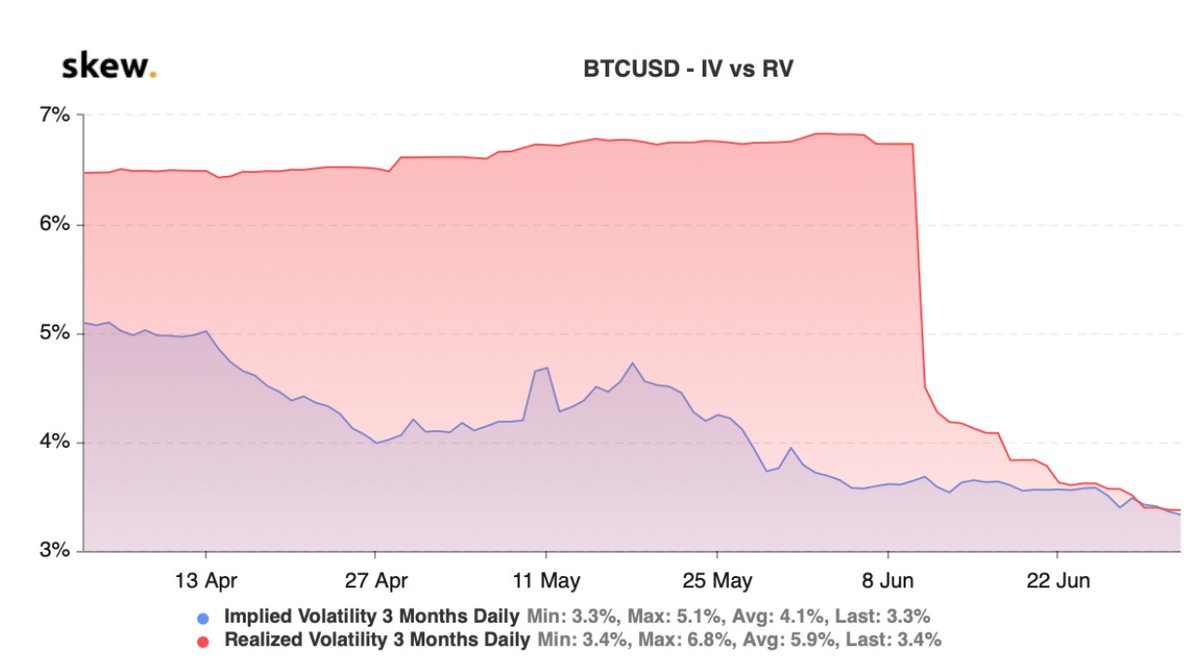

Implied and realized volatility have been crushed due to yield seeking funds (advertised to investors as low-risk yield generating vehicles) flooded the market with short volatility options sales.

On paper, these funds are not writing covered calls as to not take naked exposure on the options and the market makers on the other side of the trade hedge out risk by ever-adjusting their bitcoin spot exposure.

In market makers having long volatility over-exposure, they inadvertently create tighter and more predictable price ranges for the month as they buy (back) bitcoin when price goes down and sell bitcoin when price goes up.

However, risk is mispriced in the bitcoin options market and these short-volatility funds are picking up pennies in front of a steam roller.

The takeaway:

It is an EXTREMELY attractive time to accumulate vol.

The takeaway:

It is an EXTREMELY attractive time to accumulate vol.

When might volatility come back? Likely when spot market volume picks up. When might that be?

Can't say for certain but..

US and China's equity markets are risk on and Congress reconvenes in H2 of July to debate fiscal.

h/t: @jyashouafar @AviFelman @ConvexMonster

Can't say for certain but..

US and China's equity markets are risk on and Congress reconvenes in H2 of July to debate fiscal.

h/t: @jyashouafar @AviFelman @ConvexMonster

Read on Twitter

Read on Twitter