The Model Y is a massive flop.

$TSLA delivered ~3k Model Ys in Q1 and ~13k Model Ys in Q2.

Tesla is now cutting the price of the Model Y in the U.S. (before the Model Y is even available in markets outside N.A.)

$TSLA delivered ~3k Model Ys in Q1 and ~13k Model Ys in Q2.

Tesla is now cutting the price of the Model Y in the U.S. (before the Model Y is even available in markets outside N.A.)

To put the Model Y price cut in perspective, Tesla had delivered over 80K Model 3s before it launched a lower priced version of the Model 3 the MR in October 2018.

Clearly initially Model Y demand is running materially lower than initial Model 3 demand.

Clearly initially Model Y demand is running materially lower than initial Model 3 demand.

Unlike the Model S, the Model 3, and the Cybertruck, Tesla has never released any Model Y reservation or deposit numbers.

One can likely infer that the numbers were always underwhelming.

One can likely infer that the numbers were always underwhelming.

Musk has repeatedly stated that he believes Model Y demand would be higher than Model 3 demand. Clearly that is not the case.

Here is a history of Musk's comments about the Model Y and his overly rosy if not downright fraudulent predictions for Model Y demand.

Here is a history of Musk's comments about the Model Y and his overly rosy if not downright fraudulent predictions for Model Y demand.

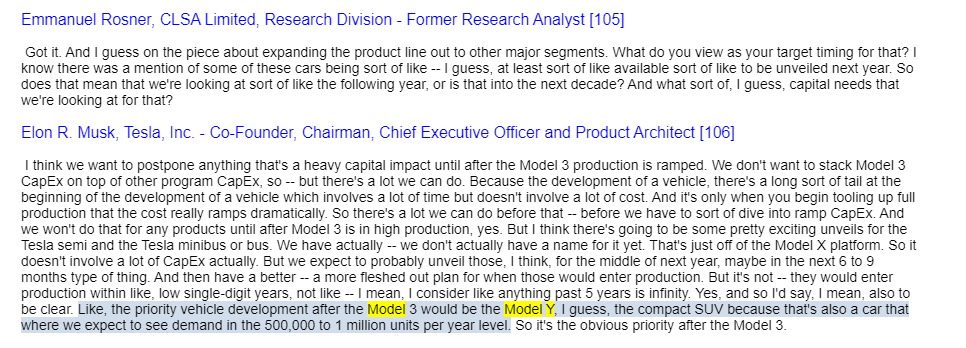

Musk's first public mention of Model Y demand expectations was on Tesla's Q2 2016 earnings call in August 2016 where Musk publicly estimated Model Y demand at 500k to 1 million units per year.

To put this in context in mid 2016 Musk's empire was on the brink of collapse as Solarcity was insolvent and a SCTY bankruptcy would reveal that Musk had embezzled government contract money at Spacex to prop up Solarcity.

Musk was desperate to keep Tesla's share price up...

Musk was desperate to keep Tesla's share price up...

... Kimbal had been margin called months earlier and Elon was very close to getting a margin call in February 2016 which was only averted by him pumping $TSLA's share price with a tweet announcing the pull forward of unveiling of the Model 3 to March 2016.

In May 2017 on Tesla's Q1 2017 earnings call, Musk stated that combined Model 3 and Model Y demand would be over 1mm units per year.

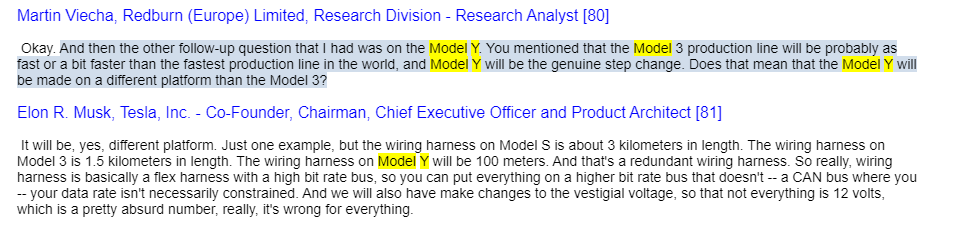

Musk stated that the Model Y would be built on a different platform than the Model 3

Musk stated that the Model Y would be built on a different platform than the Model 3

At the 2017 Tesla shareholders meeting in June 2017, Musk once again repeated that the Model Y would be built at a new factory and Fremont was too busy to build the Model Y.

