1/ Wealth, War, and Wisdom (Barton Biggs)

"WWII was the war of the century. Its effect on occupied countries and later on the losers of the war was the ultimate test in modern times of which assets could preserve the purchasing power of wealth." (p. 2)

https://www.amazon.com/Wealth-War-Wisdom-Barton-Biggs/dp/0470474793

"WWII was the war of the century. Its effect on occupied countries and later on the losers of the war was the ultimate test in modern times of which assets could preserve the purchasing power of wealth." (p. 2)

https://www.amazon.com/Wealth-War-Wisdom-Barton-Biggs/dp/0470474793

2/ "The most widely used compilations of market returns, which focus predominantly on the U.S. stock market [bringing in survivorship bias and look-ahead bias], say little about the more difficult histories of other markets that suffered extreme dislocation." (p. vii)

3/ "The averages of twentieth-century asset class returns for winners of the war exceed those of losers in all three categories (stocks, bonds, and bills).

"In the loser countries, only stocks managed to beat inflation: bonds and bills produced negative real returns." (p. vii)

"In the loser countries, only stocks managed to beat inflation: bonds and bills produced negative real returns." (p. vii)

4/ "I think the evidence is that equity markets sensed the turning points of the war, while the press and so-called expert commentators did not.

"There were three great momentum changes in WWII - although, at the time, no one except stock markets recognized them as such." (p. 3)

"There were three great momentum changes in WWII - although, at the time, no one except stock markets recognized them as such." (p. 3)

5/ "For the first 50 years of the twentieth century, equities in both France and Germany (adjusted for inflation) were a wealth-losing proposition. Government bonds were a disaster.

6/ "Diversification helped. Real assets (land, property, gold, a business) were somewhat better than stocks but far from perfect. A working farm protected both your wealth and your life. The other solution was having money outside the country in a safe haven.

7/ "Much of the market data has never been compiled in this form or published before. I include other forms of wealth such as bond, land, gold, jewelry, and property.

"There is no use working yourself to death to accumulate wealth if it can't be preserved and enhanced." (p. 4)

"There is no use working yourself to death to accumulate wealth if it can't be preserved and enhanced." (p. 4)

8/ Biggs published his book in 2007.

A related 2018 study looks at returns for equities, bonds, bills, and national indices of real estate for various countries as well as the world as a whole: https://twitter.com/ReformedTrader/status/1259274241515483136

A related 2018 study looks at returns for equities, bonds, bills, and national indices of real estate for various countries as well as the world as a whole: https://twitter.com/ReformedTrader/status/1259274241515483136

9/ "Philip Tetlock found that alleged experts were right less than half of the time and that they were worse than dart-throwing monkeys in forecasting outcomes when multiple probabilities were involved.

10/ "The more information an expert knows, the more likely he is to have pet theories and to have developed complex chains of causation in making a prediction. The better-known, more-quoted, more self-confident, and better-credential an expert, the more likely he is to be wrong.

11/ "Pundits who appear regularly on television are unreliable, as they become obsessed with showmanship, striving to be original and different just for the sake of being original and different. The clever, ingenious, outrageous forecast gets the most attention.

12/ "When experts are wrong, they seldom admit it. They tend to dismiss information that doesn't fit with their previous beliefs or actions. They are tougher in assessing the validity of new information that undercuts their theories than for evidence that is supportive." (p. 10)

14/ "In contrast, the London stock market deduced, at a time when the world and even many English despaired, that Britain would not be conquered. Stocks made a bottom for the ages in early June 1940.

15/ "Similarly, the German stock market, even in the grip of a police state, somehow understood in October 1941 that the crest of the German conquest had been reached. At the time, the German army appeared invincible. It had never lost a battle or been forced to withdraw.

16/ "There was no sign that the offensive in the Soviet Union was failing. In fact, in early December, a German patrol had glimpsed the spires of Moscow, and Germany had domain over more of Europe than the Roman Empire had had. No one understood that this was the tipping point.

17/ "The New York stock market recognized that the victories at the battles of the Coral Sea and Midway in 1942 turned the tide in the Pacific. It never looked back from the lows of that spring, but I can find no such thoughts from newspapers or military experts of the time.

18/ "The American media had been wrong on the war from the beginning. Fed by the U.S. War Department, the New York Times in the first weeks after Pearl Harbor was exaggerating any small successes of the allies and under-reporting the damage to the Pacific fleet.

19/ "Five days after Pearl Harbor, the banner headlines were, 'JAPANESE CHECKED IN ALL LAND FIGHTING; 3 OF THEIR SHIPS SUNK [including a battleship], 2ND BATTLESHIP HIT.' It was pure fiction: only one relatively insignificant Japanese destroyer had been sunk." (p. 12)

20/ "Surowiecki relates how 800 guesses were entered regarding the weight of an ox on display, mostly by those who had no expertise. The average of all the guesses was almost exactly correct (1197 vs. 1198 pounds) and far superior to the estimates of the livestock experts.

21/ "He also conducted an experiment with a group of 56 students who were shown a jar and asked to guess how many jelly beans were in it. The average guess (871) was closer to the correct number (850) than that of all but one of the students' estimates." (p. 14)

22/ "He argues that the misjudgments individuals make effectively cancel out, leaving you with the knowledge that the group has. The larger and more decentralized the crowd, the more reliable its decision will be.

23/ "The predictions from the Iowa Electronic Markets, in which speculators bet on election outcomes, have been much better than those of political pundits and polls. Three-quarters of the time, the IEM was more accurate than the results of pre-election polls.

24/ "In the last five presidential elections, IEM predicted vote percentages with an error 30% smaller than experts'. In the 2004 Australia election, which pundits were saying was too close to call, prediction markets showed John Howard comfortably ahead. He won easily." (p. 15)

25/ "Both Manne and Surowiecki maintain that participants mus be diverse, that their judgments be independent of each other, and that they should have an economic incentive.

"If they exchange ideas and reach a consensus, the collective judgment becomes groupthink instead.

"If they exchange ideas and reach a consensus, the collective judgment becomes groupthink instead.

26/ "Investors, with their extremes of fear and greed, make the stock market prone to boom-and-bust cycles. But even in 2000, there was some rationality in the market as a whole: ludicrous valuations for tech stocks but ridiculous underpricing for other market segments." (p. 17)

27/ NOTE: Simple trend-following strategies have historically outperformed underlying markets. Even so, there is a diversification benefit to creating thousands of related trend indicators and allowing them to "vote:" https://twitter.com/GestaltU/status/1110908075333038081

28/ Similarly, using a strategy across a diverse set of asset classes (stocks, bonds, currencies, commodities) and using multiple strategies (value, momentum) in the same asset class both add diversification, creating more reliable overall results. https://twitter.com/ReformedTrader/status/1190261891680985088

29/ "We don't have any really good guesses...

