The four paradigm shifts:

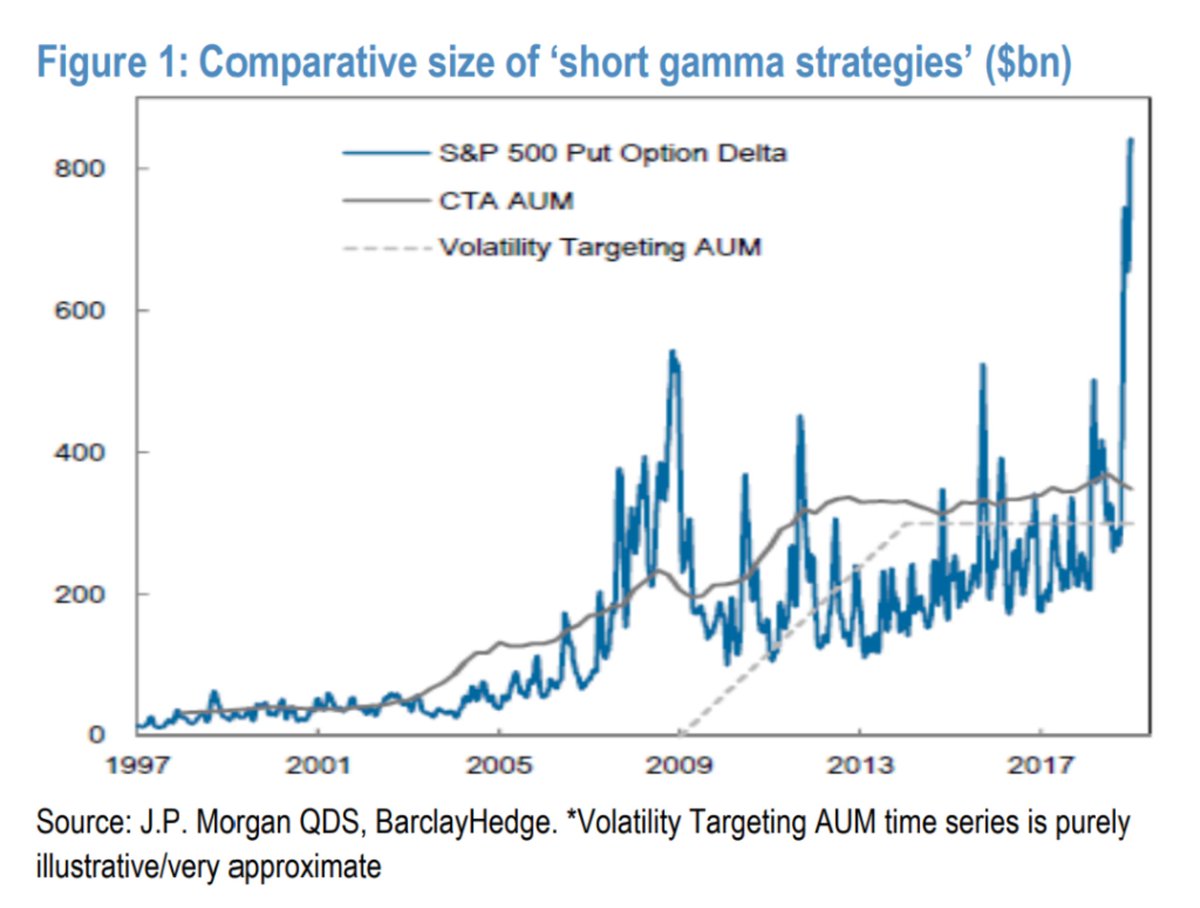

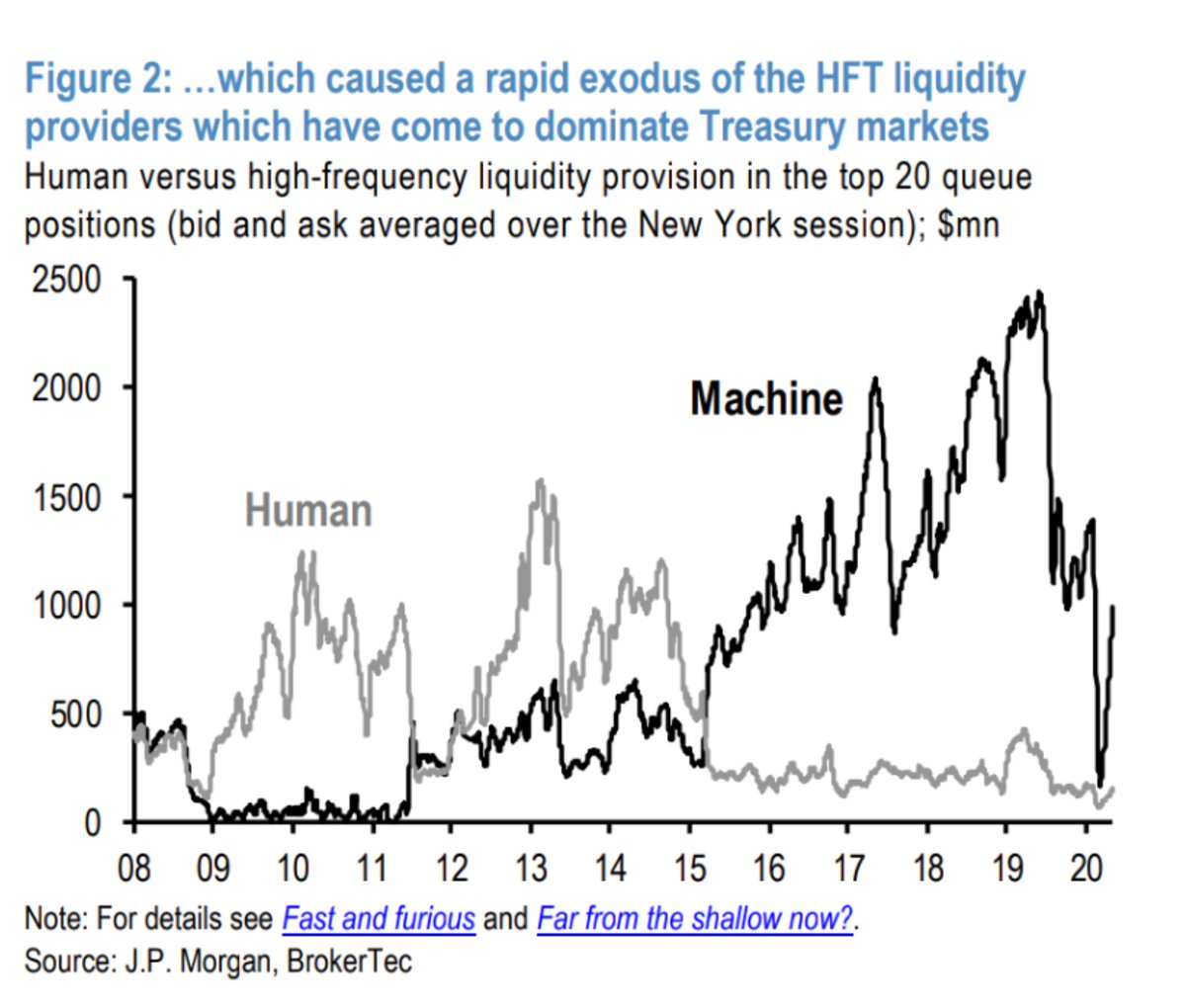

1) decline in market liquidity;

2) rise of

unconventional monetary policy;

3) “Great Power” competition between the US and China;

4) de-globalization

and the rise of populism

1) decline in market liquidity;

2) rise of

unconventional monetary policy;

3) “Great Power” competition between the US and China;

