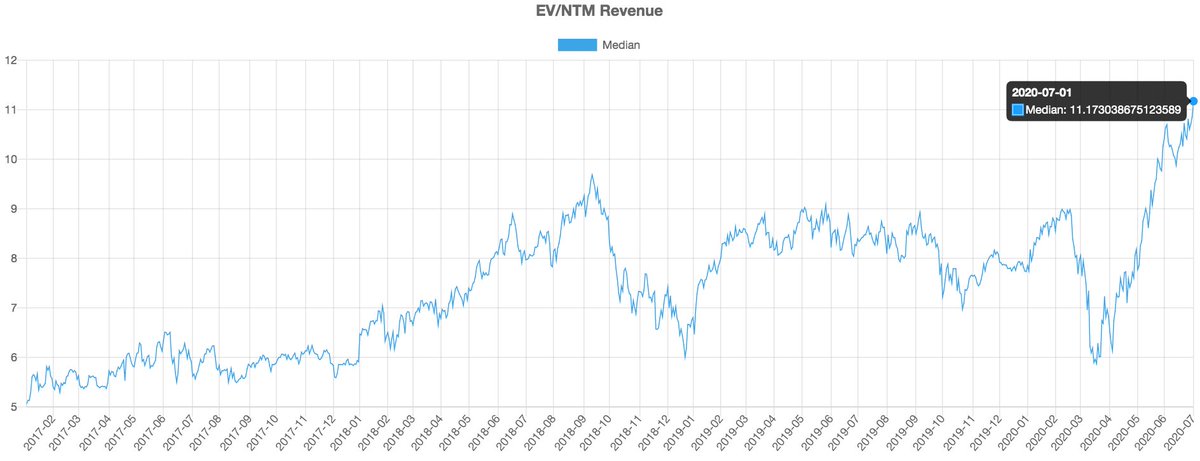

B2B SaaS Valuations continue to hit crazy all-time highs

graph from @public_comps

My thoughts on multiple expansion, the importance of S-curves, and the narrative surrounding enterprise SaaS stocks

graph from @public_comps

My thoughts on multiple expansion, the importance of S-curves, and the narrative surrounding enterprise SaaS stocks

1. Digital transformation accelerated secular trends (on-prem -> cloud & remote workforces) that have given investors increasing confidence in taking a long-term view on high growth SaaS

Multiples are expanding because investors are long duration.

Dependency on SaaS allows them to take a 2025/2030 view on the company because they know enterprise software businesses that deliver strong value propositions with high growth rates and low churn will still be around.

Dependency on SaaS allows them to take a 2025/2030 view on the company because they know enterprise software businesses that deliver strong value propositions with high growth rates and low churn will still be around.

2. Many SaaS companies are currently at their inflection point because of these secular trends, and this reduces risk because one of the biggest drivers of tech company failures is decelerating demand which is unlikely to happen in the middle of an inflection point on the S-curve

3. NTM/Revenue multiples are based on sell-side estimates. These multiples are misleading bc often times, these businesses sustain or accelerate growth contrary to sell-side estimates which are almost always decelerated.

4. Great management knows how to increase their TAM: software markets continue to be much larger than expected. Use cases for tech are increasingly adaptive and complications create opportunities.

The idea of two-factor authentication seemed foreign a decade ago but is fundamental now to security & cloud communications.

I’ll continue to long businesses with large TAMs, great management teams, and well-positioned on the S-curve.

I’ll continue to long businesses with large TAMs, great management teams, and well-positioned on the S-curve.

Read on Twitter

Read on Twitter