Because @finplan's 35th annual IBD Elite survey of independent broker-dealers is now live after months of research and preparation, A thread  and a link to the main cover story, What is an IBD? -- https://bit.ly/3dWFURr

and a link to the main cover story, What is an IBD? -- https://bit.ly/3dWFURr

and a link to the main cover story, What is an IBD? -- https://bit.ly/3dWFURr

and a link to the main cover story, What is an IBD? -- https://bit.ly/3dWFURr

Grateful for a team effort: editing @chelsea_emery, @AndrewWelsch, @DinaHampton, tech & design @arizent_co Creative Studio @MeenChoi, survey help Arizent Research, behind-scenes production by @AndrewWShilling, @perkedit and @erikawheless. Amazing cover by Nick Perkins. Thank You.

And our data collaborator, Dr. Craig Israelsen of Utah Valley University @UVU and 7Twelve portfolio, deserves special mention for years of archiving, tracking and presenting the data. I'm not sure you're on Twitter but thank you and always great working with you.

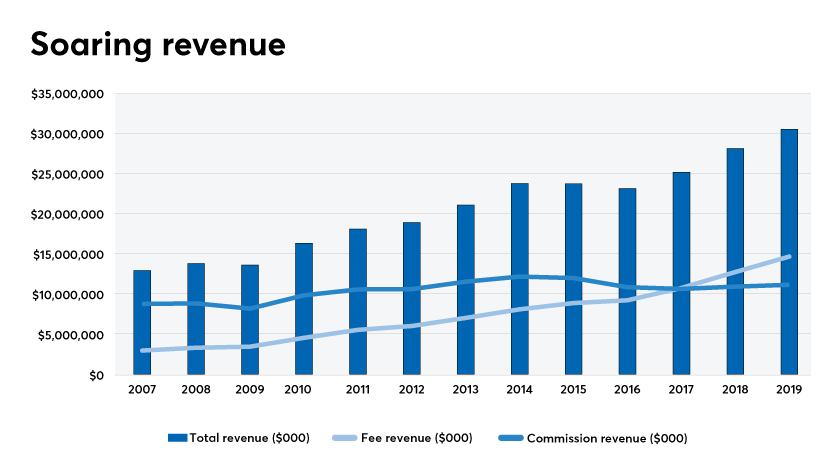

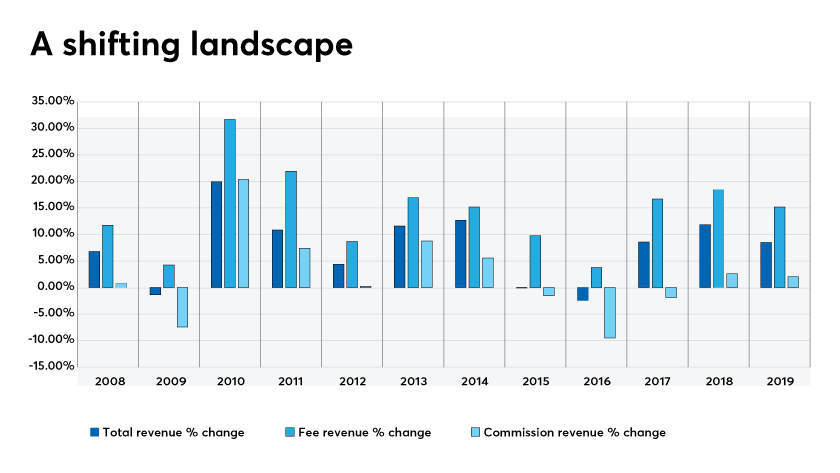

Now for results: Combined annual revenue at the top 50 IBDs has soared by 136% since 2007 to $31.2 billion. In 2019, revenue grew by 9%, down from 12% growth in 2018 but equal to 2017.

Advisory fees keep outpacing commissions by more each year, one of many long term shifts.

Advisory fees keep outpacing commissions by more each year, one of many long term shifts.