4) de-globalization

and the rise of populism

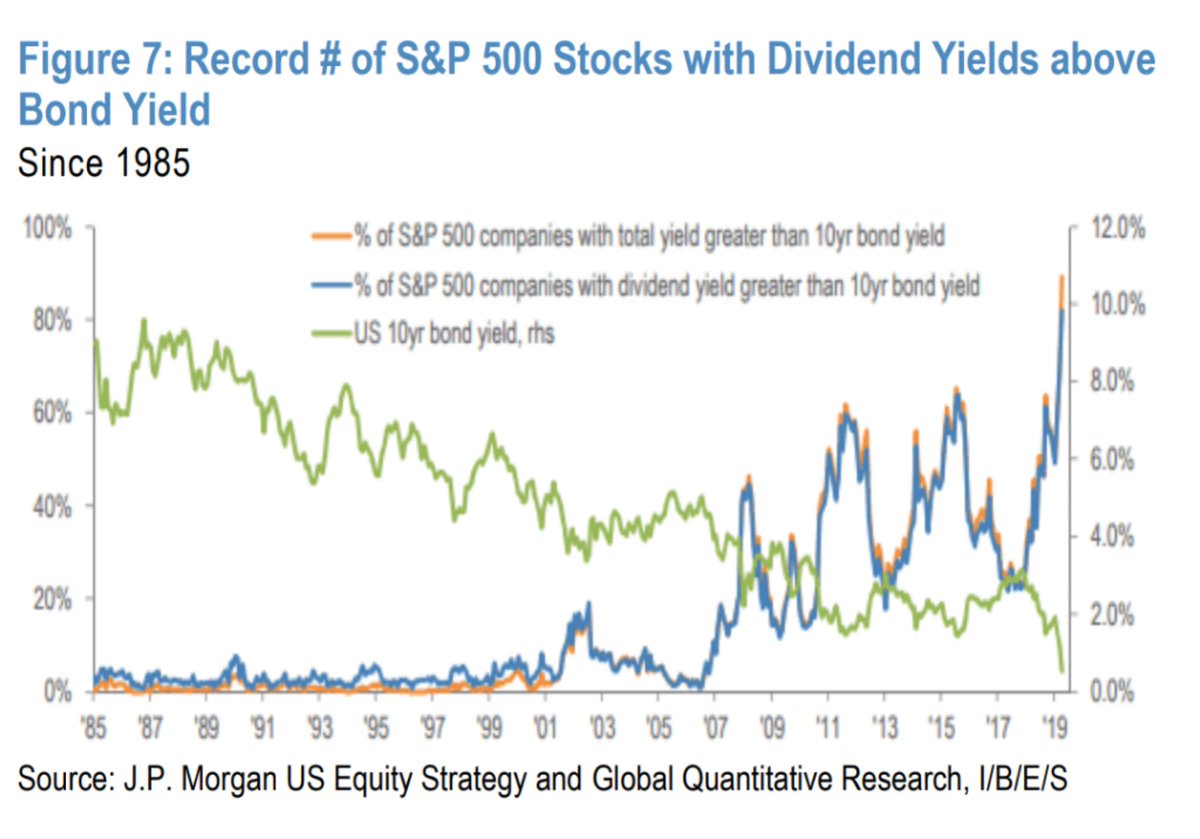

I think this comparison is inappropriate b/c it is impractical but this is what equity bulls want you to see:

