THREAD |  Research Round-up

Research Round-up

A look at the week’s research from the IIF, including:

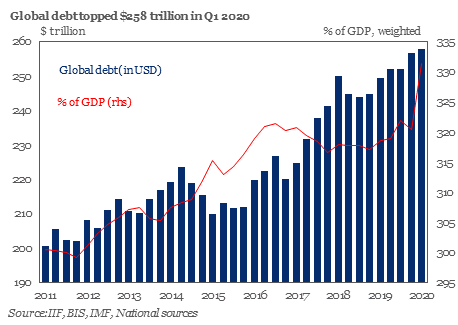

A surge in #globaldebt, reaching a record-high 331% of GDP ($258T) in Q1 2020

A surge in #globaldebt, reaching a record-high 331% of GDP ($258T) in Q1 2020

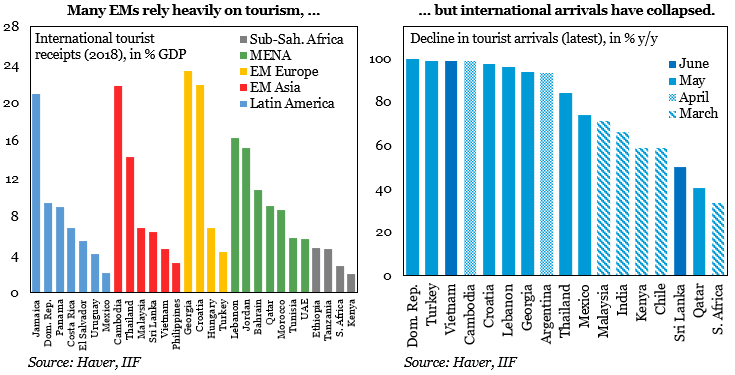

The impact of decreased #tourism on EM economies

The impact of decreased #tourism on EM economies

Analysis of Chinese household balance sheets

Analysis of Chinese household balance sheets

Research Round-up

Research Round-up

A look at the week’s research from the IIF, including:

A surge in #globaldebt, reaching a record-high 331% of GDP ($258T) in Q1 2020

A surge in #globaldebt, reaching a record-high 331% of GDP ($258T) in Q1 2020 The impact of decreased #tourism on EM economies

The impact of decreased #tourism on EM economies Analysis of Chinese household balance sheets

Analysis of Chinese household balance sheets

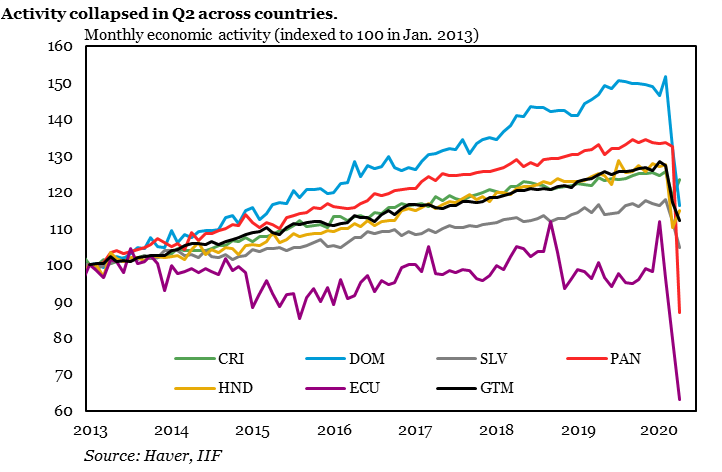

Frontier LatAm: COVID-19 and External Spillovers

“Frontier #LatAm countries, heavily dependent on tourism and remittances, have taken a hard hit from #COVID19,” writes @IIFPaola @CorcinoPaulino @mcastellano44.

http://ow.ly/YAKV50AA5B9

http://ow.ly/YAKV50AA5B9

“Frontier #LatAm countries, heavily dependent on tourism and remittances, have taken a hard hit from #COVID19,” writes @IIFPaola @CorcinoPaulino @mcastellano44.

http://ow.ly/YAKV50AA5B9

http://ow.ly/YAKV50AA5B9

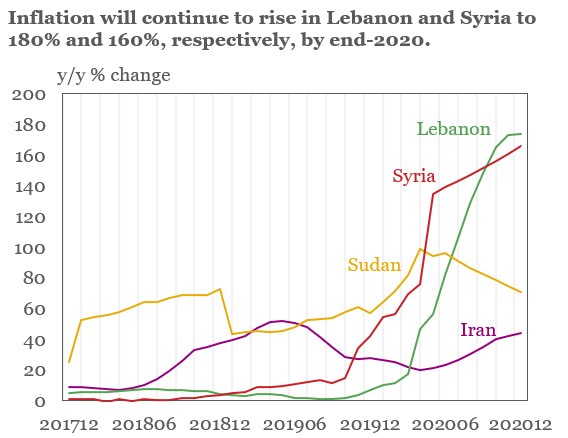

Parallel Exchange Rates in the #MENA Region

@Garbis_Iradian looks at the spread between official and parallel rates in the MENA economies with large secondary market discounts, coupled with inflation forecasts.

