Should be no secret to people in finance, but probably is to the rest of the country.

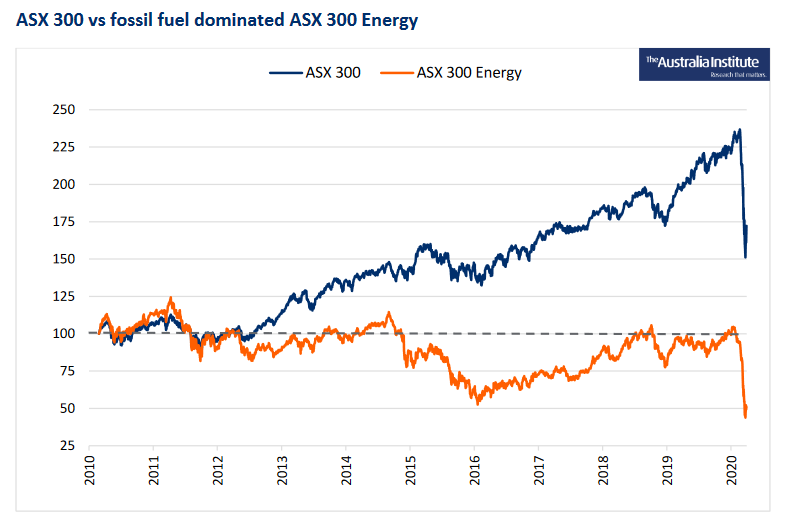

Fossil fuels were the /worst/ performing share market sector over the last decade.

Fossil fuels were the /worst/ performing share market sector over the last decade.

If you invested in fossil fuels, you probably lost a lot of money.

New report: https://www.tai.org.au/sites/default/files/P855%20Fossil%20Fuel%20Shares%20Report%20%5BWEB%5D.pdf

Fossil fuels were the /worst/ performing share market sector over the last decade.

Fossil fuels were the /worst/ performing share market sector over the last decade.

If you invested in fossil fuels, you probably lost a lot of money.

New report: https://www.tai.org.au/sites/default/files/P855%20Fossil%20Fuel%20Shares%20Report%20%5BWEB%5D.pdf

Fossil fuels performed worse than all other sectors both pre and post crash. Even before the COVID crash, investments in the ASX 300 Energy index would have sent you backwards over the decade, not even including inflation.

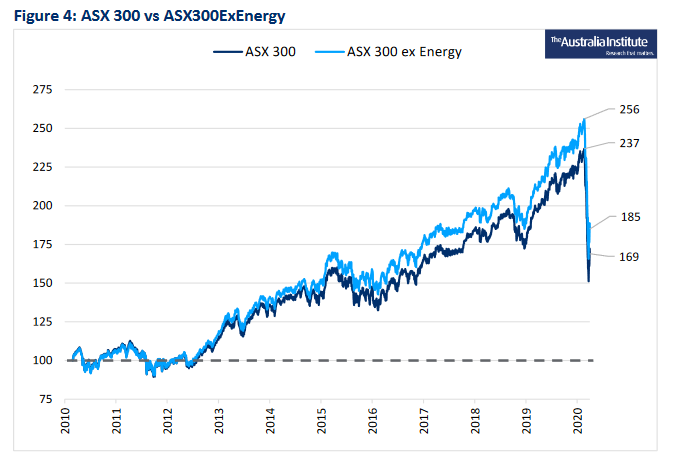

If you simply took the Energy sector out of the ASX 300, you would have got significantly higher returns over the decade.

... ~9% higher over the decade, just by leaving out coal, oil and gas companies from the broad market index.

The pap

The pap

(To show this the paper constructs an ASX 300 'ex Energy' index, based on publicly available data fro the ASX 300 and the Energy sector component.

Note this is 'total returns' - both share price gains/losses, and dividends.)

Note this is 'total returns' - both share price gains/losses, and dividends.)

Past =/= future performance. The systems of capital allocation within finance and fossil company boards that have destroyed so much shareholder value over the last decade could produce different results this decade.

or they could steer money away from multiple escalating and interlocking financial risks facing the ongoing fossil fuel expansion and in doing so help limit the enormous economic and financial damage coming at us in the coming decades.

As seen on The Business last night https://twitter.com/TheAusInstitute/status/1278499609724112896?s=19

Say you invested $100 in the ASX 300 over the decade.

By the end of the decade, you had lost ~$15-$20 because of fossil fuels.

That small part of your portfolio went backwards while everything else grew.

You would have been $15-20 better off with a fossil free portfolio.

By the end of the decade, you had lost ~$15-$20 because of fossil fuels.

That small part of your portfolio went backwards while everything else grew.

You would have been $15-20 better off with a fossil free portfolio.

So while super funds and other investors were telling everyone they could not divest from fossil fuels, they were at the same time losing vast amounts of money on this very sector.

Read on Twitter

Read on Twitter