY OBSERVATIONS:

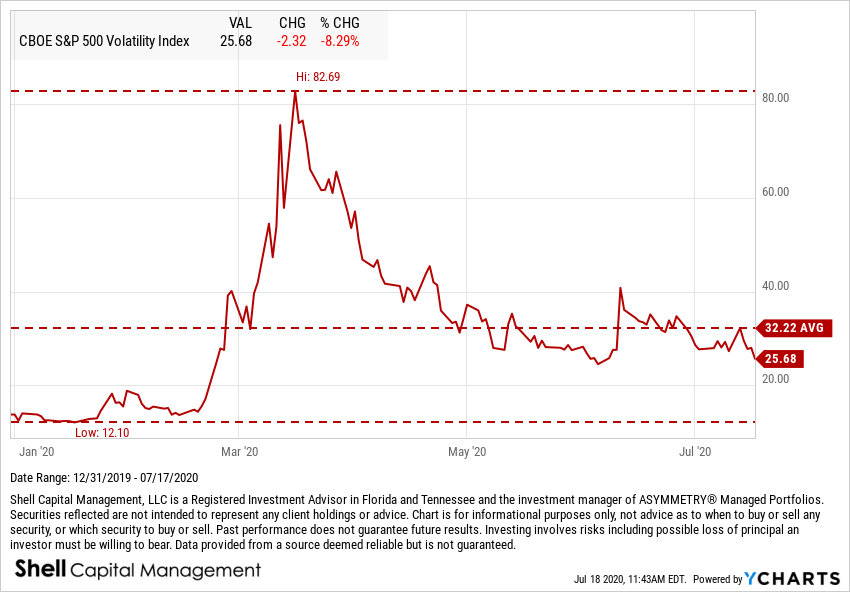

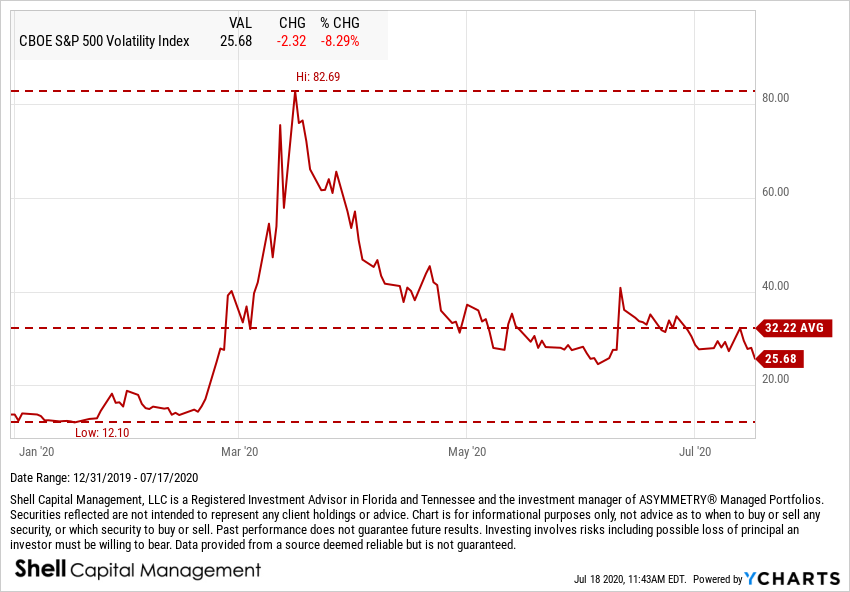

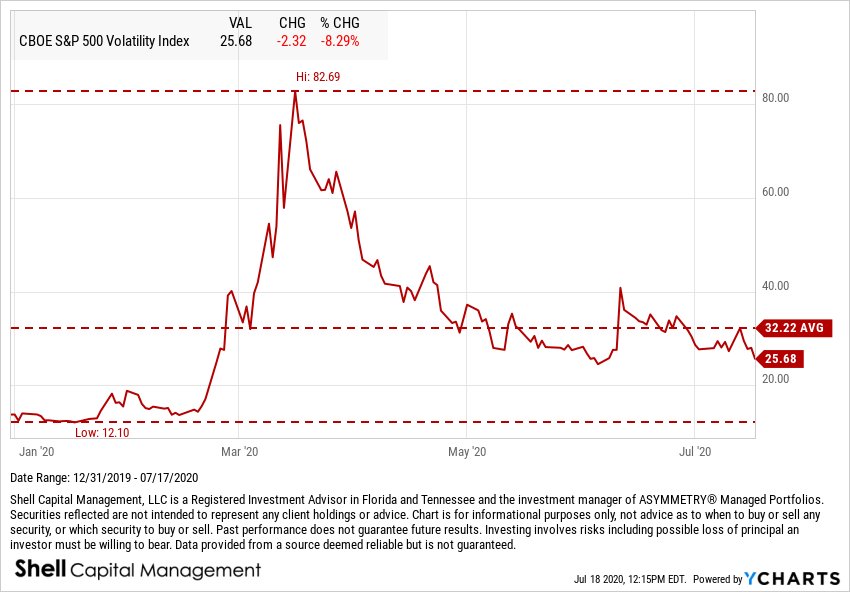

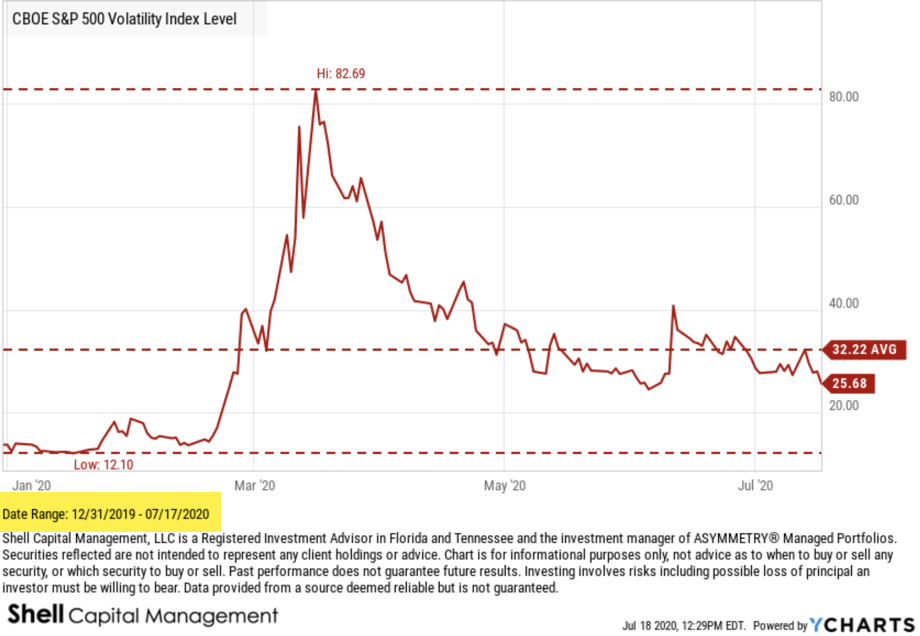

1) Year to date, so far the $VIX remains elevated in 2020 @ 25.68, but expected volatility is settling down after peaking @ 82 on March 16th.

1) Year to date, so far the $VIX remains elevated in 2020 @ 25.68, but expected volatility is settling down after peaking @ 82 on March 16th.

2) At 25.68, it suggests the monthly expectation for the volatility of a one standard deviation move of 7.5% up or down, so currently about a 68% chance of vol within that range.