"but we have thousands of slightly good guesses that we can combine to create a moderately good guess.

"In the end, we trade against those who think they have really good guesses but are just overconfident." https://twitter.com/ReformedTrader/status/1195450353472303104

"but we have thousands of slightly good guesses that we can combine to create a moderately good guess.

"In the end, we trade against those who think they have really good guesses but are just overconfident." https://twitter.com/ReformedTrader/status/1195450353472303104

30/ "The world economy and markets partially recovered, only to sag again in the late 1930s and early 1940s. Capitalism seemed a failed creed, and many thoughtful people wanted to try either communism or national socialism.' (p. 20)

More on this subject: https://www.amazon.com/Great-Depression-Diary-Benjamin-Roth/dp/1586489011/

More on this subject: https://www.amazon.com/Great-Depression-Diary-Benjamin-Roth/dp/1586489011/

31/ "In the 1930s, 10% of the population of the Soviet Union was consumed by Stalin's penitential machinery. He purged his own officer corp, Eastern European Communist leaders, and 'domestic conspirators.' Certain camps were torture chambers designed to extract confessions.

32/ "Men at work camps worked 16 hours a day, were subject to savage beatings, slept in barracks with temperatures below zero, and were given meager rations. It took 20-30 days to work a healthy man to near death before being machine-gunned at the weekly mass execution." (p. 21)

33/ "Even Churchill admitted that when evenly matched, it seemed the Germans would always prevail. By the late 1930s, Hitler had created the most successful economy in Europe. It was a false bloom fed by deficit spending on arms, but few realized that at the time." (p. 28)

34/ "The American economy collapsed again. Unemployment soared from 14% to 19+% in 1938, United Auto Workers shut General Motors with strikes, and police fired on workers armed with slingshots.

"On October 1, 1937 (Black Tuesday), stock and commodity markets panicked." (p. 29)

"On October 1, 1937 (Black Tuesday), stock and commodity markets panicked." (p. 29)

35/ "After the shock of Pearl Harbor and the initial defeats in the Philippines, the American public panicked. By the spring of 1942, there were rumors and newspaper stories of spying, sabotage, and even a Japanese invasion of the West Coast.

36/ "Fanciful stories abounded of night landings on Long Island and midget submarines in New York Harbor. No less a commentator than Walter Lippmann predicted coordinate sabotage on a grand scale. The decision to intern the entire Japanese population was implemented.

37/ "The national speed limit was reduced to 35 mph to preserve gasoline, and a law was passed that capped after-tax incomes at $25,000 ($250,000 in 2007 dollars). It was a grim, desperate time, and investors were profoundly depressed." (p. 34)

38/ "By 1937, the Dow had quadrupled from the 1932 low but was still down 60% from its 1929 high. Equities in the U.S. and Europe sold at 5-8x depressed earnings, discounts to book value, and yields considerably higher than bonds'. The one exception was the booming German market.

39/ "The Buffett of the time, Ben Graham, taught that balance sheets were at least as important as income statements and that risky stocks had to have higher yields than bonds. Creditworthines was everything. It was the matra of depression, deflation, and a secular bear." (p. 36)

40/ "By the end of 1928, Keynes was a very rich man. However, in early 1929, he was long rubber, corn, cotton, and tin when prices suddenly collapsed. His commodity losses forced him to sell stocks to meet margin calls.

41/ "By the end of 1929, he had left only tag ends and a large, illiquid position in Austin Motors, which had collapsed from 21 to 5. His net worth had fallen 75% from its high.

42/ "Ironically, Keynes had been right about the excesses in New York but had been unable to avoid the deluge.

"It is difficult to sidestep a truly vicious bear, no matter how perceptive you are. Liquidity is the ultimate coward: it runs at the first sign of trouble." (p. 37)

"It is difficult to sidestep a truly vicious bear, no matter how perceptive you are. Liquidity is the ultimate coward: it runs at the first sign of trouble." (p. 37)

43/ "As Germany became increasingly aggressive, European markets became very tender to international developments. Keynes, once again fully invested and leveraged, again suffered a severe net worth setback that gave him fits of depression and severe insomnia." (p. 38)

44/ London: "Editorial writers and market commentators disparaged Churchill and viewed Hitler with cautious optimism. Mein Kampf was widely read, in which Hitler praised the fighting spirit of the English race.

"The implication: the common enemy was Russia and Communism." (p.38)

"The implication: the common enemy was Russia and Communism." (p.38)

45/ "In the second half of the 1930s, U.S. stock market investors were still scarred from the Great Crash and its aftermath. Research on stocks and bonds was superficial, and no attention was paid to quarterly earnings. The emphasis was on a good, strong balance sheet.

46/ "The pools that manipulated stocks in the 1920s had disappeared. The financial district was a wasteland of half-empty buildings.

"The investment business had no appeal for ambitious young men. Wall Street, brokers, investment banking, and money managers were in disrepute.

"The investment business had no appeal for ambitious young men. Wall Street, brokers, investment banking, and money managers were in disrepute.

47/ "The threat of war raised the prospect of even more uncertainty, even higher taxes, regulation, and profitless prosperity.

"Once-wealthy, supposedly patrician men like Richard Whitney defaulted on loans and embezzled money." (p. 41)

"Once-wealthy, supposedly patrician men like Richard Whitney defaulted on loans and embezzled money." (p. 41)

48/ 1940: "Market declines came in spite of signs in the U.S. of growing economic strength and substantial gains in manufacturing employment.

"Then, as now, war was good for commodity prices, with raw material prices soaring 25% in September alone." (p. 45)

"Then, as now, war was good for commodity prices, with raw material prices soaring 25% in September alone." (p. 45)

49/ "To meet the need for dollars to purchase war materials, British citizens who owned U.S. securities were required report them to the Bank of England. The bank then combined and secretly sold them to Morgan Stanley. The seller received a credit in pounds.

50/ "Even in a capitalist democracy, in a time of great national emergency, the freedom of capital can be imperiled. In 1940, with the Huns 20 miles away across the channel, if you were a wealthy Englishman, you would have wanted to have some money in the U.S." (p. 46)

51/ In 1940, "stocks proved that the bottom of a bear market, by definition, has to be the point of maximum bearishness. From that point, the news doesn't actually have to be good; it just has to be less bad than what has already been discounted in prices." (p. 48)

52/ "The price of winning the struggle was so high that by the end of the war, Britain was impoverished and virtually bankrupt." (p. 57)

53/ Churchill apparently had a keen wit and was not afraid to use it on his radio-comedian son-in-law, Vic Oliver:

54/ "Churchill, critical of the government's inability to balance its budget, was actually on the verge of bankruptcy himself.

