Best companies/founders find ways to expand their TAM by venturing into adjacent markets.

Inevitably the core product will tap out&maintaining high growth rates at scale requires strategic product expansion beyond an initial wedge. In b2b software many examples standout/thread

Inevitably the core product will tap out&maintaining high growth rates at scale requires strategic product expansion beyond an initial wedge. In b2b software many examples standout/thread

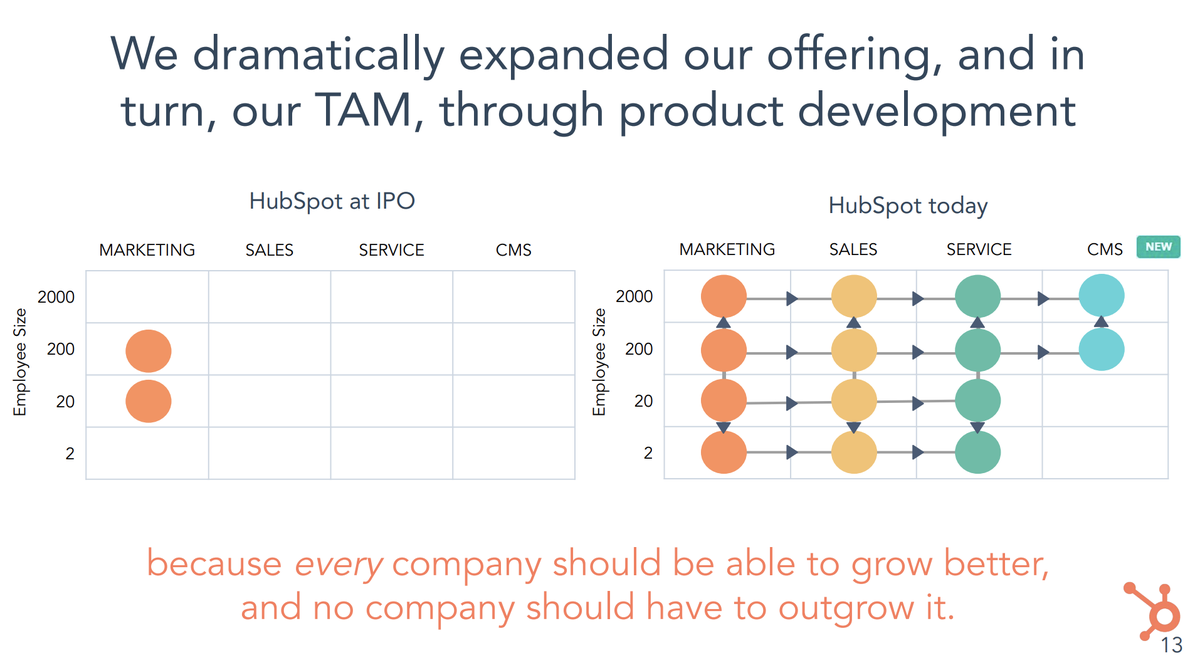

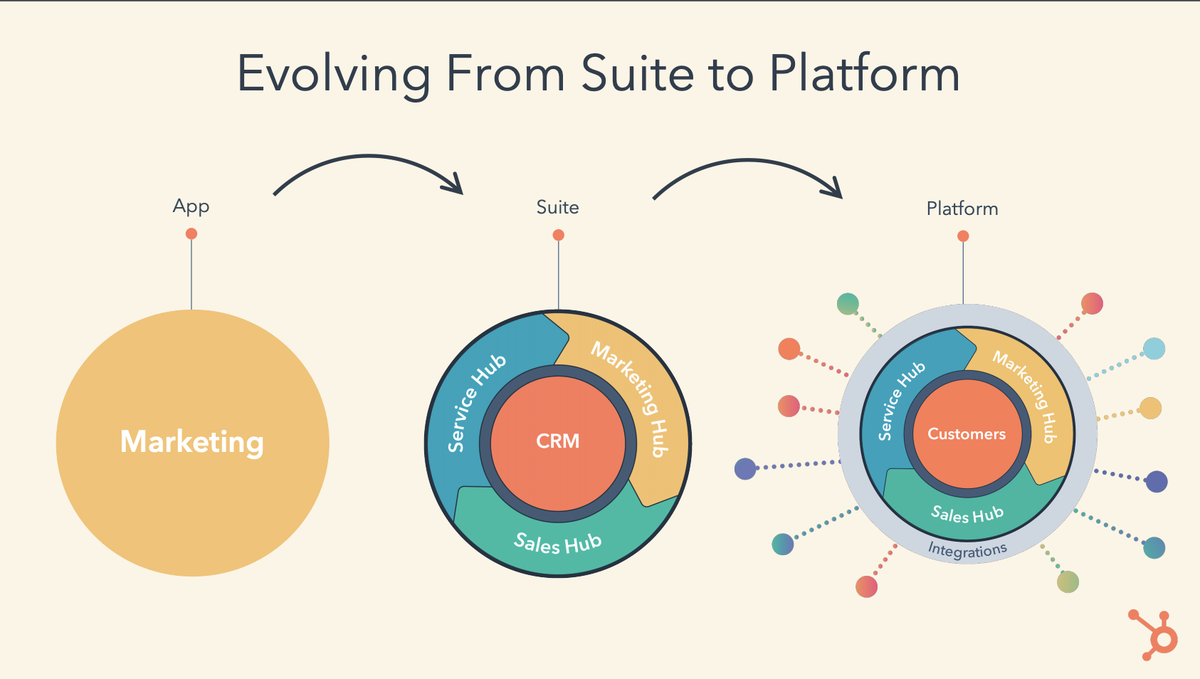

1/ HubSpot: started by offering SMBs a suite of marketing products as their first act, the "Marketing Hub". Crossed $100M of revenue in 2014 with this product & launched "Sales Hub/CRM", as their second act, to help businesses better manage leads & close them.

