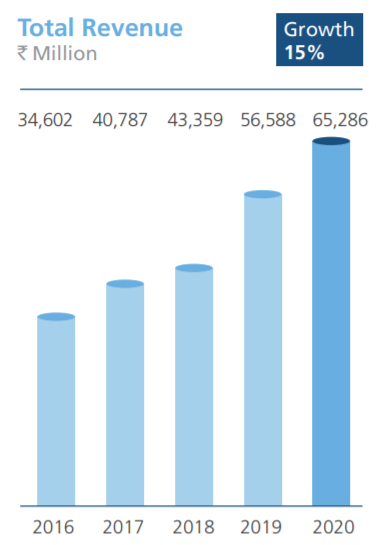

Biocon:

A thread about Business model & Unprecedented growth opportunity in Biologics (1/10)

@unseenvalue https://twitter.com/unseenvalue/status/1261704534637805573

A thread about Business model & Unprecedented growth opportunity in Biologics (1/10)

@unseenvalue https://twitter.com/unseenvalue/status/1261704534637805573

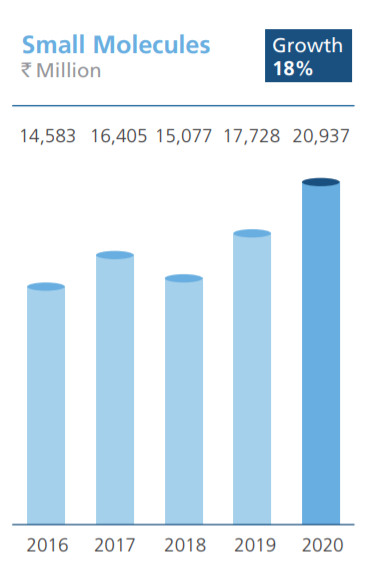

Small molecules:

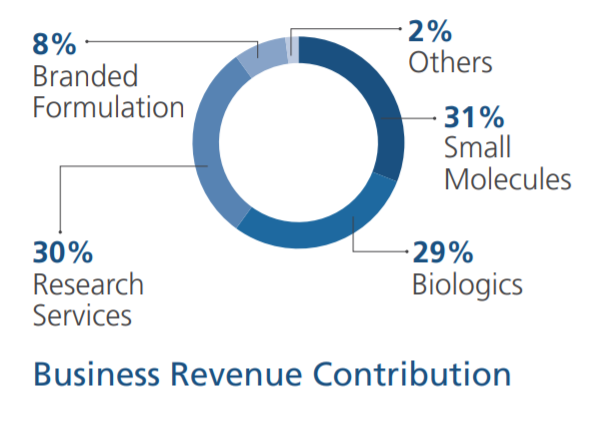

FY 20 revenue Rs.2,094 crores (33% contribution), 18% up YOY

Among world’s largest manufacturers of statins & immunosuppressant APIs. Rs 1500 cr capex announced mainly for the Vizag Immunosuppressant Greenfield plant, full impact after 4 years (2/10)

FY 20 revenue Rs.2,094 crores (33% contribution), 18% up YOY

Among world’s largest manufacturers of statins & immunosuppressant APIs. Rs 1500 cr capex announced mainly for the Vizag Immunosuppressant Greenfield plant, full impact after 4 years (2/10)

Focus in Generic Formulations segments are Metabolics, Oncology, Immunology & Auto-immune indications

Growth in small molecules will be high single-digit to low teens for the next one or two years. (3/10)

Growth in small molecules will be high single-digit to low teens for the next one or two years. (3/10)

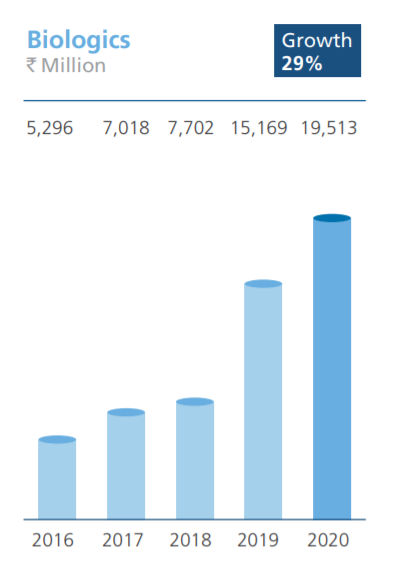

Biosimilars:

FY 20 revenue Rs.1951 crores (31% revenue contribution); 29% up YOY

Confident to reach target of US$1 billion by fiscal year 2022 with ROCE improving to 20%+ from current 10%.

