The U.S. recovery from the coronavirus-induced recession is already leveling off and showing signs of faltering only two months into the rebound, a series of real-time economic indicators show. A thread. And see my @business story here. https://www.bloomberg.com/news/articles/2020-07-11/five-real-time-charts-show-signs-economic-recovery-is-faltering?sref=cv51C53O via @economics

Neil Dutta of @RenMacLLC pointed out in a note to clients a number of indicators that are looking worse. Goldman Sachs has lowered its GDP estimates. JPMorgan has warned of slowing spending. Wall Street is increasingly worried. The problem is the resurgent virus. From Goldman.

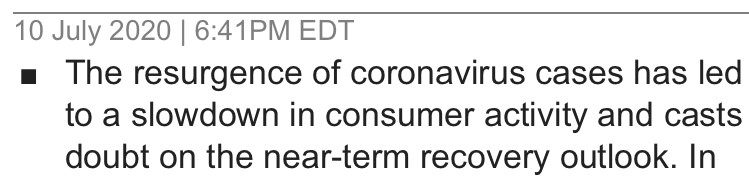

Millions of workers were brought back to jobs in May and June, but now the number of businesses open and employees working are stagnating. Take a look at Homebase data for Texas, Florida and Arizona.

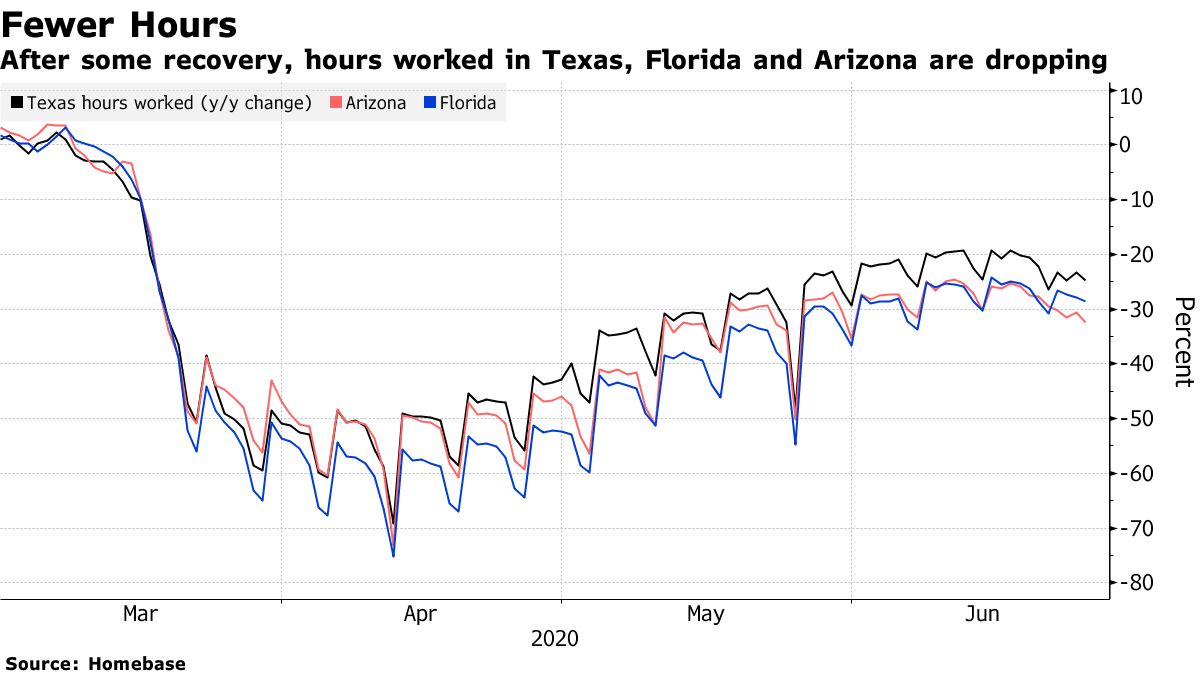

Restaurants have been among the biggest victims of the recession. Reservations on Open Table showed a pickup in May and the first half of June, followed by a drop during the last few weeks. The decline in activity has been especially true in states with rising cases.

