Normal chart for those interested

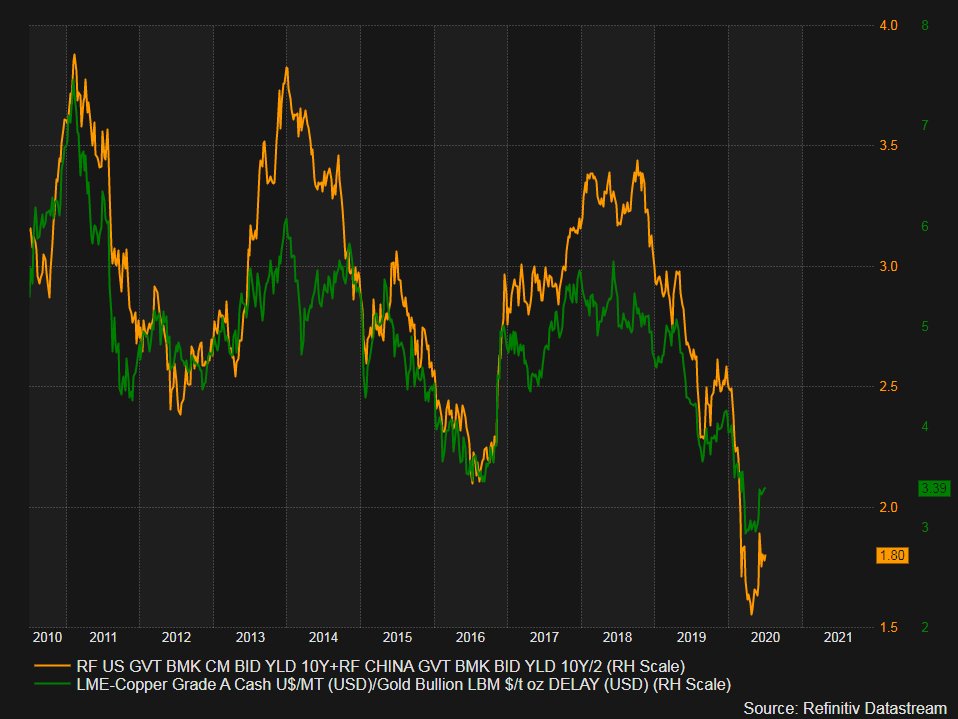

#Copper #gold ratio (green)

Average #China #US 10 Year Yield (yellow)

#Copper #gold ratio (green)

Average #China #US 10 Year Yield (yellow)

#Copper #gold ratio (green) tracking China 10 Year Yield (red) higher, while US 10 Year Yield (purple) lags. Note the divergence during 2018.

Top chart - $IVV ishares S&P 500 ETF YoY% relative to #US Money Supply M1 YoY%

Bottom chart - $IVV ishares S&P 500 ETF

Hmm...

Bottom chart - $IVV ishares S&P 500 ETF

Hmm...

Top chart - $USD Real GDP growth rate differential between #US & #China vs. Broad US Dollar Index

Bottom chart - $IVV relative to $EEM

Bottom chart - $IVV relative to $EEM

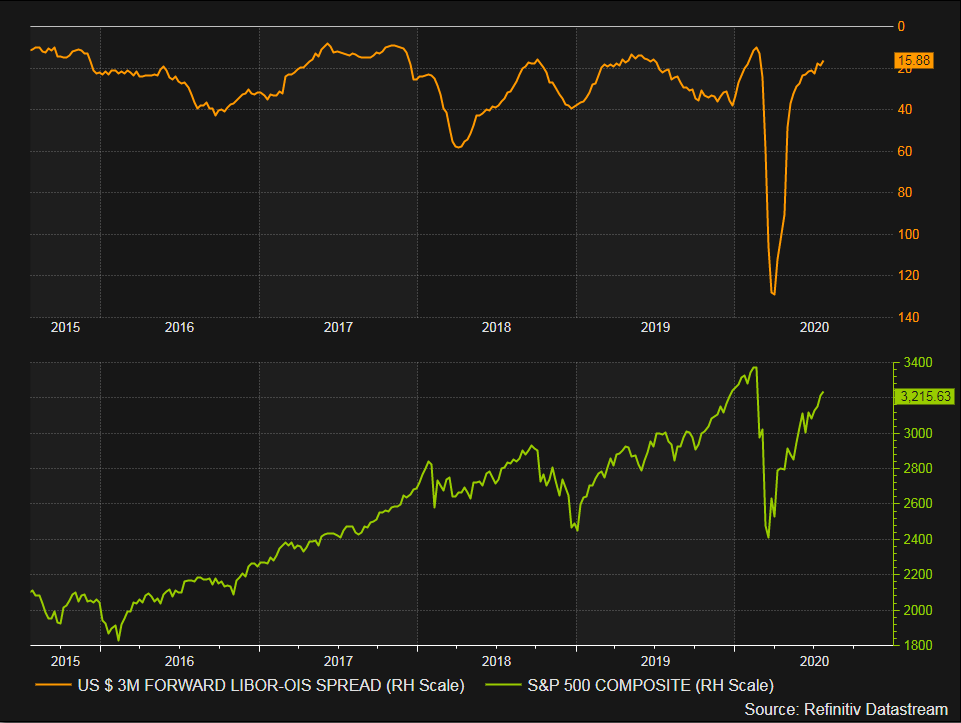

LIBOR OIS (inverted) vs. $SPY

#Copper #gold ratio (green) still tracking China 10 Year Yield (red). US 10 Year Yield (purple) breaking lower. Note the divergence during 2018.

Big relative economic outperformance from #China relative to the #US. Does it continue and does the Broad Dollar Index & $USDCNY follow...

Very interesting - #China 10 yr yield pushing higher despite the move lower in the #US 10 yr yield and #copper/ #gold ratio

Read on Twitter

Read on Twitter