1/5 @BalancerLabs is rewarding liquidity providers with around $1.5M - $2M /week. It has been doing so for weeks.

On an annualized basis, this campaign costs 70M - 100M. To understand how great an expense this is, Coinbase acquired the leading prime broker, Tagomi, for $100M.

On an annualized basis, this campaign costs 70M - 100M. To understand how great an expense this is, Coinbase acquired the leading prime broker, Tagomi, for $100M.

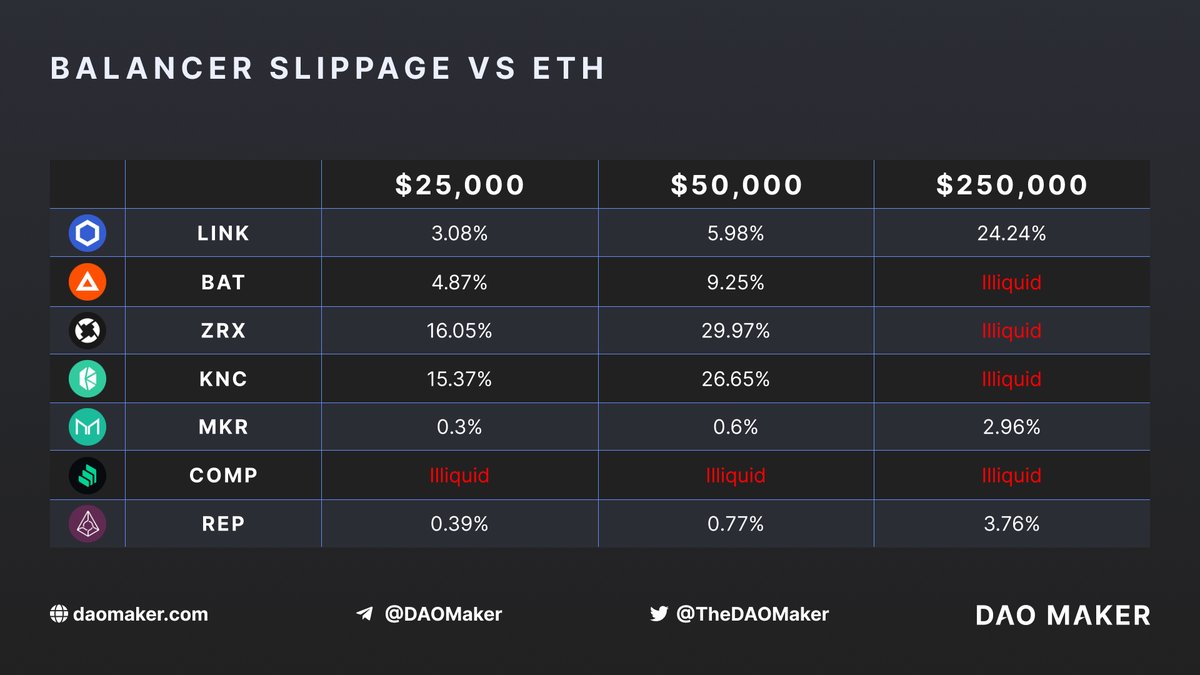

2/5 Balancer has little to show when it comes to assets that have high trading demand. Tokens with highest market caps lack liquidity to support even a tiny fraction of their daily volume.

Instead, Balancer is on its way to become another stablecoin swap pool, and nothing more.

Instead, Balancer is on its way to become another stablecoin swap pool, and nothing more.

3/5 Arguments that growth will be steady are weak. The #COMP 'airdrop' by @compoundfinance allowed #DeFi lending to quickly dominate CeFi.

Meanwhile, #BAL airdrop hasn't even allowed Balancer to dominate DEX markets. Problem lies in misappropriating the qualification for BAL.

Meanwhile, #BAL airdrop hasn't even allowed Balancer to dominate DEX markets. Problem lies in misappropriating the qualification for BAL.

4/5 Compound's product is lending.

Just depositing tokens and providing liquidity is sufficient for the underlying business to grow.

Balancer's product is the swap.

#BAL airdrop should be an incentive for ONLY deposits of tokens that have high trading demand...

Just depositing tokens and providing liquidity is sufficient for the underlying business to grow.

Balancer's product is the swap.

#BAL airdrop should be an incentive for ONLY deposits of tokens that have high trading demand...

5/5 ... & subsidies that make the trading fees for those tokens just 0.01% for months.

Instead, Balancer has incentivized merely depositing anything, regardless of whether or not it boosts the underlying business in the longterm, and hence became a transient ground for farming.

Instead, Balancer has incentivized merely depositing anything, regardless of whether or not it boosts the underlying business in the longterm, and hence became a transient ground for farming.

Read on Twitter

Read on Twitter