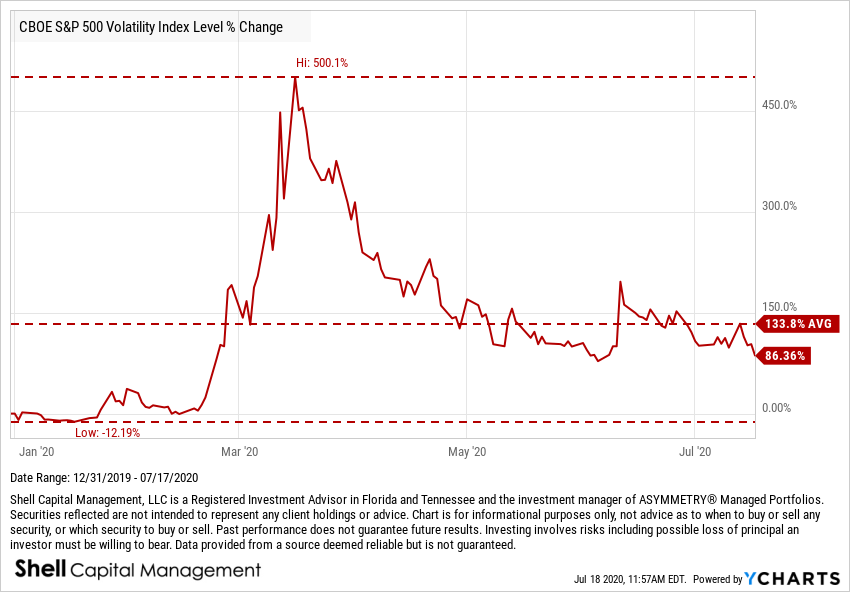

3) For perspective, the VIX gained 500% from the 2020 starting point by March 16th. VIX has averaged 134% this year, and remains 86% above its starting point.

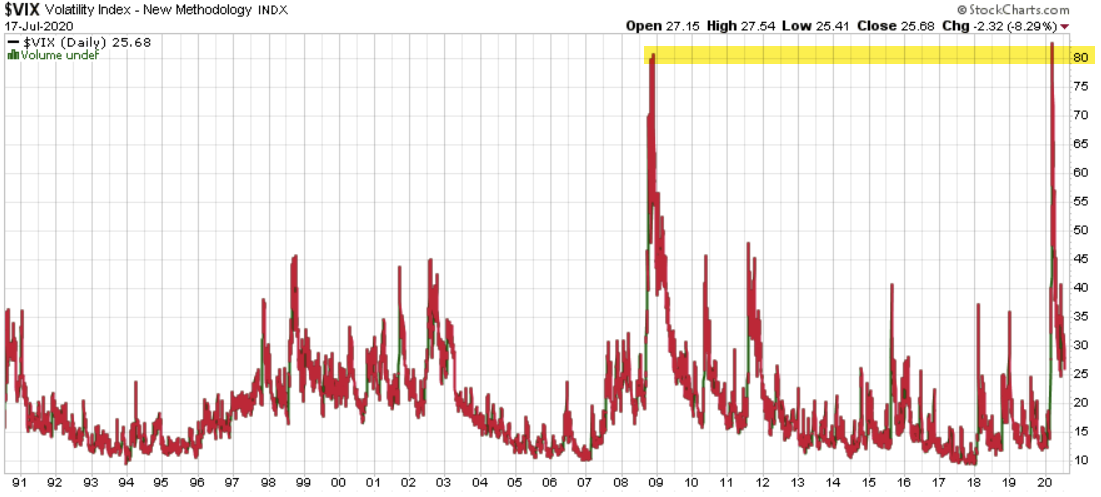

4) For a historical perspective, March 16th was the highest level ever for the modern-day VIX index, which has averaged 19.4 since 1990.

