Investments -

Investments - different Lessons.

different Lessons.My biggest winners, losers (& everything in between) over the yrs had a lot of personal lessons. Here are some of the main ones.

Sharing with few FinTwit friends.

@Gautam__Baid @TMFJMo @saxena_puru @FromValue @Matt_Cochrane7 @richard_chu97

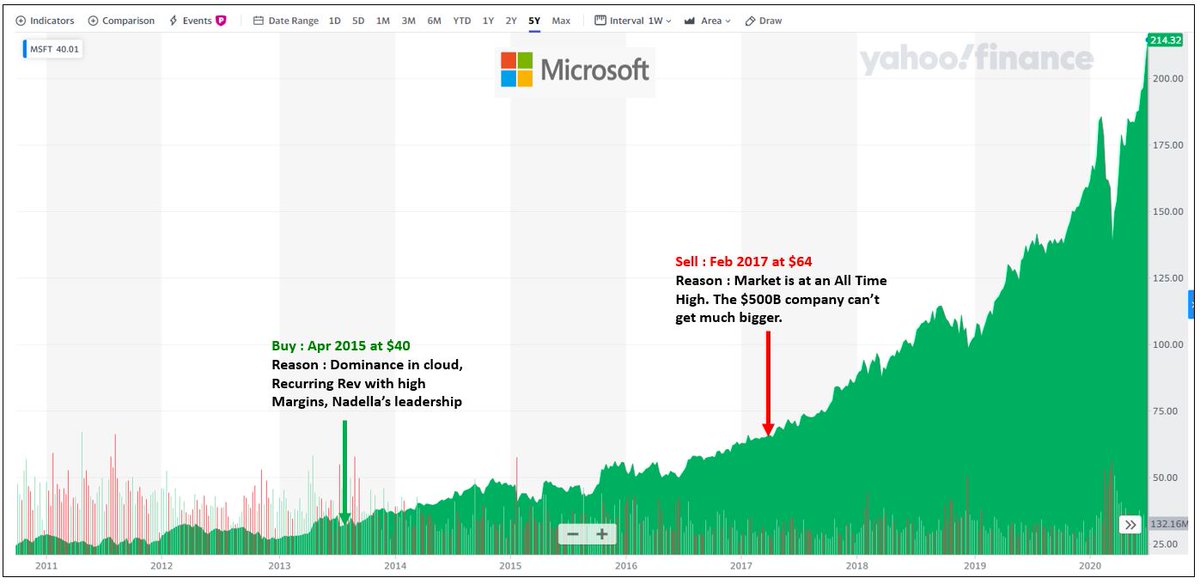

1. $MSFT Lesson : Do not sell an extremely dominant, cash gushing machine that you bought for the long-term due to general market level (ATH) reasons. Sell the losers if you have to. Winners win and the best will get a lot bigger.

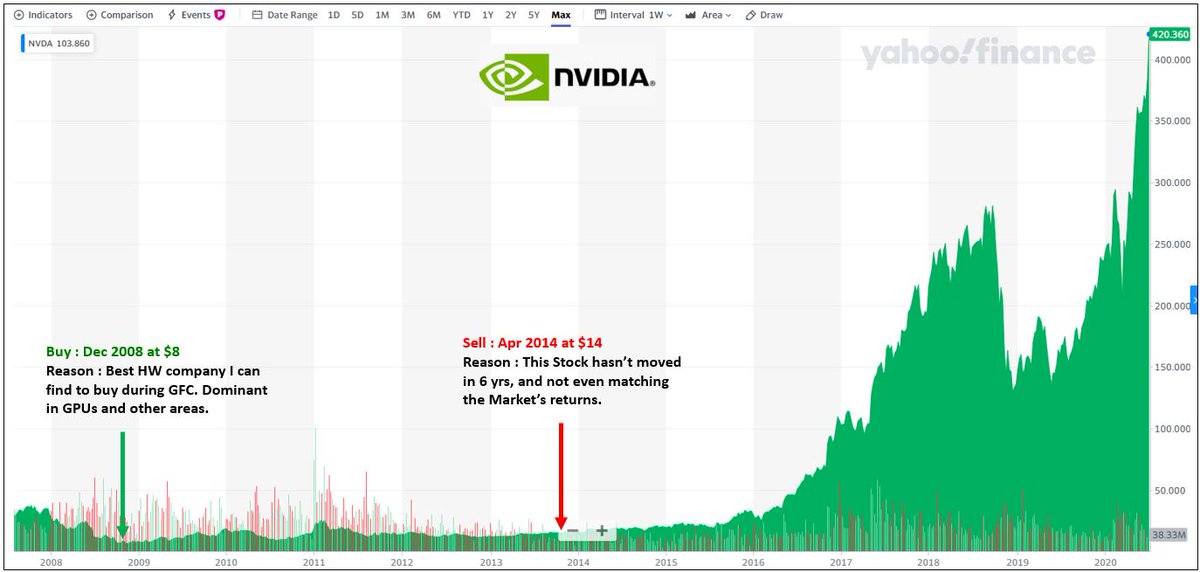

2. $NVDA Lesson : Do not sell a good and profitable company out of boredom or lackluster gains (esp when you don't need the cash from the sale). If you bought for the long-term, study the latest fundamentals again and see what the Company has on the horizon.

