I don’t get it - thread….

1. Been in the finance industry for most of the past two decades and what I am seeing I cannot wrap my head around – some thoughts and charts in this thread

1. Been in the finance industry for most of the past two decades and what I am seeing I cannot wrap my head around – some thoughts and charts in this thread

2. - Reading daily posts on daily P&L gains on individual brokerage accounts. Also reading posts on how to screen for momentum winners –portraying it as a “safe” way to make money. This scares the shit out of me being schooled in value investing. But maybe I just don’t get it

3. Can’t help it but not to post something on Tesla. Loosing share in Europe, have not grown since Q3 2018. Lawsuit and fraud fears seems not to deter robin hood traders. Market cap at USD 220bn. EV/S a whopping (close to) 7x with most automakers well below 0.5x. – Don't get it

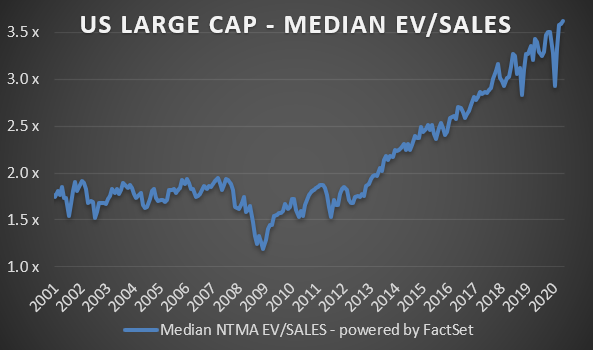

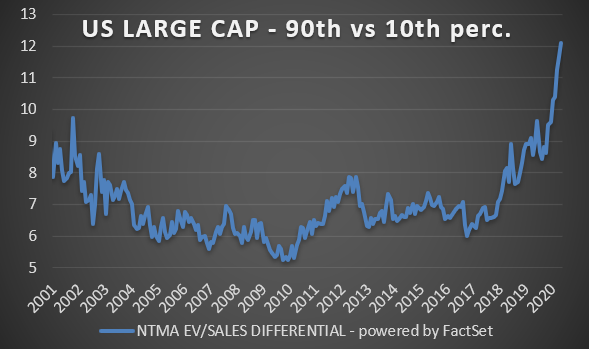

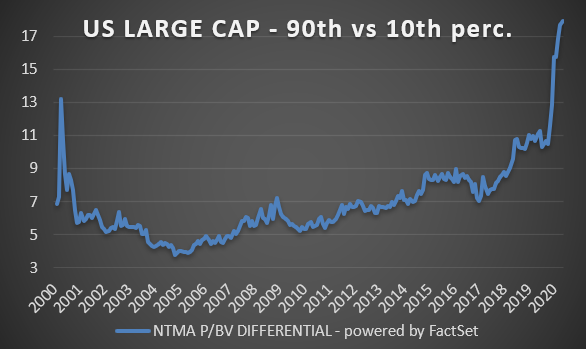

4. Valuation levels just continue to get more and more bonkers. New EV/S high, while the pandemic is not getting any better. Valuation diff's are getting even more crazy. While I remain convinced that being valuation focused should reap ample rewards it may be that I don’t get it

5.Central bankers are bailing out risk takers as inequality gets pushed even further apart. It amazes me that the moral hazard in all this craziness has not reached the policy makers. Should investors who took excessive risk not be punished. I clearly just don’t get it…

Read on Twitter

Read on Twitter