There is both good and bad news in today's trade data for Trump's trade deal with China ...

The good news first --

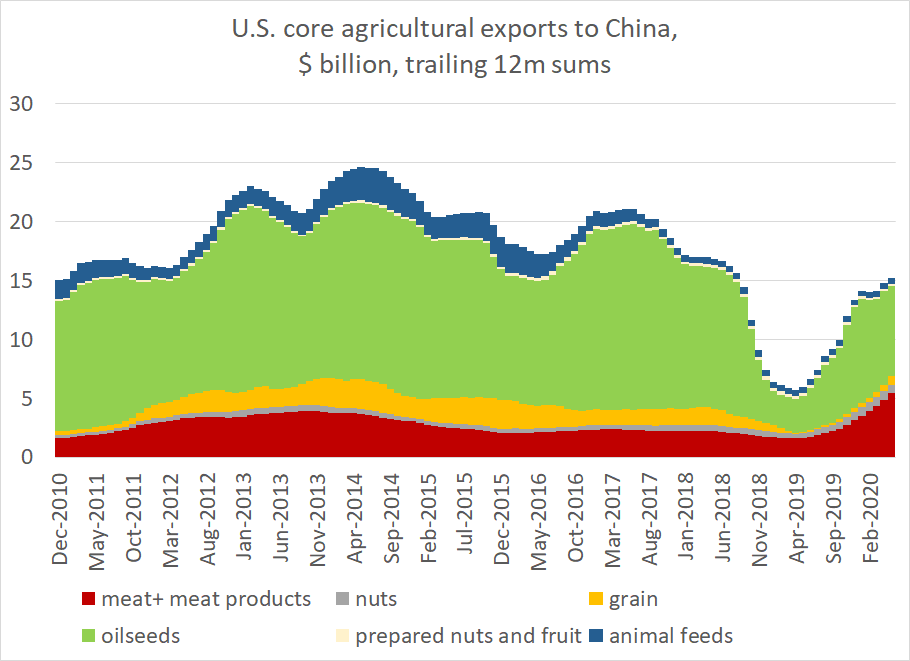

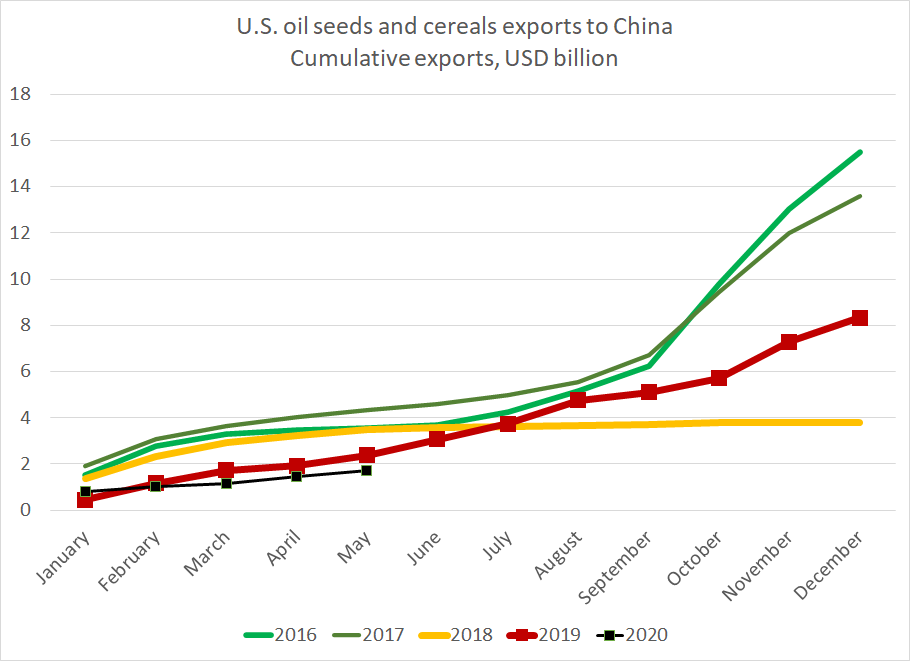

1) Ag exports to China are still on a modest uptrend, and should top last year's levels (tho they are likely to fall well short of the targeted increase)

The good news first --

1) Ag exports to China are still on a modest uptrend, and should top last year's levels (tho they are likely to fall well short of the targeted increase)

