I've been nominated by @benconomics to #TweetABlackEconomistsPaper, so I'll tweet about @danielmangrum's job market paper on financial literacy and student loan repayment

Daniel just graduated from Vanderbilt and will be starting at the NY Fed soon

1/7

Daniel just graduated from Vanderbilt and will be starting at the NY Fed soon

1/7

Research Q:

How does personal financial literacy edu. in high school affect post-college federal student loan repayment?

Method:

Dose-response diff-in-diff

As more states impose ed reqs, unis will have different changes in the % of students who are exposed to treatment

2/7

How does personal financial literacy edu. in high school affect post-college federal student loan repayment?

Method:

Dose-response diff-in-diff

As more states impose ed reqs, unis will have different changes in the % of students who are exposed to treatment

2/7

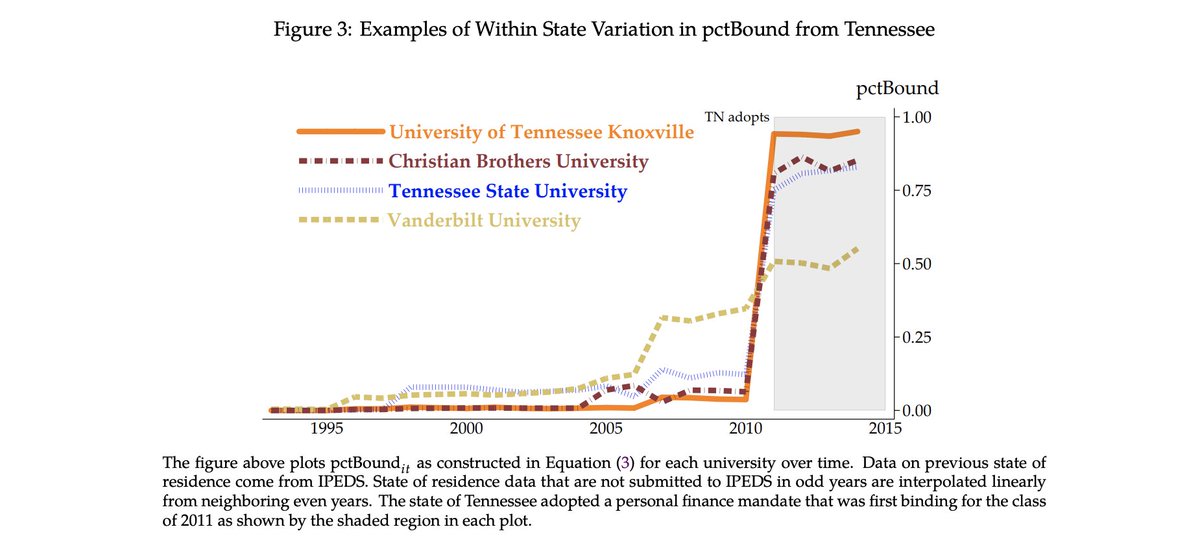

As shown below, initially Tennessee unis have low % of students exposed to treatment (pctBound)

Vanderbilt is the exception as presumably they have more out-of-state students

Once TN adopts treatment, % of students exposed at all schools, but by diff. amts.

at all schools, but by diff. amts.

3/7

Vanderbilt is the exception as presumably they have more out-of-state students

Once TN adopts treatment, % of students exposed

at all schools, but by diff. amts.

