The consequences of "output gap nonsense" in applying the fiscal rules will endanger Germany’s recovery from the Corona crisis. @AchimTruger and I provide an analysis of the underlying problems: Thread /1

https://wiiw.ac.at/how-output-gap-nonsense-endangers-germany-s-recovery-from-the-corona-crisis-n-450.html

https://wiiw.ac.at/how-output-gap-nonsense-endangers-germany-s-recovery-from-the-corona-crisis-n-450.html

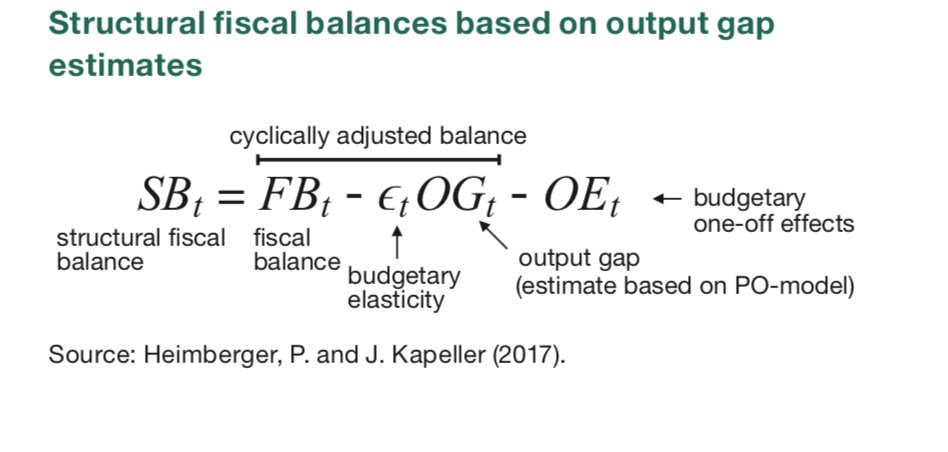

The output gap is the technical core of the EU’s fiscal rules and its estimation has an impact on the fiscal policy space of the respective EU Member State: https://www.intereconomics.eu/contents/year/2020/number/3/article/potential-output-eu-fiscal-surveillance-and-the-covid-19-shock.html /2

The "structural" deficit target is also part of the national legislation of many EU states in the context of so-called "debt brakes". In Germany, this has been the case since 2009 in the context of the constitutional debt brake /3

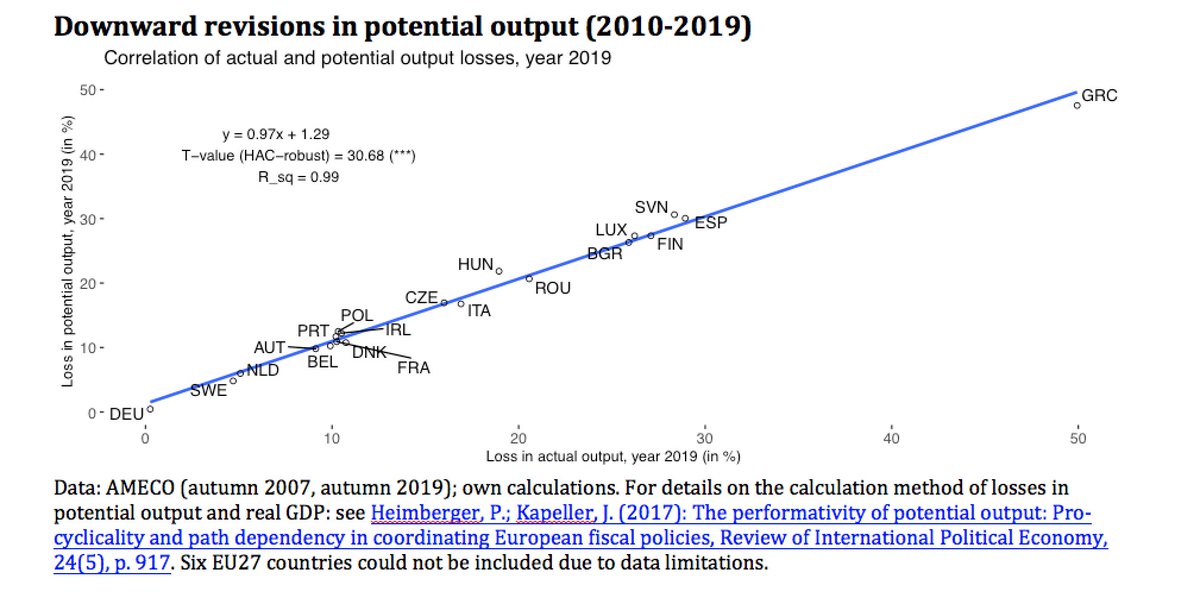

Over the course of the Euro Crisis, pessimistic estimates of the output gap promoted a pro-cyclical stance of fiscal policy with negative effects on economic growth and employment across the EU. /4