As Tesla continued to incinerate cash and the Model X ramp proved to be a debacle, on the Q2 2017 call in August 2017, Musk backtracked and stated that the Model Y would be built on the Model 3's platform.

On the Q4 2017 call in February 2018, Musk stated that Model Y demand was likely to be 1mm units for the Model Y alone.

On the Q2 2018 earnings call in August 2018, Musk stated Tesla would likely produce 750k vehicles in 2020 including the Model Y and he was aiming for 1mm vehicles of production.

Tesla had not yet started construction on the Shanghai factory and Fremont ...

Tesla had not yet started construction on the Shanghai factory and Fremont ...

... had never produced more than 428k vehicles in a year (when it was owned by Toyota/GM.) Clearly Musk's comments were lies.

At the time, Tesla was in a dire liquidity crisis which Musk would try to obfuscate with his fake $420 "Funding Secured" takeover offer a week later.

At the time, Tesla was in a dire liquidity crisis which Musk would try to obfuscate with his fake $420 "Funding Secured" takeover offer a week later.

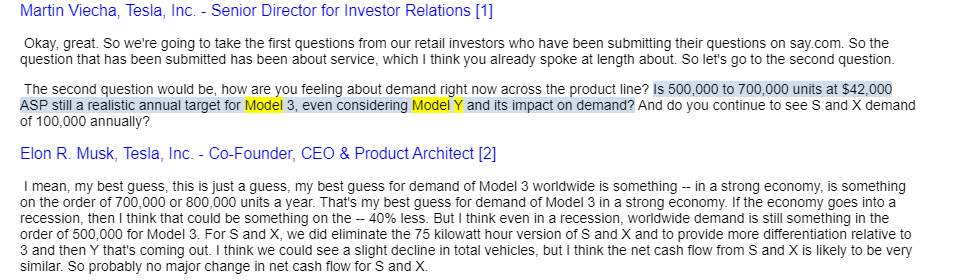

On the Q4 2018 earnings call in January 2019, Musk stated that the Model Y would have up to 50% more demand than the Model 3.

On that same call, Musk stated he believed Model 3 demand would be 700k to 800k cars per year in a strong economy and 500k in a recession implying annual Model Y demand of around 1mm cars in a strong economy and 750k cars in a recession.

Elon had no basis for these estimates

Elon had no basis for these estimates

At the time, Tesla was once again in a dire liquidity crisis. Model 3 demand was pulled forward in Q4 2018 due to the step down in the Federal tax credit.

Musk's made up demand estimates were nothing more than a desperate attempt to pump the stock.

Musk's made up demand estimates were nothing more than a desperate attempt to pump the stock.

In March 2019, Tesla unveiled the Model Y. The event was an epic disaster. There was very little social media buzz about the Model Y and the product was widely panned as basically a clone of the Model 3 at a higher price. https://www.latimes.com/business/la-fi-tesla-model-y-unveil-20190314-story.html

On the Q1 2019 earnings call in April 2019, Elon refused to give the Model Y order number when specifically asked about it.

[It would be the last time GS analyst David Tamberrino would be allowed to ask a question on a Tesla earnings call.]

[It would be the last time GS analyst David Tamberrino would be allowed to ask a question on a Tesla earnings call.]

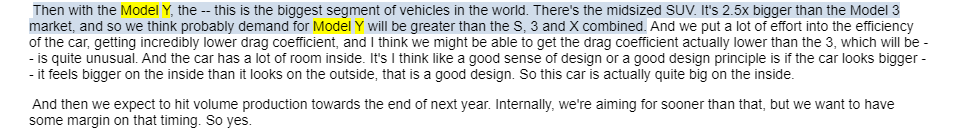

At the Tesla 2019 annual meeting in June 2019, Musk stated "we think probably demand for Model Y will be greater than the S, 3 and X combined."