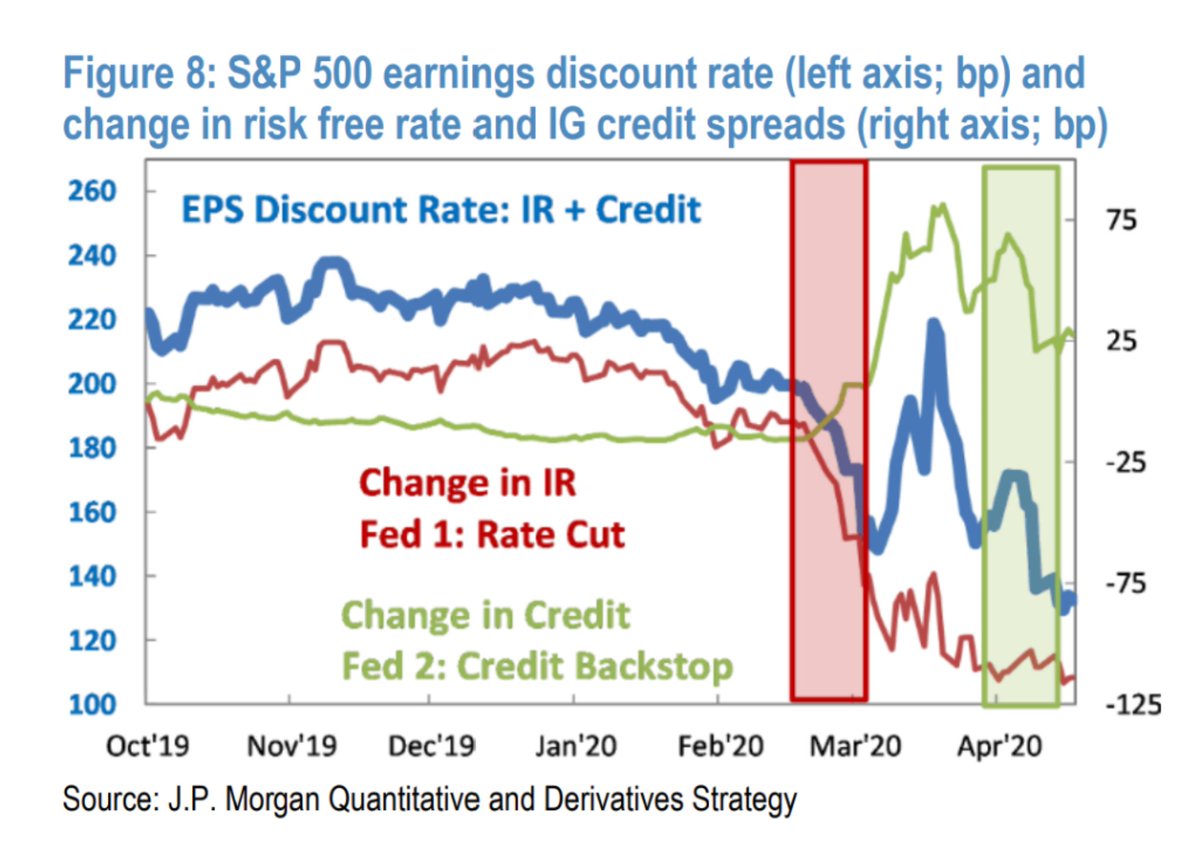

And this, which I think is nonsensical:

"We also find that for the S&P 500, the combined suppression of the risk-free rate and credit spreads by the Fed likely has a bigger positive impact on equity valuation, compared with the negative

impact of the temporary earnings loss."

"We also find that for the S&P 500, the combined suppression of the risk-free rate and credit spreads by the Fed likely has a bigger positive impact on equity valuation, compared with the negative

impact of the temporary earnings loss."

