How large will state and local government revenue shortfalls be in the coming fiscal year? The following thread provides some insights into this question. @stanveuger and I consider this issue in greater detail in our recent NBER Working Paper: https://www.nber.org/papers/w27426

1/21

1/21

At the outset, gauging state and local revenue shortfalls requires two key pieces of information. First, how much revenue do they typically generate? Second, how much do we expect economic activity (which is taxed to generate state and local government revenues) to contract?

2/21

2/21

On point 1, a great resource (with a lag) is the Annual Survey of State and Local Government Finances. In 2017, “General revenue from own sources” (primarily taxes and various charges/fees) totaled $2.4 trillion across state and local governments: https://www.census.gov/programs-surveys/gov-finances.html

3/21

3/21

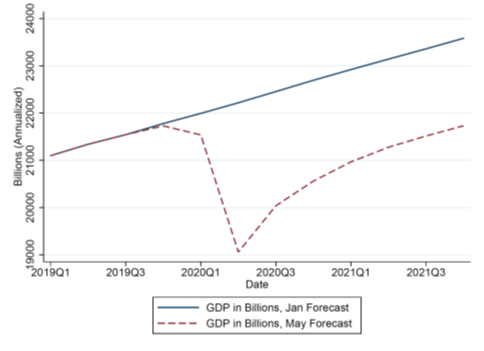

On point 2, we relied on forecasts from the Congressional Budget Office (CBO). In May, CBO revised pre-Covid forecasts that were released in January. The revised forecast is for economic output over the next 4 quarters to be about 9 percent lower than estimated in January.

4/21

4/21

A rough initial estimate based on CBO’s forecasts is that state and local government revenues will be around 9 percent lower over the coming year than one would have thought prior to Covid. That’s around $220 Billion ($2.4T x .09).

5/21

5/21

We can be more precise by thinking about specific tax bases and how sensitive they might to the Covid crisis. E.g., how will income, sales, and property tax revenues compare? Past work indicates that income taxes are highly cyclical while property taxes are more resilient.

6/21

6/21

Let’s first think about income taxes. A best-estimate based on past research is that a 9% decline in economic output may lead to around 14% less income tax revenues. This reflects progressivity: As income contracts, both the base and the average rate decline.

7/21

7/21

Linking CBO’s estimates with past research, @stanveuger and I estimate that state governments will miss out on around $57B in income tax revenues over the next 4 quarters. See pages 9 and 10 of our paper for further discussion of the past work contributing to this estimate.

8/21

8/21

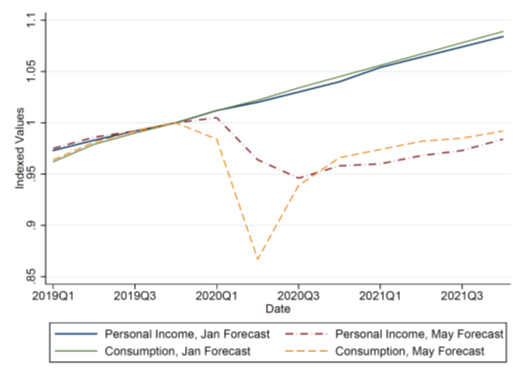

What about sales taxes? An interesting initial point about sales taxes is that consumption declined more dramatically than income in Q2 2020. For the coming year, however, CBO forecasts that both consumption and income will be 9 percent below its earlier forecast.

9/21

9/21

@stanveuger and I estimate that states will realize an aggregate sales tax shortfall of around $47B over the coming year.

States’ experiences may vary significantly because of variation in their sales tax bases. @TaxFoundation has great resources on this.

10/21

States’ experiences may vary significantly because of variation in their sales tax bases. @TaxFoundation has great resources on this.

10/21

One sales tax fact of interest is that sales tax bases are often quite narrow. By one estimate from @TaxFoundation, they cover sales equivalent to just 23 percent of aggregate income nationwide: https://taxfoundation.org/sales-tax-base-broadening/

11/21

11/21

A second sales tax fact of interest is that very few states tax sales of “professional services.” This is relevant because these have been resilient categories of consumption during the pandemic thus far: https://taxfoundation.org/2020-state-business-tax-climate-index/

12/21

12/21

Coming back to our findings, @stanveuger and I estimate a $106B shortfall in state government sales and income tax revenues for the coming year. Additional research is needed to fill out the remainder of the state and local government finance pictures.

13/21

13/21

Fortuitously, additional research is coming together through the efforts of the editorial team at @JournalTax. For the U.S. context, two particularly relevant papers are considering a) local government finances writ large, and b) school district finances.

14/21

14/21

In a paper not yet online, Chernick ( @howard_chernick), Copeland, and Reschovsky consider local governments. Their estimates highlight that local gov’t revenues will be somewhat more resilient than state government revenues. This is due in large part to property taxation.

15/21

15/21

Nationally, local governments get around half of their own-source revenues from property taxes while state governments get roughly 1 percent from property taxes. Property taxes are resilient in part because property values are often assessed with multi-year lags.

16/21

16/21

In a paper already online, Gordon ( @NoraEGordon) and Reber ( @econsarahreber) focus on school districts. School districts are likely to be squeezed more by declines in support from states rather than own-source revenues:

https://static1.squarespace.com/static/59b87c3d2278e7ce6ec3d6a8/t/5efb2fad43a6911561511608/1593520046184/GordonReberNTJ.pdf

17/21

https://static1.squarespace.com/static/59b87c3d2278e7ce6ec3d6a8/t/5efb2fad43a6911561511608/1593520046184/GordonReberNTJ.pdf

17/21

Gordon ( @NoraEGordon) and Reber ( @econsarahreber) highlight that school districts offering hybrid instruction could face additional costs up to $150-$250B: https://ccsso.org/sites/default/files/2020-06/HELPLetterFinal.pdf

18/21

18/21

To wrap up, if Covid-19 suppresses next year’s overall economic activity by around 9 percent, as CBO estimated in May, shortfalls to state and local government revenues are likely to fall in the range of $200B to $250B.

19/21

19/21

Shocks to spending needs may be equally if not more relevant, as highlighted by @NoraEGordon and @econsarahreber. Beyond schools, health spending has of course been impacted directly. Federal relief legislation has included funds targeted directly at some of these needs.

20/21

20/21

In discussions of future federal relief for state and local governments, it will be important to be clear on whether packages of various sizes are targeting the entirety of state and local needs vs. revenue shortfalls vs. specific expenditure needs.

21/21

21/21

Read on Twitter

Read on Twitter