At this point, Musk almost certainly knew Model Y orders were dramatically below initial Model 3 order levels.

At this point, Musk almost certainly knew Model Y orders were dramatically below initial Model 3 order levels.

At the time, Tesla's share price had fallen below $200/share and Musk was perilously close to being margin called.

His materially false statements on Model Y demand (as well as endless leaked emails) were used to engineer a rebound in Tesla's stock price to avoid personal ruin.

His materially false statements on Model Y demand (as well as endless leaked emails) were used to engineer a rebound in Tesla's stock price to avoid personal ruin.

On Tesla's Q2 2019 earnings call in July 2019, Musk quantified an expectation for 750k annual Model 3 deliveries and 1.25mm annual Model Y deliveries.

Musk had no factual basis for making these statements and knew that Model Y backlog was massively below expectations.

Musk had no factual basis for making these statements and knew that Model Y backlog was massively below expectations.

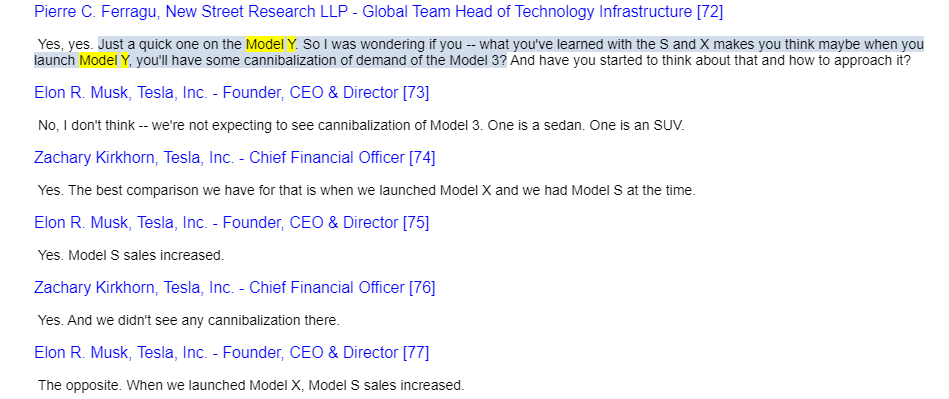

On the Q3 2019 earnings call in October 2019, Musk and Zach stated that they didn't expect the Model 3 to cannibalize Model 3 demand.

They based this on Tesla's experience with the Model X launch.

They based this on Tesla's experience with the Model X launch.

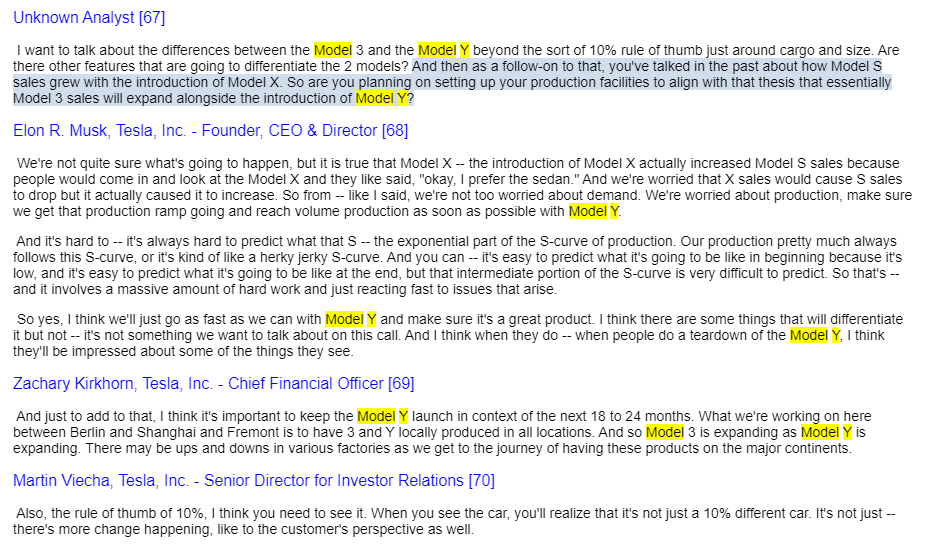

On the Q4 2019 earnings call in January 2020 Musk said:

" So from -- like I said, we're not too worried about demand. We're worried about production, make sure we get that production ramp going and reach volume production as soon as possible with Model Y."

