Where can one find high quality, rapidly growing companies at prices fit for a value investor in the market these days? Generally, it is going to have to be in some kind of a special situation. 1/n

In this case, a sum of the parts thesis (don’t smash the unfollow button quite yet)…with an unlocking catalyst (still here?). The thesis has started to play out over the last few weeks, but I still like the setup.

I’m talking about $IAC – IAC/Interactive Corp. 3/n

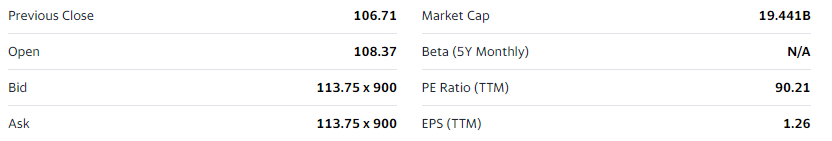

In recent weeks, $IAC was a ~$25bn company, whose value was comprised of a $21bn stake in $MTCH, $5bn or so in $ANGI, and then some “other stuff” that no one paid much attention to. Perhaps it was a 90 cent dollar – not that interesting on the surface. 4/n

But last week $IAC spun off $MTCH (and “spun off” simplifies the transaction quite a bit – this was a complicated transaction with multiple moving parts that weren’t all locked down until the final hour). 5/n

"New" IAC started trading on July 1st, and all day that day major retail brokerages didn't have any quotes or trading in the company. Here are screenshots from Etrade and Fidelity . 6/n

The sell side has started to update their numbers, models, and price targets, but they still have a ways to go. 8/n

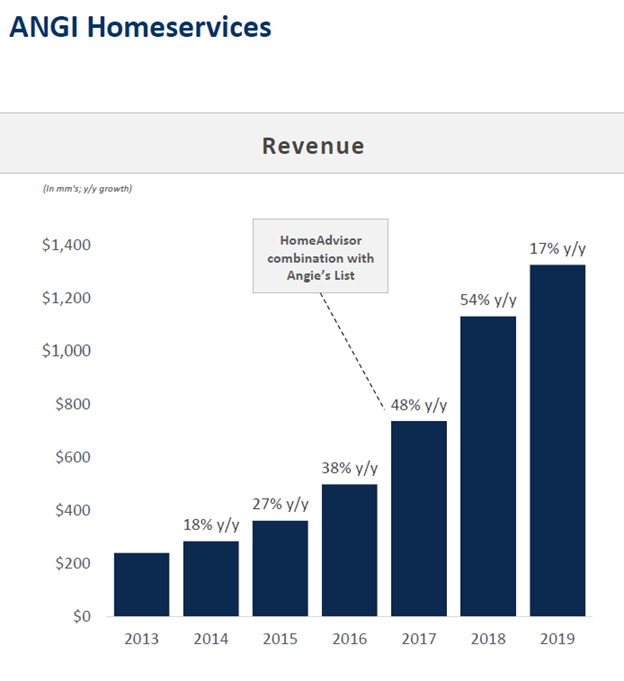

Today, $IAC is a sub-$10bn market cap whose value is comprised of $5.7bn of $ANGI, just under $4bn of cash, as well as “other stuff” that analysts previously ignored, but that I think folks will now take a much closer look at (and for the most part will like what they see. 9/n

I think that the private businesses, net of capitalized corporate costs, are worth $2bn+, a figure that could prove to be very conservative over the coming years. 10/

So rather than a $25bn market cap company trading at 90c on the dollar, we have a $9.8bn market cap company with almost 40% of the market cap represented by net cash, $5.7bn represented by the position in $ANGI, as well as another $2bn+ in (rapidly-growing) value. 11/

Even after the value-unlocking catalyst of the $MTCH spin, the EV (net of cash and the $ANGI position) is still being valued by the market at ~$0 today. 12/

We now have an ~80c or cheaper dollar with a much simpler structure (and with a much larger net cash cushion). If anything, I think the discount to NAV should have shrunk with this transaction, not expanded. 13/

ANGI seems to have some nice tailwinds according to alt data (and some traditional data). 16/ https://twitter.com/modestproposal1/status/1278004908747304967

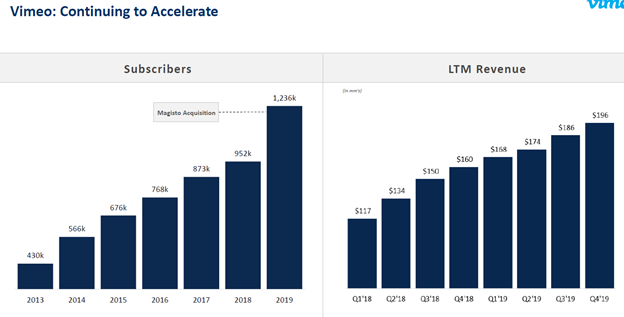

Vimeo is a ~$200mm ARR business growing ~30% with high incremental margins. 17/ https://twitter.com/ElliotTurn/status/1266731380718927882