3. $AMZN Lesson : If you love everything about the mega wide moat company and want to own it, but getting stuck at one point (lack of Net income in this case), study the reasons for that. Follow the Revenue, Operating Cash Flow & other trends to see the whole picture.

4. $SHOP Lesson : If you studied, understood and loved the company and it's still small but with a long runway ahead, don't get stuck on the past bargain prices (during Market crashes). Look to the future and buy a little (preferable 1/3rd or 1/2).

5. $LULU Lesson : If you got lucky buying a hyper growth and profitable company at extremely low prices during a Market crash, celebrate the big gains but hold or add more if there's plenty of growth ahead.

6. $V Lesson : If you have the thesis nailed down from the beginning, and the story is playing out exactly as planned over the years giving you big gains, ADD more to those winners. It's the growth in $, not the % that eventually matter at a personal Portfolio level.

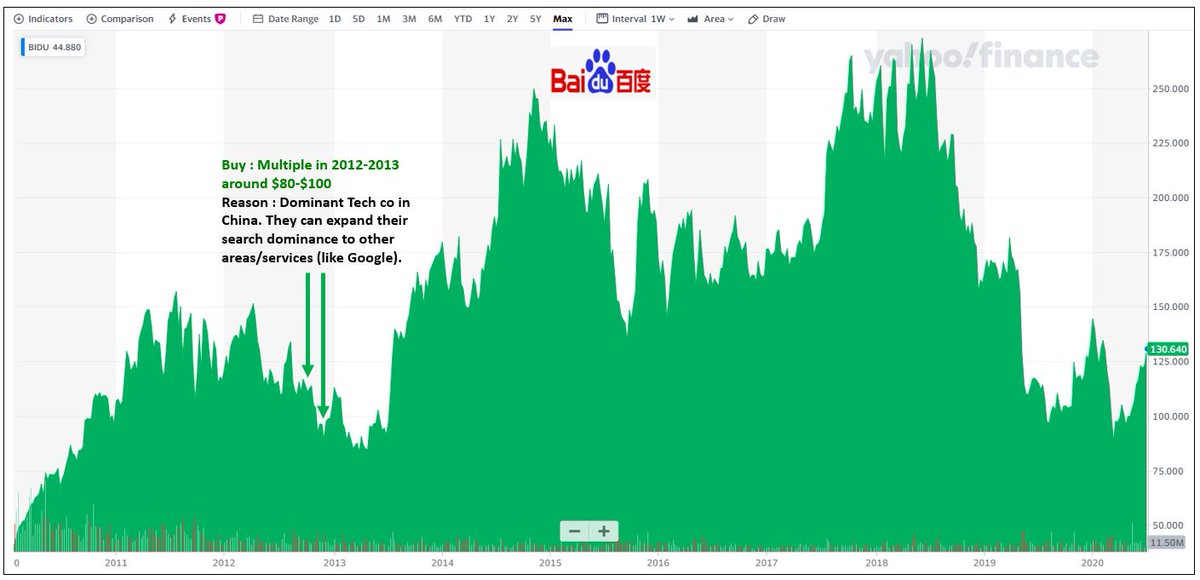

7. $BIDU Lesson : If you had a good thesis in the beginning but it stalls or doesn't improve over the years, move on. 2-3 years is more than enough time for the Company to plan, communicate and prove itself.