" So from -- like I said, we're not too worried about demand. We're worried about production, make sure we get that production ramp going and reach volume production as soon as possible with Model Y."

At this time Musk knew that the Model Y order book was dramatically below the Model 3 at the time of initial Model 3 deliveries.

Zach pointed out the Model Y would be built in geography across the world implying Fremont would likely be building Model Ys only for NA.

Zach pointed out the Model Y would be built in geography across the world implying Fremont would likely be building Model Ys only for NA.

The Model Y started deliveries in Q1 2020.

Initial build quality has been horrendous.

Reviews have been mixed and generally poorer than initial reviews for the Model S, Model X and the Model 3. https://electrek.co/2020/06/16/tesla-model-y-quality-issues/

Initial build quality has been horrendous.

Reviews have been mixed and generally poorer than initial reviews for the Model S, Model X and the Model 3. https://electrek.co/2020/06/16/tesla-model-y-quality-issues/

Based on current demand levels of the Model Y and declining demand for the Model 3 in North America and Europe, the Fremont factory will likely have to reduce production in the next year as the Shanghai factory (and any future Korean factory) satisfy Asian demand, an Austin ...

... or Tulsa factory satisfies Cybertruck and Semi demand (ha!) and the Berlin factory satisfies Model Y and likely Model 3 demand in Europe.

How long before Tesla completely closes down the Fremont factory?

How long before Tesla completely closes down the Fremont factory?

