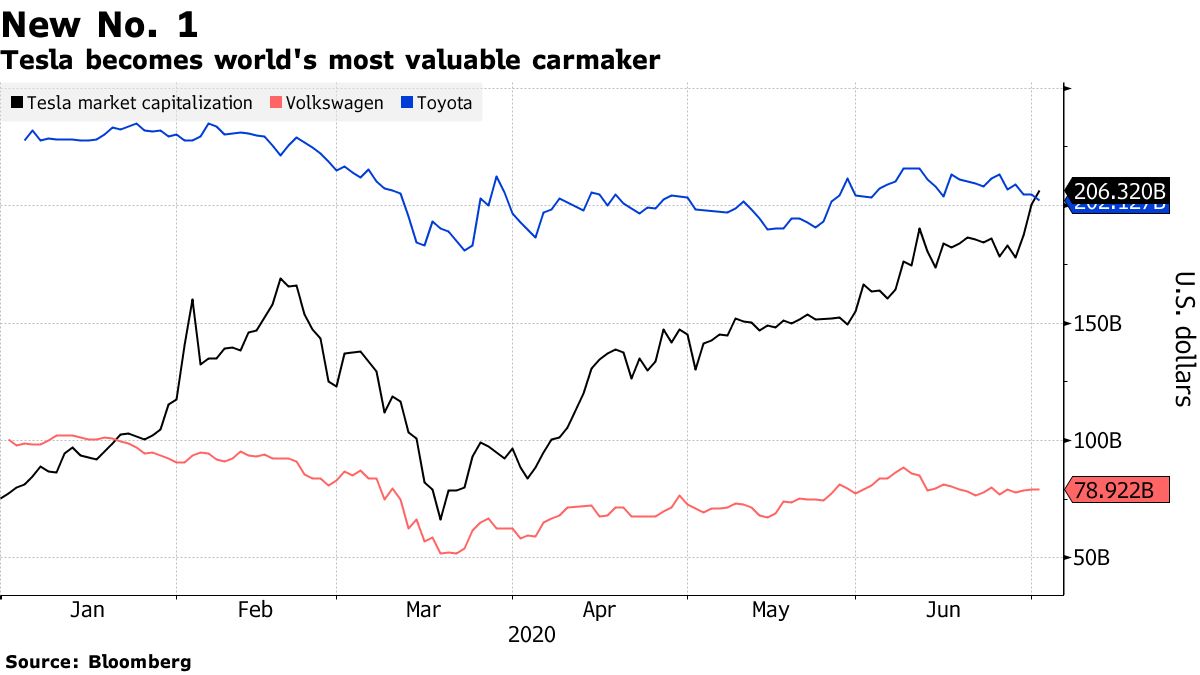

It’s happened: Tesla is now the most valuable automaker in the world.

The 16-year-old Silicon Valley upstart has just overtaken the 82-year-old Toyota https://trib.al/hfygd4m

The 16-year-old Silicon Valley upstart has just overtaken the 82-year-old Toyota https://trib.al/hfygd4m

Tesla has appreciated 170% so far in 2020 -- more than four times the return of the auto industry's 10 largest companies combined.

Tesla is more valuable than No. 3 Volkswagen, which sold 30 times more vehicles than Tesla did last year http://trib.al/hfygd4m

Tesla is more valuable than No. 3 Volkswagen, which sold 30 times more vehicles than Tesla did last year http://trib.al/hfygd4m

This is an existential turning point for the stock market. Climate change and Covid-19 has accelerated the transition to a technology-focused economy driven by:

Online sales

Online sales

Remote engagement

Remote engagement

Artificial intelligence http://trib.al/hfygd4m

Artificial intelligence http://trib.al/hfygd4m

Online sales

Online sales Remote engagement

Remote engagement Artificial intelligence http://trib.al/hfygd4m

Artificial intelligence http://trib.al/hfygd4m

Tesla shares increased more than 400% during the past year as the best performer among the 500 largest U.S. companies for one reason: Growth.

That’s what inspires every bull market and has characterized Tesla since its IPO just over a decade ago http://trib.al/hfygd4m

That’s what inspires every bull market and has characterized Tesla since its IPO just over a decade ago http://trib.al/hfygd4m

Among the 10 largest car makers, Tesla revenue grew 668% during the past five years.

