Gold at $1800/oz: a short thread.

Gold is trading just above $1800/oz after hitting a fresh 8-year high this week. Not much appears to stand in the way of #gold challenging the all-time high of $1921/oz set in September 2011.

Gold is trading just above $1800/oz after hitting a fresh 8-year high this week. Not much appears to stand in the way of #gold challenging the all-time high of $1921/oz set in September 2011.

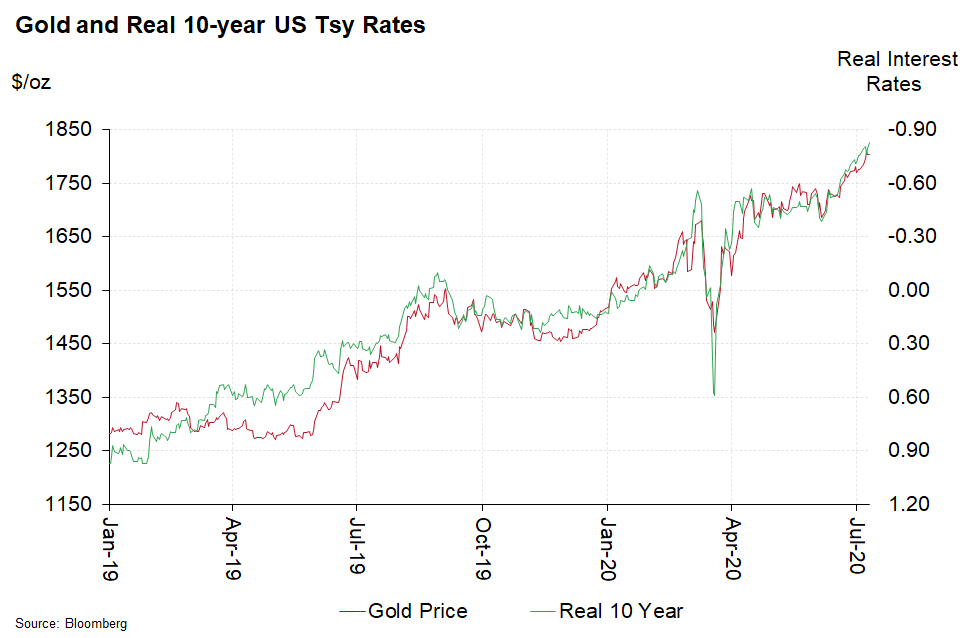

The best financial market-related explainer of the move in #gold is ever-falling real US yields and this relationship remains extremely important.

As concerns about the impact of the Coronvirus intensify, real rates have headed every lower, helping gold.

As concerns about the impact of the Coronvirus intensify, real rates have headed every lower, helping gold.

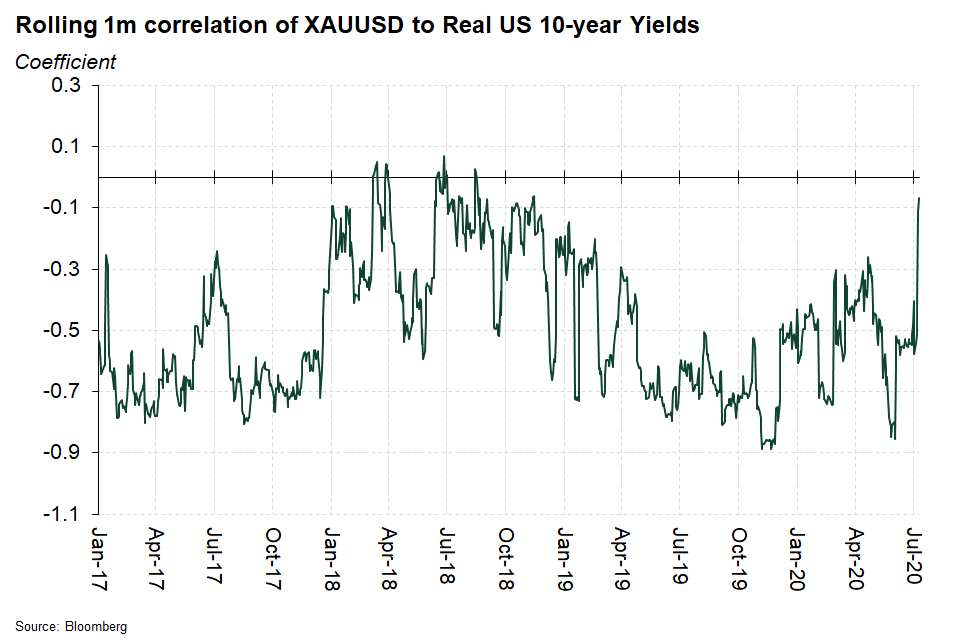

(Although interestingly the correlation of real rates and #gold has weakened sharply over the past month as this chart shows)

