No shock. Pay your taxes, esp if u're patriotic. As an American, we don't really benefit from tax arbitrage much in Hong Kong & we still pay. Uncle Sam finds you globally. The question is beyond HK, how does China get Chinese people to pay taxes? US has global banks that comply. https://twitter.com/HK_NikkiSun/status/1281540466270302209

Many people think that they are entitled to benefits but entitlements come from redistribution of wealth.

I believe in individualism but I also believe in tribalism. As in, I believe if you are a citizen of a country & succeed, it's the self + family + system that allow u to.

I believe in individualism but I also believe in tribalism. As in, I believe if you are a citizen of a country & succeed, it's the self + family + system that allow u to.

Jeff Bezos succeed in America because of not just himself but also his parents, his schools, his community, his mentors, his system (American capitalism that allows the creme to rise to the top & capital market that supports his ideas) & so on & so forth.

Taxation redistributes.

Taxation redistributes.

Takes from the hard-working, successful (either through luck, genetics, inheritance etc), and disciplined & redistribute that back via the state spending

State spending is not always the most inefficient but in theory in things that the private market'd fail, eg education.

State spending is not always the most inefficient but in theory in things that the private market'd fail, eg education.

In Hong Kong, it is clear that the private market FAILS in creating housing for Hong Kong people. And I think taxation is not distributed well to create adequate supply for all those people that work hard.

I haven't met a person here that's lazy. But why is society so unequal?

I haven't met a person here that's lazy. But why is society so unequal?

It is unequal because of the way in which the Hong Kong gov chooses to tax - it does not tax capital gains.

Moreover, property tax is pretty low if you compare to the USA for example. So?

Capitalists COMPOUND while labor lags. Simple as that. Time for a rethink of distribution.

Moreover, property tax is pretty low if you compare to the USA for example. So?

Capitalists COMPOUND while labor lags. Simple as that. Time for a rethink of distribution.

While the income tax rate in China is high, if you look at the sources of revenue, you can easily see that many people do not pay income taxes as they should (don't we read about so many millionaires & billionaires).

Yet, a lot of taxes in China come from indirect taxation (VAT)

Yet, a lot of taxes in China come from indirect taxation (VAT)

Taxation is a very interesting topic & one that I think most people don't spend a lot of time thinking about. I personally think it's the most important topic but I suppose that's an economist thinking.Expenditure is also important. In the US, most expenditure goes to the elderly

Many people think that they pay taxes & get nothing in return but US expenditure is skewed towards the following:

*The very young K-12 (free public education & if poor free medicare etc)

*The elderly: social security + medicare biggest share of expenditure & more than defense.

*The very young K-12 (free public education & if poor free medicare etc)

*The elderly: social security + medicare biggest share of expenditure & more than defense.

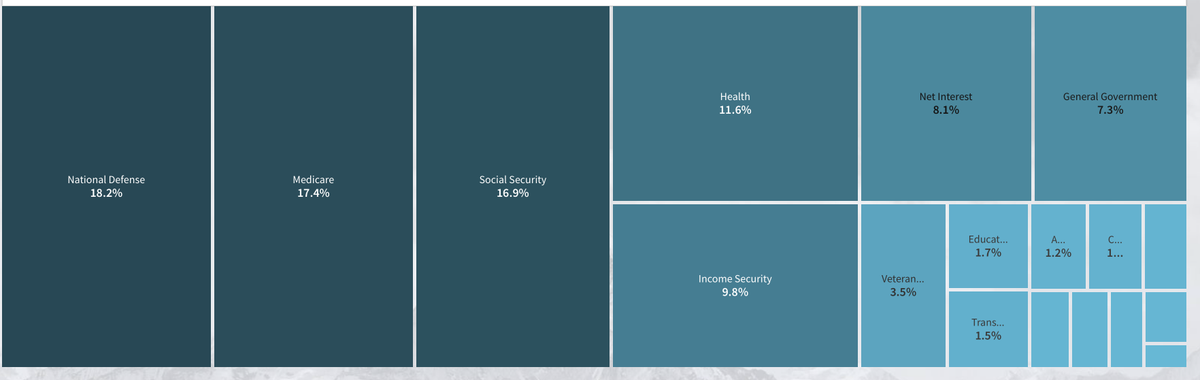

US federal gov expenditure in 2019 (note that u have state spending too & I will talk about that later)

