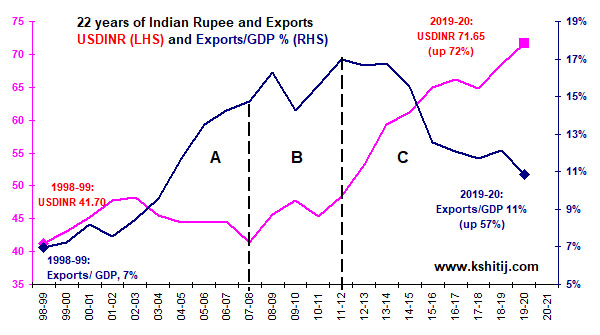

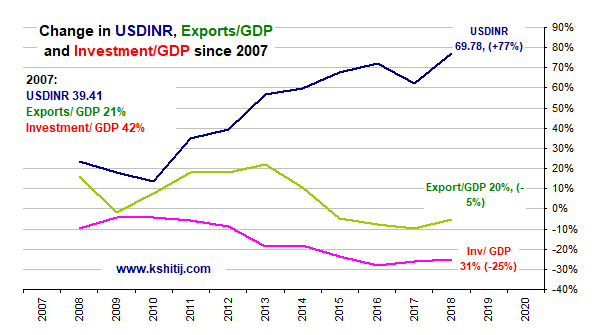

1/13. Data on Exports/GDP and USDINR shows Rupee weakness has not helped to increase Indian exports. Why weaken the Rupee unnecessarily?

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

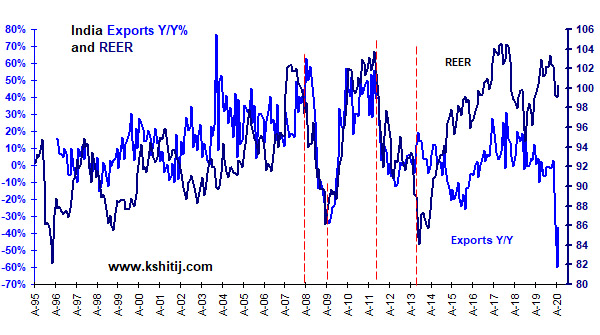

2/13. Also... REER overvaluation does not restrict exports, weak REER does not promote exports. Why weaken the Rupee unnecessarily?

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

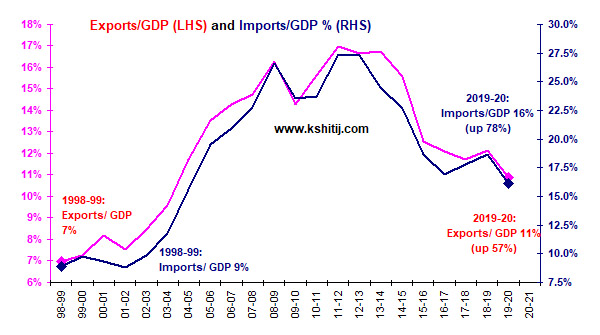

3/13. Exports are correlated with imports, not with Rupee. Why weaken the Rupee unnecessarily?

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

4/13. Crude is a barometer of global trade and GDP growth. Exports and imports rise/ fall with Crude. Why weaken the Rupee unnecessarily?

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

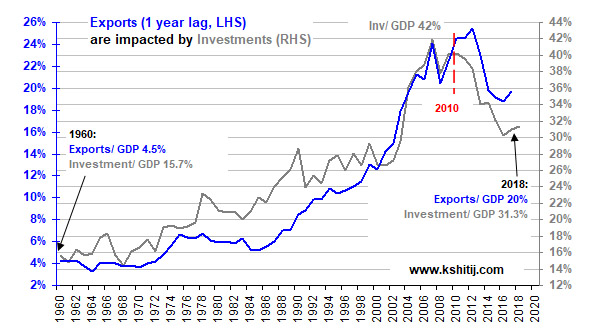

5/13. Exports show close positive relation with Investments. To increase exports, we should increase Investments, not weaken the Rupee.

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

6/13. Since 2007, Rupee down 77%, yet exports down 5%! Also Investments down 25%. Currency weakness is wrong medicine for export weakness. Increase Investments instead.