2/ In 2016, the company crossed $250M in revenue and launched "Service Hub" a customer service platform competing with Zendesk. And just recently it announced their entry into the CMS market with "CMS HUB" as their fourth act while on track to do shy of $1B of revenue in 2021.

3/ See how their market positioning has evolved with the product suite expansion. In 2019, 35% of customers used 2+ "Hubs" up from 25% in the prior year. The co has managed to increase its dollar retention from ~90% at IPO to 100%+ and its market cap from <$1B to ~$10B today.

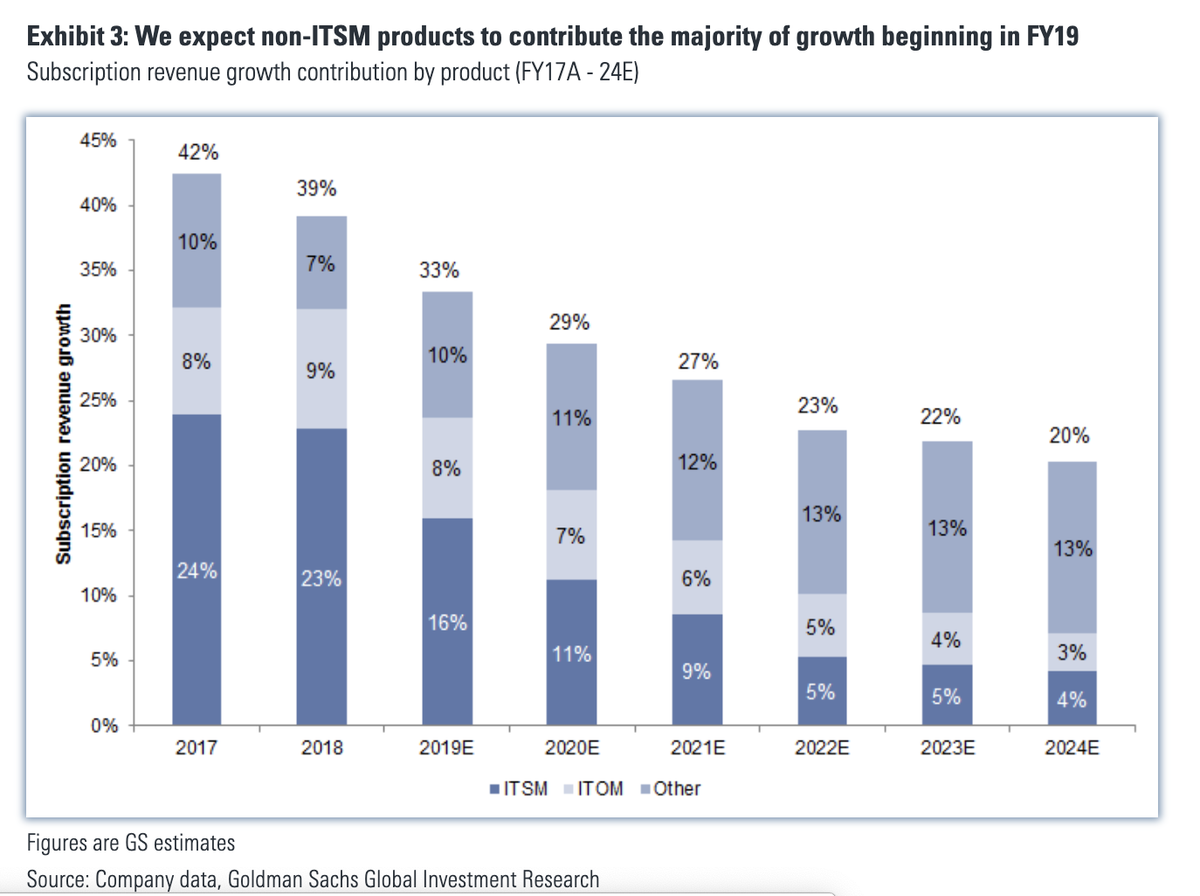

4/ ServiceNow:founded in 2003 as a platform to automate enterprise IT operations (tickets & workflows), "IT Service Management/ITSM". In 2011, they launched "IT Operations Management/ITOM", their 2nd product. ITOM took 5 yrs to reach $100M+ of rev& is on a path to $1B+ rev per yr

5/ When looking at segments to enter, ServiceNow has explicitly said they seek products that can reach $100M of rev in 3yrs &have the potential for $1B+ later.

