With recent DeFi token price run-ups, people have been crying "bubble!".

So is it too late to invest or not?

Here are my thoughts on where we are in the state of the DeFi market from an "inside perspective"

So is it too late to invest or not?

Here are my thoughts on where we are in the state of the DeFi market from an "inside perspective"

1/ DeFi has been around for years, but has only recently received serious recognition in the crypto community

But even with the buzz, the levels of understanding, usage, and capital allocation are all still low with high upside potential

But even with the buzz, the levels of understanding, usage, and capital allocation are all still low with high upside potential

2/ *Understanding*

This past month, the core crypto community learned at a high level what DeFi protocols do.

Some have decided to seriously dedicate time towards studying different protocols and learning how they work

This past month, the core crypto community learned at a high level what DeFi protocols do.

Some have decided to seriously dedicate time towards studying different protocols and learning how they work

3/ It really takes months of learning to be able to truly appreciate the potential of the technology

To understand the power of composability, permissionless structures, incentive design, etc.

I'd estimate only a few dozen people intimately understand each DeFi app currently

To understand the power of composability, permissionless structures, incentive design, etc.

I'd estimate only a few dozen people intimately understand each DeFi app currently

4/ *Usage*

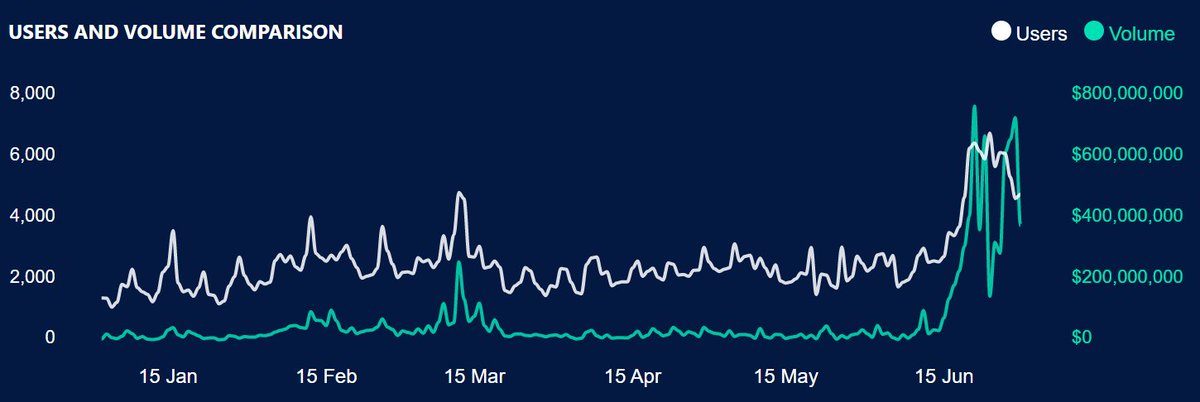

DeFi usage has traditionally been concentrated with hardcore users and/or ETH whales. This has tripled within the last 2 weeks, but still only puts us at 6,000 daily active users

Compare to CeFi which has 100x more

H/T @DappRadar

DeFi usage has traditionally been concentrated with hardcore users and/or ETH whales. This has tripled within the last 2 weeks, but still only puts us at 6,000 daily active users

Compare to CeFi which has 100x more

H/T @DappRadar

5/ DeFi probably won't become larger than CeFi on a DAU basis, but there's still a large gap to fill.

Many that are previously skeptical of DeFi become amazed when they actually use it. The stats tell us that many haven't gotten over that usage hurdle yet.

Many that are previously skeptical of DeFi become amazed when they actually use it. The stats tell us that many haven't gotten over that usage hurdle yet.