Among the 10 largest car makers, Tesla revenue grew 668% during the past five years.No major company approached that level of growth -- Facebook revenues increased 467% http://trib.al/hfygd4m

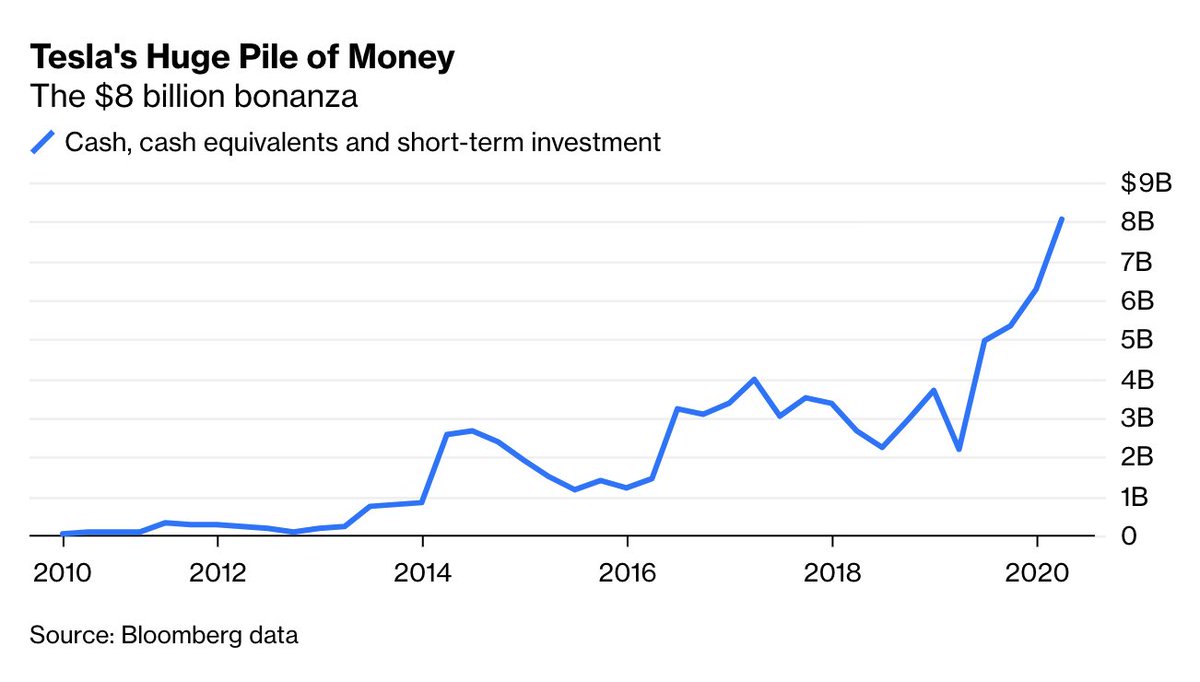

Tesla has been criticized in the past for “burning through cash.”

Yet Elon Musk’s company has more than $8 billion in cash today. That’s almost four times its liquidity from a year ago and five times its cash in 2015 http://trib.al/hfygd4m

Yet Elon Musk’s company has more than $8 billion in cash today. That’s almost four times its liquidity from a year ago and five times its cash in 2015 http://trib.al/hfygd4m

Tesla's cash is rapidly increasing partly because of its growing market share, especially in China, where it is the No. 1 EV manufacturer amid hundreds of competitors.

Now it’s the short sellers who have lost more than $1 billion betting against it http://trib.al/hfygd4m

Now it’s the short sellers who have lost more than $1 billion betting against it http://trib.al/hfygd4m

Yet with bearish analysts, Tesla is in good company:

In 2006, Amazon wasn't favored by 85% of its analysts. Amazon now trades above $2,700, or 86 times the price in 2006 http://trib.al/hfygd4m

In 2006, Amazon wasn't favored by 85% of its analysts. Amazon now trades above $2,700, or 86 times the price in 2006 http://trib.al/hfygd4m

Anyone suggesting Tesla is different to Amazon ought to consider its trajectory:

2017: No. 8 among automakers, and worth $52 billion

2017: No. 8 among automakers, and worth $52 billion

2018: No. 3 with a $57 billion valuation

2018: No. 3 with a $57 billion valuation

July 1st, 2020: No. 1, with a market cap of $209 billion http://trib.al/hfygd4m

July 1st, 2020: No. 1, with a market cap of $209 billion http://trib.al/hfygd4m

2017: No. 8 among automakers, and worth $52 billion

2017: No. 8 among automakers, and worth $52 billion 2018: No. 3 with a $57 billion valuation

2018: No. 3 with a $57 billion valuation July 1st, 2020: No. 1, with a market cap of $209 billion http://trib.al/hfygd4m

July 1st, 2020: No. 1, with a market cap of $209 billion http://trib.al/hfygd4m

The market for electric vehicles is forecast to increase to:

10% of global passenger vehicle sales by 2025

10% of global passenger vehicle sales by 2025

28% in 2030

28% in 2030

58% by 2040

58% by 2040

Meanwhile, Tesla's share of the EV market is increasing, and the future looks bright http://trib.al/hfygd4m

10% of global passenger vehicle sales by 2025

10% of global passenger vehicle sales by 2025 28% in 2030

28% in 2030 58% by 2040

58% by 2040Meanwhile, Tesla's share of the EV market is increasing, and the future looks bright http://trib.al/hfygd4m

Read on Twitter

Read on Twitter