"Ten years later, with his six-volume history of WWII, he became the best-paid author in history for a single work. (The record still stands.)" (p. 60)

"Ten years later, with his six-volume history of WWII, he became the best-paid author in history for a single work. (The record still stands.)" (p. 60)

55/ "On May 10, 1940, world opinion was that the French army was the finest in the world, that its Maginot Line was impregnable, and that Britain was the pre-eminent military power.

"A week later, France was beaten, and the English army was fighting for its life at Dunkirk.

"A week later, France was beaten, and the English army was fighting for its life at Dunkirk.

56/ "The world had never seek anything like the Blitzkrieg's new tactics, technology, and superior planning and training.

"It should not have been a surprise: in 1937, General Heinz Guderian published Achtung-Panzer! The attack on the Western Front followed that model." (p. 69)

"It should not have been a surprise: in 1937, General Heinz Guderian published Achtung-Panzer! The attack on the Western Front followed that model." (p. 69)

57/ "The Dutch maintained that with one phone call, they could present an invader with an impassable wall of water. It was 'all nonsense,' wrote Churchill. If their dyke and border guards were betrayed, the Dutch basic defense line could be breached in a single day." (p. 69)

58/ "In the London bombings, "people lost homes and businesses, raising compensation issues. The city's complex sewage system was being destroyed, with waste being pumped into the Thames instead. People were sleeping in cold, damp subway tunnels that were vulnerable to epidemics.

59/ "War unravels the bonds of civil society. Bombed houses were looted, theft increased markedly, and murders increased by 22%.

"The rich had to hide or take physical possession of their valuables. It was easier to safeguard jewelry and silverware than antique furniture.

"The rich had to hide or take physical possession of their valuables. It was easier to safeguard jewelry and silverware than antique furniture.

60/ "Art was difficult to steal but vulnerable to bombings. A very rich lady confided that she had 'slept with my jewelry instead of my husband for four years.'

"American cigarettes and nylon stockings revitalized the black market, creating wealth for the wrong people." (p. 86)

"American cigarettes and nylon stockings revitalized the black market, creating wealth for the wrong people." (p. 86)

61/ "The Home Guard developed a bomb that would stick to the steel on German tanks. Devoted soldiers or civilians could use it at close range, but the explosion would cost them their lives." (p. 87)

The "sticky bomb" bomb shows up in Saving Private Ryan:

The "sticky bomb" bomb shows up in Saving Private Ryan:

62/ "Within 24 hours after a British surrender, anyone who had not turned in firearms and radio sets would be liable for immediate execution. It would have been a harsh occupation. Wealth would have been confiscated or destroyed: not a friendly environment for equities." (p. 89)

63/ "Since factories were targeted for bombing, many family businesses were so damaged that they were shut down or destroyed.

"In the long run, business interruption compensation was paid by the government but was usually inadequate. Wealth was essentially wiped out." (p. 93)

"In the long run, business interruption compensation was paid by the government but was usually inadequate. Wealth was essentially wiped out." (p. 93)

64/ "Hitler was repeatedly cautioned by both military and political advisors that English morale would be strengthened by his Russian adventure. However, Hitler would have none of it: his judgments had been too infallible in the last, and he was intolerant of dissent." (p. 105)

65/ "It was logical for the Dow to decline. A U.S. entry into the war was a godsend for Britain. For U.S. companies and investors, it meant wage and price controls, higher taxes, and excess profit taxes. No one knew what a war economy's unintended consequences would be." (p. 106)

66/ "Russian soldiers were cut to pieces by panzers and from the air.

"Anyone who surrendered was considered a traitor. A POW's children was deprived of food; his parents, sent to the gulag. POWs were amenable to fighting for the Germans to get better living conditions." (p.115)

"Anyone who surrendered was considered a traitor. A POW's children was deprived of food; his parents, sent to the gulag. POWs were amenable to fighting for the Germans to get better living conditions." (p.115)

67/ "Soviet field commanders who failed to achieve objectives were removed from command and often executed on the spot.

"Russian soldiers captured by the Germans had no shelter and were given virtually no food or water. When winter came, they died where they stood." (p. 117)

"Russian soldiers captured by the Germans had no shelter and were given virtually no food or water. When winter came, they died where they stood." (p. 117)

68/ "The Ukrainians hated the Soviets, who had purged local officials, persecuted teachers, and enforced collectivization. They regarded the Germans with curiosity and relief.

"However, Hitler wanted the farms for Aryan settlers and instituted 'racial cleansing'/extermination.

"However, Hitler wanted the farms for Aryan settlers and instituted 'racial cleansing'/extermination.

69/ "Families were wrenched apart, villages were burned, women were dragged off as sex slaves, and men were sent to Germany as laborers (jammed into rail cars with no food or sanitation). These measures led not to pacification but to hatred and a fierce resistance.

70/ "Russian soldiers and deserters far behind the front lines could not rejoin the Russian army without being shot or assigned to penal battalions.

"Instead, they roamed the countryside, looting/pillaging. In time, these guerilla bands became a major adversary to the Germans.

"Instead, they roamed the countryside, looting/pillaging. In time, these guerilla bands became a major adversary to the Germans.

71/ "There were Soviet partisans, Jewish bands, Polish groups, and common bandits. All preyed on the Germans, and most preyed on each other. They stole anything they could get their hands on.

"By December 1943, Moscow was providing them with arms through air drops." (p. 121)

"By December 1943, Moscow was providing them with arms through air drops." (p. 121)

72/ "The Germans regarded civilians as partisans and shot them for their clothes. After the Russian scorched-earth policy, millions of civilians died of frostbite and starvation.

" 'It is the horrors of the 13th century. We are chipping at frozen carcasses of horses for meat.'

" 'It is the horrors of the 13th century. We are chipping at frozen carcasses of horses for meat.'

73/ "Apart from gold and jewelry, getting money from Germany to Switzerland was hard (exchange controls and taxes). It was virtually treason, and you took your life in your hands.

"But some Nazis - just in case - were surreptitiously sending money to South America." (p. 128)

"But some Nazis - just in case - were surreptitiously sending money to South America." (p. 128)

74/ "Japan was battle-tested and superbly trained but no match for the U.S. as an industrial power. In some respects, its economy was almost medieval. The new Zero was the best fighter aircraft in the world but was delivered from its factory in ox carts." (p. 132)

75/ "Powerful businessmen and army generals demanded that Japan take advantage of the chaos in Europe to secure a natural resource base in southeast Asia.

