FinTwit is full-on breadth hating mode again. Reminder that was also the case until about a week before the June 8 high.

And at that $SPX high, A/D was at a new ATH and 97% of the $NYSE was >50-d and 70% >200-d. Breadth peaked with price https://twitter.com/ukarlewitz/status/1265757894504374273

And at that $SPX high, A/D was at a new ATH and 97% of the $NYSE was >50-d and 70% >200-d. Breadth peaked with price https://twitter.com/ukarlewitz/status/1265757894504374273

To each his/her own, but bad breadth is useful at price lows (a washout), but in real-time (key), it is a minefield of false signals at price highs. There are better signals available to you. Jmo from the past 26 yrs https://twitter.com/ukarlewitz/status/1265754166611161088

Another real time example of ‘good breadth’ preceding a high in price. $RUT still lower than it was then https://twitter.com/sentimentrader/status/1265595555293601793

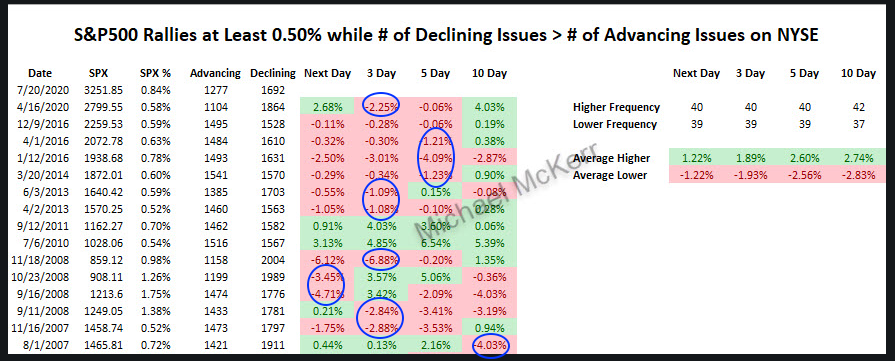

$SPX up big but breadth negative. Last 15 time, 12 (80%) down more 1%, 2 (13%) up big and 1 flat. No bueno

