Part 3 of "10k in 10 tweets"

Had never heard of this company but it was mentioned a few times when I put the original question out.

Let's look at Plug Power (PLUG)...

[THREAD]

Had never heard of this company but it was mentioned a few times when I put the original question out.

Let's look at Plug Power (PLUG)...

[THREAD]

1/ The company sells hydrogen fuel cells. These are basically big battery packs powered by hydrogen.

Except it's different than batteries because they don't require charging. You actually fill them up with hydrogen just like at the gas pump.

Except it's different than batteries because they don't require charging. You actually fill them up with hydrogen just like at the gas pump.

2/ It was sort of hard to conceptualize exactly what this company did. But if you cut through the jargon, it sells these hydrogen-powered packs to manufacturing facilities so they can place them on forklifts.

Talk about a niche. Hydrogen-powered forklifts!

Talk about a niche. Hydrogen-powered forklifts!

3/ Most customers lease rather than buy these packs outright so they must be expensive.

The benefits are long-term cost savings from not having to replace batteries as well as environmental considerations.

The benefits are long-term cost savings from not having to replace batteries as well as environmental considerations.

4/ Speaking of customers, 2 customers account for 50% of revenues, actually down from 72% just two years ago.

So who are these customers? Let's find out...

So who are these customers? Let's find out...

5/ Reading further, we see that Plug Power issued the exact same number of warrants to both Amazon and Walmart.

I had never seen this but apparently it's kinda common when a big customer makes a purchase with a much smaller supplier.

Learn more here:

https://devoncroft.com/2018/08/02/comcast-vests-additional-warrant-shares-in-harmonic/

I had never seen this but apparently it's kinda common when a big customer makes a purchase with a much smaller supplier.

Learn more here:

https://devoncroft.com/2018/08/02/comcast-vests-additional-warrant-shares-in-harmonic/

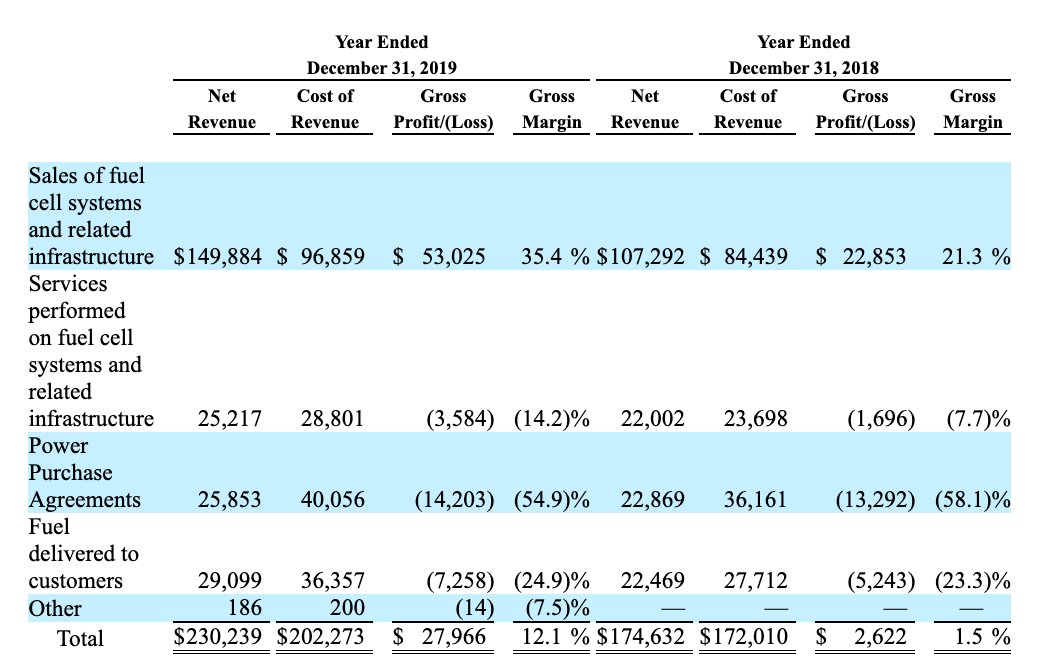

6/ The company was started in 1997 and it has never achieved a single quarter of profitability.

In fact, for a few reasons, the company has negative gross margins pretty frequently.

In fact, for a few reasons, the company has negative gross margins pretty frequently.