"They were right: in July 1941, the U.S., Britain, and Holland embargoes cut Japan off from all supplies of oil." (p. 135)

"They were right: in July 1941, the U.S., Britain, and Holland embargoes cut Japan off from all supplies of oil." (p. 135)

76/ "The Pearl Harbor strike seemed a spectacular success at first blush, but it aroused and united the American people. Although 18 warships were sunk or badly damaged, most rested in shallow water and were repaired in months, not years. Losses of trained men were small.

77/ "The U.S. carriers were out at sea and remained unscathed. Little damage was done to oil storage tanks or submarine pens.

"None of this was fully appreciated until later. As 1942 dawned, Japan was well along in the process of conquering Southeast Asia for its vast resources.

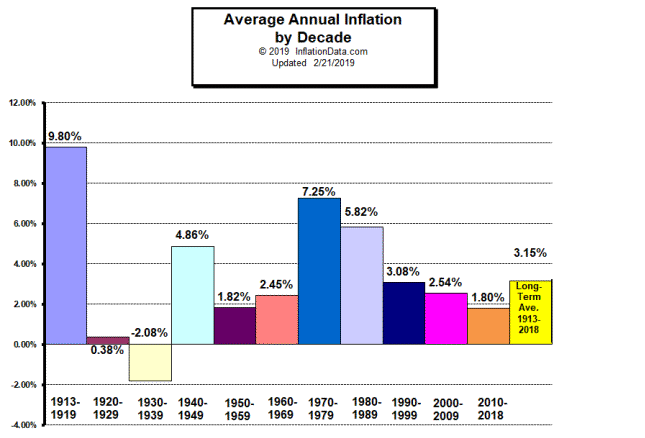

"None of this was fully appreciated until later. As 1942 dawned, Japan was well along in the process of conquering Southeast Asia for its vast resources.

78/ "In several countries, the locals welcomed their liberation from European colonialism. The Japanese spoke of their 'sacred mission to free Asian territory from the white man's yoke.'

"The supposedly impregnable fortress of Singapore ignominiously surrendered." (p. 136)

"The supposedly impregnable fortress of Singapore ignominiously surrendered." (p. 136)

79/ "The Japanese rehearsed their battle plans with an elaborate table war game, accounting for unforeseen circumstances by rolling dice.

"The Midway game did not go well in rehearsal because the dice indicated that there was a chance of discovery and a trap by the U.S. fleet.

"The Midway game did not go well in rehearsal because the dice indicated that there was a chance of discovery and a trap by the U.S. fleet.

80/ "Yamamoto's chief of staff reversed the decisions of the umpires, saying Americans had lost the will to fight.

"Japanese officers were so confident that they returned to their ships intimate personal possessions that had been left behind before Pearl Harbor." (p. 143)

"Japanese officers were so confident that they returned to their ships intimate personal possessions that had been left behind before Pearl Harbor." (p. 143)

81/ "In the fog of war, Midway was at first not perceived to be the great victory that it was. An inexperienced, bedraggled, outgunned American task force had beaten the best navy in the world at its own game. Nobody could believe it.

82/ "The Japanese naval aviation never recovered from losing so many veteran air crews. Bad luck, overconfidence, and a few poor decisions had doomed their effort. The courage of American aviators and the U.S.'s ability to read the Imperial Code were also major factors.

83/ "There were also two fortuitous accidents. The timing of the arrival of the American torpedo bombers that inadvertently lured the Zeroes down to sea level was accidental, as was bad luck for the Japanese, who were caught refueling and rearming aircraft by the dive bombers.

84/ "The dive bombers had become separated from the torpedo planes and were lost. The lead pilot spied the wake of a Japanese destroyer that had been sent to investigate an American submarine. The bombers followed it back to the carriers, arriving at the perfect moment." (p. 150)

85/ "The Japanese government announced a great victory and told Hitler that Midway was a triumph. (The official German war diary records his elation). However, within the officer corps, the truth could not be concealed: 'all the senior officers had been deeply shamed by Midway.'

86/ "To fail in one's obligation was unbearable to the duty-bound Japanese.

"Prime Minister Tojo was not told of the extent of the disaster for a week. The public was informed that Japan had lost a carrier and America, two (the actual totals being four Japanese to one American).

"Prime Minister Tojo was not told of the extent of the disaster for a week. The public was informed that Japan had lost a carrier and America, two (the actual totals being four Japanese to one American).

87/ "Officers from sunken ships were confined to base; the sailors were sent back to the South Pacific, not even allowed to see their families.

"Chastened, Japan's offensive moves were over even though she still had the naval firepower to challenge the U.S. fleet.

"Chastened, Japan's offensive moves were over even though she still had the naval firepower to challenge the U.S. fleet.

88/ "Instead, she reverted to defensive tactics, leading to a long war of attrition that she could not hope to win against a superior industrial power. The United States was already laying down modern new battleships and carriers at a high rate." (p. 152)

89/ "Free equity markets as suppliers of capital are not compatible with either authoritarian socialist dictatorships or communism.

"Markets understood the ebb and flow of the war. It had to be the wisdom of crowds, as both sides controlled war news and used propaganda." (p.153)

"Markets understood the ebb and flow of the war. It had to be the wisdom of crowds, as both sides controlled war news and used propaganda." (p.153)

90/ "When officers failed to return, rumors began to circulate. The Nomura family gradually sold equity holdings and even sold short. They purchased real assets, which allowed them finance rapid expansion later and eventually have the dominant securities firm in Japan." (p. 154)

91/ 1942: "A seat on the Exchange changed hands for $17k, the lowest price since 1897 and 97% below the high of 1929.

"The listlessness affect real estate. A New York hotel could not be sold at 1x annual earnings. Rents in Wall Street office buildings were as low as $1/sq.ft.

"The listlessness affect real estate. A New York hotel could not be sold at 1x annual earnings. Rents in Wall Street office buildings were as low as $1/sq.ft.

92/ "There was surging war production, huge budget deficits, and strong corporate profits.

"However, the U.S. Treasury had proposed a 60% corporate tax rate, and a Renegotiation Board to recover excess profits was looming, making earnings and dividend forecasts impossible.

"However, the U.S. Treasury had proposed a 60% corporate tax rate, and a Renegotiation Board to recover excess profits was looming, making earnings and dividend forecasts impossible.

93/ "The FDR administration seemed determined to use mobilization to level income and wealth. These policies, combined with incompetence in fighting the war, sapped the confidence of investors.

"Every right-thinking prognosticator with a head on his shoulders was bearish.

"Every right-thinking prognosticator with a head on his shoulders was bearish.