https://twitter.com/MikeMcKerr_TDA/status/1285312238157520896

https://twitter.com/MikeMcKerr_TDA/status/1285312238157520896

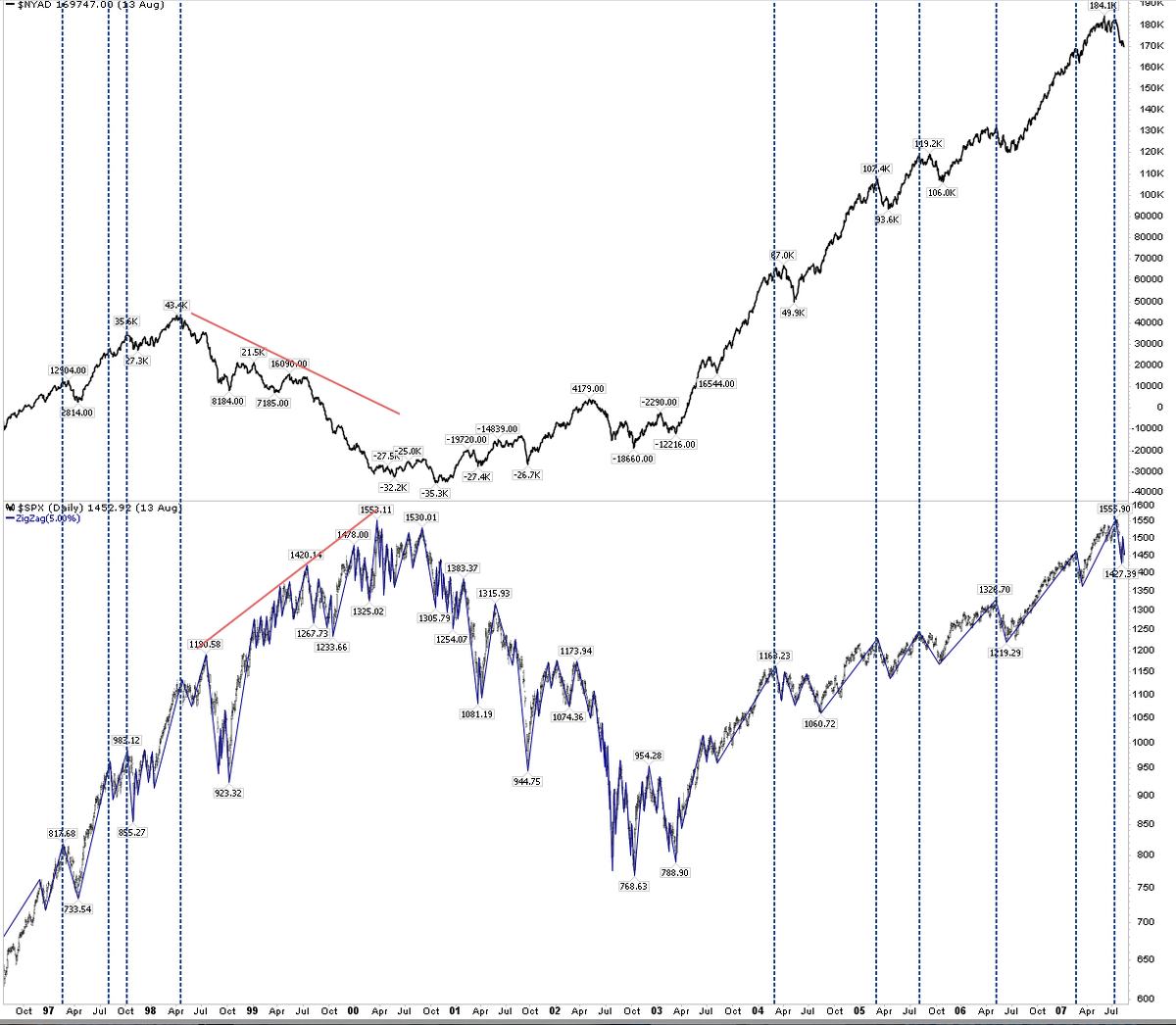

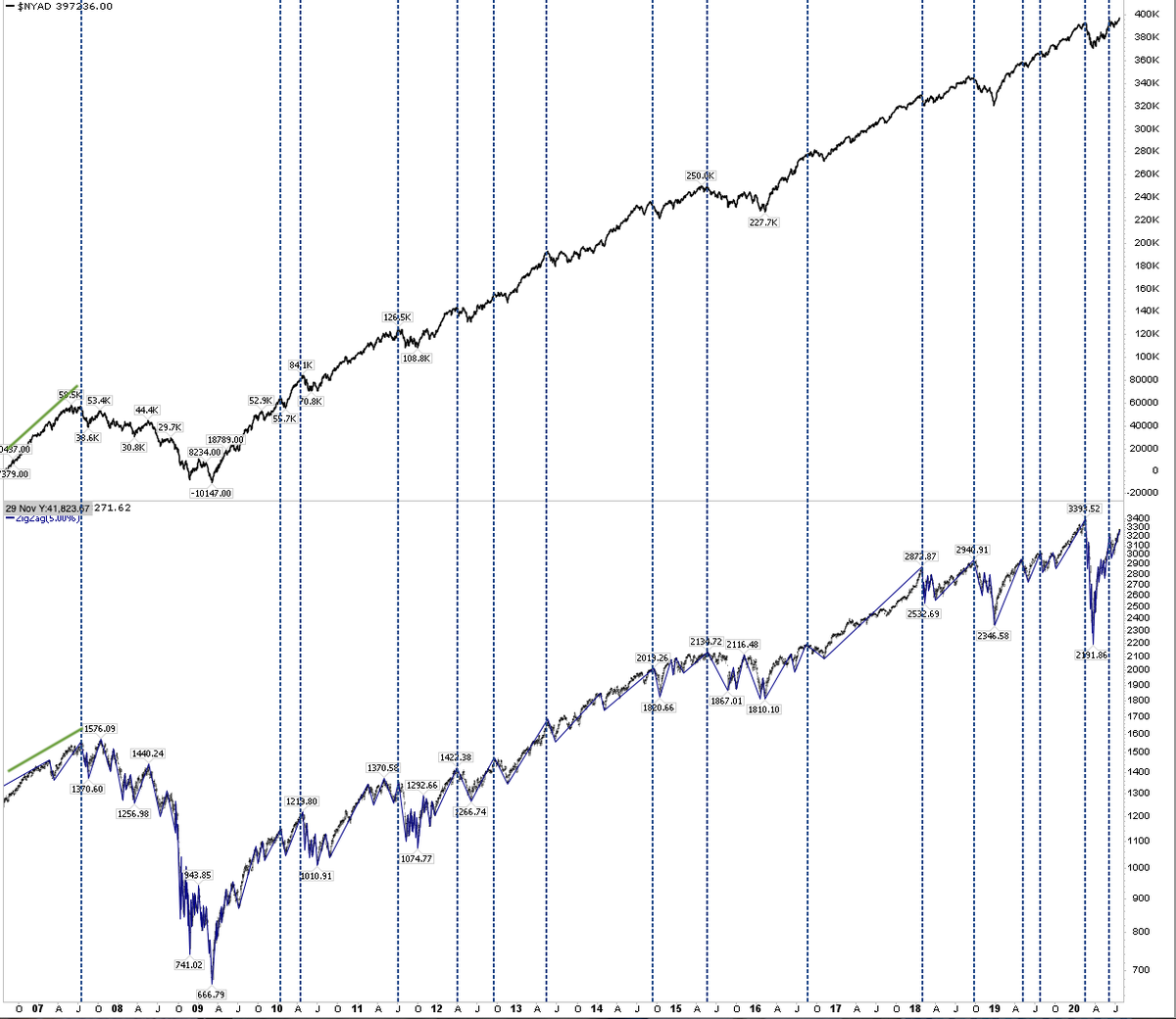

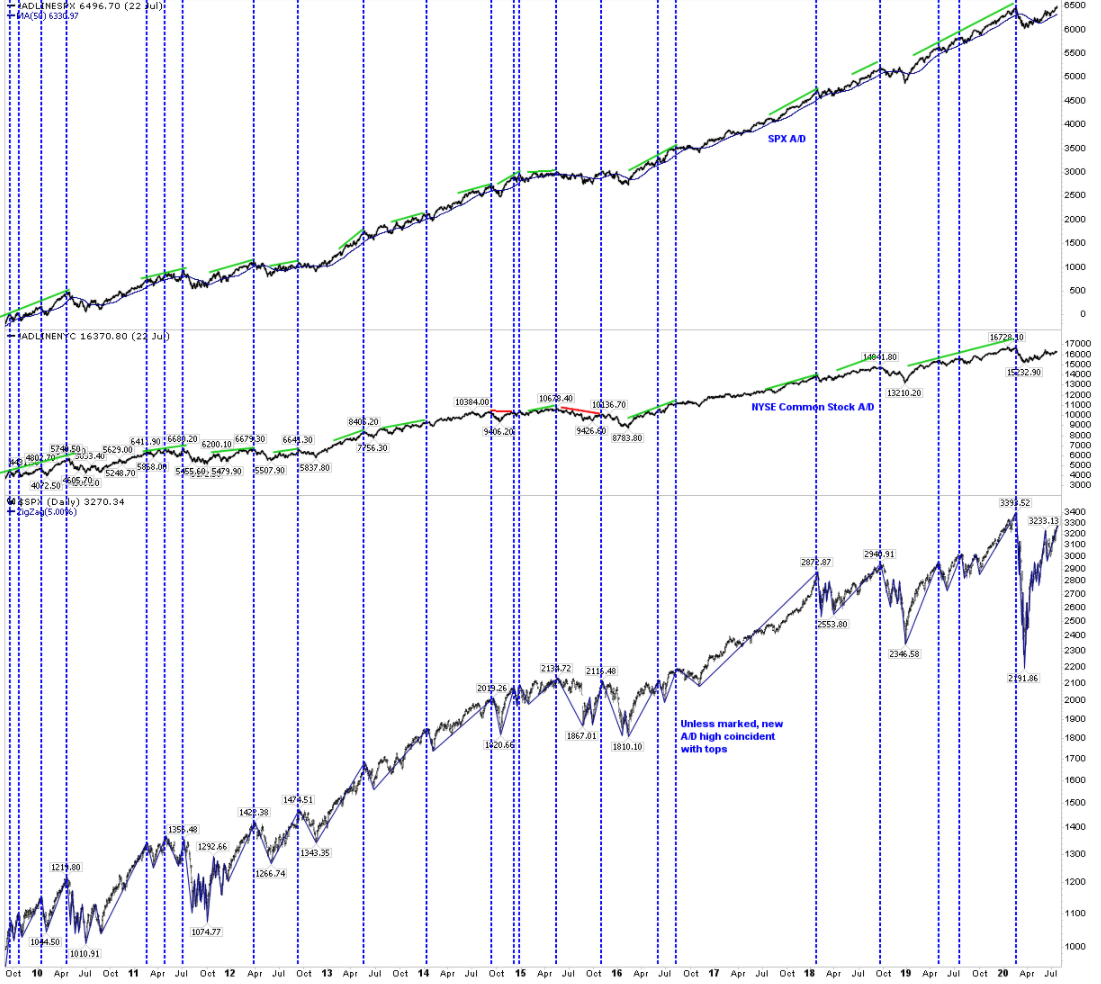

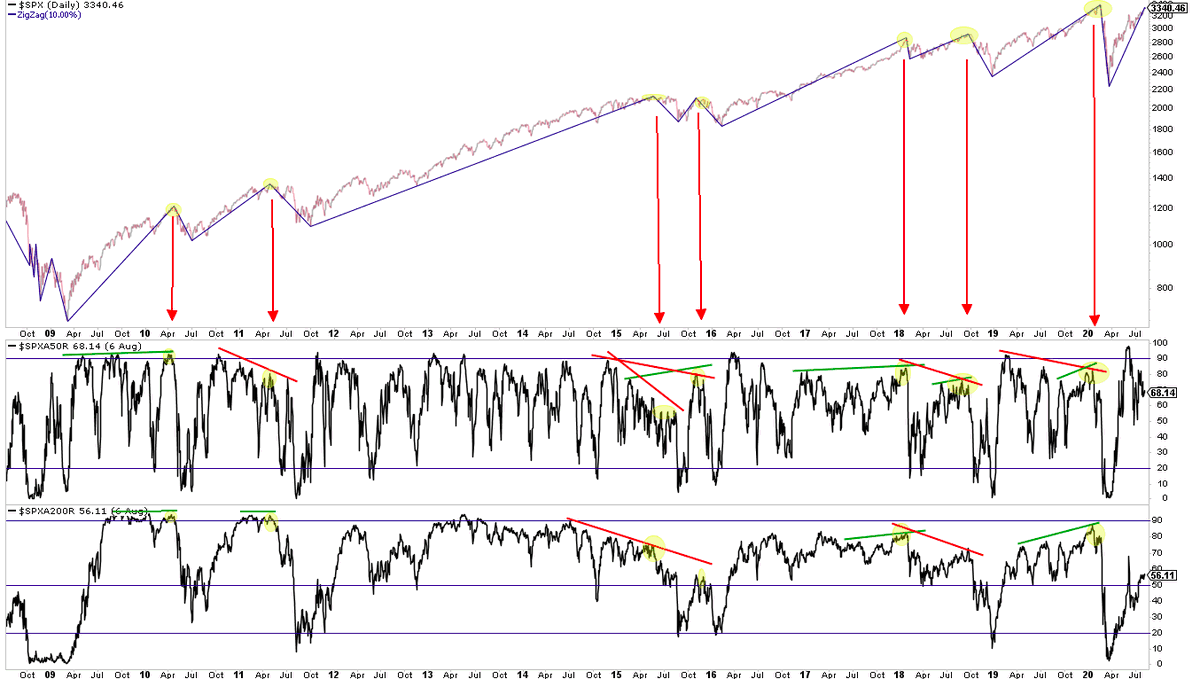

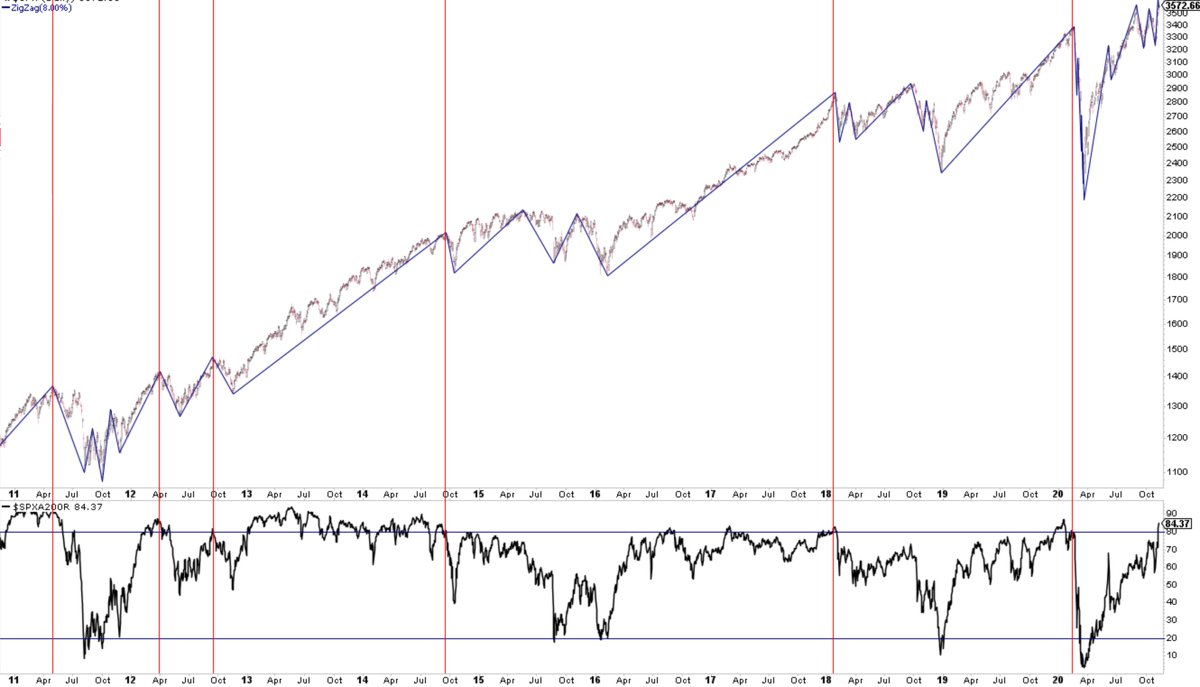

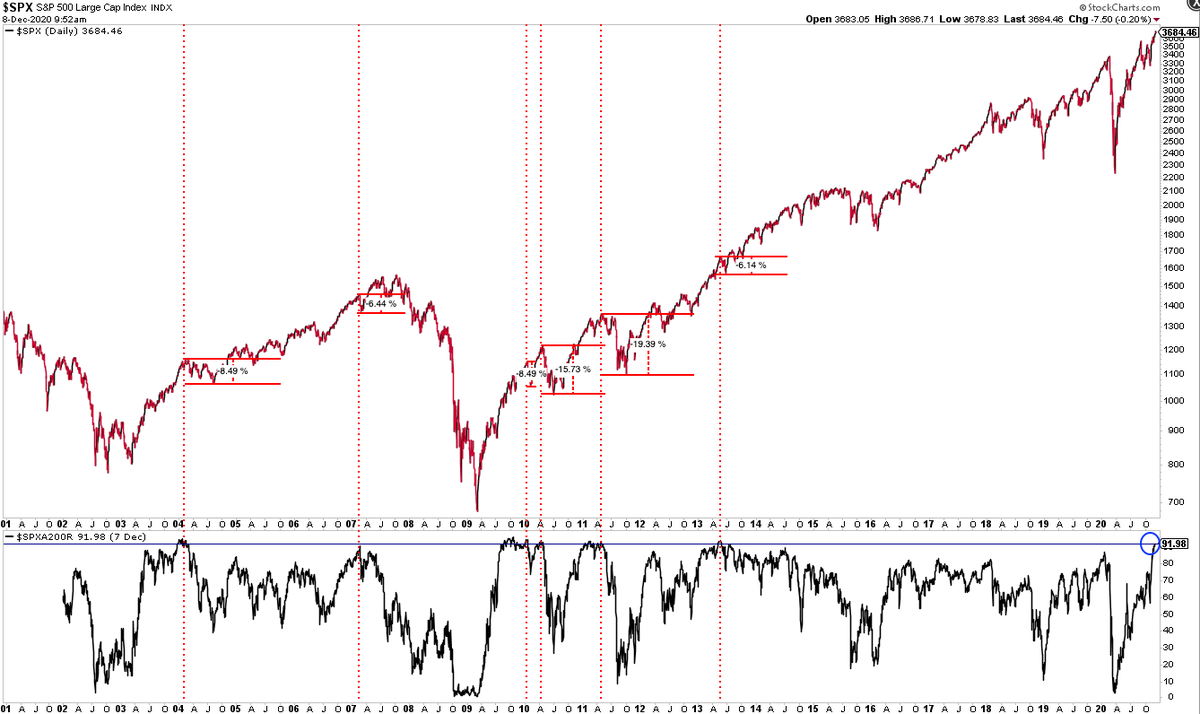

Breadth: Cumulative A/D (top panel) is at a new high. Why this is considered a good sign is a mystery since a new A/D high has occurred at nearly every >5% fall in $SPX (bottom panel), whether $SPX was at an ATH (2013-on) or a lower high (2003-07; 2009-13)

Long story short: generations of bright minds have tried to figure out which stocks will be the next FAAMNG and in the process 95% of them have underperformed $SPX. The end. https://twitter.com/SamRo/status/1286249849457975296

