(1/11) Thread on $BRK's purchase of $D's pipes announced last week. Bottom line: should be a ~10%+ FCF yield growing around inflation.

I'm not an expert on these pipes - these are syndicated thoughts from @MLPguy @NiceQuarterGuys @StrapCap @BillDjango3 @Negative_GW @EnergyCynic

I'm not an expert on these pipes - these are syndicated thoughts from @MLPguy @NiceQuarterGuys @StrapCap @BillDjango3 @Negative_GW @EnergyCynic

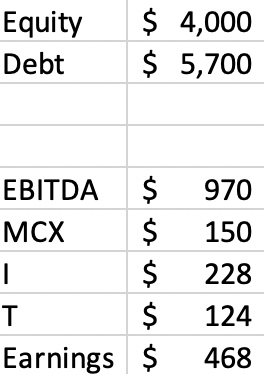

First off, price: as per @StrapCap , $BRK paid ~10x EBITDA. Here's a conservative look at how that might map down to FCF. Assumptions are maintenance capex (MCX) at ~15% of EBITDA, debt cost of 4%, D&A = MCX, and tax at 21%.

With those numbers, you'd get an 11.7% going in cash on cash yield.

Hopefully the other numbers are conservative, maybe a little less maintenance capital, probably an accelerated depreciation tax shield, and perhaps lower debt cost as well.

Hopefully the other numbers are conservative, maybe a little less maintenance capital, probably an accelerated depreciation tax shield, and perhaps lower debt cost as well.

As you can see, however, debt / EBITDA is ~6x. That's a lot of leverage, so there's a chance Buffett could inject some equity and run the assets with possibly as low as 3x leverage. If you re-run those numbers at 3x you have ~$6.7bb of equity capital and an ~8% initial yield.

The initial yield is fairly high, especially in this environment. To determine a likely range of returns, we need to look at the competitive position, earnings growth, etc.

First off, these are demand pull assets, as opposed to supply push assets.

Supply push assets are when you build a pipe because producers need to ship to a demand center.

Demand pull assets consist of pipes that take hydrocarbons to end customers.

Supply push assets are when you build a pipe because producers need to ship to a demand center.

Demand pull assets consist of pipes that take hydrocarbons to end customers.

As you can imagine, demand pull pipelines are generally much better assets - more stability, little dependence on production, and better competitive positions with relatively low overbuild risk.

As long as the end users still use natural gas, $BRK should do well.

As long as the end users still use natural gas, $BRK should do well.

Many people assume nat gas demand will fall over time along with oil, but in pretty much every scenario, the EIA projects good growth in nat gas demand:

https://www.eia.gov/outlooks/aeo/pdf/AEO2020%20Natural%20Gas.pdf

Take the projections with a grain of salt, but I think they're directionally correct.

https://www.eia.gov/outlooks/aeo/pdf/AEO2020%20Natural%20Gas.pdf

Take the projections with a grain of salt, but I think they're directionally correct.

Back to the actual assets, these pipes are regulated, which means they're usually allowed to take rates up roughly along with inflation. I wouldn't expect volume growth to be a factor here, but on the other hand, the risk of volumes (and earnings) falling off is low.

To put it all together, depending on the capital structure $BRK should get an 8-12% initial cash on cash yield, demand growth over time and low overbuild risk should mean volumes would be steady, and rates and earnings should go up roughly along with inflation.

(End) That would all add up to LDD rates of return on a very high quality asset. As a $BRK shareholder, I'm quite pleased with this purchase and I think it probably clears $BRK's opportunity cost in simply buying back more of its own stock.

Again, I'm not an expert on these specific pipes. So to the energy squad: if I made any obvious mistakes then let me know and I'll add the corrections to this thread.

Thabks to @nothingbutnnets, important info on the capital structure here: https://twitter.com/nothingbutnnets/status/1282021105520332801?s=21 https://twitter.com/nothingbutnnets/status/1282021105520332801

And from @BuckQuivas, not all of these are quite as good as I thought: https://twitter.com/buckquivas/status/1282037534755889152?s=21 https://twitter.com/buckquivas/status/1282037534755889152

Read on Twitter

Read on Twitter