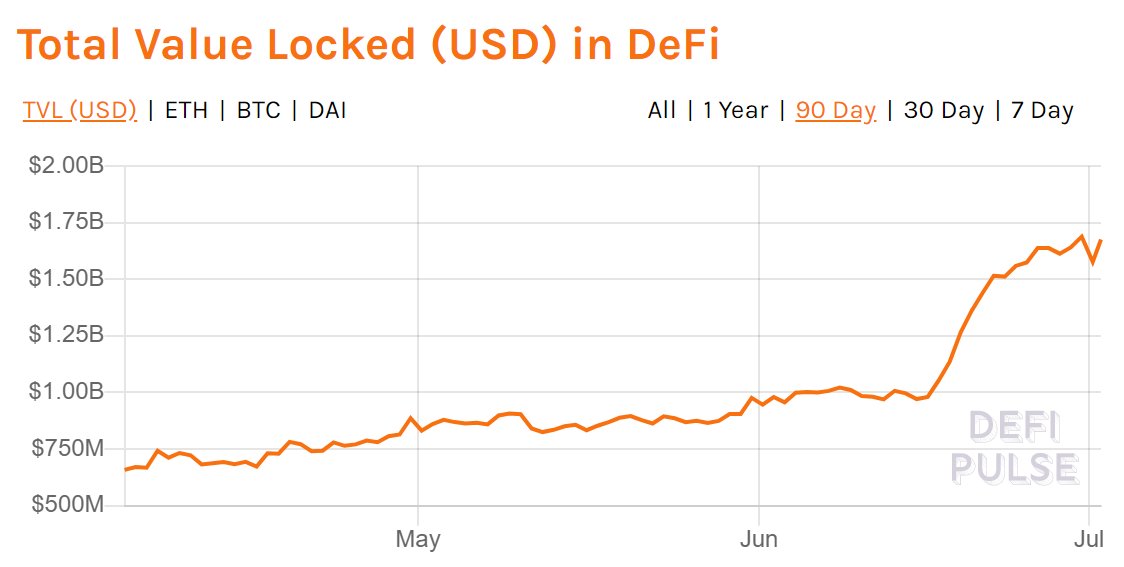

6/ The top 3 crypto assets (BTC, ETH, USDT) have an aggregate value of $200B+.

Value locked in DeFi is <1% of that, but growing fast.

Coinbase itself custodies $20B+ of assets

Value locked in DeFi is <1% of that, but growing fast.

Coinbase itself custodies $20B+ of assets

7/ *Capital Allocation*

Crypto investor groups can be segmented simply to crypto funds, crypto individuals, and greater retail.

Until recently, the vast majority of crypto funds & crypto individuals either discounted DeFi investments and/or did not know how to evaluate them

Crypto investor groups can be segmented simply to crypto funds, crypto individuals, and greater retail.

Until recently, the vast majority of crypto funds & crypto individuals either discounted DeFi investments and/or did not know how to evaluate them

8/ It is only recently that "sophisticated investors" have more seriously started thinking about DeFi investments

However, true capital from these groups have yet to spill in. Private/public market valuations are still <10% of where they were in 2018 and capital is conservative

However, true capital from these groups have yet to spill in. Private/public market valuations are still <10% of where they were in 2018 and capital is conservative

9/ Those that focused on DeFi before June 2020 profited handsomely. You didn't even need to have private market access.

The top multibag performers - $SNX, $KNC, $LEND, $RUNE, $BNT barely had any crypto fund investment. Most funds had exited at a loss or never even allocated.

The top multibag performers - $SNX, $KNC, $LEND, $RUNE, $BNT barely had any crypto fund investment. Most funds had exited at a loss or never even allocated.

10/ The rallies we saw with these assets since 2019 were "hated rallies". As in most investors had no exposure and were skeptical. This skepticism is starting to turn and smart money that has been sitting on the sidelines is dipping its toes in, but only slightly

11/ The biggest ball of hot money that has only barely been activated is Asian money

Singaporeans have crushed it and have been miles ahead of everyone else

Koreans really only invest in coins on local exchanges

The early momentum in China is what's really interesting

Singaporeans have crushed it and have been miles ahead of everyone else

Koreans really only invest in coins on local exchanges

The early momentum in China is what's really interesting

12/ Chinese money was long skeptical, completely missed the DeFi gains and they are starting to feel the FOMO.

The players left standing are disciplined, because those that previously FOMO'd easily have blown up.

The players left standing are disciplined, because those that previously FOMO'd easily have blown up.

13/ Long story short, smart money is starting to trickle in, with a lot of peripheral money potentially snowballing in after. And I didn't even get to greater retail.

I will write a separate thread about China investor psychology & market structure because that's its own beast.

