1/ Nice to see our letters being followed by InsiderMonkey. $PDD is certainly one of our best idea recently. To be clear, we started the position in 18 Q3 at cost of $19 when it was seen as a piece of sh*t selling only counterfeits. what did I see then? http://www.insidermonkey.com/blog/is-pinduoduo-pdd-a-good-value-investor-stock-now-853408/

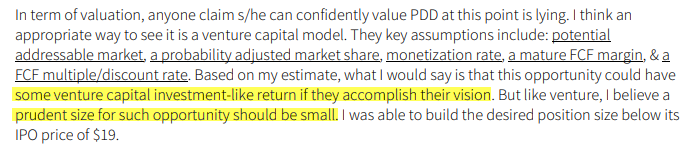

2/ Original thesis was laied out in detail in our 18 Q3 letter, p3. to p5. https://taovalue.files.wordpress.com/2018/10/taovalue_2018_q3_final.pdf

3/ Remind that the public perception then for $PDD was abysmal during a counterfeits PR crisis, but here was what I saw, "the most impressive Chinese companies"

5/ Commander factor: I saw Colin Huang on his way to be "the best entrepreneur/businessman of his generation".

6/ System factor: nothing but impressive. locked up ALL employees' options for 3 years. great design of the punishment system (on the whole batch rather than only the individual complaints)

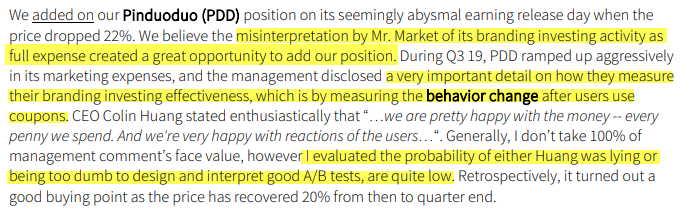

8/ In 19 Q4, decided to add the position and here is why. https://taovalue.files.wordpress.com/2020/03/taovalue_2019_q4_final.pdf

9 & end/ Looking back, I understudied its psychology based moat, here is a good study on this by YC. If I were to get this one better, could have built a bigger position earlier. https://blog.ycombinator.com/pinduoduo-and-the-rise-of-social-e-commerce/

Read on Twitter

Read on Twitter