"Eliminating Impermanent Loss (IL)" is kind of a meme now, but @Bancor has actually come up with a pretty elegant solution for "Mitigating" IL

This can have huge implications for Liquidity Provisioning

Here's why and how it works

This can have huge implications for Liquidity Provisioning

Here's why and how it works

What is impermanent loss?

This is the loss associated with a change in asset exposure after price changes due to providing liquidity to a constant function market maker [CFMM] (Uniswap, Balancer, Bancor V1).

This is relative to just holding the assets.

https://blog.bancor.network/beginners-guide-to-getting-rekt-by-impermanent-loss-7c9510cb2f22#:~:text=What%20Is%20Impermanent%20loss%3F,the%20greater%20the%20impermanent%20loss.

This is the loss associated with a change in asset exposure after price changes due to providing liquidity to a constant function market maker [CFMM] (Uniswap, Balancer, Bancor V1).

This is relative to just holding the assets.

https://blog.bancor.network/beginners-guide-to-getting-rekt-by-impermanent-loss-7c9510cb2f22#:~:text=What%20Is%20Impermanent%20loss%3F,the%20greater%20the%20impermanent%20loss.

Why is IL important?

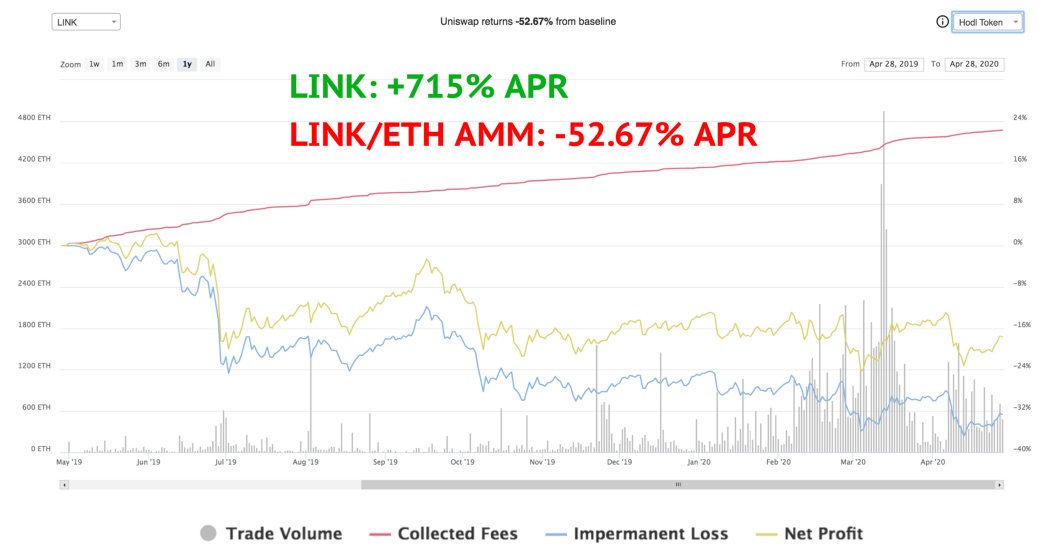

IL is the largest economic blocker preventing Liquidity Providers (LPs) from providing liq. to CFMMs. It adds a large uncertainty when assessing profitability to LPing. If the market moves quickly in one direction, LPs are at a loss relative to HODLing

IL is the largest economic blocker preventing Liquidity Providers (LPs) from providing liq. to CFMMs. It adds a large uncertainty when assessing profitability to LPing. If the market moves quickly in one direction, LPs are at a loss relative to HODLing

Liquidity mining (LM) has overcome this blocker for LPs by providing outsized yields to attract LPs, but this is not a long term solution.

LM Yields will eventually fall and IL will be a larger concern. No one wants to suffer IL during a bull run

LM Yields will eventually fall and IL will be a larger concern. No one wants to suffer IL during a bull run

The first element in Bancor's solution is single asset liquidity provisioning. Instead of needing to have exposure to 2 or more assets like in other CFMMs, Bancor LPs can choose to LP with either Token (TKN) or Bancor (BNT) in a particular pool and receive a corresponding share

This actually solves another friction point with current CFMMs, which is needing to have exposure in two+ assets while managing constantly changing delta & gamma exposure

