$JMIA A Thread: 5-10 year hold + millionaire maker stock

What is Jumia? Jumia is a combination of Amazon, Uber Eats, Square (merchant processing), Small Business Lending, 3PL, and Utility/Cell Phone bill payments for all of Africa

What is Jumia? Jumia is a combination of Amazon, Uber Eats, Square (merchant processing), Small Business Lending, 3PL, and Utility/Cell Phone bill payments for all of Africa

Some comparable companies to JMIA:

AMZN, SQ, UBER (for the United States)

MELI (For S. America)

MELI is the Amazon + Square of S. America, with a heavy focus in Argentina. In 2008, MELI was at a low of $7.81 per share. Today, MELI is trading for over $1,000 per share

AMZN, SQ, UBER (for the United States)

MELI (For S. America)

MELI is the Amazon + Square of S. America, with a heavy focus in Argentina. In 2008, MELI was at a low of $7.81 per share. Today, MELI is trading for over $1,000 per share

Next a look at financials for MELI / JMIA (a much better comparison than AMZN)

MELI is operating in Argentina, Brazil, Mexico, Uruguay, Columbia, Chile, and Peru. Combined, these countries have a population of ~490 Million people.

In 2019 MELI reported Net Rev $2.3B

MELI is operating in Argentina, Brazil, Mexico, Uruguay, Columbia, Chile, and Peru. Combined, these countries have a population of ~490 Million people.

In 2019 MELI reported Net Rev $2.3B

In comparison, JMIA reported earnings of $180M for 2019

(a 50% increase over 2018, and a 95% increase from 2017)

JMIA intends to eventually service all of Africa, and is currently in 11 countries across Africa (with a combined population of ~600 Million).

(a 50% increase over 2018, and a 95% increase from 2017)

JMIA intends to eventually service all of Africa, and is currently in 11 countries across Africa (with a combined population of ~600 Million).

The 11 Countries that Jumia is currently in account for ~70% of Africa's GDP and ~70% of Africa's Internet Users.

Important to note: Internet + Tech is making BIG moves in Africa. Total population of Africa is ~1.2 Billion. Lots of room for economic growth.

Important to note: Internet + Tech is making BIG moves in Africa. Total population of Africa is ~1.2 Billion. Lots of room for economic growth.

Back to the financials.

I compared 2019 revenue (MELI $2.3B, JMIA $180M)

When was the last time MELI reported revenue of $180M (or thereabouts)?

I compared 2019 revenue (MELI $2.3B, JMIA $180M)

When was the last time MELI reported revenue of $180M (or thereabouts)?

MELI Rev Yearly

2004: $12.7M

2005: $28.2M

2006: $52.1M

2007: $85.1M (IPO here $18/share)

2008: $137M (low of $7.81/share)

2009: $172M (traded in 2010 between $35-75/share)

2004: $12.7M

2005: $28.2M

2006: $52.1M

2007: $85.1M (IPO here $18/share)

2008: $137M (low of $7.81/share)

2009: $172M (traded in 2010 between $35-75/share)

JMIA Rev Yearly (since reported)

2017: $105M (USD, reported in EURO)

2018: $146M (USD, reported in EURO)

2019: $180M (USD, reported in USD)

Hmmmm . . . . interesting to see such a similar trajectory as 2007-2009 with MELI

And what was MELI trading at in 2009? Oh yeah, $35-$75

2017: $105M (USD, reported in EURO)

2018: $146M (USD, reported in EURO)

2019: $180M (USD, reported in USD)

Hmmmm . . . . interesting to see such a similar trajectory as 2007-2009 with MELI

And what was MELI trading at in 2009? Oh yeah, $35-$75

A quick change here: I realize I said JMIA had a 50% increase YoY 2018 to 2019 and nearly 100% increase 2017 to 2019. I was wrong. I didn't calculate EUR to USD correctly.

2018 to 2019 YoY increase is 24%

2017 to 2019 increase is 72%

2018 to 2019 YoY increase is 24%

2017 to 2019 increase is 72%

Well, considering JMIA has rev comparable to MELI 2009 rev, why is JMIA trading at $7.5/share, where MELI was $50+ after reporting rev of 2009?

An obvious answer is that MELI is "closer to home" (aka closer to the United States), and perhaps feels like a "safer" investment.

I also think there is a sentiment that Africa is still a "third world country," with little infrastructure that could support JMIA in the long term.

I also think there is a sentiment that Africa is still a "third world country," with little infrastructure that could support JMIA in the long term.

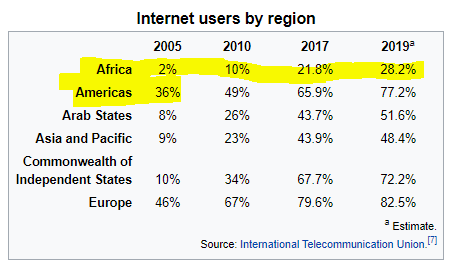

Also consider internet access. In order for Amazon to work, Internet had to become main stream. So what is happening to internet access in Africa? Interesting . . . internet users in Africa are BOOMING. Comparable to 2005 Americas.

What about economic growth in Africa? Clearly it is going to vary greatly from country to country (Africa is a BIG place), here are some interesting things to watch

Family Feud Africa (entertainment bis growing)

10 growth cities

Family Feud Africa (entertainment bis growing)

10 growth cities

Another thing to remember:

The rate at which countries are advancing/developing is increasing. Meaning they adopt technological and infrastructure advances faster than previous countries (they have a the benefit of a blueprint). Give Africa 5 more years . . . just watch.

The rate at which countries are advancing/developing is increasing. Meaning they adopt technological and infrastructure advances faster than previous countries (they have a the benefit of a blueprint). Give Africa 5 more years . . . just watch.

Back to some exciting JMIA specific items. How about these major brands that are ALL using JMIA to get their products sold in Africa:

$JNJ

$INTC

$MSFT

$HPQ

$KO

$PG

$AAPL

L Oreal

Nivea

Aeropostale

Unilver

Nestle

Carrefour

Haier

$JNJ

$INTC

$MSFT

$HPQ

$KO

$PG

$AAPL

L Oreal

Nivea

Aeropostale

Unilver

Nestle

Carrefour

Haier

A few additional interesting articles on $JMIA growth

BIG jump in Uber Eats type component (Food Delivery) DURING COVID scare https://techcabal.com/2020/06/18/in-nigeria-jumia-foods-order-volume-is-growing-by-30-mom/

BIG jump in Uber Eats type component (Food Delivery) DURING COVID scare https://techcabal.com/2020/06/18/in-nigeria-jumia-foods-order-volume-is-growing-by-30-mom/

https://weetracker.com/2020/06/18/jumia-unveils-logistics-services/

JMIA has 3PL system in place. MASSIVE for shipping products around (again, mimicking the blueprint of Amazon). Can be used for people to ship goods even if they aren't selling on JMIA (builds a bigger brand footprint and gets foot in door w new merchants)

JMIA has 3PL system in place. MASSIVE for shipping products around (again, mimicking the blueprint of Amazon). Can be used for people to ship goods even if they aren't selling on JMIA (builds a bigger brand footprint and gets foot in door w new merchants)

https://www.pmldaily.com/business/2020/07/jumia-introduces-airtel-money-payments-on-platform.html

JMIA is constantly making it easier and easier for people to pay for product on it's platform.

JMIA is constantly making it easier and easier for people to pay for product on it's platform.

Read on Twitter

Read on Twitter