Pegfilgrastim, Trastuzumab & upcoming Glargine will be the main driver of $1B sales (4/10)

FY 20 revenue Rs.1951 crores (31% revenue contribution); 29% up YOY

Confident to reach target of US$1 billion by fiscal year 2022 with ROCE improving to 20%+ from current 10%.

Pegfilgrastim, Trastuzumab & upcoming Glargine will be the main driver of $1B sales (4/10)

Biocon Biologics has Global Product Portfolio pipeline of 28 molecules.

With MYLAN, 11 biosimilars being co developed for global markets (5/10)

With MYLAN, 11 biosimilars being co developed for global markets (5/10)

With SANDOZ, set of next-gen immunology, oncology biosimilars being co-developed for global markets (6/10)

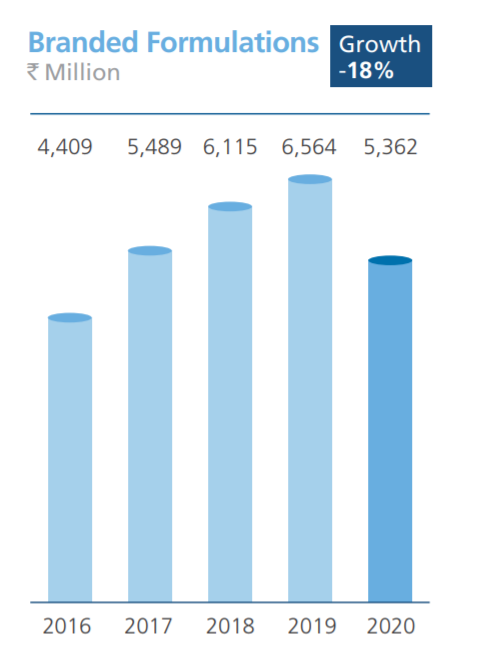

Branded Formulations:

In FY 20 revenue Rs.536 crores (8% revenue contribution); down 18%

UAE JV generic operation NeoBiocon will be discounted as loss making (29 cr) & JV partner is charged with governance issue. (7/10)

In FY 20 revenue Rs.536 crores (8% revenue contribution); down 18%

UAE JV generic operation NeoBiocon will be discounted as loss making (29 cr) & JV partner is charged with governance issue. (7/10)

In UAE two biosimilars Glargine and Trastuzumab will continue. Rest of the business (Indian fomulation 70% biologics, 30% small molecules) will be reported under Biologics from now on (8/10)

Novel Molecules:

No revenue, still in R&D stage.

Focused on Diabetes, Inflammation & Immuno-oncology.

Study going on for Insulin Tregopil for Diabetes, Itolizumab & BVX-20 for

Inflammation, EGFR mAb + TGFβrII for Immunology (9/10)

No revenue, still in R&D stage.

Focused on Diabetes, Inflammation & Immuno-oncology.

Study going on for Insulin Tregopil for Diabetes, Itolizumab & BVX-20 for

Inflammation, EGFR mAb + TGFβrII for Immunology (9/10)

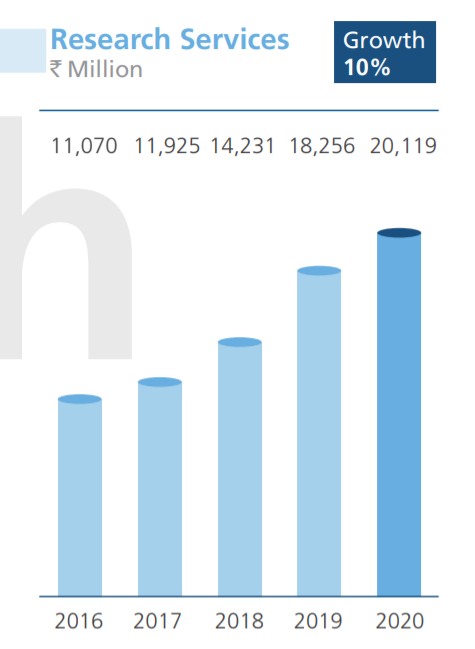

Research division Syngene is 70% subsidiary

Revenue at Rs 2012 crores (30% contribution), up 10%

CDMO is early days of Indian IT industry

An old tweet regarding Syngene (10/10)

https://twitter.com/SwarnashishC/status/1260733087220035589?s=20

Revenue at Rs 2012 crores (30% contribution), up 10%

CDMO is early days of Indian IT industry

An old tweet regarding Syngene (10/10)

https://twitter.com/SwarnashishC/status/1260733087220035589?s=20

Read on Twitter

Read on Twitter