In the ten years preceding the start of the corona pandemic, the negative effects of the "output gap nonsense" were mainly felt by the more crisis-ridden EU countries; see in particular Italy: https://wiiw.ac.at/output-gap-nonsense-understanding-budget-conflict-ec-italy-government-n-386.html /5

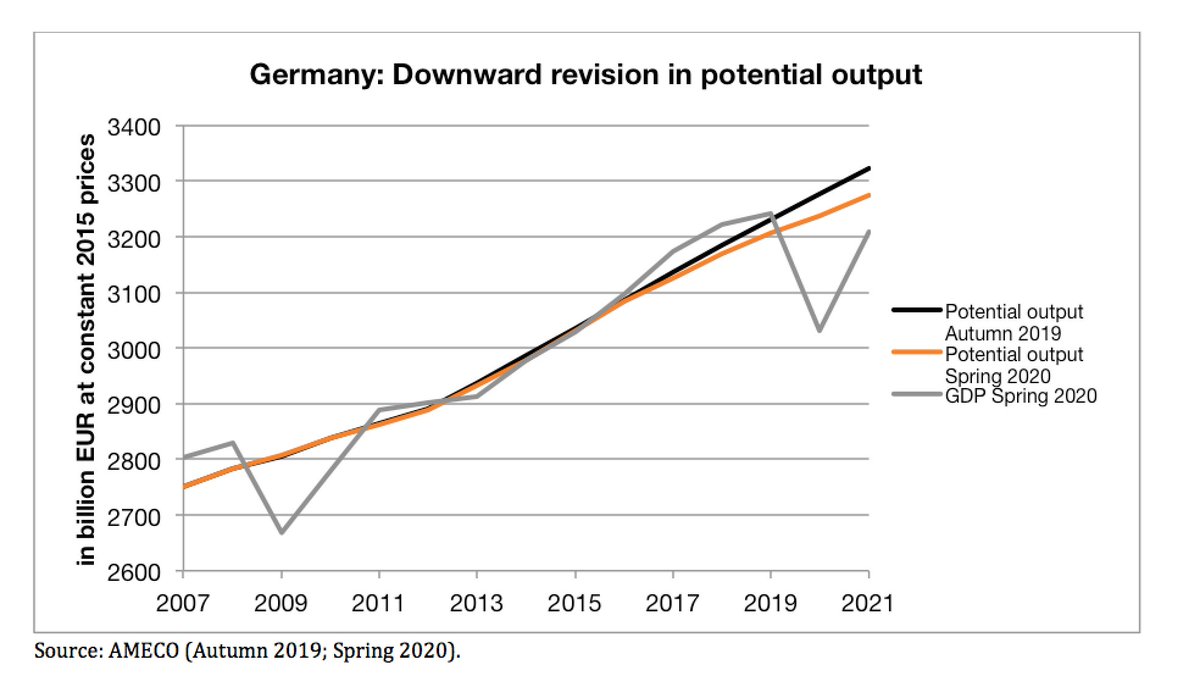

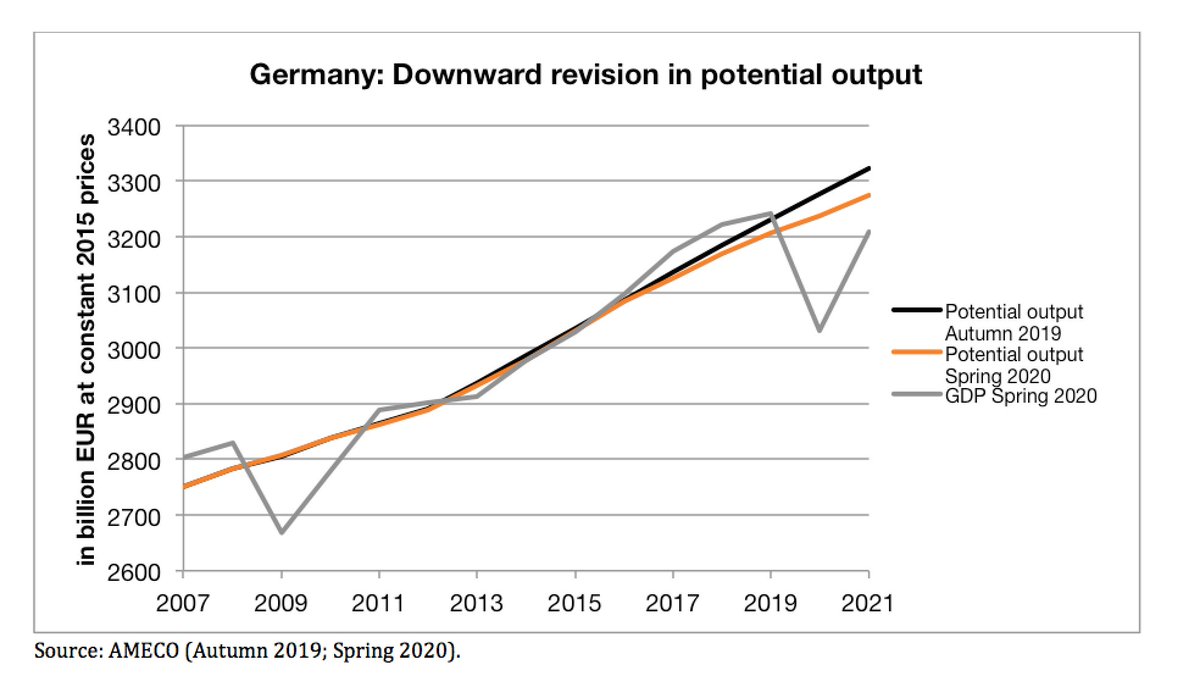

But with the economic slump in the context of the Corona crisis, Germany is now also affected by "output gap" nonsense. The current forecast of the EU Commission revises Germany's potential output in the context of the corona crisis downwards by almost 47.4 billion euros. /6