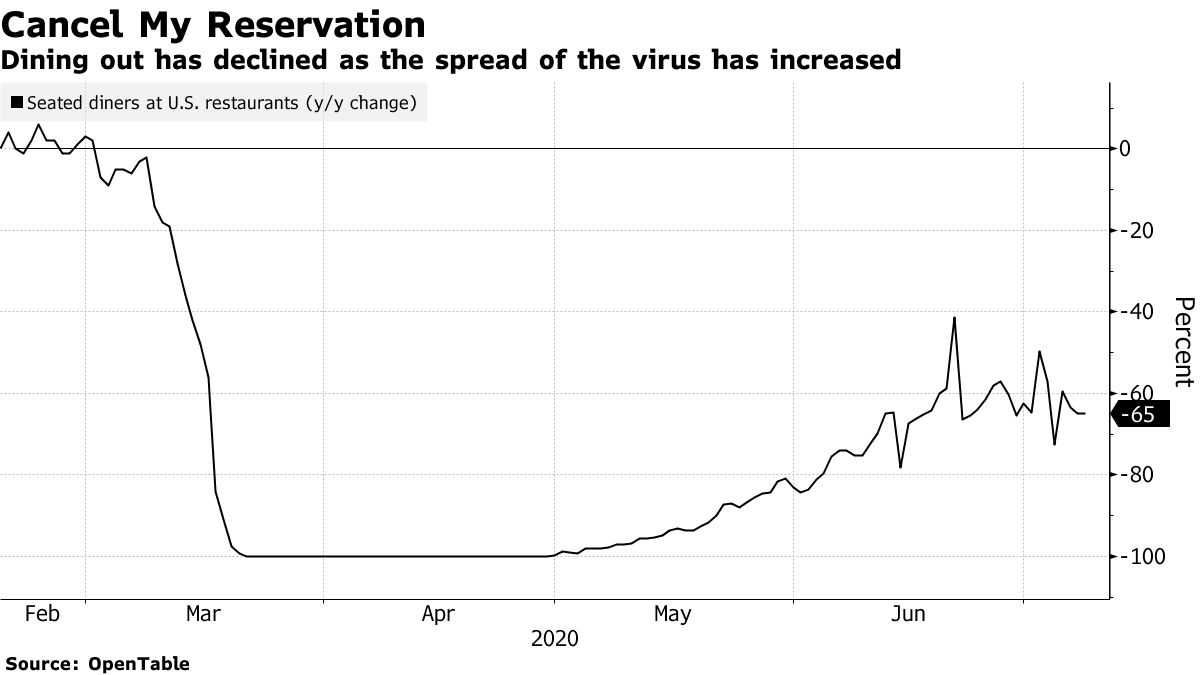

Homeowners remain under continued pressure. About 9% of households with a mortgage failed to make their last payment and 16% of the survey respondents said they fear they can’t cover the next one, according to the U.S. Census Bureau’s Household Pulse survey in late June.

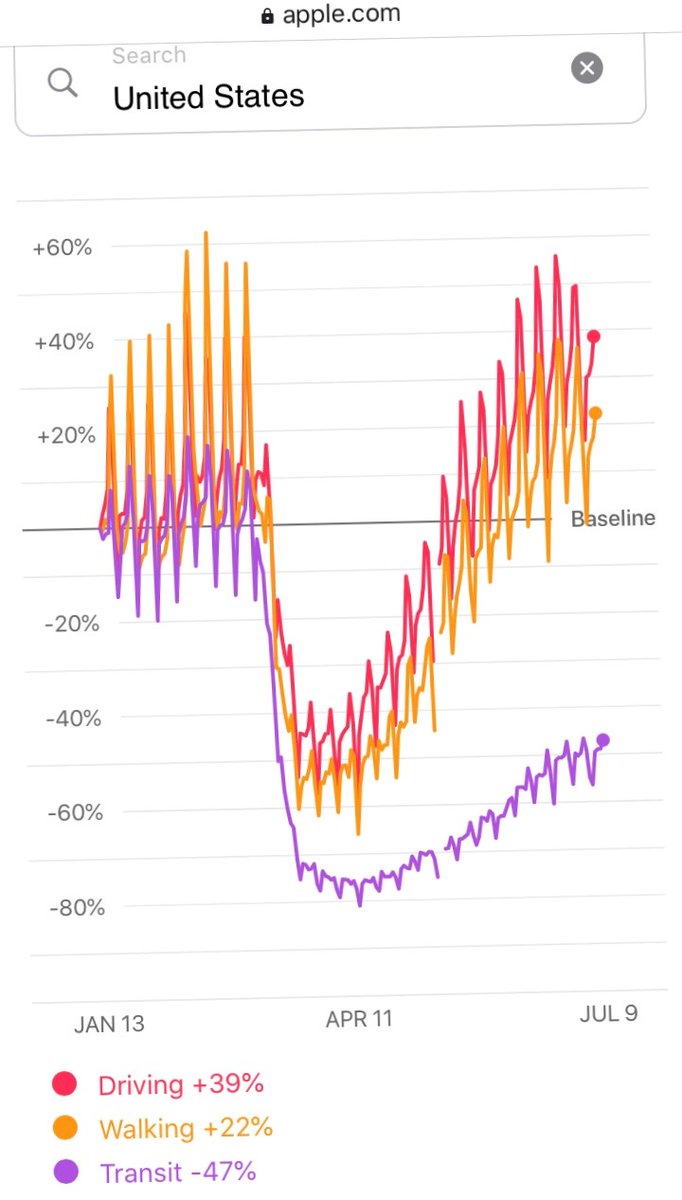

Overall, consumers are staying more at home, and mobility is leveling off a bit, despite the pics you see at random beaches. Yes some young people are getting out. Anyone middle aged or especially 65 or older wants to be very cautious. Take a look at mobility trends from Apple.