Using $SPX A/D (top panel; at new high) or $NYSE common stock A/D (middle) doesn’t give a different conclusion

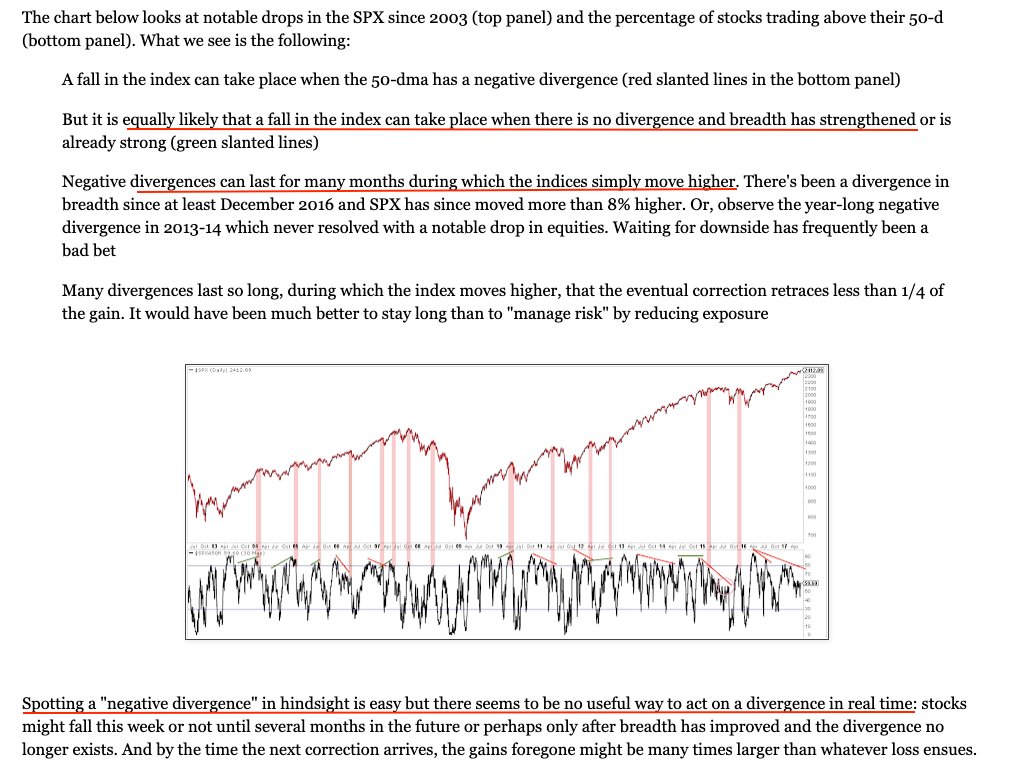

Another look at breadth, using % stocks >50-d or 200-d. Poor participation + divergences hasn’t stopped a 4-mo rally back to ATHs. This is nothing new. Divergences can last days or a year. Markets can peak with or without them, on 'good breadth' or bad. In real time, worthless

I have been regularly tweeting this message out throughout this rally to demonstrate that things can look tidy in hindsight but real time is all that matters and most (not all) of this kind of analysis doesn’t give any edge.