94/ "As the public learned that upbeat news reports were false/misleading, they lost faith in the military and the media.

"With prime corporate bonds yielding 2.75% and stocks, 8-9%, the chairman of Metlife intoned that stocks had no role in life insurance companies' portfolios.

"With prime corporate bonds yielding 2.75% and stocks, 8-9%, the chairman of Metlife intoned that stocks had no role in life insurance companies' portfolios.

95/ "The State of NY banned stocks from insurance company portfolios, an edict that remained until the 1950s when the great postwar bull market was already entrenched.

"But stocks were cheap: 30% of NYSE stocks sold at trailing P/E<4. Many sold at discounts to net cash." (p.158)

"But stocks were cheap: 30% of NYSE stocks sold at trailing P/E<4. Many sold at discounts to net cash." (p.158)

96/ Japan: "The Ministry of Finance encouraged brokerage firms to market investment trusts. People believed in the 'New Japan.' The market climbed in nominal terms. But just as in Germany, the economy's apparent prosperity was financed by massive deficits and rising inflation.

97/ "By 1944, the war situation became desperate. School children were put to work making balloon bombs that were supposed to drift 5,000 miles across the Pacific. A seven-day work week was imposed, women were doing heavy manual labor, and there was unrest. Inflation soared.

98/ "Black markets and barter exchanges sprang up. Stocks were under rigid price controls. After the 1945 surrender, stock markets were officially closed.

"1930-1949: stock prices rose 3,280% (nominal) but fell 75% after inflation. Government bonds weren't much better." (p. 162)

"1930-1949: stock prices rose 3,280% (nominal) but fell 75% after inflation. Government bonds weren't much better." (p. 162)

99/ "MacArthur was determined to destroy the corporate monopolies, end feudalism, and drastically reduce ancient inherited privileges. Banks judged to have financed the war effort and imperialism were suspended and their assets seized.

100/ "All land held by absentee owners had to be sold to the government at an administered price that was ridiculously low. The landwas sold back at the same price in small lots to peasants with a 30-year repayment clause and a priviso that the buyer had to work the land himself.

101/ "People were hungry and cold. Speculators bartered warm clothes, diamonds, and food for land, which was so cheap that an acre had the price of a cup of coffee.

"The black market and those selling construction materials to rebuild bombed-out cities made fortunes.

"The black market and those selling construction materials to rebuild bombed-out cities made fortunes.

102/ "Big conglomerates were broken up. The 11 richest families were required to exchange the majority of their stocks for government bonds that were non-negotiable for ten years. Graduated taxes were introduced along with a 75% inheritance tax (which still remains at 60% today).

103/ "MacArthur's reforms were probably almost as destructive as wealth, though not as bloody, as Soviets' in Eastern Europe.

"The reforms explain MacArthur's tremendous popularity with the Japanese people and why Japan never had a serious internal Communist movement." (p. 165)

"The reforms explain MacArthur's tremendous popularity with the Japanese people and why Japan never had a serious internal Communist movement." (p. 165)

104/ "Bombings incinerated factories and production machinery, but the underlying land and franchises were still there from which to rebuild.

"Occupying Americans were not interested in stealing collectibles (spoils of war from China), which have become very valuable." (p. 166)

"Occupying Americans were not interested in stealing collectibles (spoils of war from China), which have become very valuable." (p. 166)

105/ "Japan's docile acceptance of surrender came from the respect the Japanese had for MacArthur and for Emperor Hirohito, whom MacArthur treated with dignity.

"There was no resistance to the occupation, and Japan rose from the ashes healthier and stronger than before." (p.168)

"There was no resistance to the occupation, and Japan rose from the ashes healthier and stronger than before." (p.168)

106/ "Stocks fail the liquidity test during times of extreme distress, but so does everything else except maybe gold and jewelry. Warm clothes and food were most desired. One European family survived by bartering its large inventory of sweaters and overcoats for food." (p. 170)

107/ Japan: "After the war, property values soared to unimaginable heights.

"But who could have foreseen that farmland was not going to work [government-forced selling at distressed prices] and that commercial real estate would [enormous post-war growth through 1980s]?" (p. 171)

"But who could have foreseen that farmland was not going to work [government-forced selling at distressed prices] and that commercial real estate would [enormous post-war growth through 1980s]?" (p. 171)

108/ "Only five stock markets (U.S., Canada, U.K., New Zealand, and Sweden) experienced no interruption in trading (1921-2006). Nine had a break in trading of at least six months, and seven suffered a long-term closure lasting years.

109/ "Eleven markets were permanently shut down without being restarted in their original form, including private wealth havens like Hong Kong and Singapore.

"The long-term real return for equities in the "stable and lucky" countries was 6.5%, 230 bps higher than "the losers."

"The long-term real return for equities in the "stable and lucky" countries was 6.5%, 230 bps higher than "the losers."

110/ "The numbers show the rewards of political stability, winning wars, and no hyperinflation. Inflation was almost twice as high in the Losers as in the Luckies. Perhaps staying neutral at all costs and avoiding political upheaval are a recipe for market prosperity." (p. 178)

111/ "The nobles of the Third Reich were to be granted by the state large estates in occupied countries to be worked by slave labor.

"This presumably purchased the loyalty of offers and was a direct expropriation of the property of the landed wealthy in Eastern Europe." (p. 181)

"This presumably purchased the loyalty of offers and was a direct expropriation of the property of the landed wealthy in Eastern Europe." (p. 181)

112/ "Mussert and von Tinnigen used trumped-up charges to seize businesses of prosperous Dutch (particularly Jewish) families. Prominence of wealth was a real liability.

"Holland had always treated Jews decently; the SS's arrests and deportations aroused resistance." (p. 183)

"Holland had always treated Jews decently; the SS's arrests and deportations aroused resistance." (p. 183)

113/ "Holland in 1939 was a large net exporter of food, but the Germans stripped the country of its crops. By 1944, agricultural inventories were nonexistent; the entire harvest went to Germany. In that brutal winter, more than 100,000 Dutch civilians starved to death." (p. 184)

114/ "France still remembered two million dead in trenchs and farm boys' self-inflicted wounds. The legacy of WWI was strikes, mutinies in the army, and Socialist politics. Manufacturing productivity was abysmal, and farms used agricultural methods 50 years out of date." (p. 188)

115/ 1940: "25% of the French population scavenged for food, looting, trying to escape the Germans. There were no police. Disbanded groups of French soldiers were the worst offenders. By contrast, German soldiers were under orders: no looting. Merchants welcomed their business.

116/ "French people were thoroughly frightened by the chaos and were ready to accept some loss of liberty in return for normalcy, which they believe was represented by Hitler.