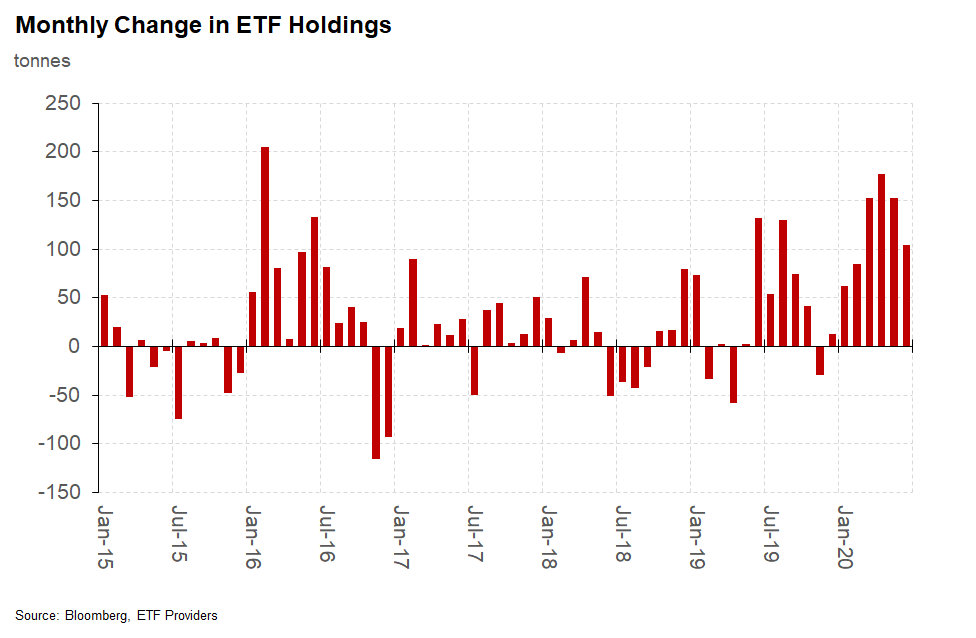

ETF inflows remain a strong driver of gold with 11 of the last 12 months seeing inflows into physically backed #gold ETFs.

We’ve written and tweeted about the importance of these flows this week if you want more detail.

We’ve written and tweeted about the importance of these flows this week if you want more detail.

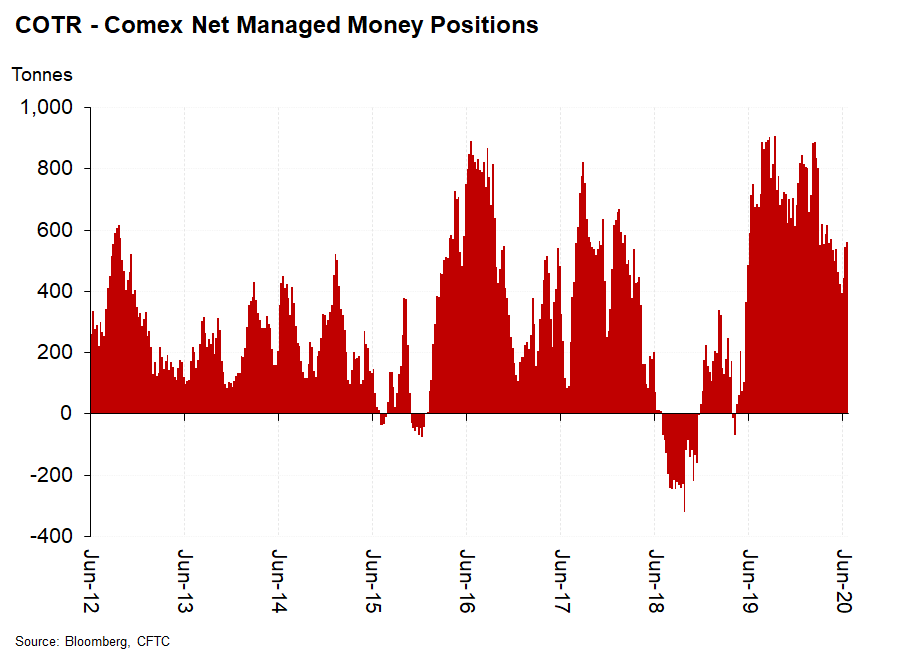

And even Comex speculative #gold longs have joined in recently, although with less vigour than normal due to the well-tweeted issues with Comex liquidity, premium to spot and roll costs.

Consumer demand is weak in important #gold markets like China and India, but we expect to see slowly improving consumer demand in the second half of the year.

Looking forward, investor buying is the main factor driving gold demand at the moment: even if consumer demand improves in H2 as we expect, its not going to be a strong year for this sector.

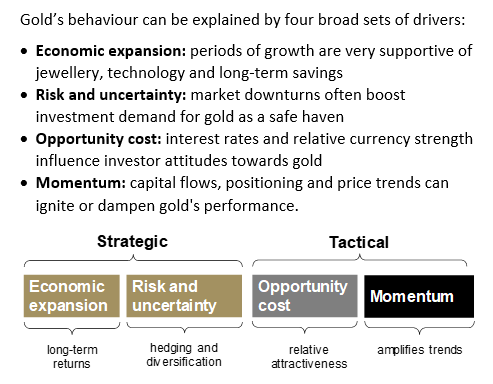

Momentum, risk & uncertainty and opportunity cost have driven #gold investment this year and we expect this to continue.

We will be releasing an updated 2020 Outlook for #gold next week so do look out for it.

We will be releasing an updated 2020 Outlook for #gold next week so do look out for it.

All of our research and strategy can be found on #Goldhub with our current thoughts on the #blog.

https://www.gold.org/goldhub

https://www.gold.org/goldhub

@threadreaderapp please unroll

Read on Twitter

Read on Twitter