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish

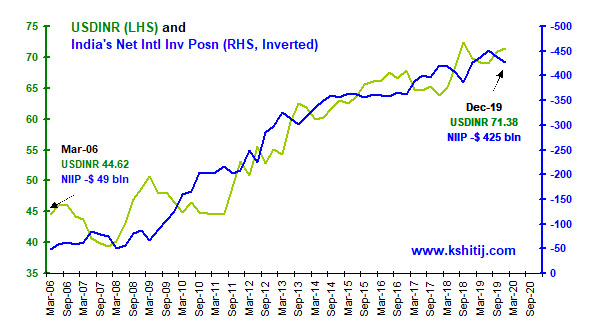

7/13. NIIP will always deteriorate, FX Reserves will never catch up. Buying $ to increase FX Reserves war chest will weaken Rupee forever.

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

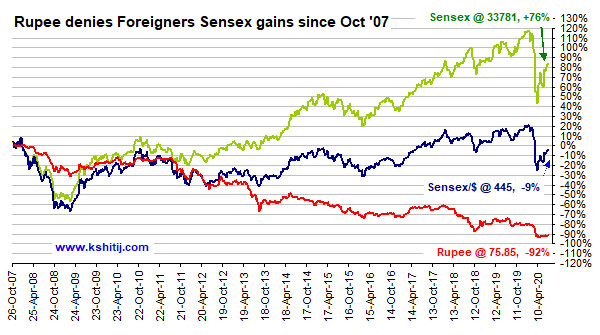

8/13. Rupee weakness eats into $ returns of FPIs. Continued Rupee weakness could repel FDI also, crippling exports. Why weaken the Rupee?

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

9/13. Sensex/USDINR needs remain > 350 to keep long-term bullishness alive and attract FPIs and FDI. Do not weaken Rupee unnecessarily.

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

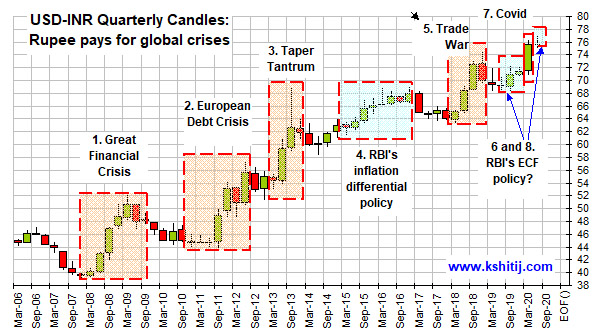

10/13. Since Aug-19 RBI has overriden its own FX policy of “not targeting any level, only smoothening volatility”. Why weaken the market?

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

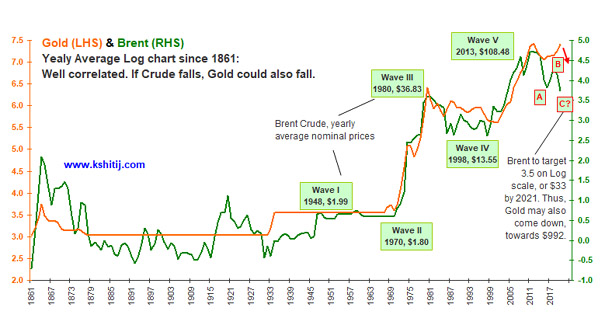

11/13. Gold & Crude can fall, enabling India to attract investments to fuel exports, growth. Rupee weakness can scuttle this opportunity.

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

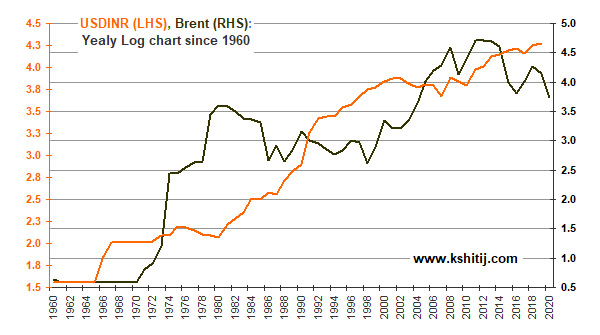

12/13. Lower Crude > lower CAD > stronger Rupee > higher Investments > growth in exports, GDP. Weak Rupee can kill this opportunity.

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

13/13. Post-1947 Rupee-weakness can end now, else weak-Rupee policy risks 172. Can kill investments, exports, growth. No hara-kiri please!

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

https://colourofmoney.kshitij.com/rbi-risk-172/

@DasShaktikanta @RBI @sanjeevsanyal @ananthng @NileshShah68 @chokhani_manish @latha_venkatesh

Read on Twitter

Read on Twitter