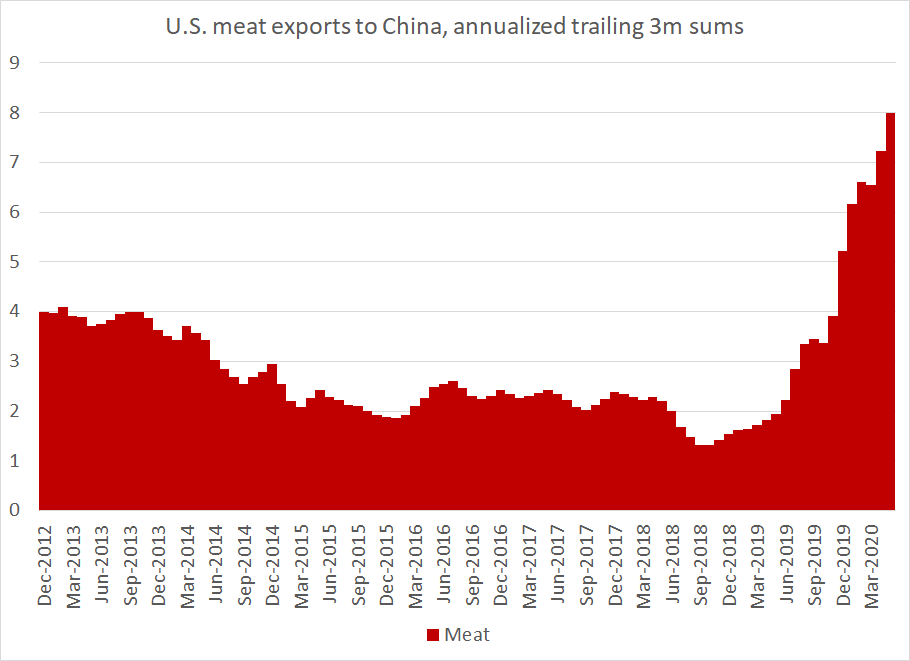

2) Meat exports to China are running at about a $8b annual pace -- 4 times their 2017 level.

Now a lot of this would likely have happened even without the trade deal, as China needs imported pork ...

Now a lot of this would likely have happened even without the trade deal, as China needs imported pork ...

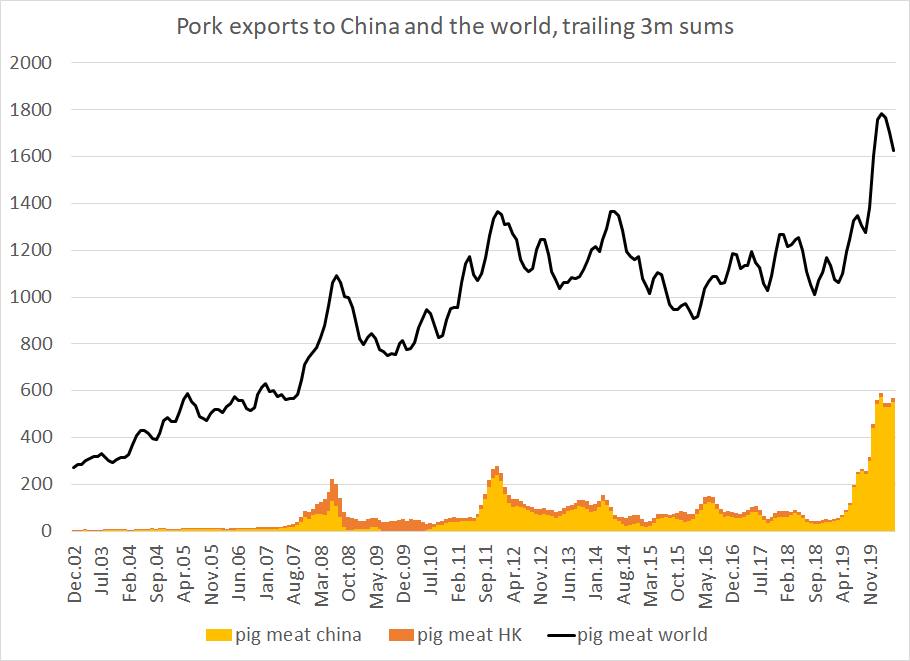

3) Pork exports to China jumped ahead of the trade deal (African swine fever) but remain at record levels.

