(0) As per requested, I spent some weekends putting together my basic framework on the $ETH + $DeFi space. Would greatly appreciate your feedback as it’s the sole purpose of putting the deck out there -- should be pretty timely as the space heats up

Link: https://drive.google.com/file/d/1_pjGxEdCgZDnzvhWFDuBjAT2o5C965gP/view?usp=sharing

Link: https://drive.google.com/file/d/1_pjGxEdCgZDnzvhWFDuBjAT2o5C965gP/view?usp=sharing

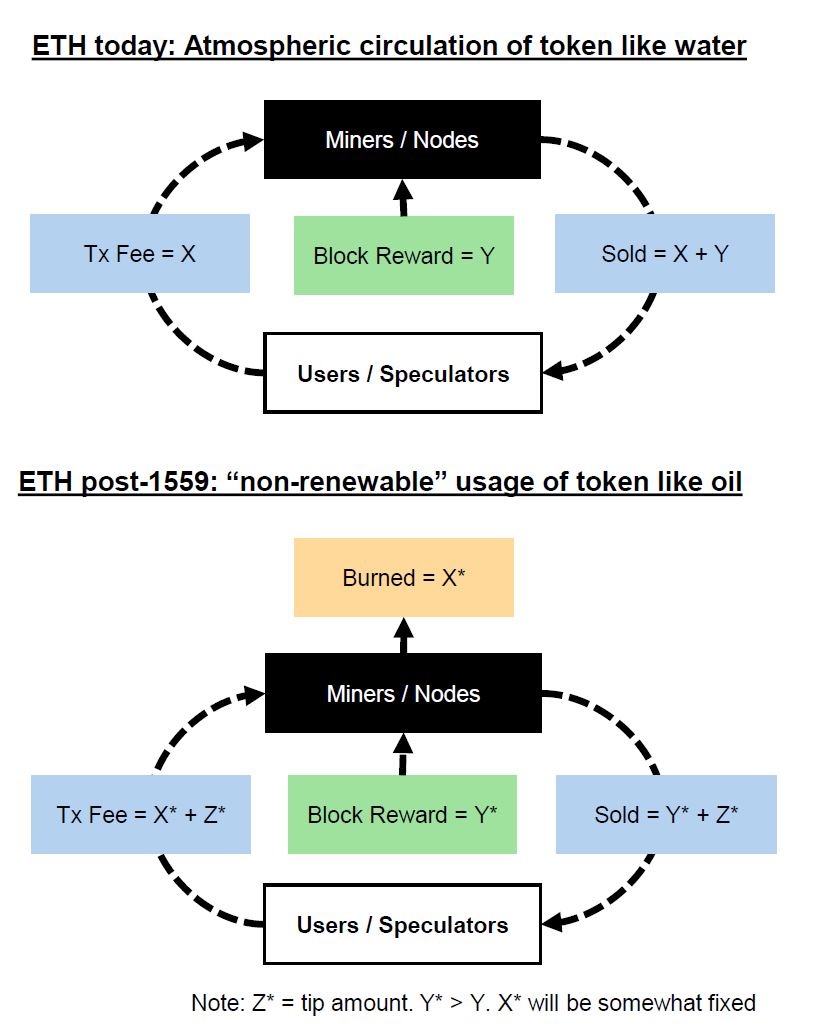

(1) ETH is a digital commodity today powers and secures transactions and code execution, much like water powering watermills as a “recyclable” resource. EIP-1559, much like alchemy, transforms ETH from water to be more like oil.