at all schools, but by diff. amts.3/7

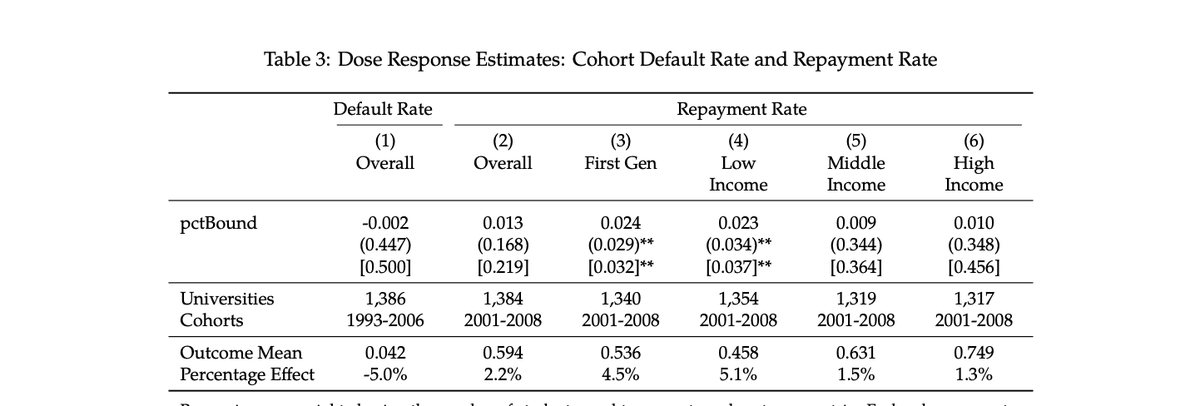

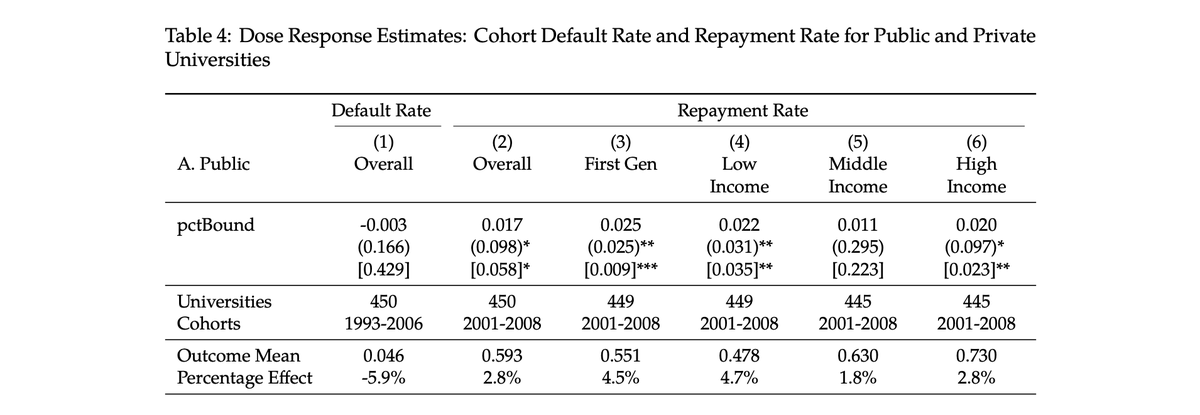

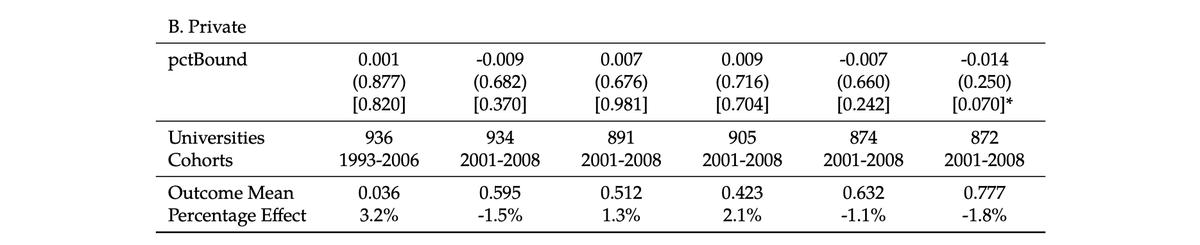

Results:

Financial literacy education improves repayment, particularly for first-gen and low-income students at public unis

1st pic: first-gen and low-income students = 5% more likely to make a payment in their 1st year

2nd/3rd pics: but only for students at public unis

4/7

Financial literacy education improves repayment, particularly for first-gen and low-income students at public unis

1st pic: first-gen and low-income students = 5% more likely to make a payment in their 1st year

2nd/3rd pics: but only for students at public unis

4/7

Mechanism:

Students more knowledgeable about fed student loan regulations

more knowledgeable about fed student loan regulations

Not due to

1. loan balances (only high-income students change borrowing behavior)

loan balances (only high-income students change borrowing behavior)

2. improved overall financial literacy

3. increased likelihood of attending/graduating college

5/7

Students

more knowledgeable about fed student loan regulations

more knowledgeable about fed student loan regulationsNot due to

1.

loan balances (only high-income students change borrowing behavior)

loan balances (only high-income students change borrowing behavior)2. improved overall financial literacy

3. increased likelihood of attending/graduating college

5/7

Conclusion:

Familiarizing students w/federal student loan regulations when they take out loans helps them repay the loans in the long run

Alternatively, simplifying the loan process may have similar effects

6/7

Familiarizing students w/federal student loan regulations when they take out loans helps them repay the loans in the long run

Alternatively, simplifying the loan process may have similar effects

6/7

Here is the link to the full paper if you want to learn more:

https://www.danielmangrum.com/docs/PFMandates_current.pdf

And here is a link to his website if you want to learn about his other research!

https://www.danielmangrum.com/home.html

7/7

https://www.danielmangrum.com/docs/PFMandates_current.pdf

And here is a link to his website if you want to learn about his other research!

https://www.danielmangrum.com/home.html

7/7

Read on Twitter

Read on Twitter