DotDash is one of the smaller businesses (at least it was compared to Match!) that I think no one spent much time on before, and may not be the melting ice cube that some fear. 19/

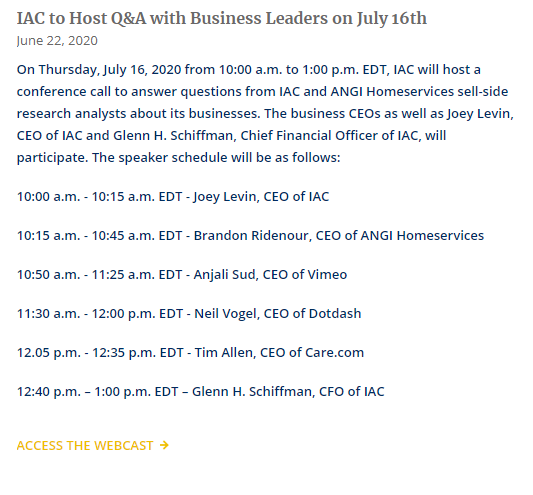

IAC management has started to get out and tell the story about some of their "hidden" gems (both of these transcripts are good reads). 20/

And have an investor event planned for July 16th in which they will continue to showcase new IAC. 21/

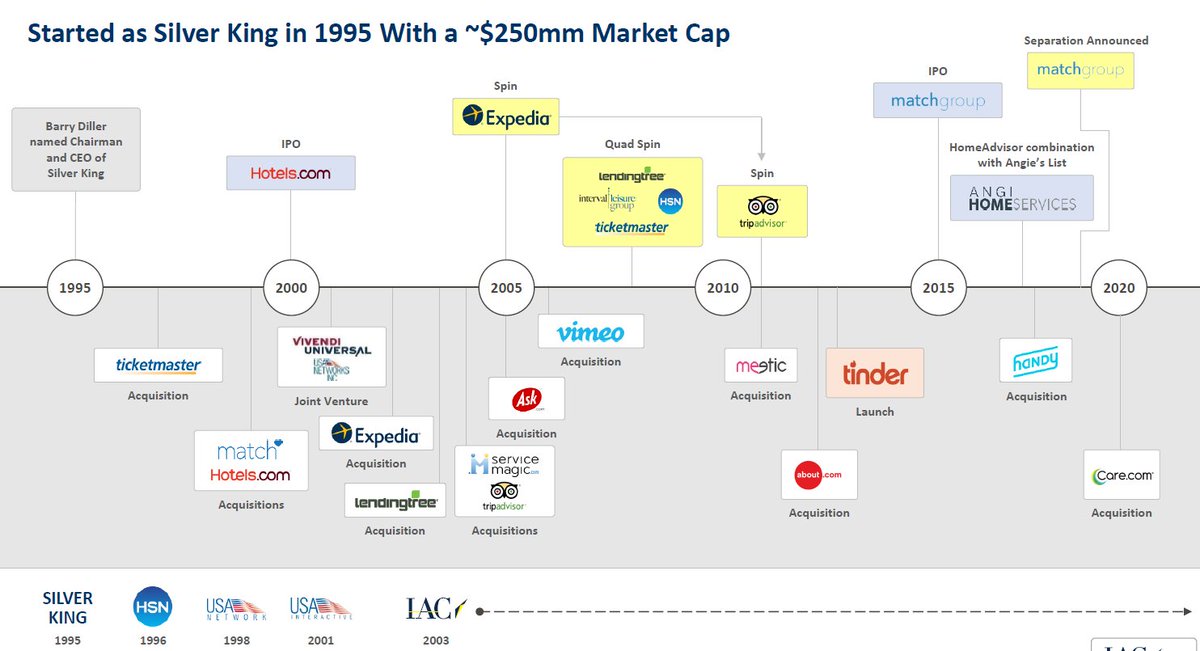

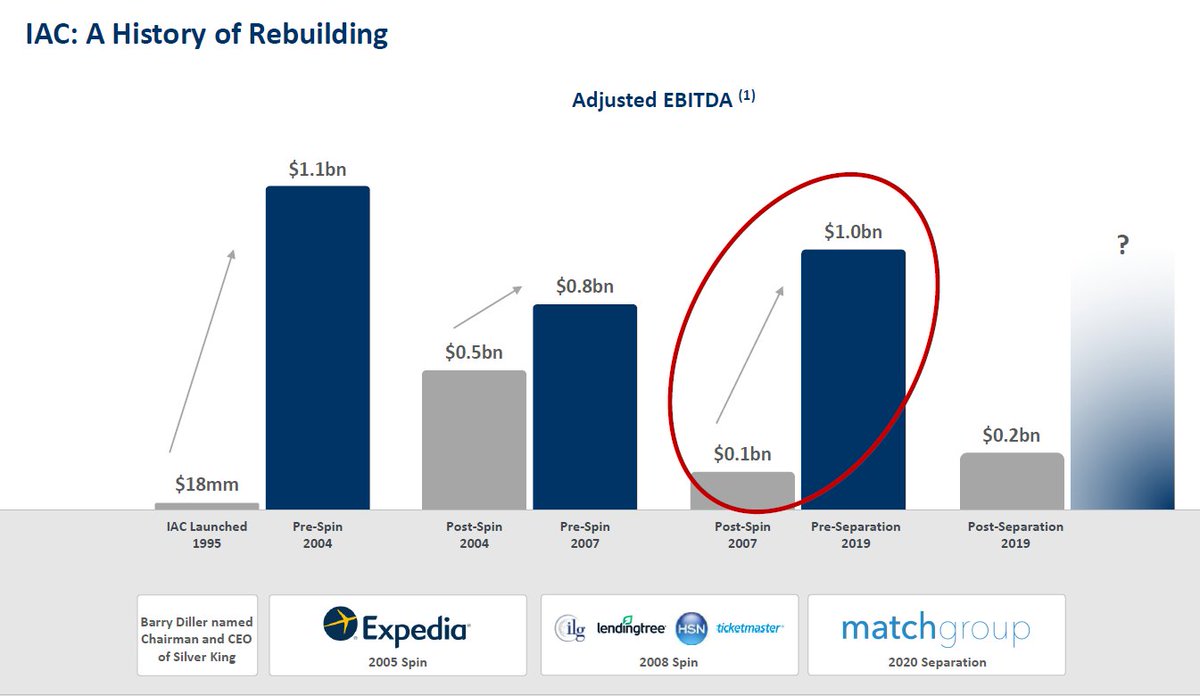

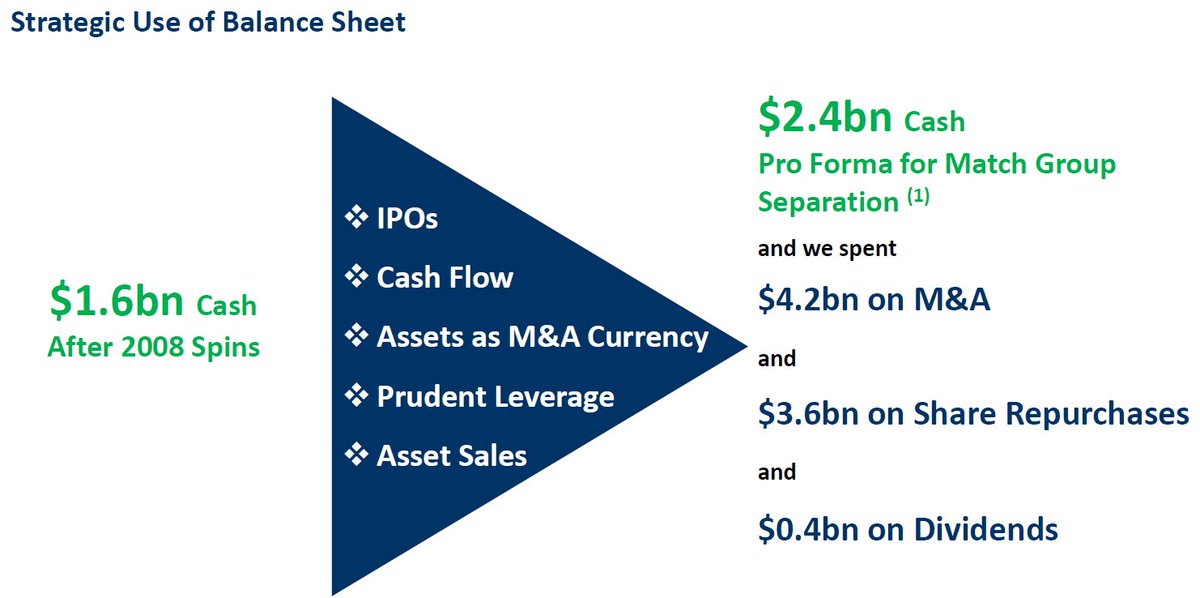

Let's not forget about the management team that we are betting on, and their history of value creation. 22/

They are excellent operators, capital allocators, and communicators (the old and more recent - two already this year - investor letters are worth reading). We can now align with them at the beginning of their next iteration. Same playbook; (mostly) new game. 23/

After their last major spin-off and simplification transaction just over a decade ago, the company was fairly aggressive buying back stock in the 2010-2012 time period. I assume their first priority now is doing smart deals, but repos are in their playbook (incl. at ANGI) 25/

<intermission>

Back later (most likely tomorrow) with a few final thoughts. Everyone have a good and safe Fourth.

Back later (most likely tomorrow) with a few final thoughts. Everyone have a good and safe Fourth.

Read on Twitter

Read on Twitter