These changes in delta is what causes IL

e.g. 50 ETH delta -> 45 ETH delta if price goes up

These changes in delta is what causes IL

e.g. 50 ETH delta -> 45 ETH delta if price goes up

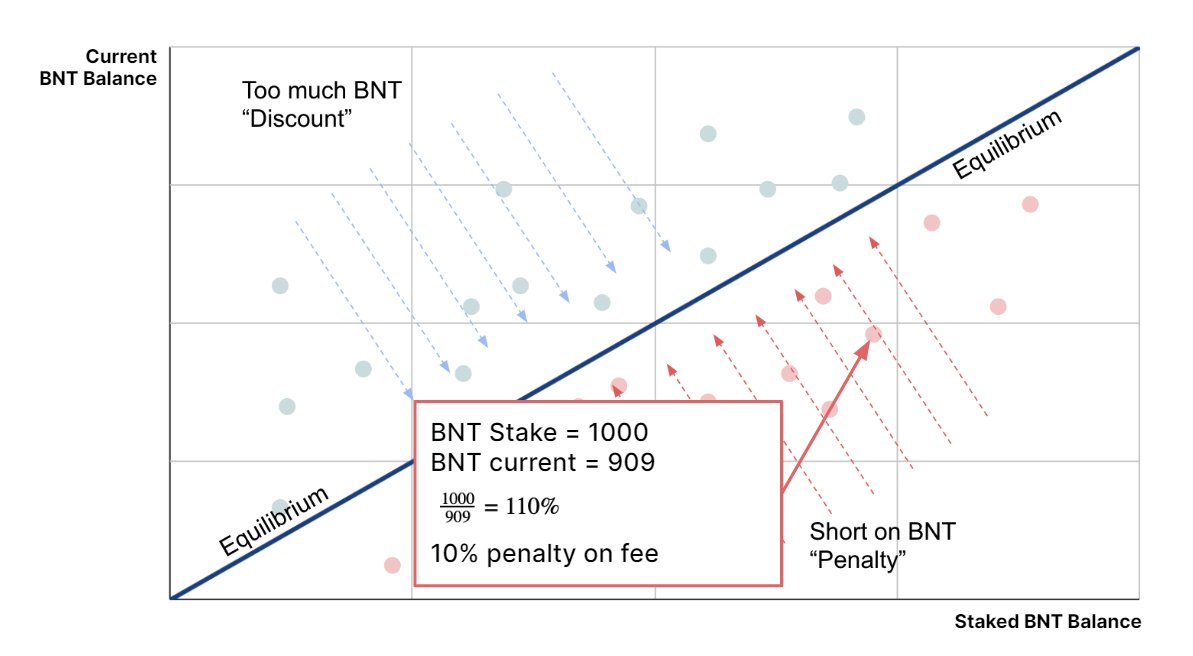

So what Bancor does is track the pool's TKN & BNT originally staked balances, and create incentives for traders to return the pool back to the originally staked balances. This is via two mechanisms:

1. "Arbitrage incentives"

2. Dynamic Fees

1. "Arbitrage incentives"

2. Dynamic Fees

Arbitrage incentives are essentially Bancor pools setting prices that encourage traders to fill TKN deficits or reduce TKN surplusses.

For example, if there is a TKN surplus, then the pool will price TKN at a discount to market and traders will buy/pull TKN out of the pool.

For example, if there is a TKN surplus, then the pool will price TKN at a discount to market and traders will buy/pull TKN out of the pool.

The opposite happens for a TKN deficit (BNT discounted to attract TKN).

This repricing happens via pool weight adjustments (eg 50/50 -> 49/51)

Now the side effect of this is that BNT LPs are esentially arbed to make TKN LPs whole. BNT LPs essentially realize the TKN LP IL.

This repricing happens via pool weight adjustments (eg 50/50 -> 49/51)

Now the side effect of this is that BNT LPs are esentially arbed to make TKN LPs whole. BNT LPs essentially realize the TKN LP IL.

They are compensated for this via dynamic fees. If BNT LPs are at a deficit relative to original stake, then a larger % of transaction fees will be shifted towards them

The time in which BNT LPs are made whole depends on price action, tx volume, and a host of other factors

The time in which BNT LPs are made whole depends on price action, tx volume, and a host of other factors

BNT LPs will also additionally be compensated via Liquidity Mining rewards, but this is a short term bonus and also dilutive

BNT LPs should be long term aligned with LPing because they take on the IL risk in the short run, for hopefully larger yields in the long run

BNT LPs should be long term aligned with LPing because they take on the IL risk in the short run, for hopefully larger yields in the long run

@Bancor has many other interesting updates in V2 including external+internal oracles, price matching, liquidity amplification, etc.

These changes have their own different implications which I'll explore in a later thread.

These changes have their own different implications which I'll explore in a later thread.

Images from this thread can be found in the public Bancor presentation uploaded here:

https://docs.google.com/presentation/d/17V1lRlV7J9ll1ZD13DdW0gj1QUQoP377ZdoxZo_5e9Y/edit#slide=id.g8a4c3c4e65_0_5

cc: @CurveFinance @thorchain_org @NateHindman @tarunchitra @haydenzadams @fcmartinelli @DegenSpartan

https://docs.google.com/presentation/d/17V1lRlV7J9ll1ZD13DdW0gj1QUQoP377ZdoxZo_5e9Y/edit#slide=id.g8a4c3c4e65_0_5

cc: @CurveFinance @thorchain_org @NateHindman @tarunchitra @haydenzadams @fcmartinelli @DegenSpartan

Read on Twitter

Read on Twitter