Why we love the idea of #BharatBond

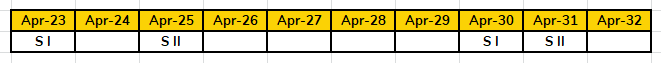

1.Fixed Maturity – Hence are like Target Date Funds. It fills the gap of long dated Target Date Funds – Helps to plan a regular annual income stream

1.Fixed Maturity – Hence are like Target Date Funds. It fills the gap of long dated Target Date Funds – Helps to plan a regular annual income stream

2.Over a period we are likely to have the gaps in dates filled. May be could even have one maturing every 6 months. Smart investors can use it to construct their retirement plans!

3.Largely Interest rate immunized portfolios – When requirement date and maturity date are matched, the investor need not worry about MTM swings. You know what you are likely to get at maturity (intermediate cash flows may make more or less depending on their reinvestment rates)

4.Quality portfolio – AAA (all GoI owned entities). We @wealthyantra have always considered PSU & Banking debt funds as our core post retirement investment option or the typical FD replacement.

5.What are the risks – The most important risk is that of a downgrade of an entity that would force a sell. Given the lack of liquidity in our debt markets (as we saw in March 2020) it can lead to spreads widen!

6.Downgrade and a forced sell down may also mean those MTM losses are permanent.

7. If the Issues falling into BharatBond indices can by sovereign guaranteed, this issue will not arise!

8.Bottomline – It’s a great investment option that should be a part of everyone looking to retire soon or those that have retired should consider using as an annuity.

Thank you @EdelweissAMC @iRadhikaGupta @FinMinIndia

End!

Thank you @EdelweissAMC @iRadhikaGupta @FinMinIndia

End!

Read on Twitter

Read on Twitter