"The English had run back to their boats and fled to England. What kind of ally was that?" (p. 190)

"The English had run back to their boats and fled to England. What kind of ally was that?" (p. 190)

117/ "Collaborating with the Germans was more widespread than was admitted after the war. If you fled, the state seized your assets.

"After all, murmured many, weren't a lot of the Jews Socialists or even Communists? There was no proof the Germans would mistreat them." (p. 195)

"After all, murmured many, weren't a lot of the Jews Socialists or even Communists? There was no proof the Germans would mistreat them." (p. 195)

118/ "Hitler determined to loot France, but it was done subtly at first.

"Bank loans were 'not appropriate,' and new equity issues had to be sold at a discount to occupation authorities and German companies. The Reich mark was arbitrarily revalued upward vs. the franc." (p. 196)

"Bank loans were 'not appropriate,' and new equity issues had to be sold at a discount to occupation authorities and German companies. The Reich mark was arbitrarily revalued upward vs. the franc." (p. 196)

119/ "Eventually, forced labor laws compelled 600,000 more Frenchmen to work in German factories under abysmal conditions for minimal wages. There was a severe shortage of labor to work farms. Food became in desperately short supply, and inflation rose astronomically." (p. 197)

120/ "Initially, having wealth enabled you sell shares or withdraw bank funds to obtain food, medicine, cigarettes, liquor and clothes on the black market.

"By 1944, this was no longer the case. Food, warm clothes, perhaps a bottle of prewar wine had the most purchasing power.

"By 1944, this was no longer the case. Food, warm clothes, perhaps a bottle of prewar wine had the most purchasing power.

121/ "Inflation and the black market sapped incomes. Nominal stock prices limped along.

"After the war, inflation was even higher, and Socialism again reared its head. Insurance, banks, mines, and utilities were nationalized. In real terms, stocks collapsed." (p. 198)

"After the war, inflation was even higher, and Socialism again reared its head. Insurance, banks, mines, and utilities were nationalized. In real terms, stocks collapsed." (p. 198)

122/ "1940-50: French equities rose in nominal terms but fell 7.6+%/year in real terms. French and bills declined by 20+%/year.

"This sounds bad, but the Dow Jones Industrial Average was selling at the same price in 1982 as it was in 1966, a decline 50+% in real terms." (p. 200)

"This sounds bad, but the Dow Jones Industrial Average was selling at the same price in 1982 as it was in 1966, a decline 50+% in real terms." (p. 200)

123/ "Wealthy French families of 1940 were still wealthy in 1950 b/c gold, farmland, property, and businesses were up 20% (real): excellent inflation hedges but only modest wealth enhancers.

"Most family fortunes were 20% in gold bars in Switzerland or buried in the backyard.

"Most family fortunes were 20% in gold bars in Switzerland or buried in the backyard.

124/ "But to sell some of your gold hoard, you had to find a real buyer or a black market dealer, and you might end up with a knife in your back or in a cellar with the Gestapo.

"With no open market, you had to accept a discount from the true value of your gold.

"With no open market, you had to accept a discount from the true value of your gold.

125/ "French banks had to report the contents of safe deposit boxes. Occupation authorities 'borrowed' it by issuing promissory notes and shipped the gold back to Germany. At the end of the war, the notes were not honored.

"Any gold that remained was hoarded by German officials.

"Any gold that remained was hoarded by German officials.

126/ "The serious money was made by black marketers, who then bought/hoarded gold. Buying property or ostentatious displays of wealth was dangerous, as black marketers were despised as leeches on society. After liberation, they were physically abused and their property seized.

127/ "In occupied Europe, all considered, gold was the best asset to hide in, preserve wealth, and maintain some liquidity. Stocks, land, real estate, and businesses worked only if you had a very long-term horizon. The black market was the most lucrative profession." (p. 202)

128/ "Italy in the 1930s was wracked by inflation, a high birth rate, pervasive poverty, poor government, and rampant corruption. Benito Mussolini had begun as a Marxist but clawed his way to power using a mixture of violence, oratory, and guile." (p. 204)

129/ Italy, 1944-5: "In the North, Fascists were summarily executed.

"Desperate groups searched for food/loot. Some families that had some wealth banded together in their most defensible villa in the hills: it wasn't worth the bloodshed to storm such resolute groups." (p. 207)

"Desperate groups searched for food/loot. Some families that had some wealth banded together in their most defensible villa in the hills: it wasn't worth the bloodshed to storm such resolute groups." (p. 207)

130/ "During the 1940s, Italian stocks declined 11.5%/year (real), but inflation concealed the disaster.

"Bonds and bills in real terms fell 6.2%/year for the first half of the century and an astounding 27.6% during the 1940s. Buildings were destroyed, pillaged, or commandeered.

"Bonds and bills in real terms fell 6.2%/year for the first half of the century and an astounding 27.6% during the 1940s. Buildings were destroyed, pillaged, or commandeered.

131/ "War saved the Mafia. The Fascist regime wanted to be the only organization preying on Italy. The invasion by the Allies ended the harassment. The Mafia dons learned the names of Italian-American officers and ingratiated themselves: not the U.S. Army's finest hour." (p. 209)

132/ ""Once every couple of generations, an epic event occurs that destroys accumulated wealth. A few countries (post-Civil War U.S., Sweden, Australia) have been lucky so far, but in Europe, the apocalypse has happened on a regular, generational basis.

133/ "Buildings were expropriated, depreciated, or worse. It was hard to get them back or receive compensation after local records had been destroyed. The raw land was there, but if the original owner was a hated landlord, locals conveniently couldn't remember who'd owned it.

134/ "In West Germany, property rights were eventually restored. It was crucial to not be in the Soviet zone, though after the Wall came down, values in the East recovered. There was no compensation for destroyed buildings, but title to the underlying land was retained." (p. 211)

135/ "Since the late 19th century, Germany's military adventures had been financed by borrowing and then paying off debt with the spoils of war. After 1918, there was no loot; the German economy was on the verge of hyperinflation even before the first reparations payment was due.

136/ " 'My father got a 20-year insurance policy in 1903, and paid faithfully every month. When it came due, he cashed it in and bought a single loaf of bread.'

"The only winners were those who had hedged the Mark in 1918 or who repaid their loans against real property." (p.212)

"The only winners were those who had hedged the Mark in 1918 or who repaid their loans against real property." (p.212)

137/ LEAP calls are a way to borrow and also hedge a large nominal price increase. The Rise of Carry hypothesizes that vertical skew would reverse with high inflation:

https://twitter.com/ReformedTrader/status/1283209614104752128

Jamie Mai bought creatively structured calls for this purpose: https://twitter.com/ReformedTrader/status/1206083356766531584

https://twitter.com/ReformedTrader/status/1283209614104752128

Jamie Mai bought creatively structured calls for this purpose: https://twitter.com/ReformedTrader/status/1206083356766531584

138/ "Farmers refused to sell food for worthless paper. Food riots broke out. Middle-class Germans were forced to sell or barter anything they owned for food.