‘Equal weight’ $SPX has been underperforming 'market weight' $SPX for 5 years (bottom panel), during which $SPX has gained 50% (top). Other peaks before a >10% drop occurred when equal weight outperformed. Not useful but it's still a FinTwit favorite for some reason

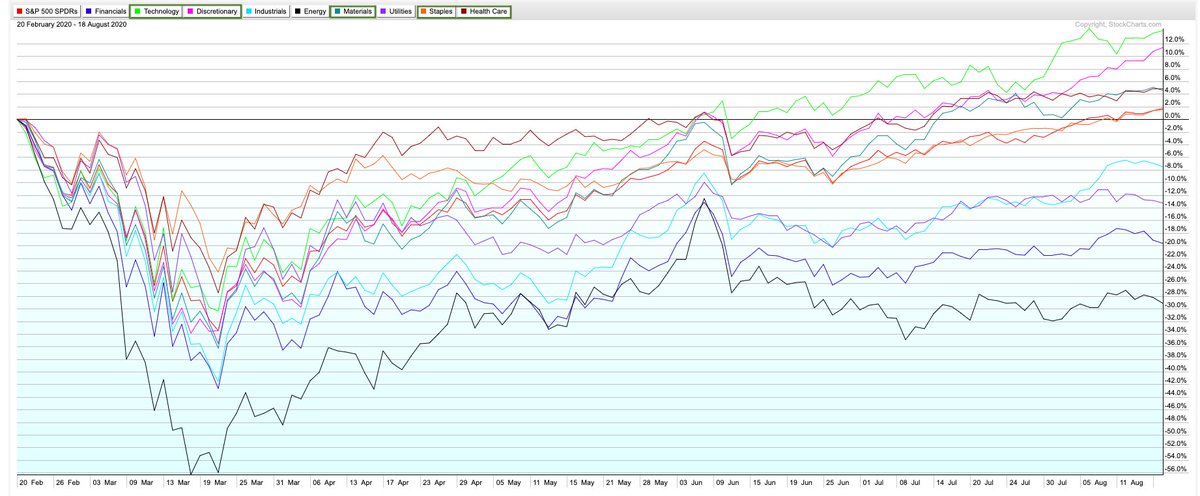

Breadth: 5 of 9 sectors have outperformed $SPY since the Feb peak to yesterday’s new ATH in $SPX (LHS). fwiw, by the time $SPX made a new ATH in April 2013, 8 of 9 sectors were outperforming, the big laggard being financials (RHS)

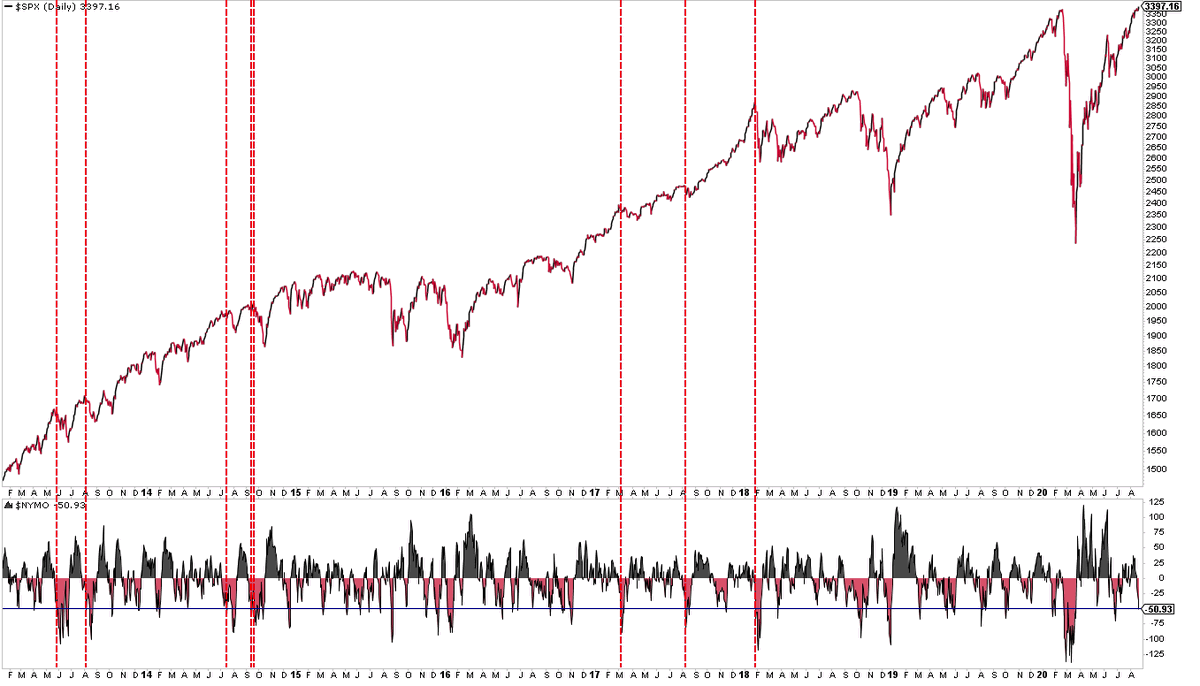

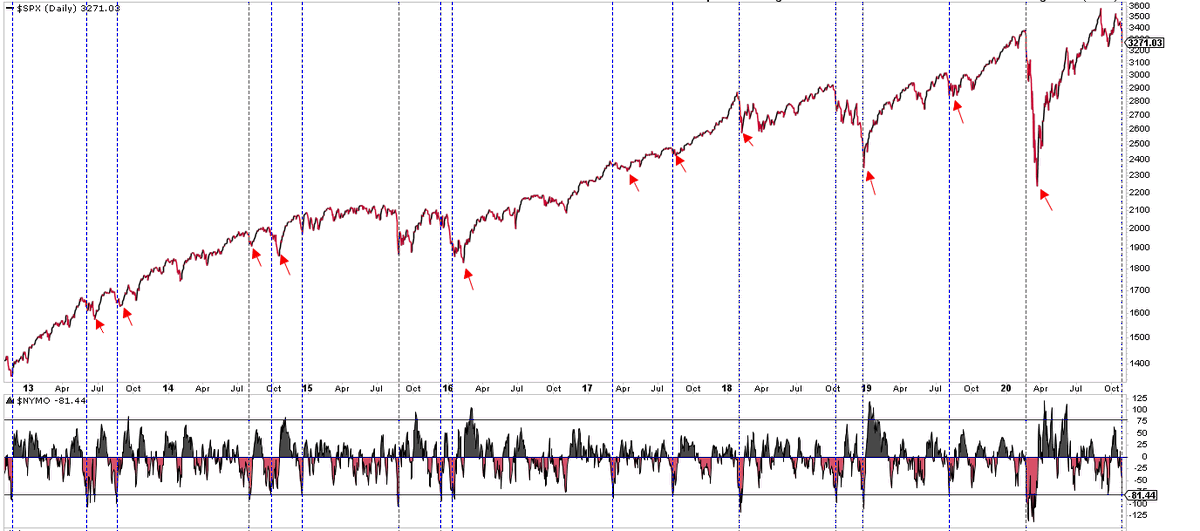

Breadth: Two looks. First, $NYMO -50 but $SPX at an ATH on Friday. I found zero since 2013 but here are some that occured close to a $SPX high