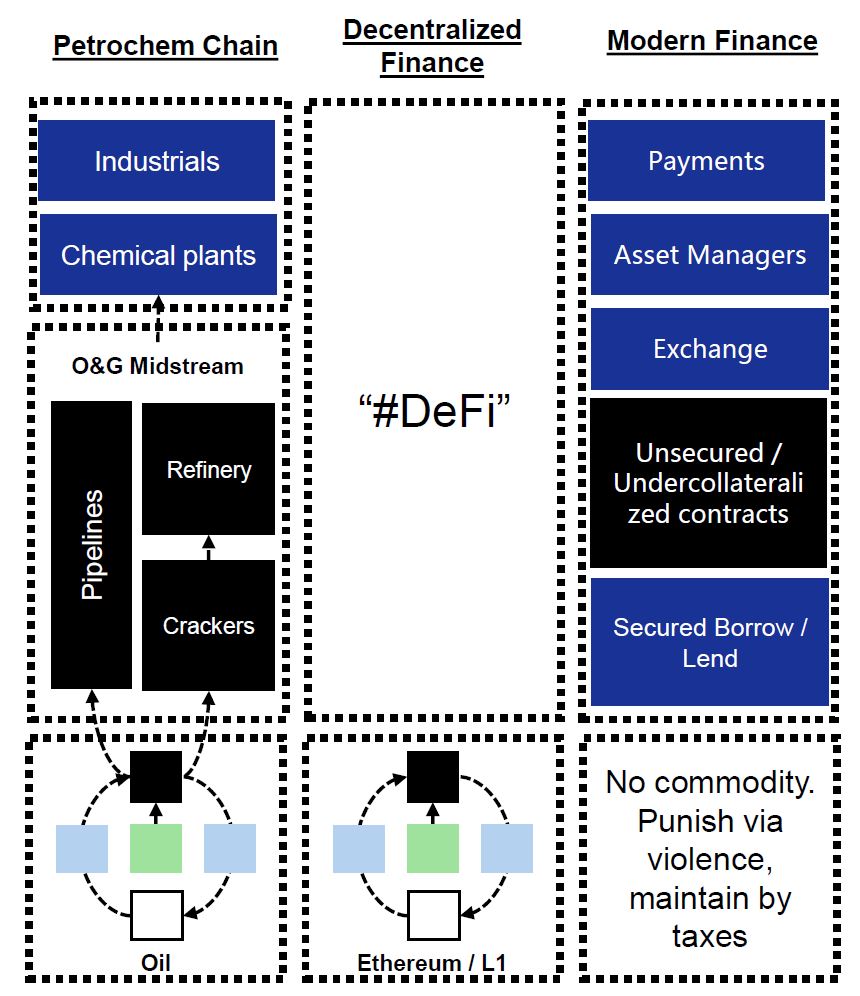

(2) The #DeFi stack, by extension, is therefore utilizing digital commodities as feedstock to explore various modules / functions within and beyond the current finance infrastructure, much like the petrochemical / industrial value chains built on top of oil.

(3) A well-designed, well-maintained L1 token protocol should track industry growth. Stakeholder base may matter more given need of iterations, and outsized return in Layer-1 would prompt replacements, despite potential security boost & price inelasticity thanks to robust demand.

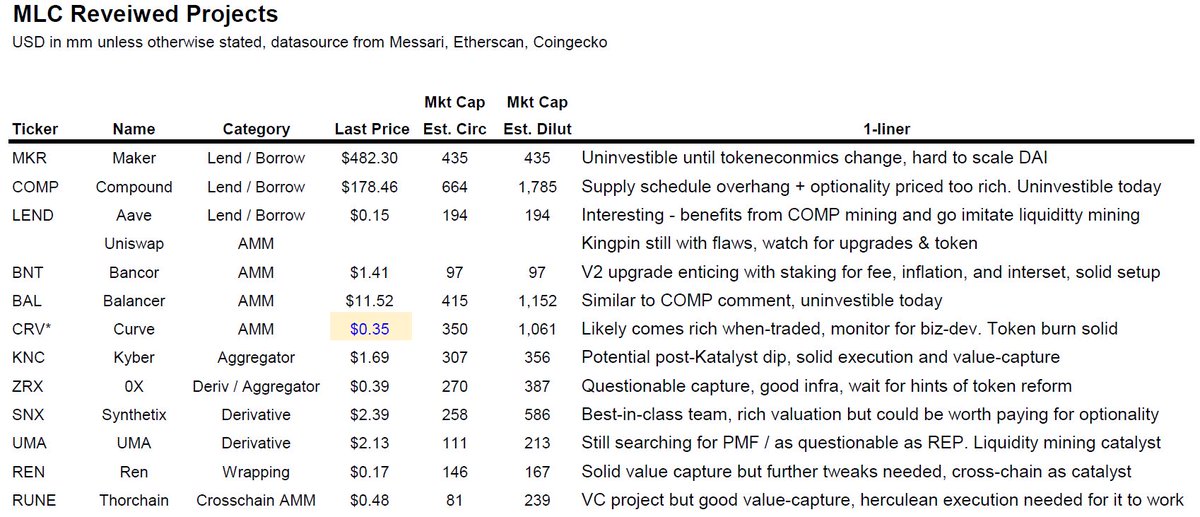

(4) Of the #DeFi ecosystem today, we envision AMM and lending protocols to merge overtime. Winners could be ephemeral so we would prefer to avoid tokens with overhang such as $COMP, $BAL, and $CRV (if high valuation),

(5) …and lean into tokens with pending or hypothesized catalysts such as $LEND, $BNT, and $REN. To extend the alchemy analogy, the phase-change from governance to value-capture is what drives out-sized return (like $KNC). $ZRX and $RUNE require further herculean efforts.

(6) …We are monitoring Uniswap, Graph, and 1inch potential token issuance closely. Team that consistently executes (such as $SNX) deserves a premium. Tokens like $MKR and $UMA still need to work on token-mechanics / PMF.

(7) We generally feel like more experimentation can be done on formulaic and flexible issuance / buyback / dividend based on protocol usage / adoption as well as discriminating in favor of users / long-term holders.