In 2015 they launched:HR (HR workflows) & CSM(Customer Service Management workflows). Both are $200M+/yr products now

In 2015 they launched:HR (HR workflows) & CSM(Customer Service Management workflows). Both are $200M+/yr products now

6/launching 4 products that hit $100M in rev in ~3 yrs& are on track for $1B+ is incredible. Biggest driver of future growth is non-ITSM product lines. In '18, 40% of new ACV was from non-IT products. 30%+ yoy growth rates since IPO w marketcap of $80B today up from $3B in 2012

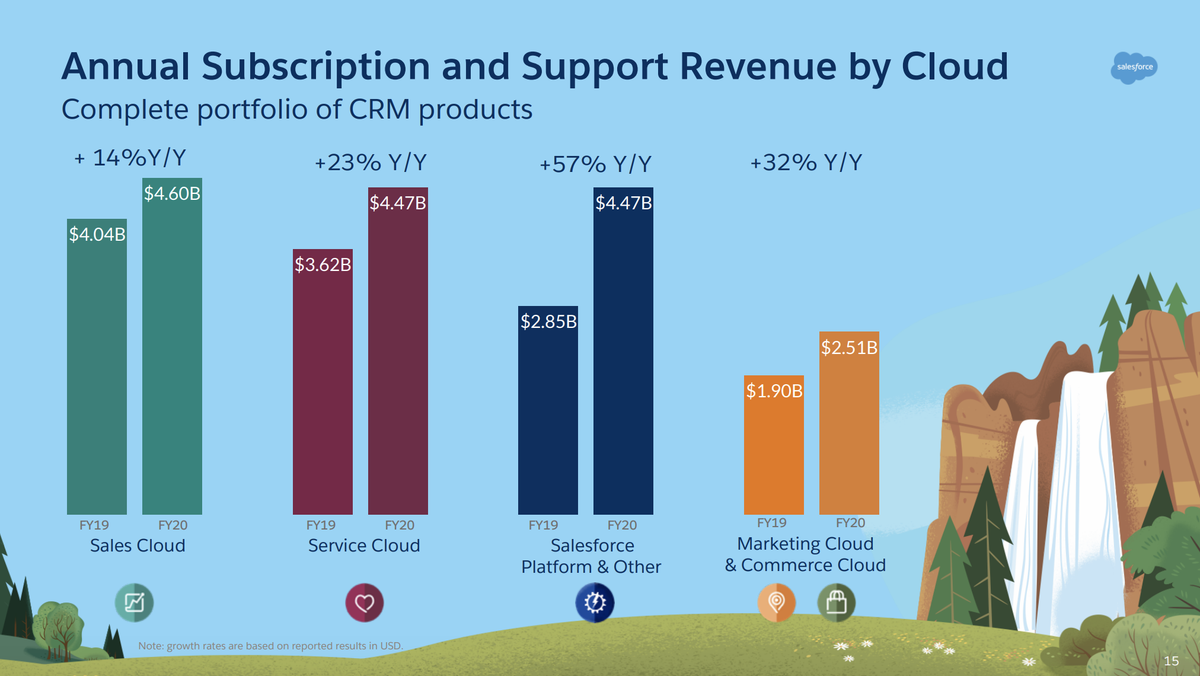

7/ Salesforce is the north star for any b2b software company that wants to scale their core product, IPO, move into adjacencies&become an unparalleled distribution force. At $180B of market cap, $17B of FY'20 revs growing 29%(!)—much of this growth comes from non-CRM products

8/ The CRM product is growing 14% yoy by far the slowest amongst other lines.

Over 20 years, Salesforce has built a formidable suite of products that they can distribute to their ever growing base...

Over 20 years, Salesforce has built a formidable suite of products that they can distribute to their ever growing base...

9/Entering new markets isn't just beneficial for sustaining high growth rates.A portfolio of products provides advantages against single-sku competitors. A multi-product company can pay/bid more to acquire users, knowing it can later up/cross sell them vs its single product peers

10/At the stage I invest in, most of my time is spent on getting into the weeds of a company's core market. But every now&then, it's exciting to come up for air& imagine the various paths, products & markets a company can venture into one day. We call it "dreaming the dream" :)

Read on Twitter

Read on Twitter