As a result, the Commission forecasts an output gap of only -2.0% of GDP for 2021 despite the economic slowdown. Without the downward revision, the EU Commission would have estimated the output gap at -3.4% (higher underutilisation). /7

In view of a smaller estimated output gap, the current Commission forecasts indicate that Germany will have a "structural" budget deficit of 0.5% of GDP in 2021; without downward revision it would be a "structural" surplus of 0.2% of GDP /8

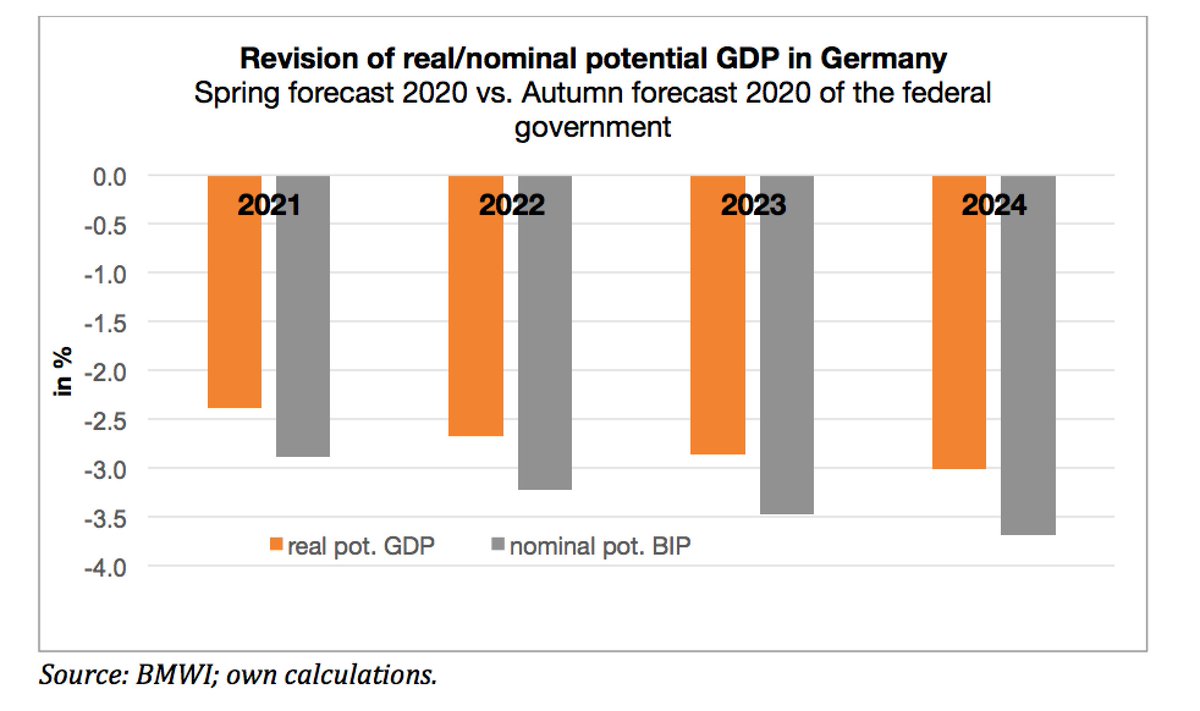

Even more serious are the problems caused by "output gap nonsense" under the German debt brake. The structural deficit is more of a binding requirement under the constitutional debt brake than at the EU level /9

