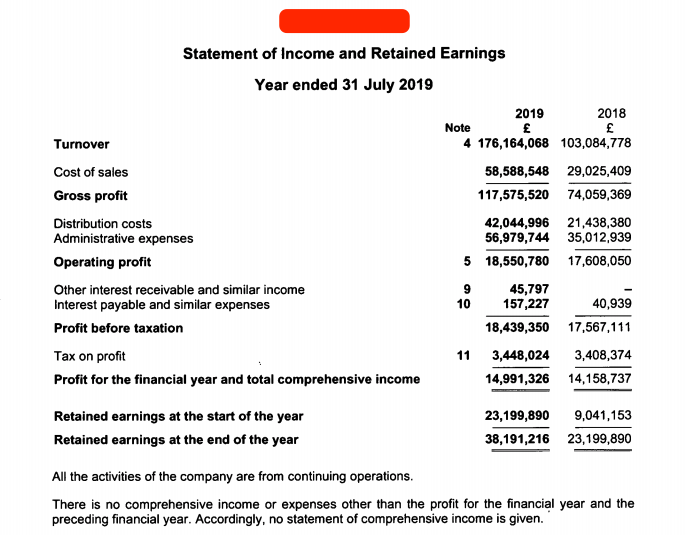

Last week @theSamParr shared Gymshark's financials. They're very impressive, but what stood out the most to me was the £53m cash pile.

How could a bootstrapped eComm company w/ rapid growth have this much cash?

Answer: a negative cash conversion cycle.

Here's how it works

How could a bootstrapped eComm company w/ rapid growth have this much cash?

Answer: a negative cash conversion cycle.

Here's how it works

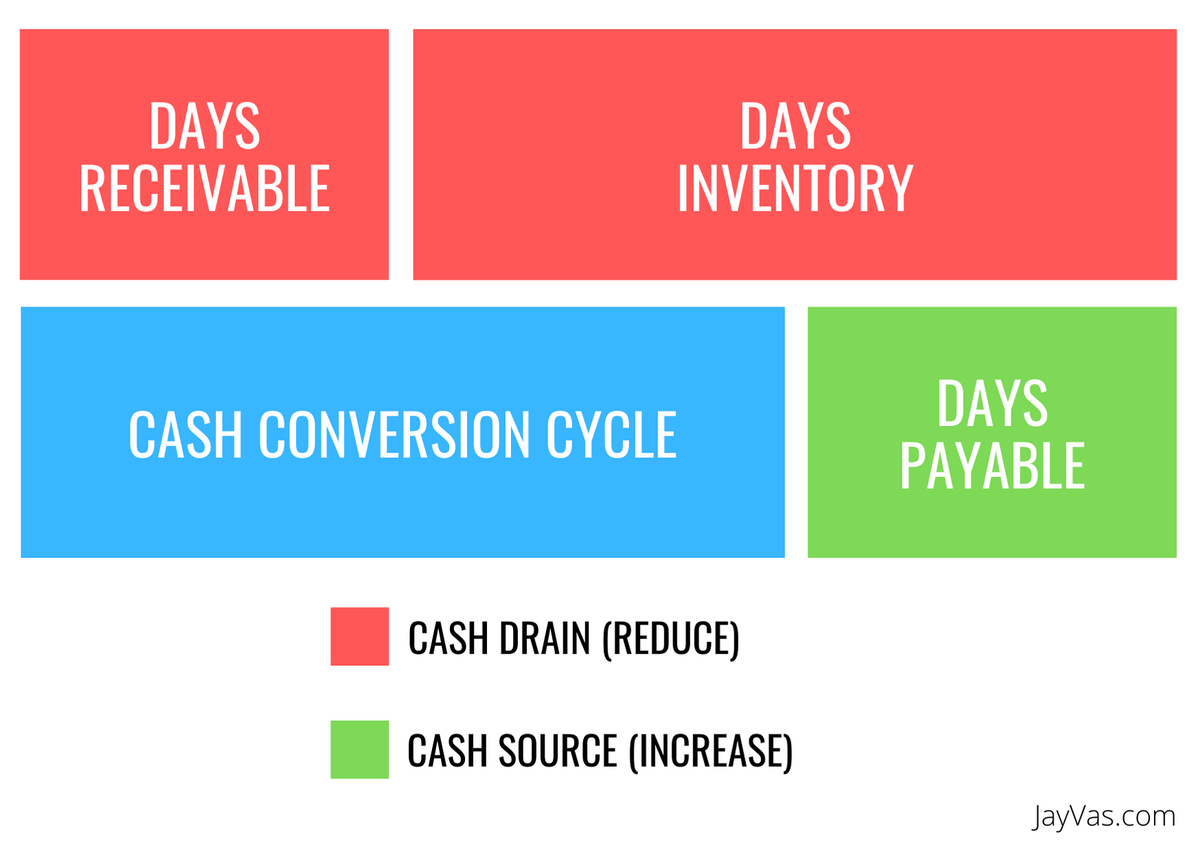

Cash conversion cycle (CCC) is a measure of how many days it takes for a biz to turn invested cash (usually purchased inventory) back into cash in its bank account.

The formula is: Days Inventory + Days AR - Days AP

Gymshark's CCC is -101 days.