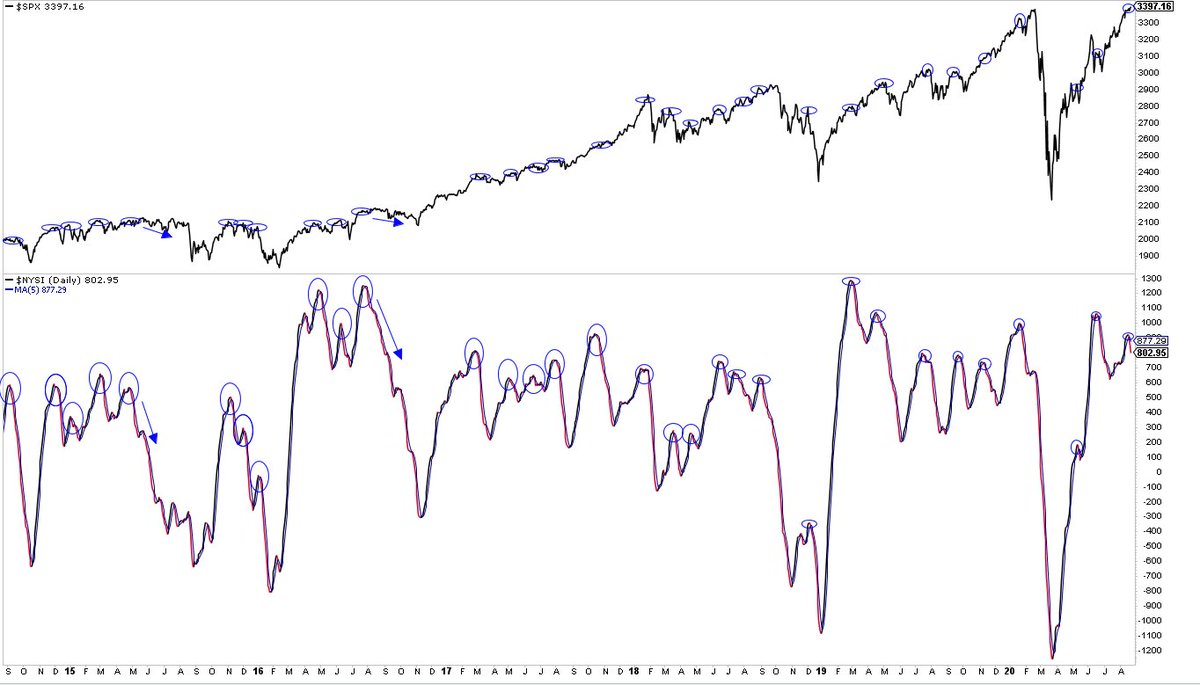

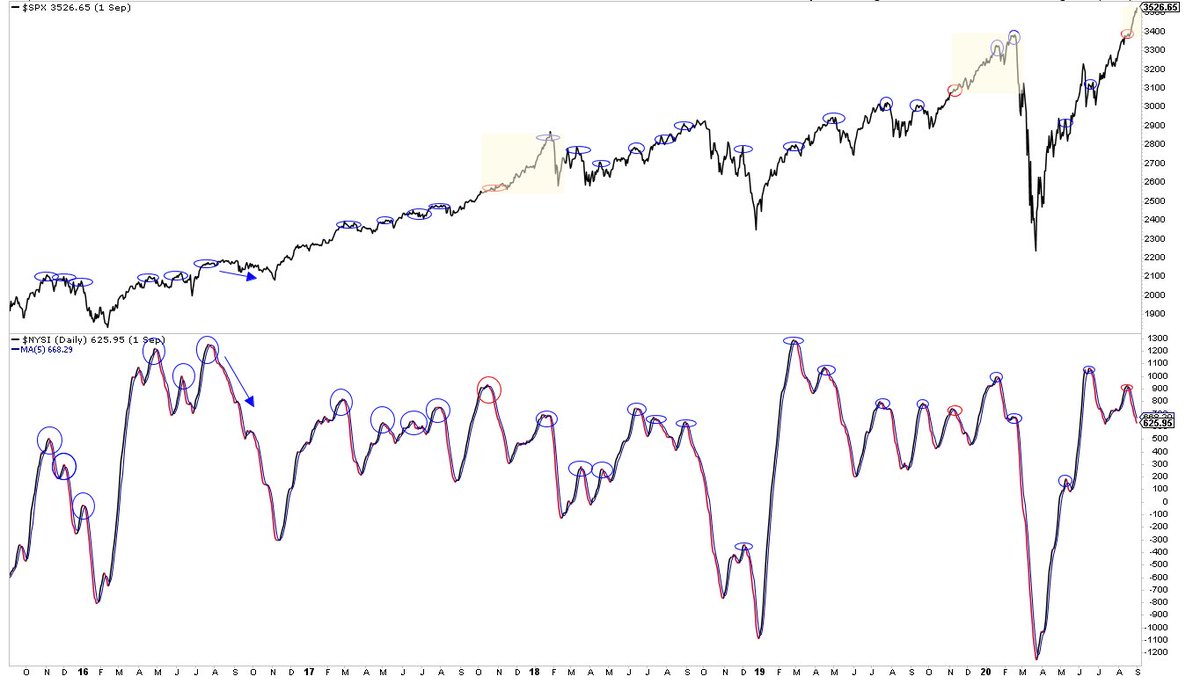

Breadth: Second, $NYSI falling below its 5-d (lower panel) with what happened to $SPX (upper panel). Oct 2017 and Nov 2019 were go-go mkts but those were the exceptions

Breadth: $SPX now up +4% while $NYSI falling. This also happened in late-2017 and -2019; in both, $SPX returned to the scene of the crime months later. Late-2013 (not shown) the same

Breadth: at the Sept 2 ATH in $SPX, the $SPX A/D line was at a new high, >80% of components were above their 50-d and close to 70% above their 200-d (the best since Feb). In other words, based on these commonly used measures, $SPX peaked on "good breadth.”

(Scroill up to see charts explaining why this is not surprising or unusual. In real time, these measures are aren’t especially helpful at tops)

Breadth: $NYSI fell from +926 on Aug 18 to +6 on Friday. Today it will rise to +9. Since Aug 18, it has only risen on one day (Sept 16). The key of course is rising on consecutive days https://twitter.com/ukarlewitz/status/1297167307886665728

Breadth: in the event, $NYSI will fall 12 pts today, to -3. No follow through breadth on consecutive days https://twitter.com/ukarlewitz/status/1310670876287803392

$NYSI went positive Oct 1 and has risen everyday since. In the last 2 days, my stream has gone full on breadth. A good collection of breadth charts here: https://twitter.com/TheChartReport/status/1314707473501216769

Among other things, what’s interesting about this is that about 70% of the signals over the past 40 years have taken place in the last 12 https://twitter.com/edclissold/status/1314591382477180930

Today, the stream says the market is toast. Recall that 2 weeks ago, the stream said it was definitely going to new ATHs because ‘breadth’.

This is how it works https://twitter.com/ukarlewitz/status/1314943846334099458

This is how it works https://twitter.com/ukarlewitz/status/1314943846334099458

Breadth on Monday was 91% down (a MDD). Today is follow through https://twitter.com/ukarlewitz/status/1158788106549514240

Breadth momentum ($NYMO) hit -81 today. Sometimes that’s the $SPX bottom, but more often there’s more selling ahead (either directly or after a bounce)

Yesterday, bounce. Today, lower low. Momentum, whether upward or downward, takes time to wear off. https://twitter.com/ukarlewitz/status/1321583261479362560

At the Oct 12 high in $SPX, the A/D line was at a new high, 80% of components were above their 50-d and 75% above their 200-d. Objective;y, very good breadth. Surprised $SPX fell 8% since then? You shouldn’t be. Beating this dead horse some more https://twitter.com/ukarlewitz/status/1309128488587272194