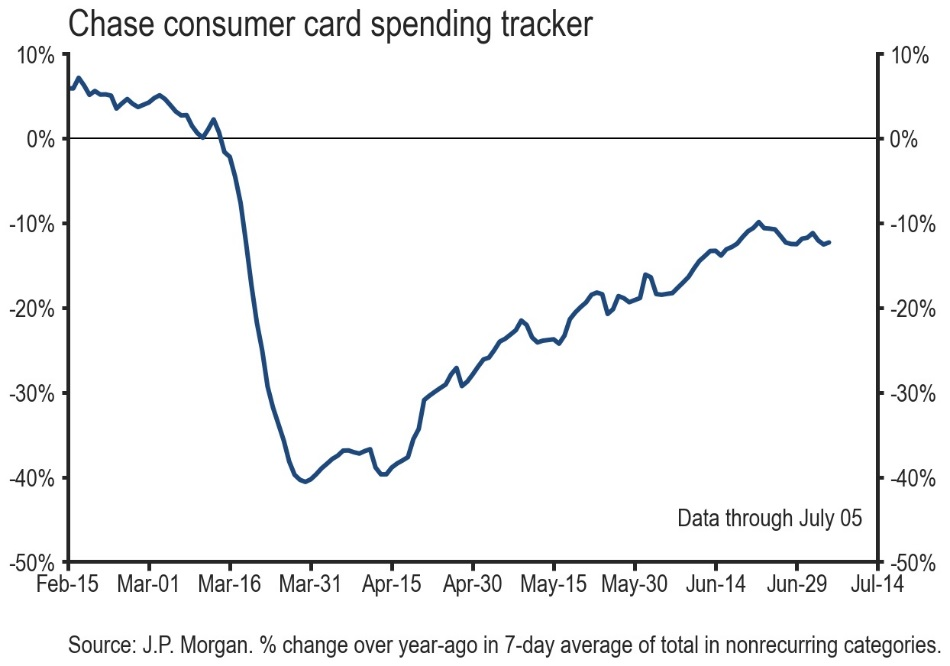

JPMorgan has a great measure of activity by looking at credit card data. I have a Chase credit card, and 30 million other Americans do too, including debit cards. We are slowing our spending. It is "widespread across states" reflecting some caution.

The backdrop is most official government data, which is lagged, have been upbeat. 4.8 million jobs were added in June – but that reflects the survey in the first half of the month. Citi’s surprise index is at a record.

Some policy makers have been arguing to reopen state economies as a way to help with U.S. jobs and growth. But the reality is that consumers, not politicians, are dictating economic activity. There are at least three studies by leading economies that show that.

. @Austan_Goolsbee and Chad Syverson had an @nberpubs NBER paper pointing out as much: "Shutdown orders had only modest effects on the economy... Instead, consumer fear seems to have driven the declines." https://www.nber.org/papers/w27432

An @nberpubs paper by Lisa Kahn, Fabian Lange and David Wiczer found the lockdowns had little to do with the economic impact. https://nber.org/papers/w27061 Also a Raj Chetty & Co. paper found consumer spending constrained by consumer behavior, not governments. https://opportunityinsights.org/wp-content/uploads/2020/05/tracker_paper.pdf

The Federal Reserve has policy tools, but their ability to bolster an economy hurt by confidence is limited, as @raphaelbostic of @AtlantaFed said last week: ``“Business leaders are getting worried. Consumers are getting worried.” https://www.bloomberg.com/news/articles/2020-07-07/fed-s-bostic-says-virus-spread-threatens-to-undermine-confidence?sref=cv51C53O

Contrary to conventional wisdom, as @TheStalwart points out, Wall Street is paying attention. Stocks like $AMC, $SPG and $DAL have been declining in recent weeks. Energy and banking stocks have been dropping too. Here's chart for leading shopping mall owner Simon Property Group.

Where does that leave us? If we get control of the virus, there’s reason to think the U.S. recovery reaccelerates. If we don’t, it could be stalled for quite some time. I’m generally an optimist, but would have expected the virus to be under control by now.

Read on Twitter

Read on Twitter