$AMZN = -21 days

$WMT = 2 days

The formula is: Days Inventory + Days AR - Days AP

Gymshark's CCC is -101 days.

$AMZN = -21 days

$WMT = 2 days

A negative CCC means that your vendors finance your operations & no extra cash needs to be invested as you grow.

But most eComm businesses have CCC's between 40 to 100 days. If you sell $3k/day, that means $120k-300k cash is stuck in operations, instead of in your bank account.

But most eComm businesses have CCC's between 40 to 100 days. If you sell $3k/day, that means $120k-300k cash is stuck in operations, instead of in your bank account.

Optimizing your CCC is the difference between your growing eComm business being cash-rich vs. cash-poor.

There are 3 levers you can pull to improve CCC:

1) Increase accounts payable

2) Reduce accounts receivable

3) Reduce inventory

There are 3 levers you can pull to improve CCC:

1) Increase accounts payable

2) Reduce accounts receivable

3) Reduce inventory

Increase accounts payable

Most eCommerce businesses have 30 days or less to pay their vendors. Don't settle for that, constantly ask for better terms/more credit.

Gymshark’s days payable is 163, which means that on average their vendors give them 163 days to pay their bills!

Most eCommerce businesses have 30 days or less to pay their vendors. Don't settle for that, constantly ask for better terms/more credit.

Gymshark’s days payable is 163, which means that on average their vendors give them 163 days to pay their bills!

Reduce accounts receivable

eComm businesses typically don't have AR (your paid upfront). But's its possible to have negative AR by:

1) Taking preorders for new product

2) Batch ordering/dropshipping product only after receiving customer orders

3) Annual memberships sold upfront

eComm businesses typically don't have AR (your paid upfront). But's its possible to have negative AR by:

1) Taking preorders for new product

2) Batch ordering/dropshipping product only after receiving customer orders

3) Annual memberships sold upfront

Reduce inventory

Biggest source of cash drain for an eComm biz. You want to sell ordered inventory before your vendor bill is due (thats how you get a negative CCC).

1) Reduce # of SKUs you hold

2) Ask vendors to set inventory aside for you to order frequently (batch ordering).

Biggest source of cash drain for an eComm biz. You want to sell ordered inventory before your vendor bill is due (thats how you get a negative CCC).

1) Reduce # of SKUs you hold

2) Ask vendors to set inventory aside for you to order frequently (batch ordering).

Many people see Gymshark as a company with amazing marketing and great leadership. But after seeing their financials, it’s obvious that they’re also a company with incredible financial management.

More on CCC here (including formulas/calculators): https://jayvas.com/the-power-of-having-a-negative-cash-conversion-cycle/

More on CCC here (including formulas/calculators): https://jayvas.com/the-power-of-having-a-negative-cash-conversion-cycle/

A lot of comments here:

“vendor debt is still debt”

Yes that’s true, but I’d take vendor debt over traditional debt any day (esp as a small biz owner).

-no personal guarantee

-no interest

-no assets collateralized

-flexible as a grow

-much easier to negotiate

“vendor debt is still debt”

Yes that’s true, but I’d take vendor debt over traditional debt any day (esp as a small biz owner).

-no personal guarantee

-no interest

-no assets collateralized

-flexible as a grow

-much easier to negotiate

Another common Q:

“if you have the cash, why not just pay the vendor debts?”

Cash gives you options, and vendor debt is very borrower-friendly.

Why aren’t $AMZN (CCC -21 days) and $AAPL (CCC -48 days) paying down theirs? It’s not like they don’t have the cash.

“if you have the cash, why not just pay the vendor debts?”

Cash gives you options, and vendor debt is very borrower-friendly.

Why aren’t $AMZN (CCC -21 days) and $AAPL (CCC -48 days) paying down theirs? It’s not like they don’t have the cash.

Common Q:

“how can I implement this asap?”

Sorry, I didn’t mean to make it sound easy to achieve neg CCC (my eCom biz isn’t there).

It’s really hard and takes a lot of time and effort. But you should always be working towards it.

“how can I implement this asap?”

Sorry, I didn’t mean to make it sound easy to achieve neg CCC (my eCom biz isn’t there).

It’s really hard and takes a lot of time and effort. But you should always be working towards it.

Your business needs to be the linchpin in your supply chain.

You need to have influence over your customers/suppliers in order to dictate terms.

Customer influence - Tesla mass pre-orders, Supreme selling drops asap

Supplier influence - Walmart/Amazon manhandling their vendors

You need to have influence over your customers/suppliers in order to dictate terms.

Customer influence - Tesla mass pre-orders, Supreme selling drops asap

Supplier influence - Walmart/Amazon manhandling their vendors

Common Q:

“how do I get my vendor to extend terms?”

You need to treat your vendor like an investor, because you’re basically asking them to invest in your biz.

-Pitch them on your vision

-Show them your plan for rapid growth

-Show them potential sales

-Develop the relationship

“how do I get my vendor to extend terms?”

You need to treat your vendor like an investor, because you’re basically asking them to invest in your biz.

-Pitch them on your vision

-Show them your plan for rapid growth

-Show them potential sales

-Develop the relationship

Read on Twitter

Read on Twitter