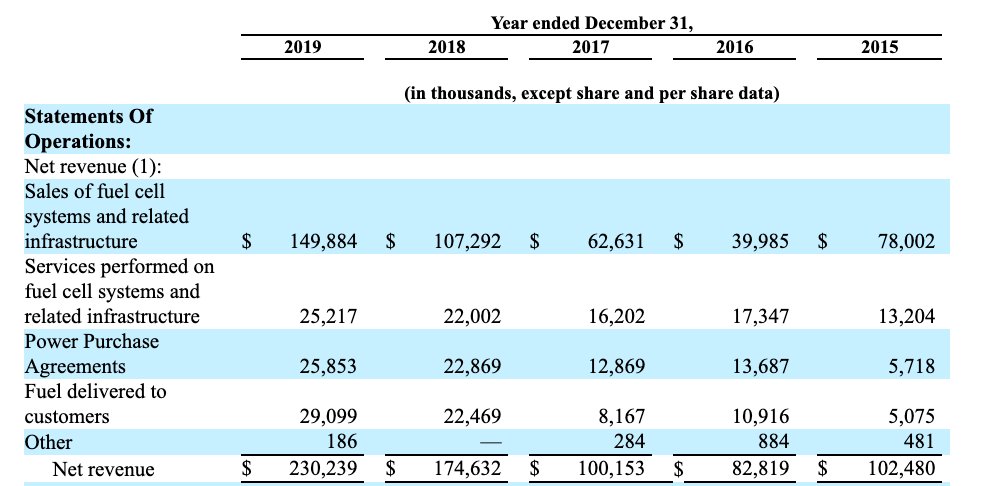

7/ The company has 4 revenue segments:

1. fuel cell systems (highest gross margin and best growth. These are the packs)

2. maintenance

3. PPA (payments to access full service, these are likely the lease agreements to big customers like Amazon and Walmart)

4. fuel delivery

1. fuel cell systems (highest gross margin and best growth. These are the packs)

2. maintenance

3. PPA (payments to access full service, these are likely the lease agreements to big customers like Amazon and Walmart)

4. fuel delivery

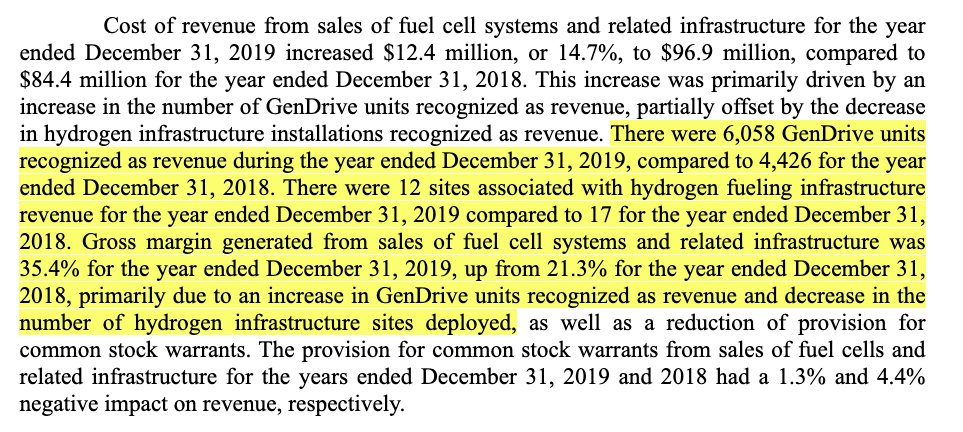

8/ Here we see the gross profitability of each segment.

The only positive one is the sales of fuel cell systems. In fact, the company just released a new product for fuel cells in light-duty trucks to expand outside of forklifts.

The only positive one is the sales of fuel cell systems. In fact, the company just released a new product for fuel cells in light-duty trucks to expand outside of forklifts.

9/ One interesting note in here is that the number of hydrogen fueling stations decreased from 17 to 12. But fuel delivered to customers also decreased.

I'm not sure what the end game is here. Customers need to get hydrogen from somewhere...

I'm not sure what the end game is here. Customers need to get hydrogen from somewhere...

10/ I enjoyed looking at this company because it was out-of-the-ordinary and a little difficult to understand.

A history of negative gross margins, unproven tech in other use cases, supplier dependence, and extremely lumpy orders would keep me on the sidelines but fun to study.

A history of negative gross margins, unproven tech in other use cases, supplier dependence, and extremely lumpy orders would keep me on the sidelines but fun to study.

Read on Twitter

Read on Twitter