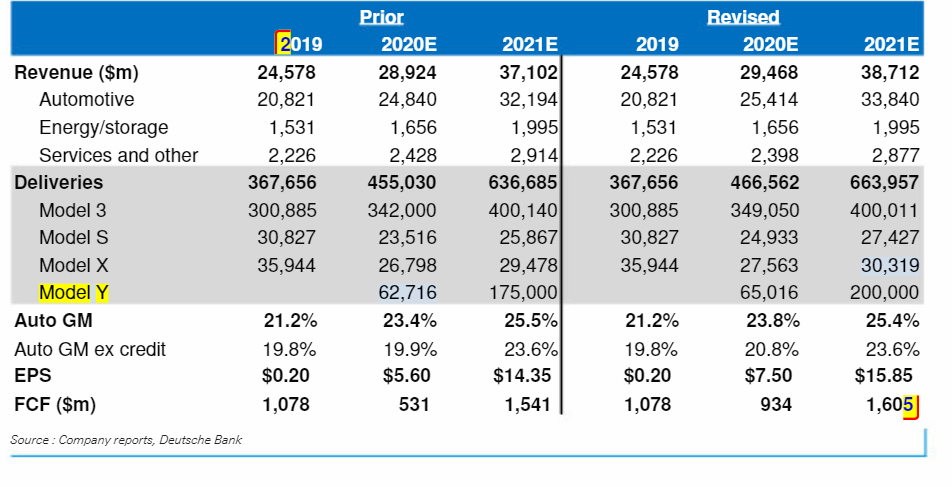

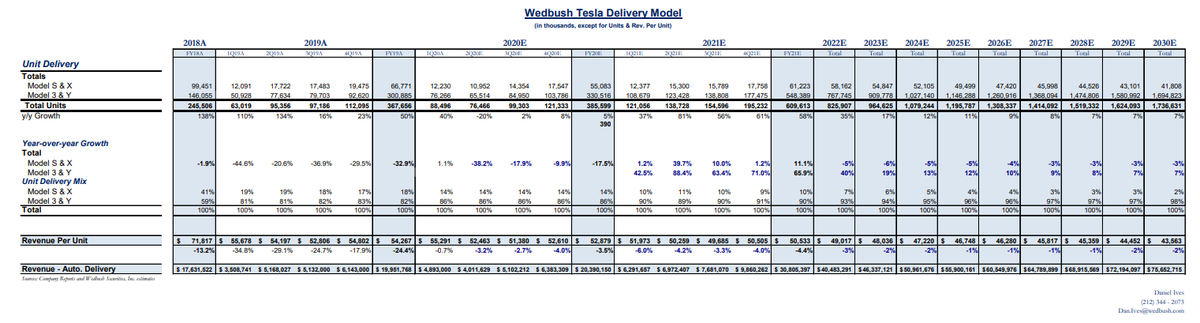

Meanwhile the sell side has aggressive estimates for Model Y demand embedded in their models. For example, DB estimates that Tesla will deliver 175K model Ys in 2021 while Model 3 demand also grows.

Similarly, Wedbush Analyst Dan Ives estimates that combined Model 3/Y demand will grow 66% in 2021.

While Shanghai demand may grow, the Model 3 is in decline outside of Asia and the Model Y is a flop.

While Shanghai demand may grow, the Model 3 is in decline outside of Asia and the Model Y is a flop.

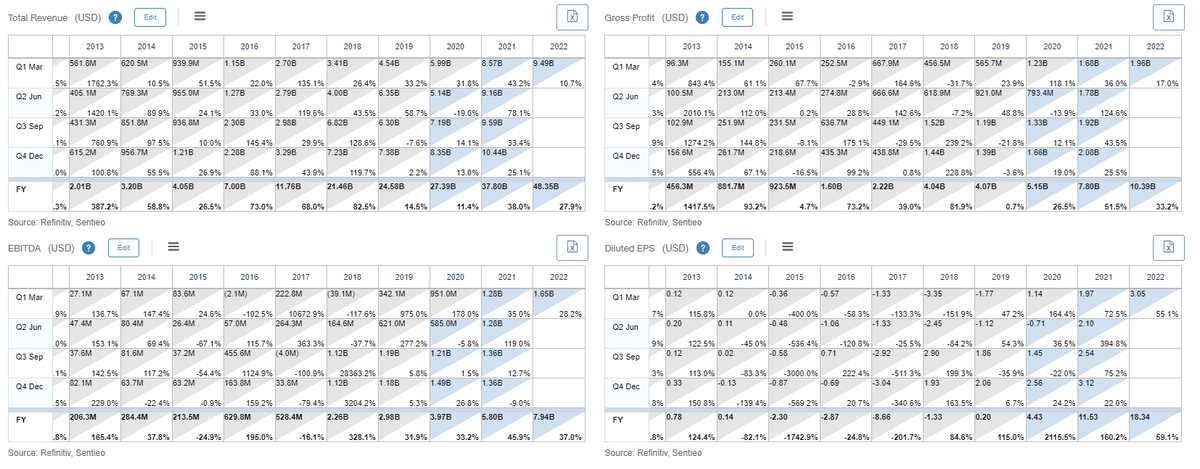

Robust Model Y demand is embedded within every sell side model and forms the basis for why the sell side is currently modelling $TSLA's revenues to grow 38% in 2021.

As the Model Y continues to reveal itself to be a giant flop, these estimates will need to be cut materially.

As the Model Y continues to reveal itself to be a giant flop, these estimates will need to be cut materially.

Read on Twitter

Read on Twitter

![On the Q1 2019 earnings call in April 2019, Elon refused to give the Model Y order number when specifically asked about it. [It would be the last time GS analyst David Tamberrino would be allowed to ask a question on a Tesla earnings call.] On the Q1 2019 earnings call in April 2019, Elon refused to give the Model Y order number when specifically asked about it. [It would be the last time GS analyst David Tamberrino would be allowed to ask a question on a Tesla earnings call.]](https://pbs.twimg.com/media/EcrNT47WsAcSUjr.png)