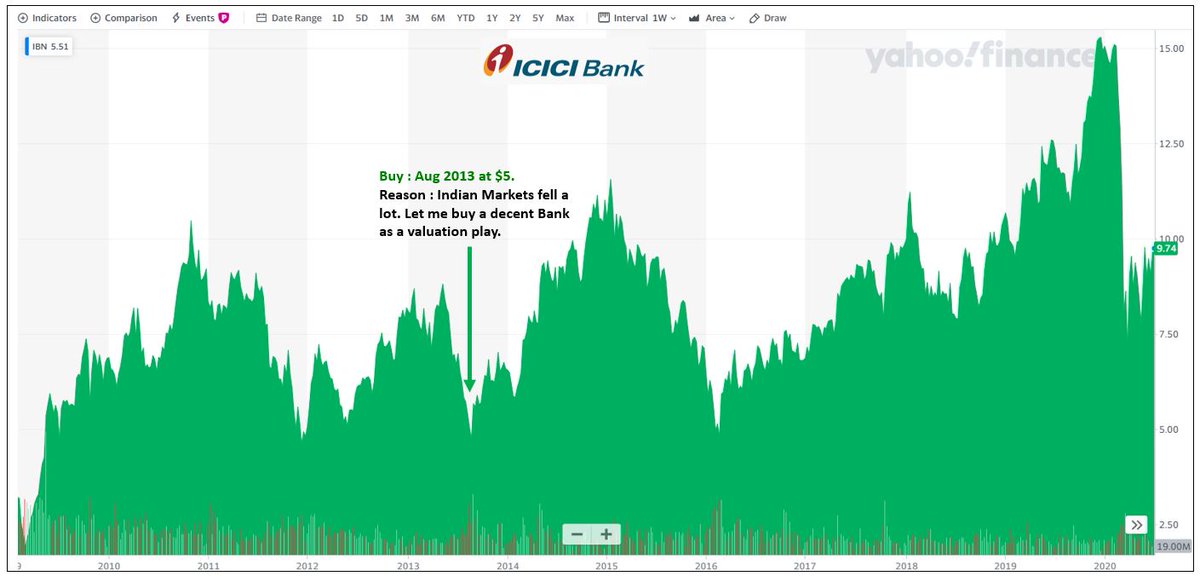

8. $IBN Lesson : If you bought a medium term position purely for under-valuation, and the story plays out as planned, capture the profit and move on. Don't leave these cyclical Co's in the Portfolio for nothing. Do not take round-trips.

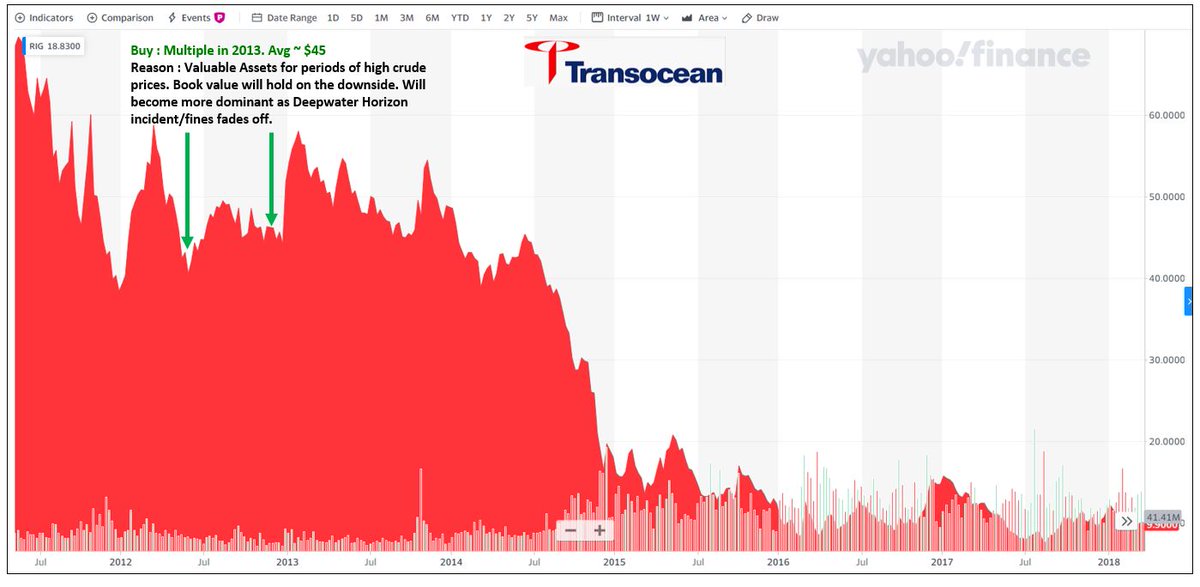

9. $RIG Lesson (same with $SDRL) : If your thesis collapses due to external factors and the Co's can't do anything about it, sell and move on. Your patience will be exploited & killed by these type of Co's. Also, stay away from commodities. There are much better hunting grounds.

10. $CPRI Lesson (formerly $KORS) : Do not pile a bad decision to cover up a previous bad decision. You'll get what you deserve. Also, most Fashion is fickle and consumer tastes change fast.

Your investment lessons are based on what goals you wanted to achieve (from the positions and overall Portfolio) the actions you took, and their results over time.

If you are a Business focused, patient/disciplined long-term investor, your capital, time & patience are best allocated to the Co's that can make the best out of that long-term view.

That's usually found with Financially healthy, Quality Compounders, riding major trends, run by good Mgmt, acquired at decent prices or multiple times along the way, and held for the long-term.

Find, Buy, Hold and Add to Excellence.

Find, Buy, Hold and Add to Excellence.  Sell when thesis changes/worsens.

Sell when thesis changes/worsens.  Accept and learn from your mistakes and improve the process.

Accept and learn from your mistakes and improve the process.

Everybody's goals, actions, experiences and lessons are slightly different. So none of this should be treated as direct investment advice for other people.

/END.

Happy Weekend.

/END.

Happy Weekend.

Read on Twitter

Read on Twitter