http://ow.ly/x7Be50AA5Jw

http://ow.ly/x7Be50AA5Jw

@Garbis_Iradian looks at the spread between official and parallel rates in the MENA economies with large secondary market discounts, coupled with inflation forecasts.

http://ow.ly/x7Be50AA5Jw

http://ow.ly/x7Be50AA5Jw

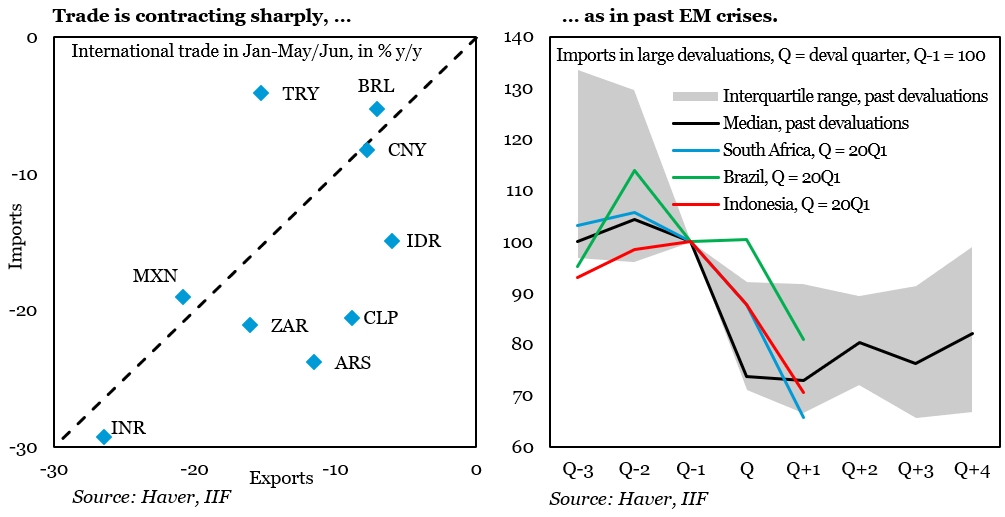

Economic Views: EM External Adjustment under COVID-19

With imports contracting even more than exports in EM, research from @SergiLanauIIF & @EconChart suggests EM current account deficits will vanish.

http://ow.ly/lxh950ABh0D

http://ow.ly/lxh950ABh0D

With imports contracting even more than exports in EM, research from @SergiLanauIIF & @EconChart suggests EM current account deficits will vanish.