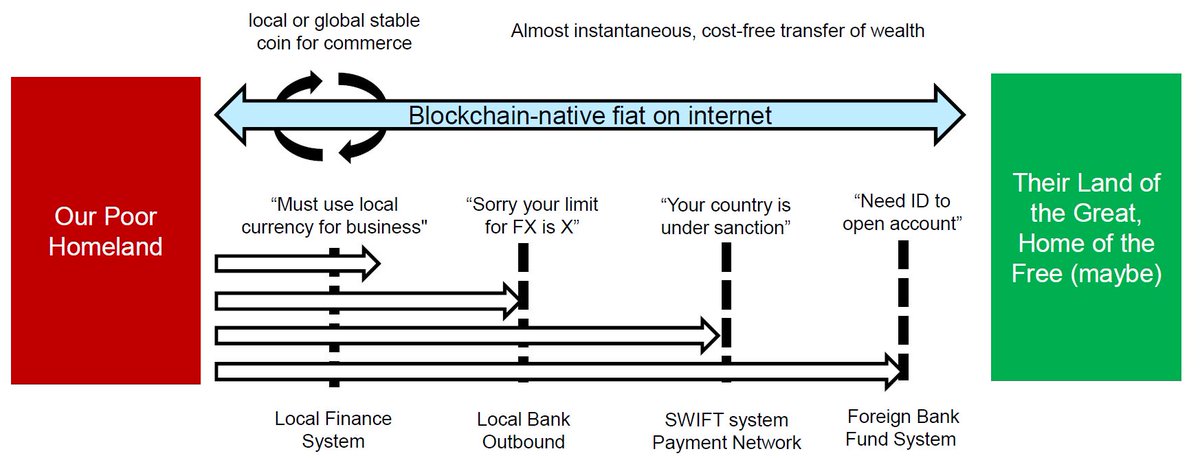

(8) Breakthrough of Blockchain-native fiat (USDT, USDC, Dai, DCEP, Libra, etc ) could spell trouble to sovereignty of most non-tier 1 nations, similar to colonization of 17-19th centuries – a harder currency retards the weaker nation’s ability to tax outright or via inflation

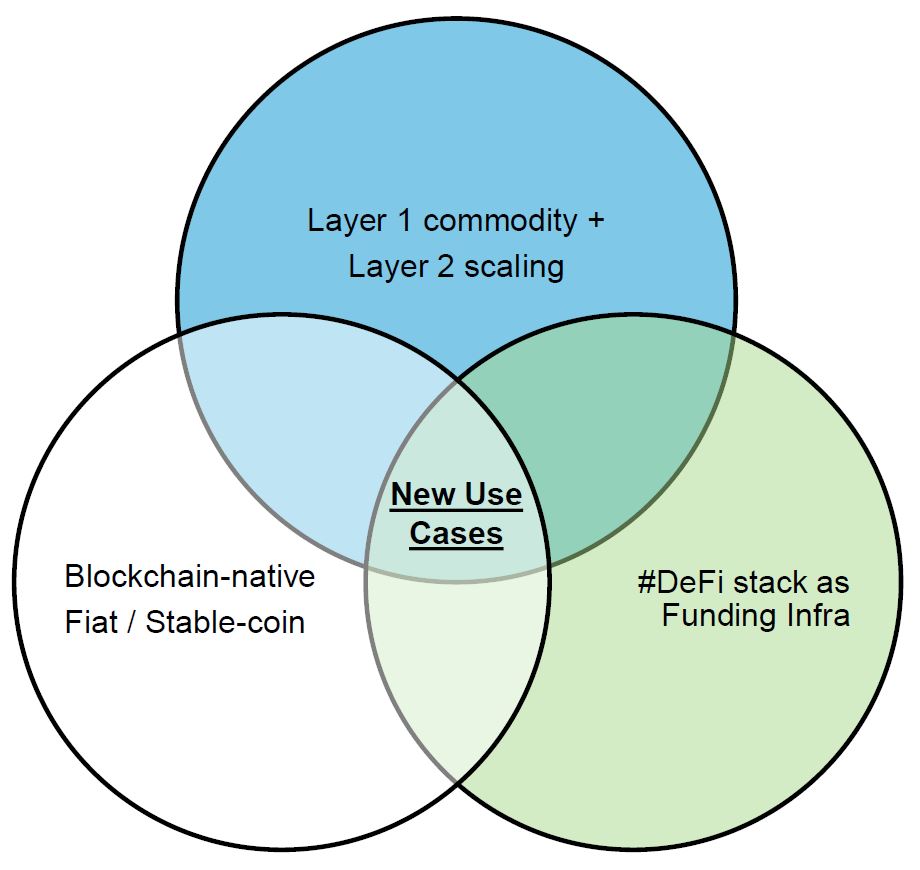

(9) A combination of blockchain native-fiat, layer-1 digital commodity, layer 2 scaling, and the #Defi infrastructure should have a Lollapalooza effect that collectively brings new use cases to reality, such use case could be otherwise cost-prohibitive and even impossible today.

(10) If successful with the mission above, we may then live in a future world with high individual sovereignty -- every line-item of the financial statements can be repackaged and sold / owned by anyone; sovereign / nation-state definition will evolve.

(11) New violent agents arise, offering violence-as-a-service for taxes; everyone can be a stakeholder on both hyperlocal & global level – local coffee shop’s bond tranche payable in coffee and a game / movie royalty due to participation will co-exist

Off to a party; happy July 4th!

Read on Twitter

Read on Twitter