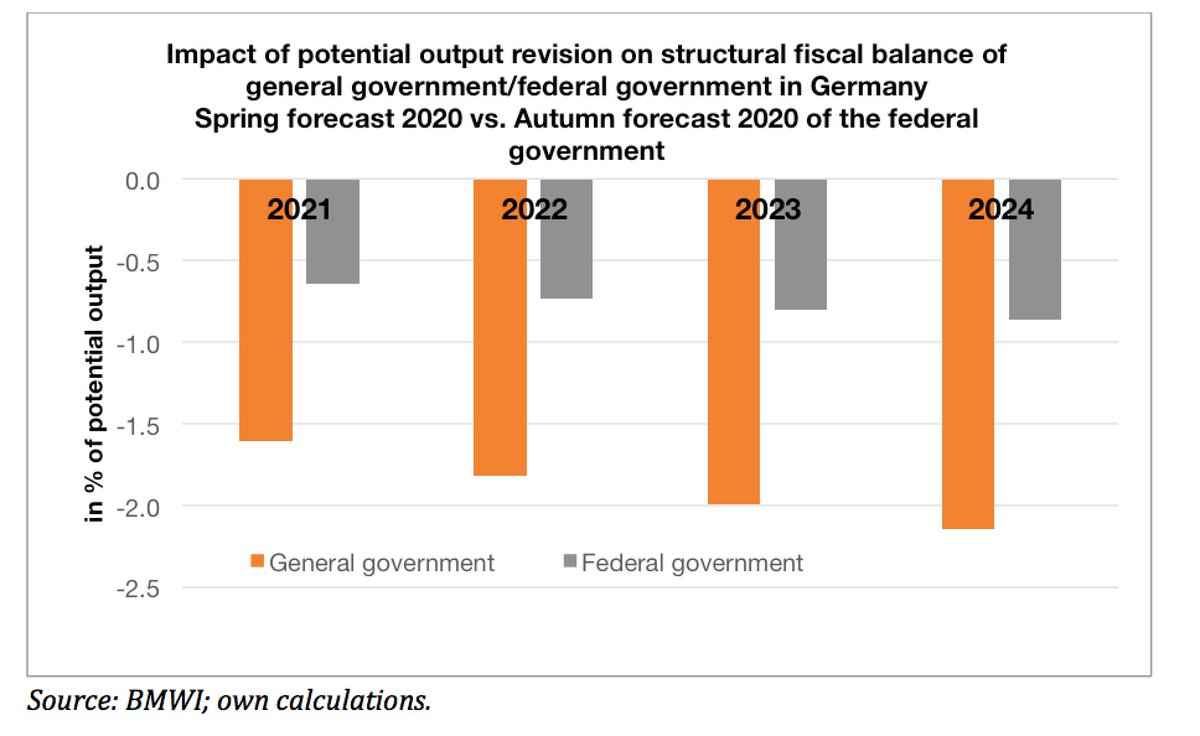

Potential output for 2021 was revised downwards by the federal government from autumn 2019 to spring 2020 by 2.4% in real terms and 2.9% in nominal terms. Over 2022-2024, which are relevant for the planning of the federal and state budgets, the deviation will increase /10

Due to the potential output revision, the structural general government balance deteriorates by 1.6 percentage points in 2021, and by 2.1 percentage points in 2024. /11

If these structural budget balances are used in the budget planning of the federal government and the states concerned, fiscal policy could turn more restrictive than appropriate as early as 2021. /12

Should the economic situation in Germany deteriorate further, additional downward revisions in potential output can be expected beyond 2021, which will successively further restrict the available fiscal space /13

When the fiscal rules are reactivated, downward revisions in potential output should remain suspended. A pragmatic solution would be to use the estimates from autumn 2019 (before the outbreak of the Corona pandemic). /14

In the long term, it would be important for the German government to push for reforming the European Commission's pro-cyclical cyclical adjustment method, which is the basis for calculating "structural" deficits. /end

Read on Twitter

Read on Twitter