I will write a separate thread about China investor psychology & market structure because that's its own beast.

14/ *DeFi HODLER Base*

Most of these DeFi projects saw periods of bottoming in 2019 where weak hand coins turned over to new investors. The investors remaining either are extremely strong hands or understand the high potential of these projects

Most of these DeFi projects saw periods of bottoming in 2019 where weak hand coins turned over to new investors. The investors remaining either are extremely strong hands or understand the high potential of these projects

15/ By now, most of the 2019 DeFi investors are well into the green. That means that while some coins have been sold to profit take, these grassroots investors now have the freedom to let positions ride

16/ Those that researched enough to take positions during altcoin death era understand the high potential here and won't be willing to sell cheap or take a quick flip. This lack of liquidity means that it doesn't take much capital inflows to move prices up.

17/ Another reason why most funds and investors are still under-allocated to DeFi is that they have been trained to wait for the dip by this 2 year market chop.

What ends up happening is that DeFi coins trend up and these investors continue to wait... until they can't anymore

What ends up happening is that DeFi coins trend up and these investors continue to wait... until they can't anymore

18/ **Wealth Effect**

So who buys the coins? Mostly the earlier DeFi investors who are redistributing profits from other positions. Most of the gains don't leave crypto, but go to other projects. This carries the DeFi train forward https://twitter.com/Rewkang/status/1270727048621744128

So who buys the coins? Mostly the earlier DeFi investors who are redistributing profits from other positions. Most of the gains don't leave crypto, but go to other projects. This carries the DeFi train forward https://twitter.com/Rewkang/status/1270727048621744128

19/ **DeFi development**

It's hitting an inflection point. Those that have follow the space know how hard it is to keep up with the new projects even when researching on a full time basis.

But these aren't like old crypto projects - these actually have potential for PMF

It's hitting an inflection point. Those that have follow the space know how hard it is to keep up with the new projects even when researching on a full time basis.

But these aren't like old crypto projects - these actually have potential for PMF

20/ The reason for acceleration is many-fold:

- Higher onchain liquidity

- More/better dev tools

- Success case studies

- More apps to interoperate with & build on top of

- More community members educating others and ideating

- etc

There are network effects to this shit

- Higher onchain liquidity

- More/better dev tools

- Success case studies

- More apps to interoperate with & build on top of

- More community members educating others and ideating

- etc

There are network effects to this shit

21/ And even with all the attention recently, this attention has only occurred within the core crypto community, one that has significantly eroded over the last 2 years of chop and lack of easy gains

True attention comes when non-crypto media & friends start chattering

True attention comes when non-crypto media & friends start chattering

22/ That point may or may not happen, but remember:

Normie FOMO is what turns a 10 bagger into a 100 bagger

Normie FOMO is what turns a 10 bagger into a 100 bagger

23/ Even Chamath Palihapitiya, one of the world's largest bitcoin holders and prominent crypto investor still hasn't heard of DeFi https://twitter.com/vakeraj/status/1275981722291757056

24/ When you are early enough to see a bubble forming, do you jump on, short it, or watch in disbelief?

Imagine exiting a winner after only a 50% gain in this market

https://twitter.com/radixcrypto/status/1279103003442720768?s=21 https://twitter.com/RadixCrypto/status/1279103003442720768

https://twitter.com/radixcrypto/status/1279103003442720768?s=21 https://twitter.com/RadixCrypto/status/1279103003442720768

One of the best quantifiable indicators of market sentiment is futures basis.

The Sept DeFi futures on @FTX_Official are currently in backwardation at a 30-40% annualized discount

Note part of the discount is due to COMP yield being hedged

The Sept DeFi futures on @FTX_Official are currently in backwardation at a 30-40% annualized discount

Note part of the discount is due to COMP yield being hedged

As @CL207 stated, this market indicator is too sober to be considered "overhyped" https://twitter.com/CL207/status/1279341069373542400

I'm not long the DeFi futures because I have plenty of exposure elsewhere, but it would be a lot more attractive if the basket removed $REP and $ZRX which I've recommended to the team

@FTX_Official Futures Basis has come down to 25% discount. When this goes into contango, people are going to be kicking themselves for not getting exposure so cheap

Read on Twitter

Read on Twitter