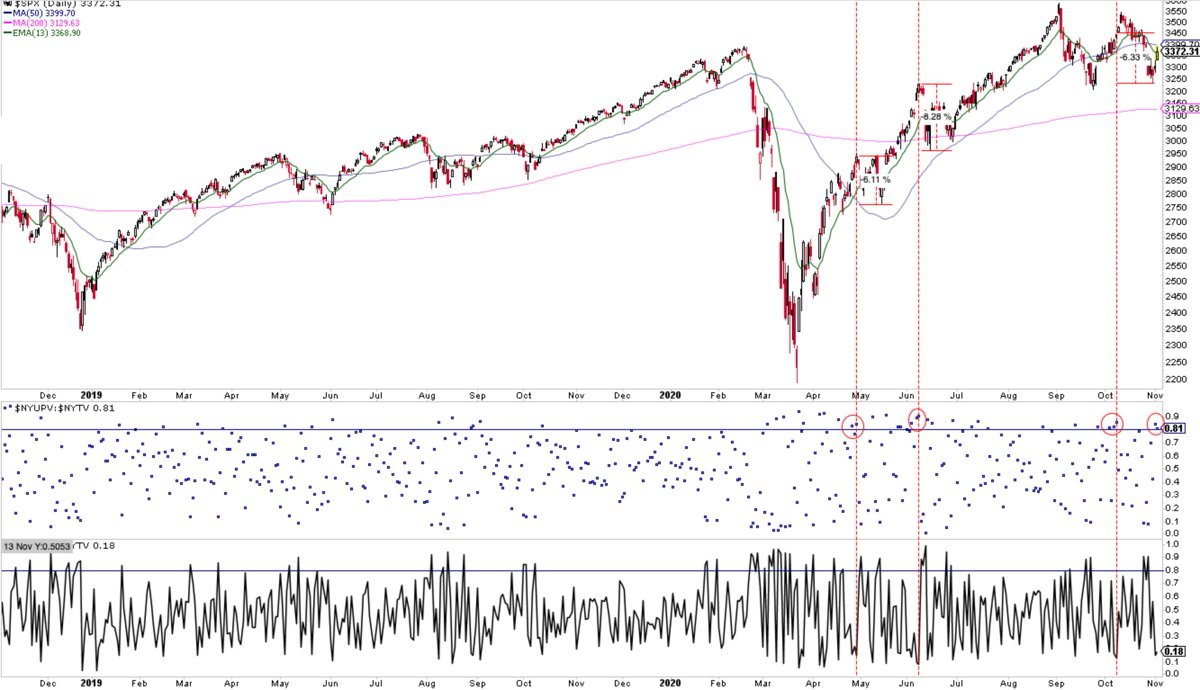

Breadth: So far, a 2nd >80% up volume day in a row (middle panel). Don’t be surprised if this leads into another >5% selloff as that’s exactly what has happened several times since the March low. Remember, it’s still 2020 $spx

Breadth thrust https://twitter.com/RenMacLLC/status/1326265055155982337

Fintwit excited that >80% of stocks above their 200-d. As many >8% drops (equal to that in Oct) take place under this condition as when breadth is weak. https://twitter.com/ukarlewitz/status/1322216759244414976

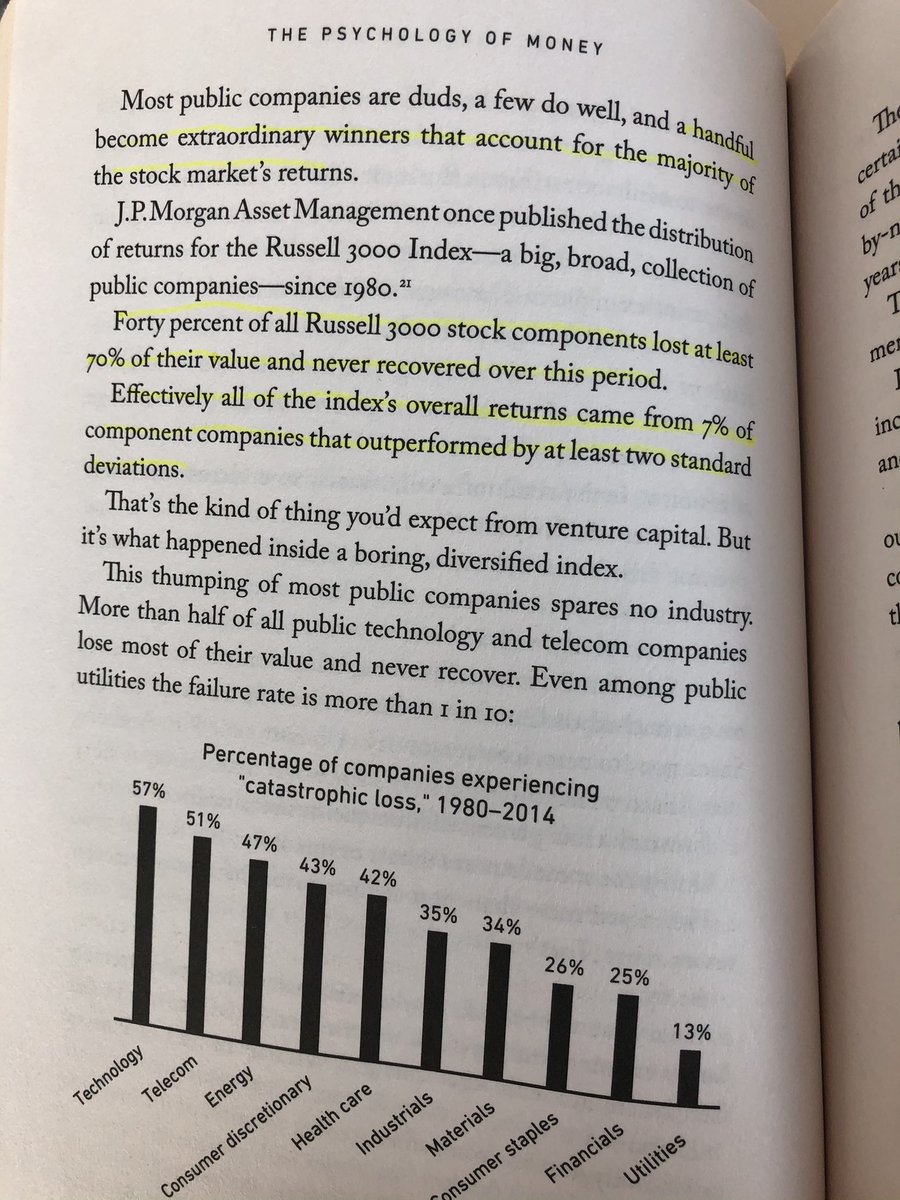

Breadth confirmation has a major problem: all equity market returns come from just 7% of stocks. It’s a feature not a bug

This is how it works https://twitter.com/WillieDelwiche/status/1328713503939710978

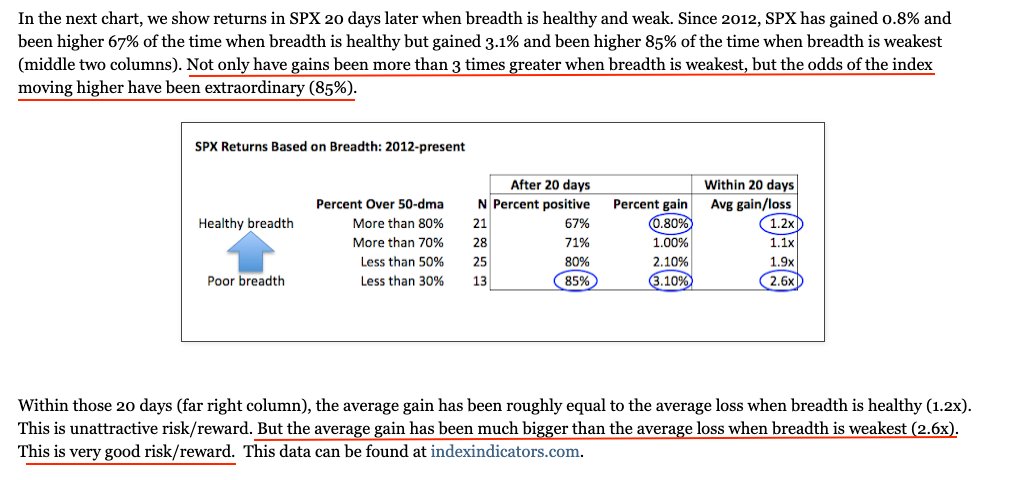

Likewise, $SPX gains and R/R best when breadth ‘weakest’. This data is 2012-17

http://fat-pitch.blogspot.com/2017/06/using-breadth-to-anticipate-market.html#more

http://fat-pitch.blogspot.com/2017/06/using-breadth-to-anticipate-market.html#more