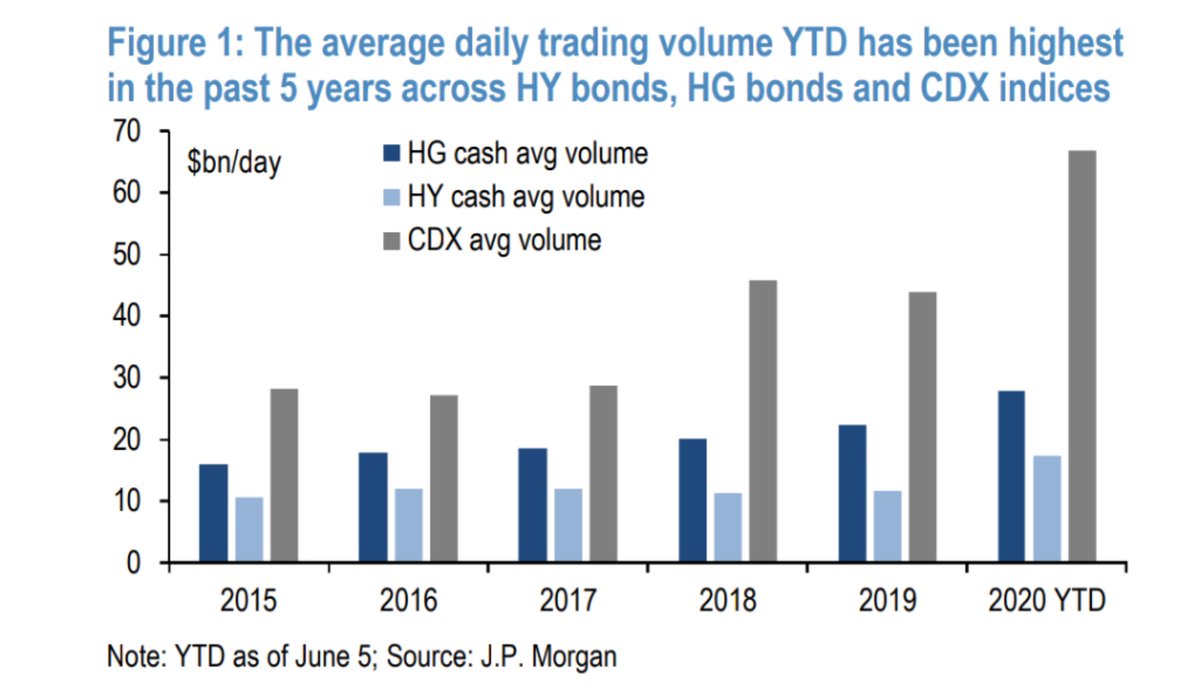

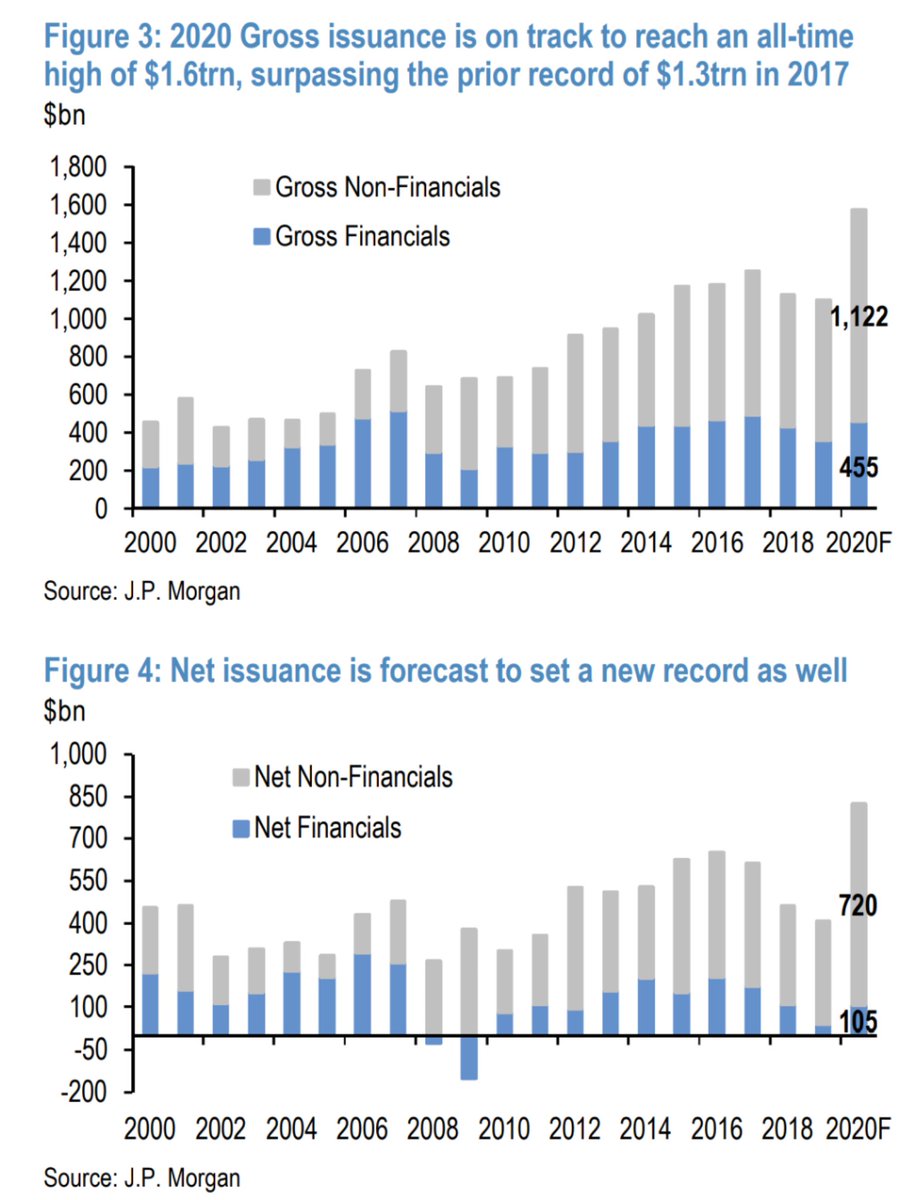

2020 is shaping to be a record in financial assets net issuance, which is logical given record liquidity

Equities are moving on the fiscal expansion much more than on CB liquidity b/c they are retail-driven. Credit moves much more on CB liquidity b/c it is largely institutionally driven...

...As Fed has been draining liquidity for a while, credit has been underperforming. While, as long as fiscal is firing, and there is no bigger champion here but US, equities will keep churning (well the FAANGS - again retail-driven).

This:

"Creating more reserves to pay interest would be stable up to a point: the monetary gift to households would come from future seigniorage. Essentially, instead of governments receiving future seigniorage income over time, they would be using it to finance the gift to..

"Creating more reserves to pay interest would be stable up to a point: the monetary gift to households would come from future seigniorage. Essentially, instead of governments receiving future seigniorage income over time, they would be using it to finance the gift to..

...households in the present. The “helicopter drop” is essentially a fiscal transfer. Beyond a certain point,

however, this process would become unstable and inflation would likely increase. The extent to which

inflation increases would depend on the evolution of...

however, this process would become unstable and inflation would likely increase. The extent to which

inflation increases would depend on the evolution of...

...inflation expectations. In the situation of higher inflation, the monetary gift to households would then be financed

by the inflation tax."

It is this inflation hurdle which makes people believe that there are no 'free lunches' in markets and the economy...

by the inflation tax."

It is this inflation hurdle which makes people believe that there are no 'free lunches' in markets and the economy...

...that's fair. But we have the tech and the data to overcome this hurdle. Check out China's DCEP and, especially, HSBC paper from 2015, "Blockchain: helicopter money on demand" for an idea how to approach that angle.

Read on Twitter

Read on Twitter