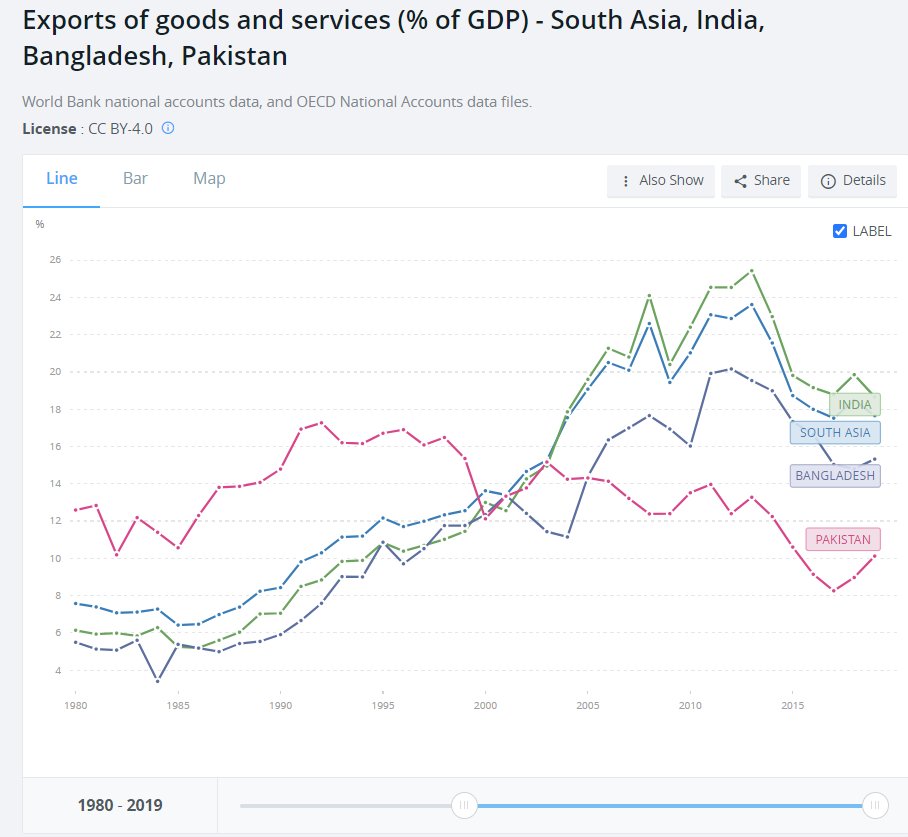

(Comment: 1/6) Deficits r not always bad but can be catastrophic if markets lose faith in ur repayment capacity. Unlike India & Bangladesh, growth episodes in #Pakistan (2004-08 & 2015-18) came at expense of falling Exports-GDP. High CAD was unsustainable! https://www.dawn.com/news/1567888

(2/6) Fiscal deficits r often less of a problem at least on their own. But persistent fiscal deficits can often lead to CAD (i.e. twin deficit hypothesis) & debt monetisation or infl tax (i.e. fiscal dominance). These implications can again increase likelihood of currency crisis.

(3/6) So yes, deficits are not bad if these come together with increase (or potential increase) in your repayment capacity. But can turn out to be catastrophic if not so. Unfortunately, Pakistan falls in the latter category.

(4/6) This reminds me of the fear expressed by many development economists during the 50s and 60s that import substitution policies may end up adversely affecting exports. https://twitter.com/ajpirzada/status/1281000280730021889?s=20

(5/6) Some researchers had already started noting in 60s how import substitution policies were adversely affecting industrial structure in Pakistan. Not much has changed since then. https://twitter.com/ajpirzada/status/1281008464790257670?s=20

(6/6) John Power (1963) summed it up pretty well in his paper on Pakistan, "doing many things poorly instead of fewer things well.”

Read it again ... just this above statement, not everything!

Read it again ... just this above statement, not everything!

Read on Twitter

Read on Twitter