Not sure pork consumers will appreciate this as much as pork producers tho, given the difficulties in the meat packing sector.

Not sure pork consumers will appreciate this as much as pork producers tho, given the difficulties in the meat packing sector.

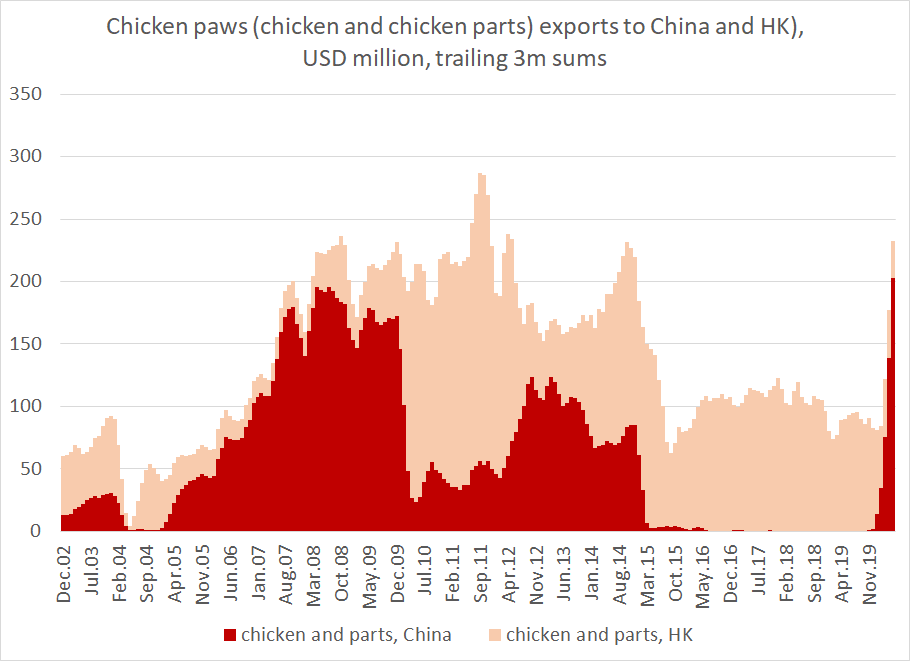

4) China has resumed importing chicken parts (feet typically) in a big way -- in effect returning to the natural pattern of trade (the fall off in exports here was a function of Chinese trade retaliation and US bird flu)

5) And China clearly did the Trump Administration a favor in May by having its state oil importers buy a lot more US oil and gas.

(of course, China can take this bid away anytime too)

(of course, China can take this bid away anytime too)

Now the bad news ...

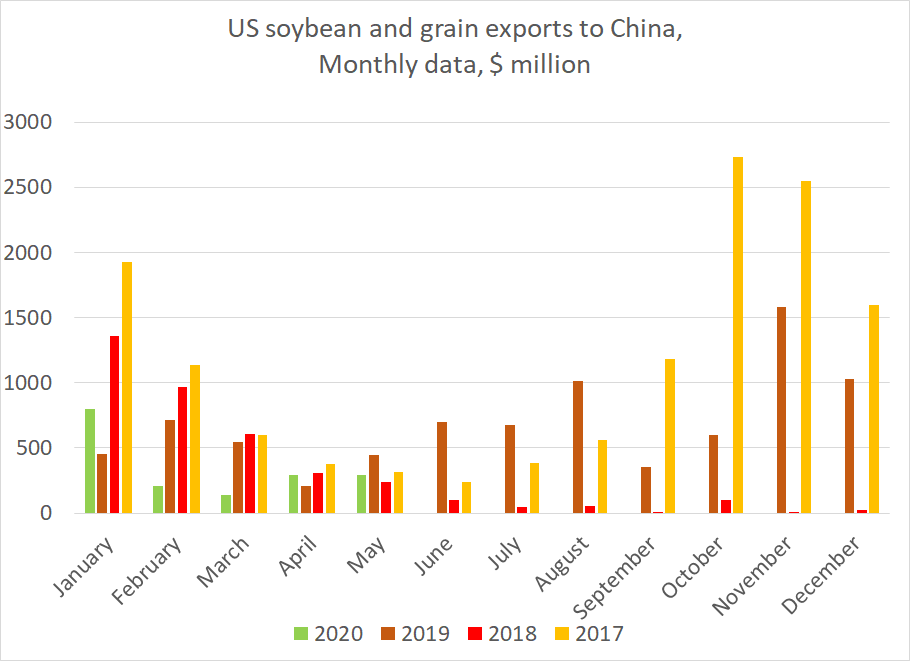

6) Soybean/ grain exports to China remain weak. 2020 exports (YTD) are under $2b. They should be ~ $4b in a normal year. And this was supposed to be a better than normal year.