"People wanted order and stability at any price. Communism or Fascism seemed to be the choices." (p. 214)

"People wanted order and stability at any price. Communism or Fascism seemed to be the choices." (p. 214)

139/ In the U.S., we haven't had an period of extreme inflation yet. The roughest bout in the memory of anyone alive today was the 1970s, which were tough but not anywhere near as hard as what other countries have experienced.

https://twitter.com/ReformedTrader/status/1231824161497944065

https://twitter.com/ReformedTrader/status/1231824161497944065

140/ "Art could be hidden, but that was risky because of looting, barbaric armies.

"Wealthy Hong Kong Chinese found that their money and homes were worth very little when the Japanese occupied the city. Jewelry was best because it could be regularly swapped for necessities.

"Wealthy Hong Kong Chinese found that their money and homes were worth very little when the Japanese occupied the city. Jewelry was best because it could be regularly swapped for necessities.

141/ "Legends are still told about magnificent pieces of jewelry swapped on the black market for a fraction of their value.

"Dealers were flooded with first-class paintings. In 1940, Keynes bought two Cezannes and two Delacroixs to the sound of howitzers." (p. 220)

"Dealers were flooded with first-class paintings. In 1940, Keynes bought two Cezannes and two Delacroixs to the sound of howitzers." (p. 220)

142/ "Fritz Thyssen, the German steel magnate, had supported Hitler with massive amounts of money and had access to the upper reaches of the Nazi party. He assumed he had paid his dues, but in 1938, the Nazis nationalized his company, citing the national emergency.

143/ "Nursing his grudge in 1938, he mentioned he was not being fairly compensated for manufacturing hundreds of units of a superb new portable cipher machine, 'Enigma.'

"Forewarned, Stephenson created a team to break the ULTRA code, creating an incalculable advantage." (p. 221)

"Forewarned, Stephenson created a team to break the ULTRA code, creating an incalculable advantage." (p. 221)

144/ "Wealthy Europeans, especially Jewish ones, have a deep-ingrained 'refugee mentality' that perpetually questions prosperity. In the last century, they experienced two wars, hyperinflation, a pogrom, and a depression. Americans led incredibly sheltered lives in comparison.

145/ "The Nazis used the hyperinflation of the 1920s to allege that 'Jew shylocks' had engineered the problem and were reaping immense profits even though, as lenders, they were the biggest losers from inflation.

146/ "The aristocratic Jewish community considered itself German and felt secure. Jewish-controlled firms were bankers to many of the largest companies in Germany, and their partners held seats on boards of over a hundred corporations. Many Jews had served Germany in WWI.

147/ "By 1933, Jews were being roughed up on the street, arrested on trumped-up charges, then disappearing. Smaller Jewish banks were compelled to sell out at a fraction of book value. Aryans could no longer be tenants in Jewish-owned buildings, forcing deeply discounted sales.

148/ "Foreign exchange controls resulted in a 78% tax on money transfers.

"You never knew when you would be assaulted or bankrupted by a crippling new rule. Suddenly, neighbors and friends were afraid to do business or socialize with formerly upstanding small-town merchants.

"You never knew when you would be assaulted or bankrupted by a crippling new rule. Suddenly, neighbors and friends were afraid to do business or socialize with formerly upstanding small-town merchants.

149/ "In 1935, the Nuremberg laws stripped Jews of citizenship, deprived them of the vote, and barred them from office.

"The price of leaving continued to go up. The elite had to emigrate and leave most of their wealth behind or stick it out and hope for the best." (p. 225)

"The price of leaving continued to go up. The elite had to emigrate and leave most of their wealth behind or stick it out and hope for the best." (p. 225)

150/ "By 1937, the catchword was 'Aryanization:' the Nazi government wanted Germans to own all substantial businesses. If the purchase discount wasn't big enough, the government intervened with not-so-veiled concentration camp threats.

"As time went on, discounts rose to 70%.

"As time went on, discounts rose to 70%.

151/ "When the Warburgs finally sold their bank in late 1938, the cash purchase price was 3.4 million marks vs. the book value of 11.6 million. After the Reich Flight Capital tax, stamp tax, and now 90% foreign exchange tax, the Warburgs left Germany with only 155,000 Marks.

152/ "After the German surrender, Warburg family eventually got back a 25% interest in their still-existent firm, some cash, and a five-year option to increase their interest to a controlling 50%. When the time came, they didn't have the money to exercise the option." (p. 228)

153/ "Tragically, Cuba reneged on its commitment to take in Jewish refugees from the liner St. Louis. The U.S. also refused to issue entry permits even after the issue was taken to FDR. A few were given asylum in Britain, but most were forced to go back to the Holocaust." (p.228)

154/ "The rich overseas Chinese in Indonesia and the Philippines have always kept nest eggs in Singapore or Hong Kong. Their business empires are only a pogrom away from confiscation.

"Don't flaunt your wealth. No matter how secure you feel, keep an escape hatch open." (p. 230)

"Don't flaunt your wealth. No matter how secure you feel, keep an escape hatch open." (p. 230)

155/ "Maintain some substantial wealth outside the country. Just be very sure the legal entitlements to that overseas wealth are utterly, incontrovertibly clear." (p. 230)

156/ "Stalin ordered no evacuation of women and children from Stanlingrad, believing this would compel the militia to fight more viciously. A teacher who balked at deploying his 13-year-old boy and girl students in a front-line position was sent to a gulag in Siberia." (p. 236)

157/ "The heroism of the Red armies and flickering newsreels of long columns of ragged German prisoners punctured the myth of the invincibility of German arms. The surrender of the Germans at Stalingrad convinced skeptics that communism was a dynamic world force." (p. 240)

158/ "When stocks were sold, the Reichsbank had the option to buy them at 1941 prices in exchange for government bonds, which remained in the bank's possession: not an attractive proposition after bond prices collapsed. Unreported sales of shares were at deep discounts." (p. 242)

159/ 1945: "Five million German civilians trying to escape the terrible wrath of the Russians fled west toward the British and American armies. Many carried art folded in pipes and their life savings in gold and jewelry.

"Russian tanks crushed them like huge steam rollers.

"Russian tanks crushed them like huge steam rollers.

