(1/n)

We should stop calling this "investing."

It's gambling. https://twitter.com/RobinWigg/status/1278601486273064960

We should stop calling this "investing."

It's gambling. https://twitter.com/RobinWigg/status/1278601486273064960

I personally don't gamble, because I don't find losing money to be fun. But millions of people apparently do.

The brokerage industry has encouraged this behavior for decades, telling people they could make a fortune day-trading in their pajamas and end up owning a tropical island: https://vimeo.com/152171610

Robinhood is the worst and most tragic, but only the latest, manifestation of that.

Robinhood is the worst and most tragic, but only the latest, manifestation of that.

I still remember reading, in 1999 or 2000, a magazine interview with a Fidelity fund manager who talked about how long-term-oriented he was. Then I turned the page and there was an ad from Fidelity's brokerage boasting of how fast you could trade: "EVERY SECOND COUNTS."

eTrade showed a photo of a chimp in a T-shirt who could outperform your broker.

The Ameritrade mom came in from her jog in her sweatpants, clicked her mouse and exclaimed "I think I just made $25,000!"

The Ameritrade mom came in from her jog in her sweatpants, clicked her mouse and exclaimed "I think I just made $25,000!"

The Stock Market Game, funded by the brokerage industry and foisted on thousands of schools for decades, trains impressionable young minds to trade like wildfire.

The way other brokerage firms are clutching their pearls over Robinhood is ridiculous..

The way other brokerage firms are clutching their pearls over Robinhood is ridiculous..

A few additional thoughts from the archive: https://jasonzweig.com/whats-speculating-whats-investing-some-of-the-wisest-investors-weigh-in/

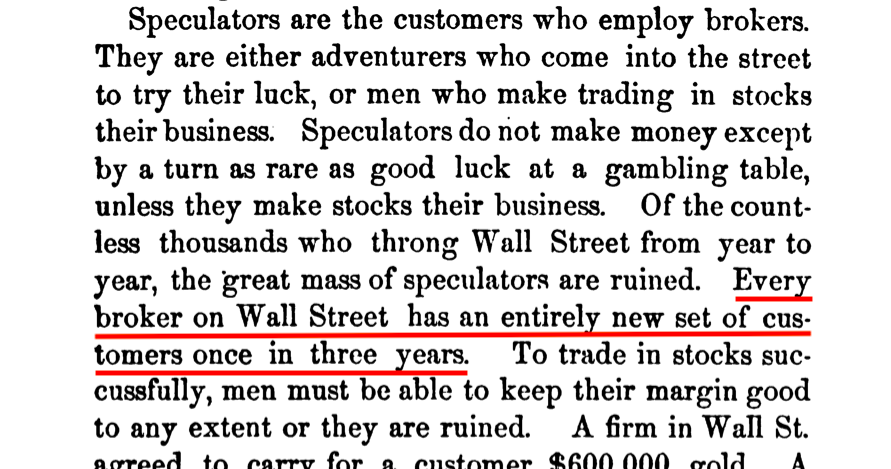

From Matthew Hale Smith's "Bulls and Bears of New York," published 146 years ago

https://books.google.com/books?id=9B-srfQubn0C

https://books.google.com/books?id=9B-srfQubn0C

Read on Twitter

Read on Twitter