6) Soybean/ grain exports to China remain weak. 2020 exports (YTD) are under $2b. They should be ~ $4b in a normal year. And this was supposed to be a better than normal year.

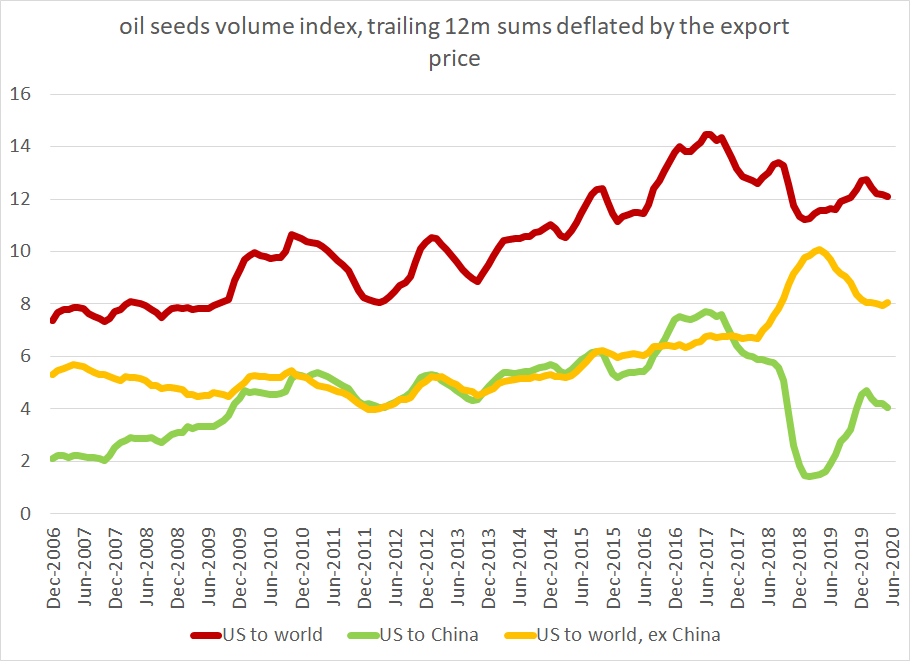

Now this may not in practice matter as much for the US economy as many think -- overall export volumes of soy and grains to the world are, best I can tell ok, as export volumes to the rest of the world remain higher than before the trade

But 7) there is no way to spend the soy/ grains side as a massive success. Exports in April and May were normal (and May is normally the low season) while February and March were objectively weak.