http://ow.ly/lxh950ABh0D

http://ow.ly/lxh950ABh0D

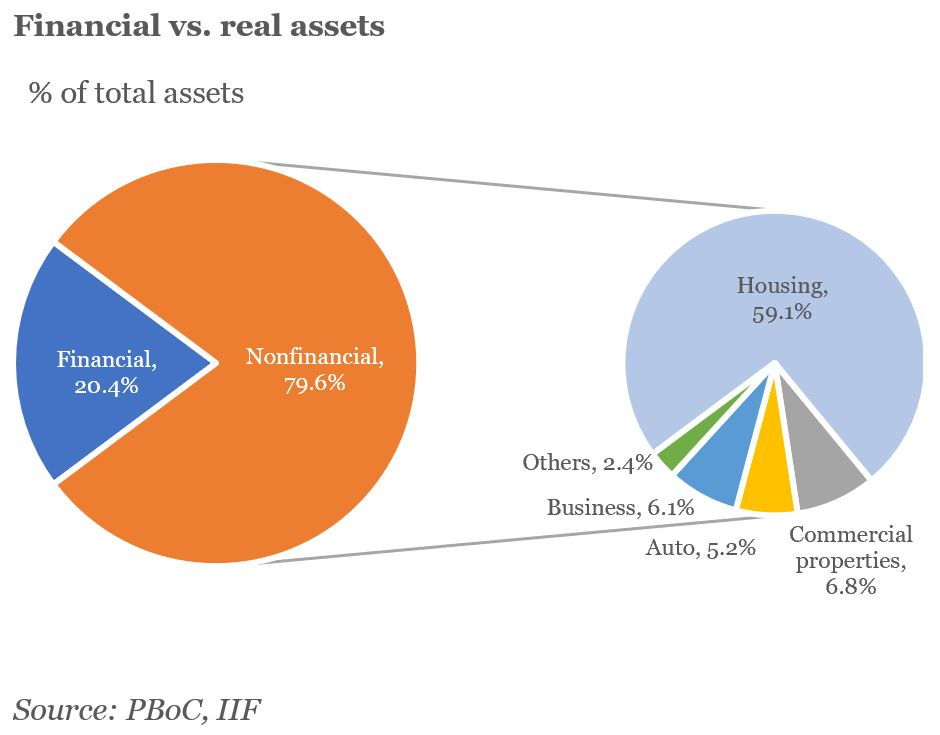

#China Spotlight: Household Balance Sheets and Asset Allocation

@genemaIIF & @phoebe_fengxy break down the #PBoC's recent release of data on Chinese household assets.

http://ow.ly/MN5f50AA640

http://ow.ly/MN5f50AA640

@genemaIIF & @phoebe_fengxy break down the #PBoC's recent release of data on Chinese household assets.

http://ow.ly/MN5f50AA640

http://ow.ly/MN5f50AA640

Macro Notes – EM Challenges: Tourism Comes to a Halt

The drastic decline in tourism this year will have a significant impact on economic activity in many emerging markets.

http://ow.ly/qdij50AA6iB

http://ow.ly/qdij50AA6iB

The drastic decline in tourism this year will have a significant impact on economic activity in many emerging markets.

http://ow.ly/qdij50AA6iB

http://ow.ly/qdij50AA6iB

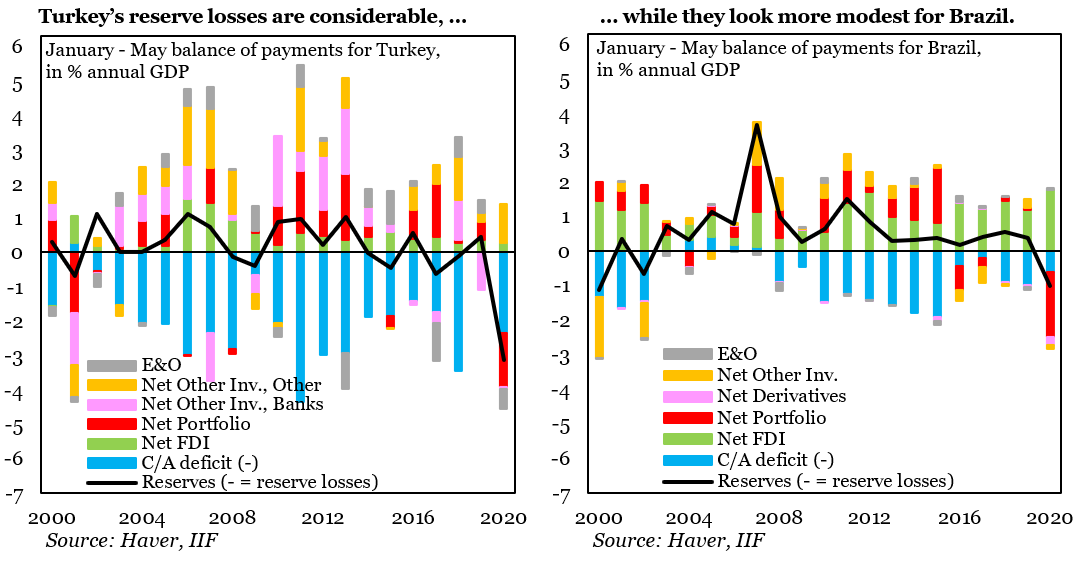

GMV – #Brazil vs #Turkey in the COVID-19 Shock

Factoring BoP deterioration into the IIF valuation model, the Brazilian Real appears substantially undervalued by ~15%, while the Turkish Lira is overvalued around 10%.

http://ow.ly/nOVo50AA6vP

http://ow.ly/nOVo50AA6vP

Factoring BoP deterioration into the IIF valuation model, the Brazilian Real appears substantially undervalued by ~15%, while the Turkish Lira is overvalued around 10%.

http://ow.ly/nOVo50AA6vP

http://ow.ly/nOVo50AA6vP

Global Debt Monitor: Sharp Spike in Debt Ratios

#Globaldebt soared to a record high 331% of GDP ($258T) in Q1 2020, increasing more than 10%pts from Q4 2019.

http://ow.ly/JTNo50AA6F2

http://ow.ly/JTNo50AA6F2

#Globaldebt soared to a record high 331% of GDP ($258T) in Q1 2020, increasing more than 10%pts from Q4 2019.

http://ow.ly/JTNo50AA6F2

http://ow.ly/JTNo50AA6F2

Read on Twitter

Read on Twitter