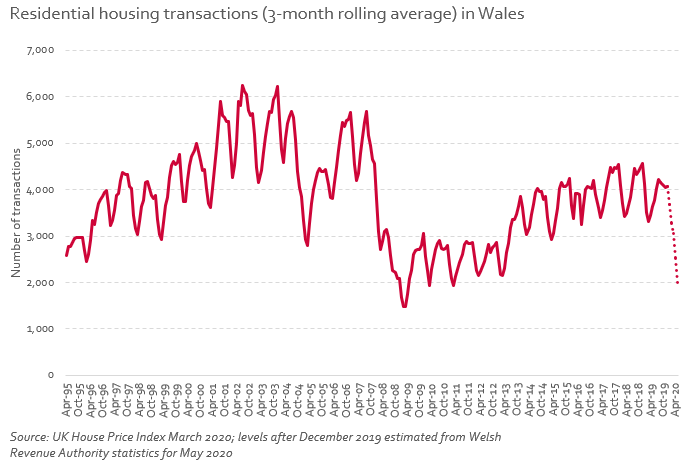

1/ As expected, the Welsh housing market has slowed considerably since the start of the crisis.

Should the Welsh Government introduce a Land Transaction Tax holiday following yesterday's announcement by the UK government?

A thread on a few things to consider:

Should the Welsh Government introduce a Land Transaction Tax holiday following yesterday's announcement by the UK government?

A thread on a few things to consider:

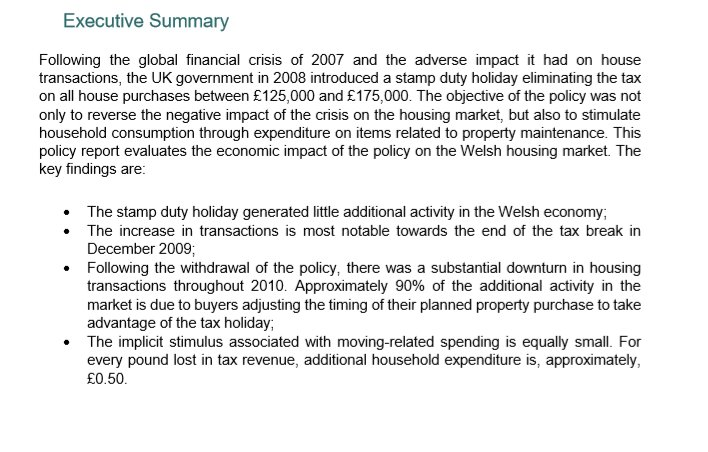

2/ The estimated cost of the holiday for the UK government is £3.8bn (based on March forecast).

This fall in UK gov revenue would reduce the Block Grant Adjustment (the amount taken off the Welsh block grant to account for tax devolution) by roughly £77 million.

This fall in UK gov revenue would reduce the Block Grant Adjustment (the amount taken off the Welsh block grant to account for tax devolution) by roughly £77 million.

3/ The Welsh Government can use this effective increase in its budget as it wishes (on extra spending or tax cuts). Is a LTT holiday the best use of this additional funding?

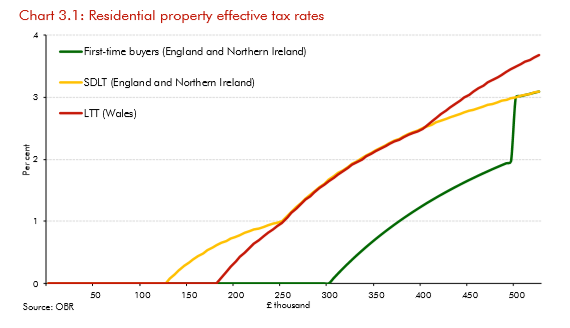

Important to remember that 2/3s of property transactions in Wales currently pay no LTT (under £180,000)

Important to remember that 2/3s of property transactions in Wales currently pay no LTT (under £180,000)

4/ Also note that differences in the Welsh tax base compared to England and NI mean the cost of mimicking UK government policy (increasing 0% rate to £500k threshold) could end up costing more than the decrease in the BGA: https://twitter.com/WalesGovernance/status/1280843281379844096?s=20

5/ In 2008-2009, the UK gov introduced a Stamp Duty holiday for properties up to £175,000.

A @TARC2013 evaluation of the holiday in Wales found it "generated little additional activity in the Welsh economy"

A @TARC2013 evaluation of the holiday in Wales found it "generated little additional activity in the Welsh economy"

6/ Also note that Stamp Duty holidays can end up hurting First Time Buyers through inflating property prices... http://obr.uk/box/a-new-tax-relief-for-first-time-buyers/

7/ This crisis is different, and the policy response (higher 0% threshold and over longer period) could be larger than in 2008-2009. There's also the potential (but marginal) border effect.

But there may well be better options to use £77m to boost the economic recovery in Wales.

But there may well be better options to use £77m to boost the economic recovery in Wales.

Read on Twitter

Read on Twitter