You might want a cup of coffee for this one.

Today we’re talking nCino $NCNO

& I’ll try to explain why an EV/Sales of 42.7x might not be as bad as it looks.

Today we’re talking nCino $NCNO

& I’ll try to explain why an EV/Sales of 42.7x might not be as bad as it looks.

First things first, what they do:

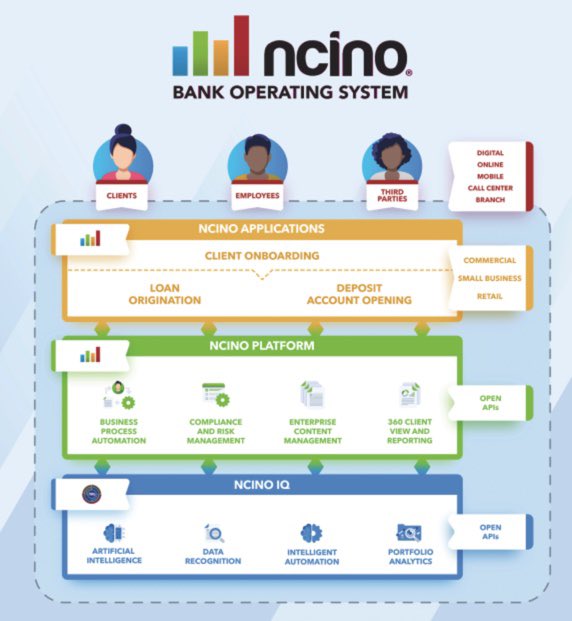

$NCNO is a SaaS company that provides operating systems for financial institutions (banks & credit unions).

The nCino Bank OS provides visibility to employees, clients, & 3rd parties all on one cloud platform.

$NCNO is a SaaS company that provides operating systems for financial institutions (banks & credit unions).

The nCino Bank OS provides visibility to employees, clients, & 3rd parties all on one cloud platform.

nCino’s products include

1) Client Onboarding: Supports front, middle, & back office onboarding processes

2) Loan Origination: Manages the entire lending process from application to closing

3) Deposit Account Opening: Checking, savings, debit/ATM, etc

4) nCino IQ: AI/ML

1) Client Onboarding: Supports front, middle, & back office onboarding processes

2) Loan Origination: Manages the entire lending process from application to closing

3) Deposit Account Opening: Checking, savings, debit/ATM, etc

4) nCino IQ: AI/ML

The Landscape /1:

*Hint: This part is really important*

Any time banks switch anything, it takes a long time & a lot of money.

For global institutions, implementation of nCino’s platform takes ~18 months. That a long sales process.

So the contracts can last 3 to 5 years.

*Hint: This part is really important*

Any time banks switch anything, it takes a long time & a lot of money.

For global institutions, implementation of nCino’s platform takes ~18 months. That a long sales process.

So the contracts can last 3 to 5 years.

Landscape /2:

That long sales process is a double-edged sword.

It takes massive investment up front, but it makes it a pain in the butt for banks to switch.

Just think about the switching costs of getting every employee & client onto a new system... ya that’s a hard sell.

That long sales process is a double-edged sword.

It takes massive investment up front, but it makes it a pain in the butt for banks to switch.

Just think about the switching costs of getting every employee & client onto a new system... ya that’s a hard sell.

So, what do big switching costs mean for $NCNO?

Answer: Liquidity Quality

The $NCNO platform is core to the day to day continuity of their customer’s lives.

This is demonstrated by a 147% subscription revenue retention rate.

Answer: Liquidity Quality

The $NCNO platform is core to the day to day continuity of their customer’s lives.

This is demonstrated by a 147% subscription revenue retention rate.

Would I have invested in $NCNO 3 years ago?

In short... hell no.

But someone did.

Jeffrey Horing of Insight Partners owned 46.6% of the common stock pre-IPO. And 63% of that stake was bought at an $8.00 share price.

In short... hell no.

But someone did.

Jeffrey Horing of Insight Partners owned 46.6% of the common stock pre-IPO. And 63% of that stake was bought at an $8.00 share price.

How’d he get it for so cheap?

If I were guessing, they needed the money & had to offer favorable terms.

Getting banks to switch their entire OS is capital intensive, but $NCNO did it & I doubt those banks will be switching any time soon.

In other words, the hard part is done

If I were guessing, they needed the money & had to offer favorable terms.

Getting banks to switch their entire OS is capital intensive, but $NCNO did it & I doubt those banks will be switching any time soon.

In other words, the hard part is done

But what about the EV/Sales of 42?

The name of the game is sustainability.

So your company had revenue growth of 50%... cool. But how long can they do it for? And how much is it gonna cost them to keep it up?

The name of the game is sustainability.

So your company had revenue growth of 50%... cool. But how long can they do it for? And how much is it gonna cost them to keep it up?

For $NCNO, it looks like those customers are tied up for a while.

& other than product innovation, it shouldn’t be too costly to retain them.

Significant upfront costs resulting in high profitability at scale = tremendous business model leverage

& other than product innovation, it shouldn’t be too costly to retain them.

Significant upfront costs resulting in high profitability at scale = tremendous business model leverage

Currently working on a more extensive article, but wouldn’t be too surprised if $NCNO compounded at an annual growth rate higher than the market in the years to come.

Tagging @saxena_puru since he just bought some

Read on Twitter

Read on Twitter