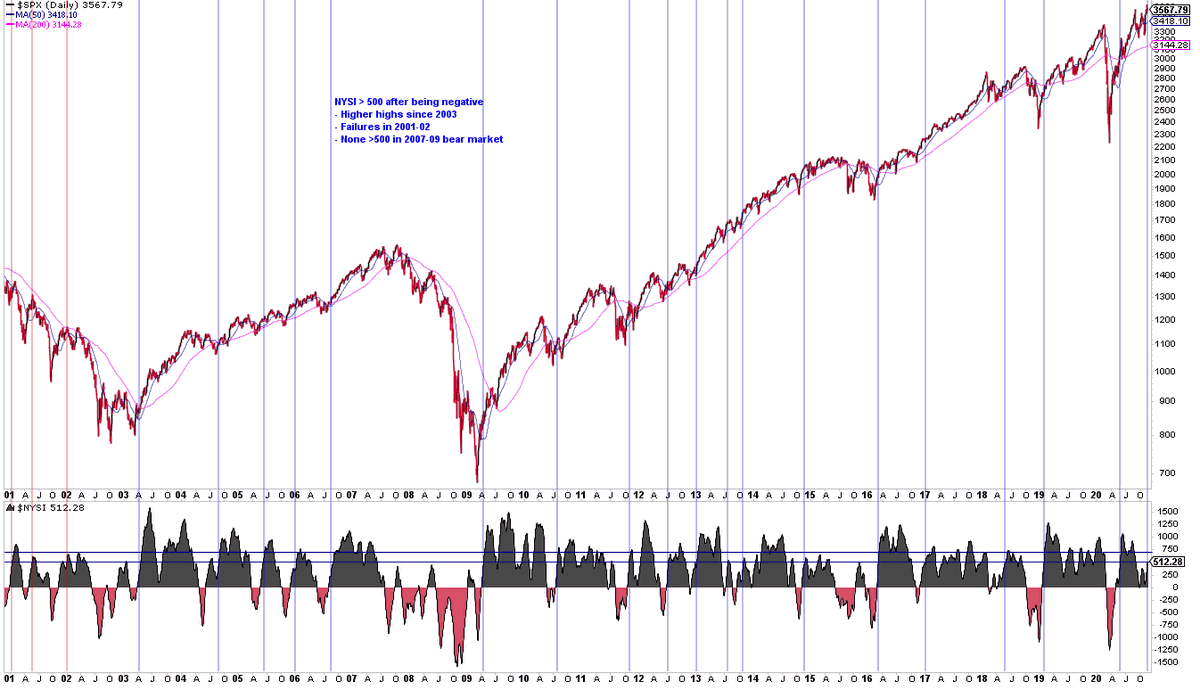

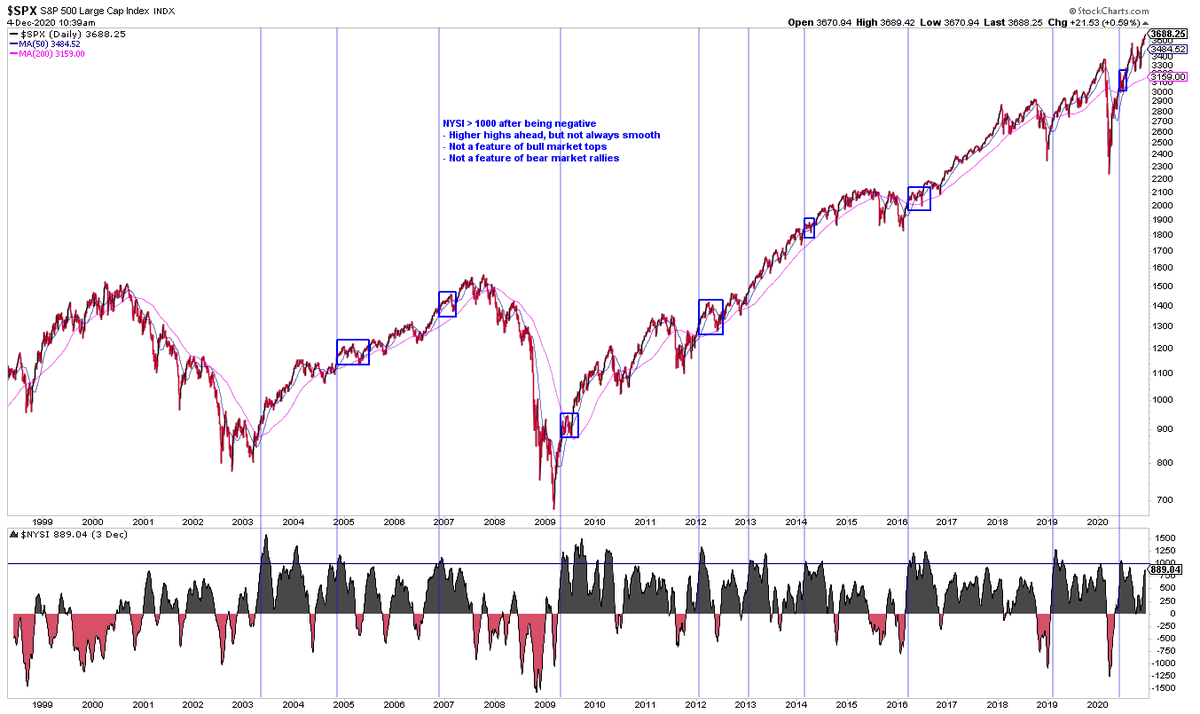

Breadth momentum is a tailwind. $NYSI went from < 0 in Sept to > 500 today. Notes on chart. More upside ahead but 5% drawdown can happen anytime