Social security 16.9% & Medicare 17.4% = 34.3% of expenditure

National defense is 18.2%

Health is also large at 11.6%

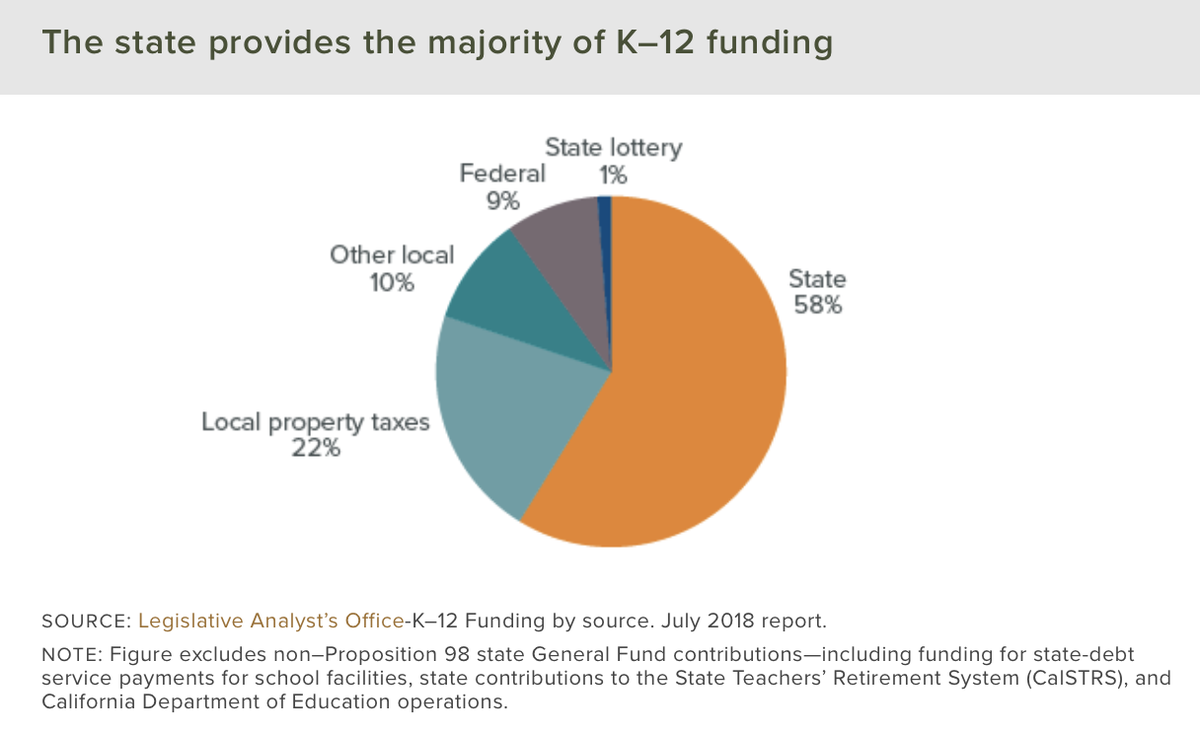

Note that education is small but most comes from state

Social security 16.9% & Medicare 17.4% = 34.3% of expenditure

National defense is 18.2%

Health is also large at 11.6%

Note that education is small but most comes from state

Who pays for your free public education??? In California, it's mostly from the state. Remember that on top of federal taxes, you have to pay state & that varies. Some don't have income tax.

Did u know that roughly half of ur property tax goes to local schools?

Did u know that roughly half of ur property tax goes to local schools?

And the US has a rather progressive tax system which means less taxes from indirect sources & more from income & moreover if you make below a certain threshold, you don't pay income taxes. The US also collects a lot of property taxes relative to other countries in the OECD.

In California, u may think u own a house but it's the gov that ultimately owns it as even if u paid off ur mortgage, u still owe the local government 1-2% per year of ur assessed value.

If default, they auction your house. Here's SD tax revenue spending & 45.4% goes to schools.

If default, they auction your house. Here's SD tax revenue spending & 45.4% goes to schools.

So you can see that taxation & spending are interesting. If you pay zero taxes but get a bunch of services, then that is because it has been redistributed to you.

And hopefully, one day, u'll be productive & pay back for those that need the services. Taxation, a great topic!

And hopefully, one day, u'll be productive & pay back for those that need the services. Taxation, a great topic!

Read on Twitter

Read on Twitter