THREAD: Long Renalytix AI (RENX LN)

Similar to GAN, Renalytix is an AIM-to-NASDAQ relisting.

The potential is pretty exciting and based on US-analogues there is plenty of upside.

Similar to GAN, Renalytix is an AIM-to-NASDAQ relisting.

The potential is pretty exciting and based on US-analogues there is plenty of upside.

Renalytix is the developer of the KidneyIntelX diagnostic platform.

It uses a combination of three blood-based biomarkers and data from patients' health records to establish a risk score for the likelihood of worsening kidney disease.

It uses a combination of three blood-based biomarkers and data from patients' health records to establish a risk score for the likelihood of worsening kidney disease.

This is important as if you can find the patients most at risk of progressing to severely impaired kidney function then you can slow that progression with drugs.

This delays the incredibly costly dialysis treatment that would be required.

This delays the incredibly costly dialysis treatment that would be required.

The current standard of care is to test a patient's urine to examine how well the kidneys are filtering the blood.

This is good at telling you who currently has advanced kidney disease, but it does not have great predictive power in telling you who might get it.

This is good at telling you who currently has advanced kidney disease, but it does not have great predictive power in telling you who might get it.

I'll leave you to look into the studies, but KidneyIntelX has been shown to have far greater predictive power in determining which patients are likely to progress to advanced kidney disease.

This leads to significant savings for the healthcare system.

This leads to significant savings for the healthcare system.

As a result, KidneyIntelX has been granted Breakthrough Device Designation by the FDA and will be reimbursed by Medicare at a cost of $950 per test. It will also have private payer coverage.

What is really interesting about Renalytix is that you can get patents for using biomarkers in diagnostic tests.

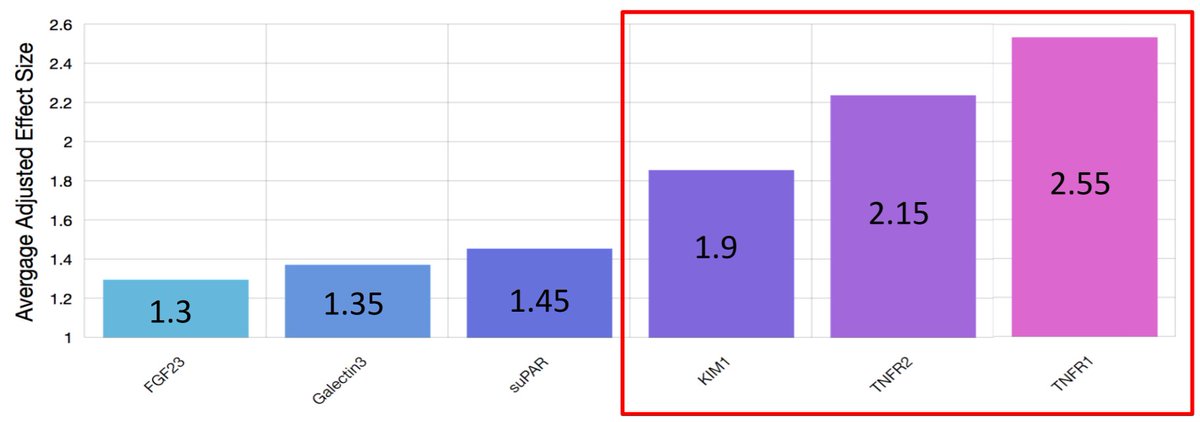

There are three biomarkers that have been shown to be especially effective in predicting advancements in kidney disease. Renalytix uses these three.

There are three biomarkers that have been shown to be especially effective in predicting advancements in kidney disease. Renalytix uses these three.

Thanks to a licensing agreement with Joslin (affiliated with Harvard Medical School), Renalytix has the exclusive right to use the two most effective (TNFR1 and TNFR2) in their platform.

The patents around these biomarkers expire in December 2029.

The patents around these biomarkers expire in December 2029.

KidneyIntelX is also the *only* AI-based (I know, I know) diagnostic platform that has been approved to be used in the US for kidney disease.

The first-mover advantage will create a huge head start in learning from the data before the patents expire.

The first-mover advantage will create a huge head start in learning from the data before the patents expire.

Demonstrating this, an interesting development occurred yesterday.

The University of Michigan agreed to provide Renalytix with an exclusive option to license its patented biomarker uEGF.

The University of Michigan agreed to provide Renalytix with an exclusive option to license its patented biomarker uEGF.

If you're a university or research institute, your choices are to try and monetise your IP yourself or simply license it to the leader in the field in return for a small royalty on their sales.

For obvious reasons most will choose the latter.

For obvious reasons most will choose the latter.

Ok, so what's the potential here?

Well, the test is priced at $950 and Renalytix will initially focus on those with Diabetic Kidney Disease, of which there are almost 13 million sufferers in the US.

You can do the maths on the addressable market.

Well, the test is priced at $950 and Renalytix will initially focus on those with Diabetic Kidney Disease, of which there are almost 13 million sufferers in the US.

You can do the maths on the addressable market.

I believe that this will scale pretty well, although admittedly the cost structure is unknown at this point.

They will process the tests themselves but will partner with health systems to avoid building out a costly sales team.

They will process the tests themselves but will partner with health systems to avoid building out a costly sales team.

(tbh it makes much more sense for an established player to acquire Renalytix and push it through their distribution network and this will happen some day imo)

Renalytix will start monetising KidneyIntelX in Q3 with the Mount Sinai Health System. More systems will follow over time.

Ultimate revenue is anyone's guess but the market cap is currently $390m and Stifel estimate they could achieve this in revenue within five years.

Ultimate revenue is anyone's guess but the market cap is currently $390m and Stifel estimate they could achieve this in revenue within five years.

Management own a lot of shares. The CEO has had a number of successful companies and owns nearly 5% of Renalytix. The CFO owns 3.2% and CTO 1.4%. The Board also have lots of shares.

Mount Sinai, a key partner, owns 15%.

Mount Sinai, a key partner, owns 15%.

As mentioned at the outset, Renalytix intends to list on the NASDAQ and has already filed an F-1.

I expect this to happen in the next few months.

At first they will be dual-listed but I assume they will ultimately have a sole listing and escape the purgatory that is AIM.

I expect this to happen in the next few months.

At first they will be dual-listed but I assume they will ultimately have a sole listing and escape the purgatory that is AIM.

The most obvious analogue is $GH which has an $8bn market cap and does a similar thing in the field of cancer.

They're a few years further along in their journey but the similarities between the two companies are striking.

$GH trades at almost 30x sales.

They're a few years further along in their journey but the similarities between the two companies are striking.

$GH trades at almost 30x sales.

Ultimately I have no idea what Renalytix is worth and it's always a risk buying a pre-revenue company.

But with a near-term catalyst, enormous potential and clear barriers to entry I think it's an intriguing prospect at this price.

But with a near-term catalyst, enormous potential and clear barriers to entry I think it's an intriguing prospect at this price.

This idea came from a smart friend who wishes to remain anonymous.

(but still wants credit...)

/end

(but still wants credit...)

/end

Read on Twitter

Read on Twitter