Of course, the real game comes after the harvest not before

Of course, the real game comes after the harvest not before

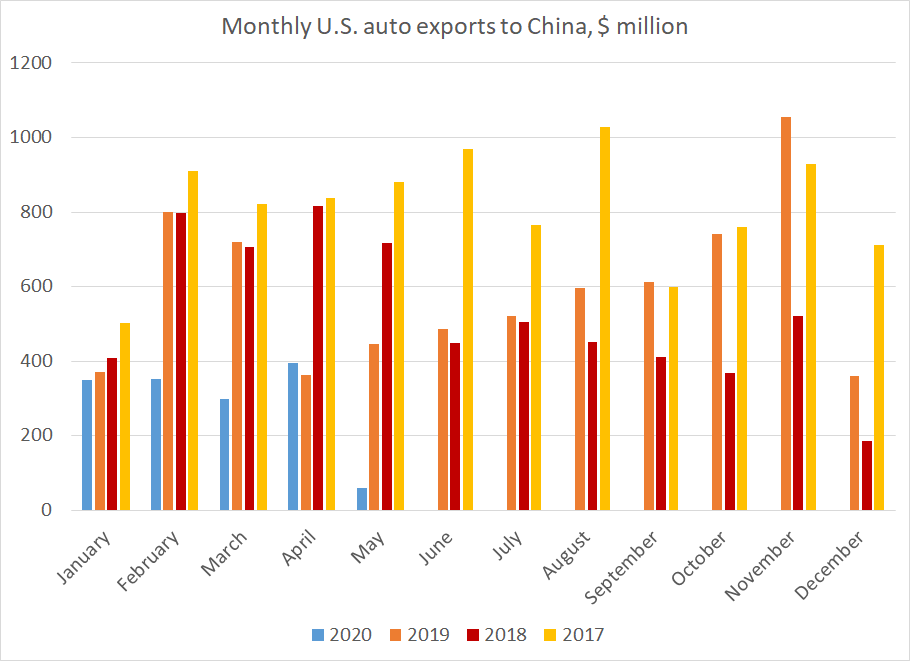

and 8) a new problem has opened up -- autos.

Don't know if the weak May number just reflects a reduction in US production (especially of BMW and Mercedes SUVs) tied to the shutdown, or if Tesla's new Shanghai plant is reducing its exports from California

Don't know if the weak May number just reflects a reduction in US production (especially of BMW and Mercedes SUVs) tied to the shutdown, or if Tesla's new Shanghai plant is reducing its exports from California

The possibility that production in China by Tesla (not a JV, no formal tech transfer requirement ... so in some sense a success for US firms) could cannibalize US exports of cars to China highlights a basic tension in Trump's deal.

Making China safe for foreign investment could easily reduce rather than increase US exports to China --

think of what would happen if BMW made all of its SUVs for the Chinese market in a whole owned Chinese sub, rather than making most of the big SUVs in S. Carolina ...

think of what would happen if BMW made all of its SUVs for the Chinese market in a whole owned Chinese sub, rather than making most of the big SUVs in S. Carolina ...

Or if GE could make aircraft engines in China for sale to the Chinese market (a state controlled market by the way) without any risk of tech transfer and full IP security ....

9) Aircraft of course should be another problem area, but the deal (conveniently) counts orders toward the target -- so actual exports there aren't so relevant (obviously they are way down)

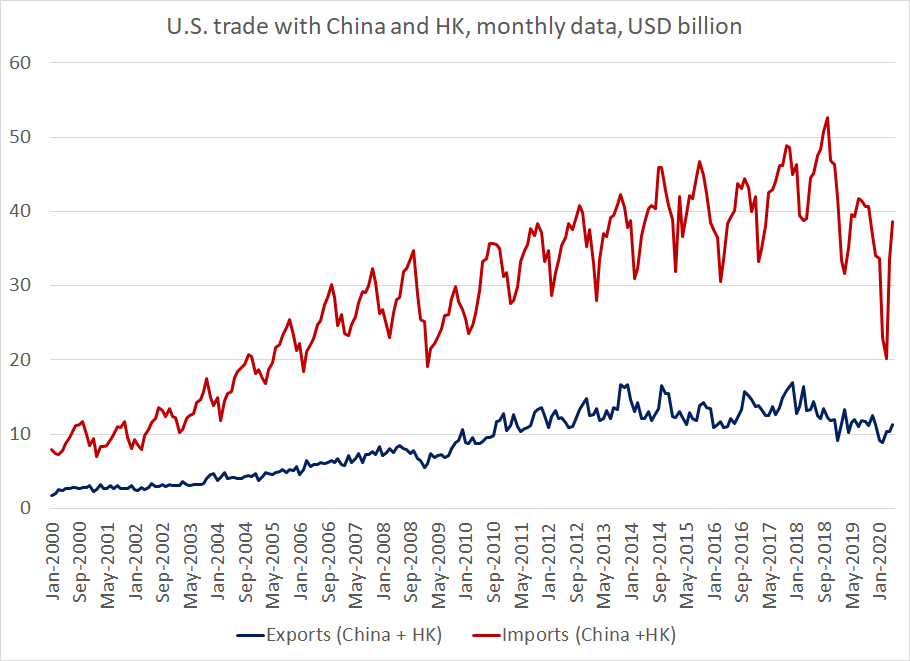

Sum it all up, and 10) exports to China are running roughly at their 2019 pace in April and May (thanks in part to big energy exports in May). Matching or exceeding 2019 (a low) is possible -- but big gains seem unlikely

Sum it all up and you can objectively argue that trade with China has held up better than trade with the rest of the world amid the pandemic (in part US exports to China tilt toward commodities). But the big earth shaking change the Administration promised haven't materialized

Read on Twitter

Read on Twitter