What are the other ways IBDs are changing and what is an IBD exactly? Asking financial advisors like @LauraLaTourette about their IBD affiliation elicits industry jargon, a sense of support from the home office and a deeply felt duty to their clients: https://bit.ly/2ZoHbLC

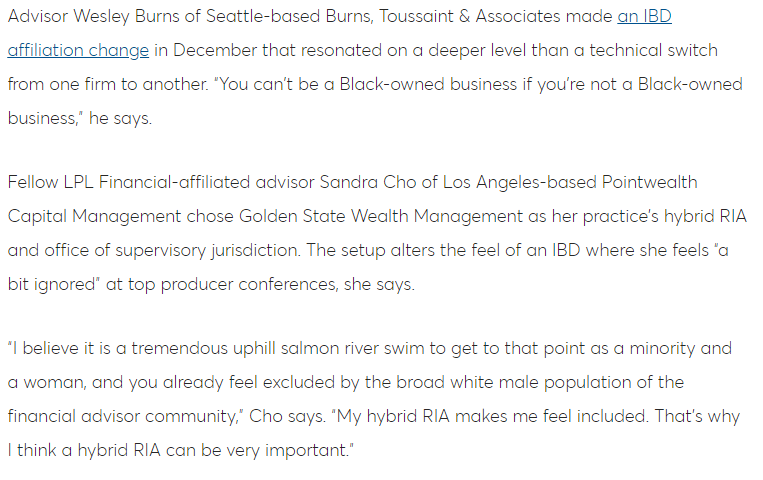

It's much deeper than BD registration and 1099 employment. Wesley Burns of Burns, Toussaint & Associates and Sandra Cho of Pointwealth Capital Management explain the significance of BD/RIA affilation to them as members of underrepresented groups in the financial services.

We also spoke with @amywebber7 of @CambridgeIBD, Jamie Price of @AdvisorGroupBDs, Adam Antoniades of @CeteraFinancial and @JamesPoer of @kestrafinancial. Thank you for engaging with issues important to the advisor community and the future of the industry.

Price's predictions:

Price's predictions:

The coronavirus pandemic adds tragedy, health risks, logistical issues, economic turmoil to the equation. Per @ECHELON_Carolyn of Echelon Partners, it's only going to speed up the consolidation. 9 IBDs with over $1B in revenue have 75% of the sector's business

Which IBDs are leveraging growth and scale? Here are the top 25 firms, including perennial No. 1 firm @LPL: https://bit.ly/3irf2MT

LPL is adopting some approaches of rivals & launching new ideas. @DanHArnold How about an interview? Been too long since we spoke

LPL is adopting some approaches of rivals & launching new ideas. @DanHArnold How about an interview? Been too long since we spoke

The coronavirus also increases the appeal of a strong back office and infrastructure for independent advisors. Here's my podcast interview with @kestrafinancial COO Kris Chester on Kestra's setup, what is an IBD and the value of operational resources now: https://bit.ly/2NMdIWx

Re: support, we asked 50 firms for demographic data on gender and race of advisors. 28 didn't share gender statistics and only 3 disclosed racial figures. As @chelsea_emery writes in Ed View column, it's 'disappointing' to efforts to track progress: https://bit.ly/31yjrY5

But still these firms do disclose a lot of data in a spirit of providing comprehensive information to the marketplace. Another major thank you is due to company spox, PR reps and in-house teams for providing annual revenues and much more in loooong survey: https://bit.ly/3dKQ6Mt

With CFP Board standards and Reg BI now in effect, where are IBDs going? The RIA movement is helping and hurting them: 12 million new non-HNW retail clients between 2012 and 2017 for all RIAs. But the number of BDs plummeted by a third between 2005-2018.

The SEC cited those figures in Reg BI. Why is the sector developing this way? The regulator notes consolidation, regs, robos, low-cost funds, as well as "the nature of the advice and the attendant conflicts of interest."

On regs, the new DOL rule means that the 2020 election is now even more important to clients, advisors and wealth mgmt firms of all types.

How much will retirement advice come up on campaign trail? I bet answer is between zero and very little. https://bit.ly/2BSu4ue

How much will retirement advice come up on campaign trail? I bet answer is between zero and very little. https://bit.ly/2BSu4ue

But to bring it back to the main theme, what does all this mean for wealth management and, again, What is an IBD?

Better question is, what do advisors want them to be? With an older generation retiring in large numbers, the next generation of planners will decide.

THE END

Better question is, what do advisors want them to be? With an older generation retiring in large numbers, the next generation of planners will decide.

THE END

Read on Twitter

Read on Twitter