1/ Thread: Buffett's genius in investing in the Unknown and Unknowable

In 2006, Richard Zeckhauser wrote an intriguing paper on "Investing in the Unknown and Unknowable", and one of the protagonists in that paper was none other than Warren Buffett.

In 2006, Richard Zeckhauser wrote an intriguing paper on "Investing in the Unknown and Unknowable", and one of the protagonists in that paper was none other than Warren Buffett.

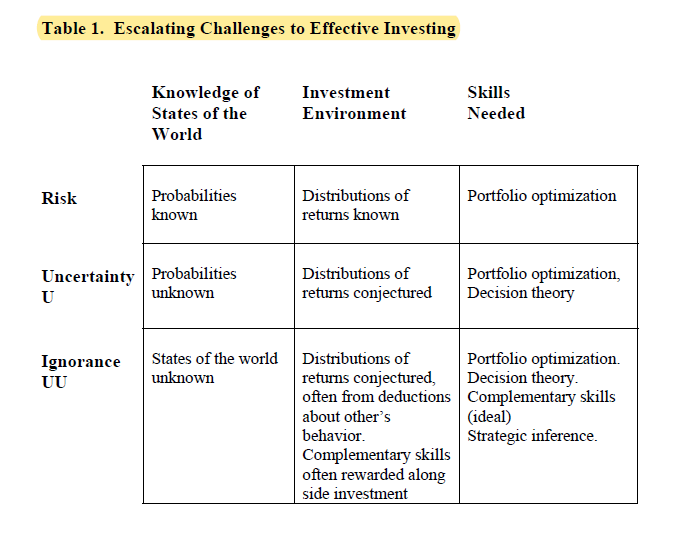

2/ While CAPM model deals with risk assuming probabilities and distributions are known, uncertainty (or unknown) indicates where probabilities could not be known.

While dealing with unknown, you can use decision theory to complement your traditional understanding of risk.

While dealing with unknown, you can use decision theory to complement your traditional understanding of risk.

3/ Beyond risk and uncertainty, there is another level beyond that: Ignorance.

The state of ignorance encapsulates both the unknown and unknowable (UU), and it is in this state one can make VERY compelling returns if they find themselves in the right side of the equation.

The state of ignorance encapsulates both the unknown and unknowable (UU), and it is in this state one can make VERY compelling returns if they find themselves in the right side of the equation.

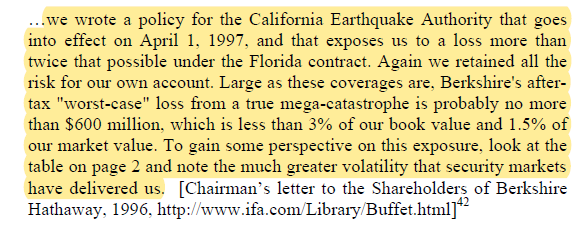

4/ Zeckhauser mentioned how Buffett capitalized on UU situations multiple times in his career.

One such instance happened in 1996.

California Earthquake Authority (CEA) was looking to buy $1B of reinsurance which would take effect after $5B in aggregate insured losses.

One such instance happened in 1996.

California Earthquake Authority (CEA) was looking to buy $1B of reinsurance which would take effect after $5B in aggregate insured losses.

5/ CEA was willing to pay 5x estimated actuarial value for the reinsurance, but could not find a single interested insurer in an insurance conference.

Buffett flew there couple days later, and decided to take the whole thing.

He had a pretty simple logic to do that.

Buffett flew there couple days later, and decided to take the whole thing.

He had a pretty simple logic to do that.

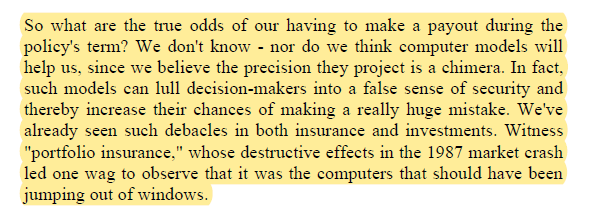

6/ Even if you hire all the PhDs of the world, you would still not be able to come up with a reasonable estimate of pricing an earthquake.

Unlike many insurance products, there is no asymmetry of information.

Here's Buffett in 1996 annual report explaining this decision.

Unlike many insurance products, there is no asymmetry of information.

Here's Buffett in 1996 annual report explaining this decision.

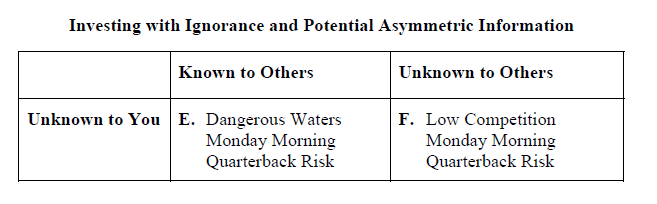

7/ There is one predominant risk that hinders even capable investors from doing well in UU situations.

Monday Morning Quarterback (MMQ) risk.

Just imagine how foolish you may appear to others for underwriting $1B reinsurance if there is indeed a catastrophic earthquake.

Monday Morning Quarterback (MMQ) risk.

Just imagine how foolish you may appear to others for underwriting $1B reinsurance if there is indeed a catastrophic earthquake.

8/ Even worse, if you somehow underestimate others' knowledge (asymmetry of info) of a situation, you may look justifiably foolish.

Whether it's known or unknown to others beforehand, career-ending MMQ risk exists in UU situations.

Whether it's known or unknown to others beforehand, career-ending MMQ risk exists in UU situations.

9/ Buffett did similar things again in 2006 hurricane season.

As competitors became increasingly reluctant, he charged as high as 20x compared to rates charged just a year ago.

As competitors became increasingly reluctant, he charged as high as 20x compared to rates charged just a year ago.

End/ "If in an unknowable world none of your investment looks foolish after the fact, you are staying too far away from the unknowable."

If right, UU situations can lead to spectacular LT returns, but it does come with MMQ risk.

Link to full paper: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2205821

If right, UU situations can lead to spectacular LT returns, but it does come with MMQ risk.

Link to full paper: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2205821

Read on Twitter

Read on Twitter