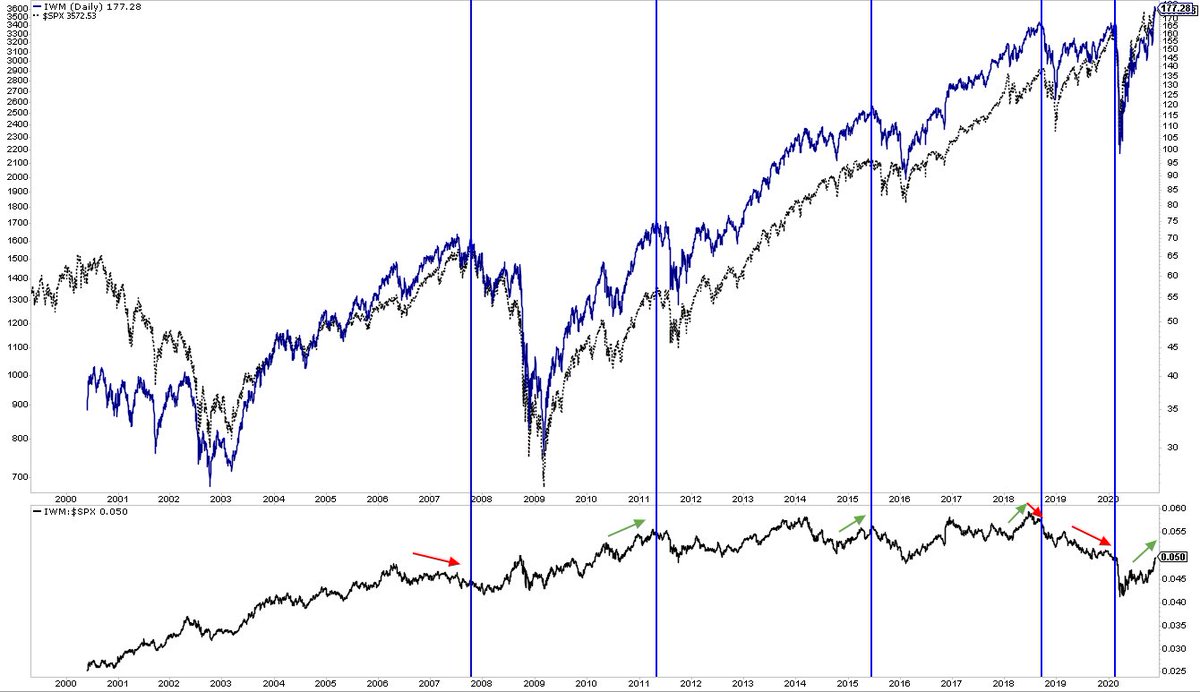

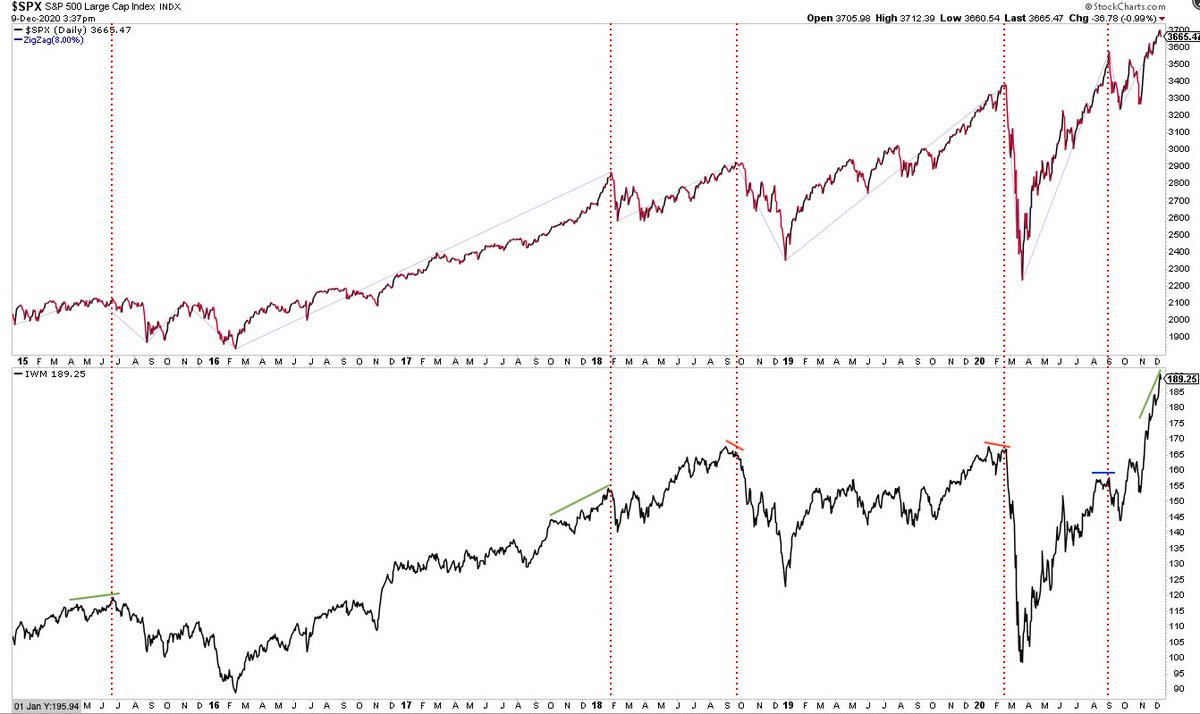

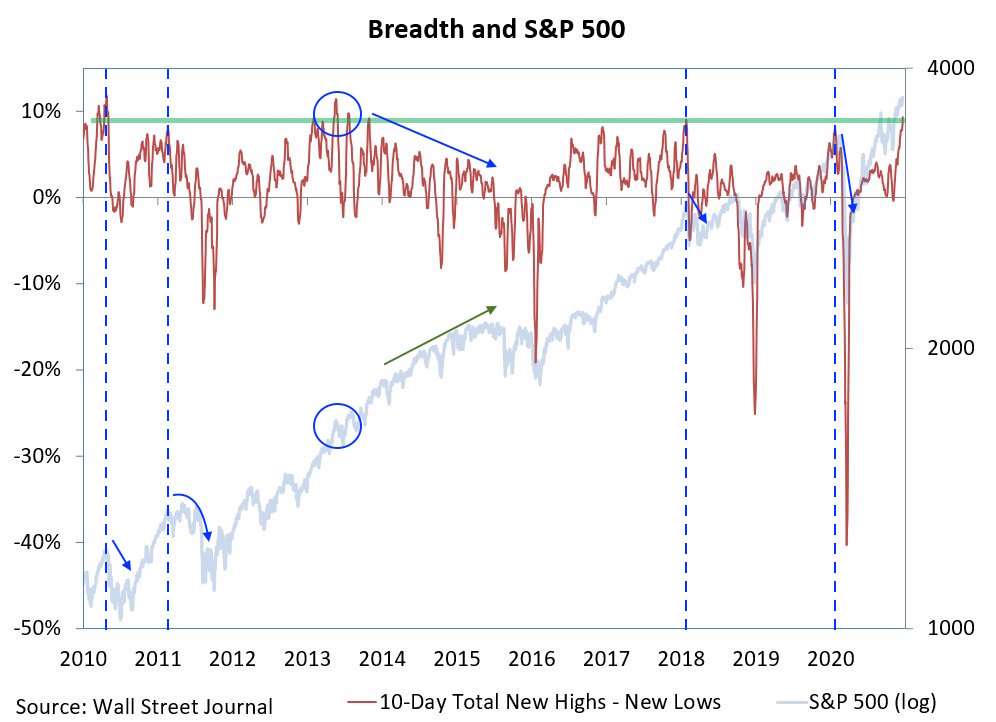

Small caps outperforming $SPX (lower panel) is irrelevant to overall market direction. Notable tops (vertical lines) happen whether they under or outperform. Why? $SPX is about 75% of total US equity market cap; small caps are less 10%. It’s dog versus tail

How 'good breadth' is equally a measure of increasing investor comfort https://twitter.com/michaelsantoli/status/1331592549706948610

More of what’s contributing to ‘good breadth.’ Think about investors’ risk tolerance when these companies are outperforming https://twitter.com/adam_tooze/status/1332655478229372928

$NYSI went < 0 in Sept to being on track to close ~940 today. The last time it closed >1000 was early June; $SPX promptly lost 8%. But, longer term, strong breadth momentum is a tailwind - not something that happens at bull market tops. Notes on chart

100% closed higher either 1 or 2 months later $NYSI $SPX https://twitter.com/twillo1/status/1334902111545434113

Stuff that happens when more than 90% of $SPX stocks are above their 200-d

I have some bad news if you think small caps (lower panel) will weaken (i.e., ‘diverge’) before $SPX weakens

More generally, you will spot the ‘breadth divergences’ that matter only in hindsight. Looking for these is a complete waste of time

The green arrows are good entry points. Red arrows happened at tops in 1980, 1987, 2011 and others (scroll up) - if you’re fine with a 20% DD and/or 18 mo of treading water then you’ll be paid for your patience. Your preferred timeframe is what matters https://twitter.com/RenMacLLC/status/1338490077459177477

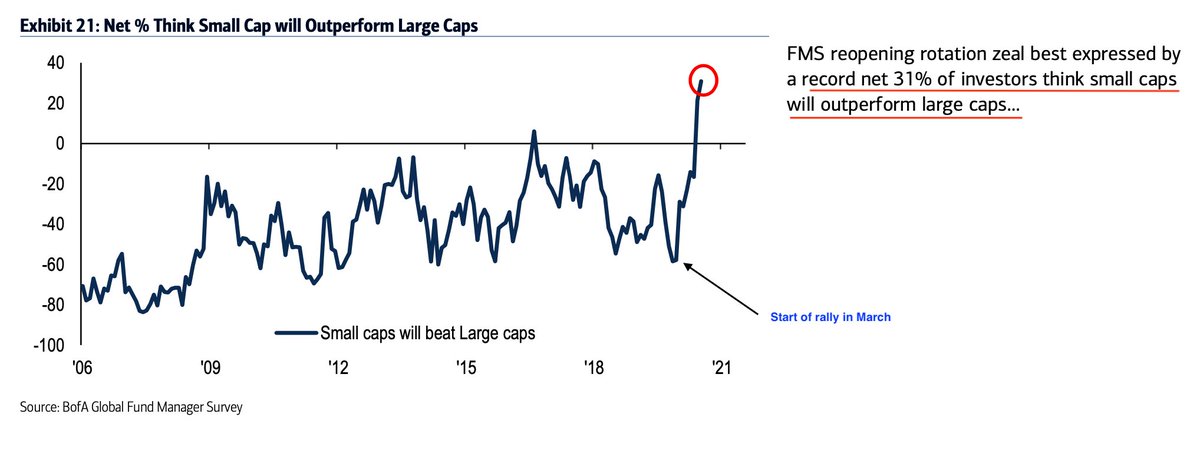

You should be connecting these breadth numbers with the sentiment numbers. That’s not an aberration, that’s how this works

10-day total new highs minus new lows at a very high level. In the past, $SPX has fallen hard (vertical lines + blue arrows), chopped (circle) or continued higher (green arrow). Why this is considered unequivocally bullish (or even useful) remains a mystery

Read on Twitter

Read on Twitter