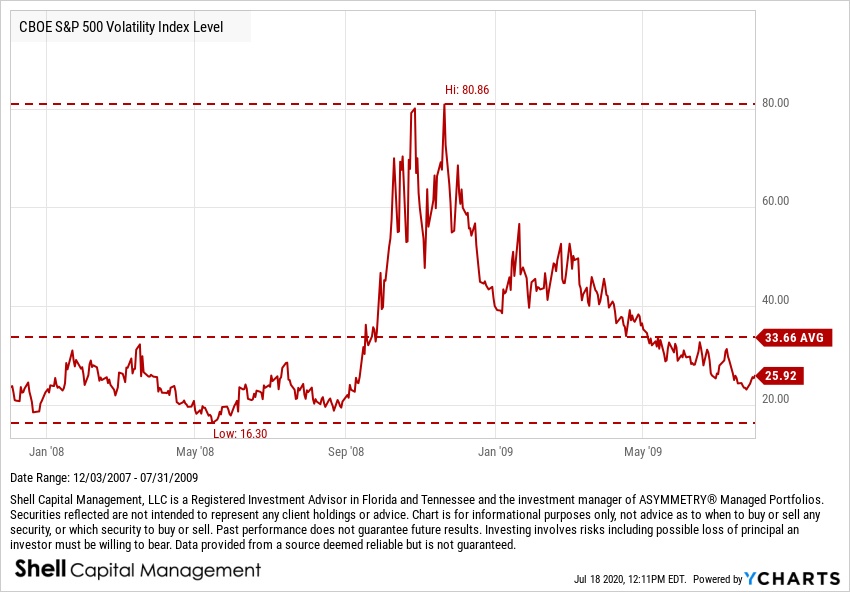

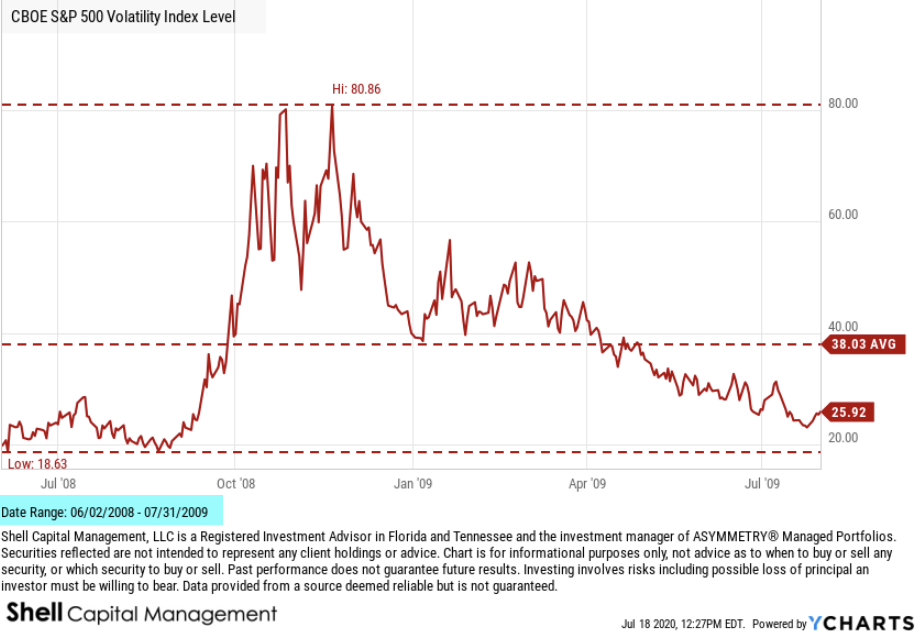

5) Up until now, only October 28, 2008, and the double-tap in late November 2008 achieved such a volatility expansion. LOOK CLOSE: does the pattern look familiar? This is 2008 into 2009, VIX trended 80 to 25.

6) Here is the VIX, now, for comparison. Periods of low contracting volatility are eventually followed by a volatility expansion. Implied vol tends to spike up, and then slowly settle down, which is what we are seeing now.

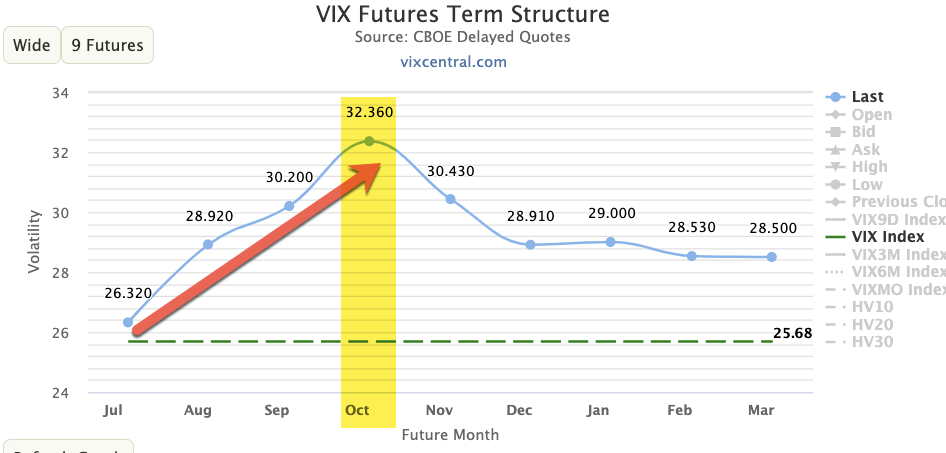

7) As we pass through time, expectations for future volatility adjust with the perception of risks. Right now, VIX futures are elevated above cash VIX through October at about 10% contango on the front month, which is a headwind for VIX ETFs as they roll.

Read on Twitter

Read on Twitter