If you believe the recommendations of Hong Kong's equity analyts, state-owned enterprise stonks only go up:

https://www.bloomberg.com/opinion/articles/2020-07-03/hong-kong-national-security-law-won-t-change-much-for-brokers?utm_campaign=socialflow-organic&utm_content=view&utm_source=twitter&utm_medium=social&cmpid%3D=socialflow-twitter-view&sref=5JzLFdzD

https://www.bloomberg.com/opinion/articles/2020-07-03/hong-kong-national-security-law-won-t-change-much-for-brokers?utm_campaign=socialflow-organic&utm_content=view&utm_source=twitter&utm_medium=social&cmpid%3D=socialflow-twitter-view&sref=5JzLFdzD

There's a lot of things to worry about in Hong Kong's national security law, from life sentences for advocating "secession" to putting every person on the planet under China's jurisdiction: https://qz.com/1875863/hong-kong-national-security-law-covers-everyone-on-earth/

One thing I'm less concerned about is the worry among the investment community that the law's restrictions on free speech will damage the fearless independence of their research output, something raised in this (excellent) recent FT story: https://www.ft.com/content/9e7d7279-4a23-4795-a6c5-89aaef460af7

That's because as far as I can see, equity research is already tainted by the need to stay on the right side of mainland politics.

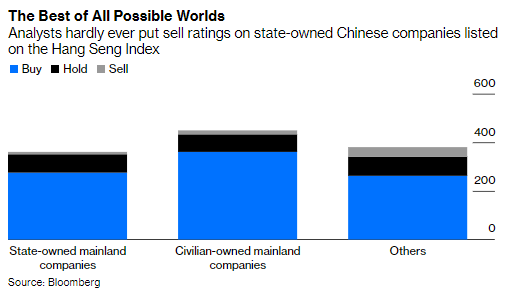

You can look at this by dividing the Hang Seng index into baskets of state-owned mainland, civilian-owned mainland, and other stocks.

You can look at this by dividing the Hang Seng index into baskets of state-owned mainland, civilian-owned mainland, and other stocks.

Hong Kong analysts hardly ever put "sell" ratings on SOEs, although objectively you'd think that companies run for political rather than commercial considerations would generally be bad investments.

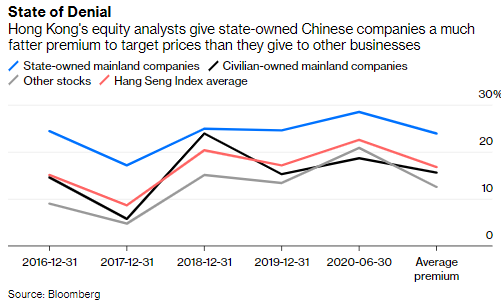

Indeed, the premium that analysts give to SOE target prices above the prices in the market is the highest of any of these groups: 24%, vs 16% for private mainland companies and 13% for the rest.

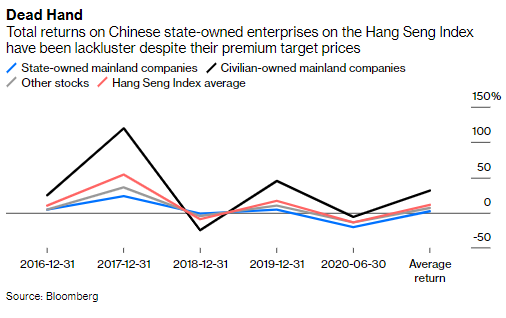

Maybe this price premium is justified by SOEs' better investment returns? Well, no.

Private mainland companies do perform well, as you'd expect from a group focused on an emerging market and the tech sector:

Private mainland companies do perform well, as you'd expect from a group focused on an emerging market and the tech sector:

But total returns on SOEs averaged just 1.9% over the past four and a half years, vs. 31% for private mainland companies and 6.1% for the rest.

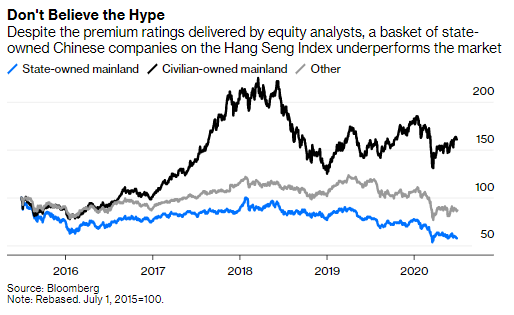

A basket of SOE stocks badly underperforms the rest of the market but, curiously, equity analysts paid for their impartial research give it the highest premium on target prices.

It seems to me that the easiest explanation of this is that equity research departments (possibly even subconsciously) don't want to offend powerful state-connected businesses and adjust their views accordingly.

As I say, there's lots to worry about in the national security law. But undermining the integrity of Hong Kong's equity research? Sell-side brokers already gave that away a long time ago. (ends)

(can't believe I painstakingly constructed a traditional Chinese translation of "stonks" and then misspelt "analysts")

Read on Twitter

Read on Twitter