160/ "Those that fled in the knee-deep snow were machine gunned. Children were herded into ditches and killed with grenades. The living and dead were stripped of watches, rings, boots and fur gloves.

"Houses and barns were set on fire.

"Houses and barns were set on fire.

161/ "After the surrender, atrocities stopped, though food was in desperately short supply.

"Stock prices were released from Nazi controls, and quotations collapsed.

"For the next five years, Hershey bars, Lucky strikes, and lumps of coal were the mediums of exchange." (p. 247)

"Stock prices were released from Nazi controls, and quotations collapsed.

"For the next five years, Hershey bars, Lucky strikes, and lumps of coal were the mediums of exchange." (p. 247)

162/ "In 1940, some affluent families retreated to family farms in the deep countryside. Not attracting attention from the Germans or collaborators by displaying wealth or overt resistance to the occupation was crucial. You did not want your farm to appear too fertile." (p. 304)

163/ Hungary: "After the communists were finally ousted, an aristocrat's son filed for restitution. He received 5% of the 1940 value of his father's net worth.

"The price of not being diversified was high, as he was reduced to menial labor after escaping to the U.S." (p. 307)

"The price of not being diversified was high, as he was reduced to menial labor after escaping to the U.S." (p. 307)

164/ "The men of the Red Army had been dehumanized: almost everyone they loved had been killed by the Germans or by their own regime. Death and horrendous wounds were a daily occurrence. They had no mercy. They wanted revenge, loot, liquor, and women.

165/ "Landowners and businessmen were classified as oppressors and deserved to be shot.

"Civilians disguised girls as boys and fled into the woods and deep countryside.

"Soviet soldiers had been hungry for so long that the sight of plump German civilians enraged them." (p. 311)

"Civilians disguised girls as boys and fled into the woods and deep countryside.

"Soviet soldiers had been hungry for so long that the sight of plump German civilians enraged them." (p. 311)

166/ "In the 1940s, equities and bonds in France or the Axis countries, lost most of their purchasing power and were illiquid.

"By 1944, virtually no one was paying rent. At least you could try to grow food on your farm and barter your gold and jewelry." (p. 313)

"By 1944, virtually no one was paying rent. At least you could try to grow food on your farm and barter your gold and jewelry." (p. 313)

167/ "Of the 100 largest U.S. companies in 1917, 61 no longer existed in 1987, and 21 were no longer in the top 100. 19 of the 21 underperformed market indexes." (p. 316)

On CAPM's issues:

https://twitter.com/ReformedTrader/status/1209140444984045568

Random stock picking > cap-weighting: https://twitter.com/ReformedTrader/status/1087925415577047041

On CAPM's issues:

https://twitter.com/ReformedTrader/status/1209140444984045568

Random stock picking > cap-weighting: https://twitter.com/ReformedTrader/status/1087925415577047041

168/ "Gold and jewelry protect a small amount of wealth if not kept in a safe deposit box *in-country*. Conquerors demand a key, and your bank will give it to them. Have your own safe at home.

"Don't tell anybody: When neighbors' children are starving, they will do anything.

"Don't tell anybody: When neighbors' children are starving, they will do anything.

169/ "Art is easily damaged, quickly plundered, and difficult to hide. It may only receive a fraction of its value when sold.

"In a chaotic, disorderly environment, you can't sell bonds, bills, or stocks. Inflation may be virulent, though bonds do well in deflation." (p. 317)

"In a chaotic, disorderly environment, you can't sell bonds, bills, or stocks. Inflation may be virulent, though bonds do well in deflation." (p. 317)

170/ "If you are part of a prosperous minority, particularly a religious one, you should always be looking over your shoulder. Your affluence attracts envy, which leads to hatred.

"Have some capital outside the country. Have a local escape hatch or sanctuary as well.

"Have some capital outside the country. Have a local escape hatch or sanctuary as well.

171/ "Wealthy Iraqui Jews who had lived there for centuries misjudged how quickly Saddam Hussein would move to expropriate wealth. Buyers sensed their desperation, and prices of property, art, and businesses collapsed. The same calamity befell the Indonesian Chinese." (p. 320)

172/ "Currency diversification is also essential in case of inflation.

"For in-country insurance, an unostentatious farm is best. Raw land can't be plundered and provides food during a disaster. In France and Italy, owning a vineyard was a wonderful wealth protector." (p. 323)

"For in-country insurance, an unostentatious farm is best. Raw land can't be plundered and provides food during a disaster. In France and Italy, owning a vineyard was a wonderful wealth protector." (p. 323)

173/ "You will suffer immense losses unless you have escaped to a safe haven well in advance of hostilities.

"If you are wealthy, you should have 5% of your money outside the country and 5% in a farm - but don't become obsessed with unforecastable Black Swans." (p. 326)

"If you are wealthy, you should have 5% of your money outside the country and 5% in a farm - but don't become obsessed with unforecastable Black Swans." (p. 326)

174/ "By policy, many banks in the twentieth century transferred money into the bank's reserve fund after a number of years of no legal contact with an account holder. Safe haven accounts must be crafted to provide flexibility regarding future identification. Read the fine print.

175/ "Uncertainty compels diversification: always the first rule of investing.

"(In sub-Saharan Africa, people believed for centuries that cattle were the safest repository of wealthy. That was until the great drought came along.)

"(In sub-Saharan Africa, people believed for centuries that cattle were the safest repository of wealthy. That was until the great drought came along.)

176/ "Diversify where your assets are held. Don't keep all your securities in the computerized databases of giant banks and brokers in New York, London, and Zurich. Make sure they are registered in your name and not in the Street Name." (p. 328)

177/ "Disregard the ranting of self-proclaimed elite thinkers and alleged experts. Their opinions cluster around the probable, and they lack the courage to predict the 10 standard deviation events that transform the world. History often leaps forward in chaotic, disorderly jumps.

178/ "Long-range air travel is likely to be first to go during a disaster. Keep an "insurance policy" farm or ranch off the beaten track but where you can get to it reasonably quickly. It should be stocked with seed, fertilizer, canned food, wine, medicine, and clothes.

179/ "Think Swiss Family Robinson. Even in America and Europe, there can be moments when law and order temporarily break down. A few rounds over approaching brigands' heads are a compelling persuader that there are easier farms to pillage. Brigands tend to be cowards.

180/ "History suggests that the rich are almost always too complacent. Black Swans, by definition, are unexpected. By the time it is apparent that you need to salvage wealth, it is usually too late. It is expensive to prepare early but far better to be early than late." (p. 333)

181/ Here's an interesting thread based on the ideas from Wealth, War, and Wisdom: https://twitter.com/KlendathuCap/status/1242820861842853891

Read on Twitter

Read on Twitter