THE STRANGE CASE OF THE BARKING DOG

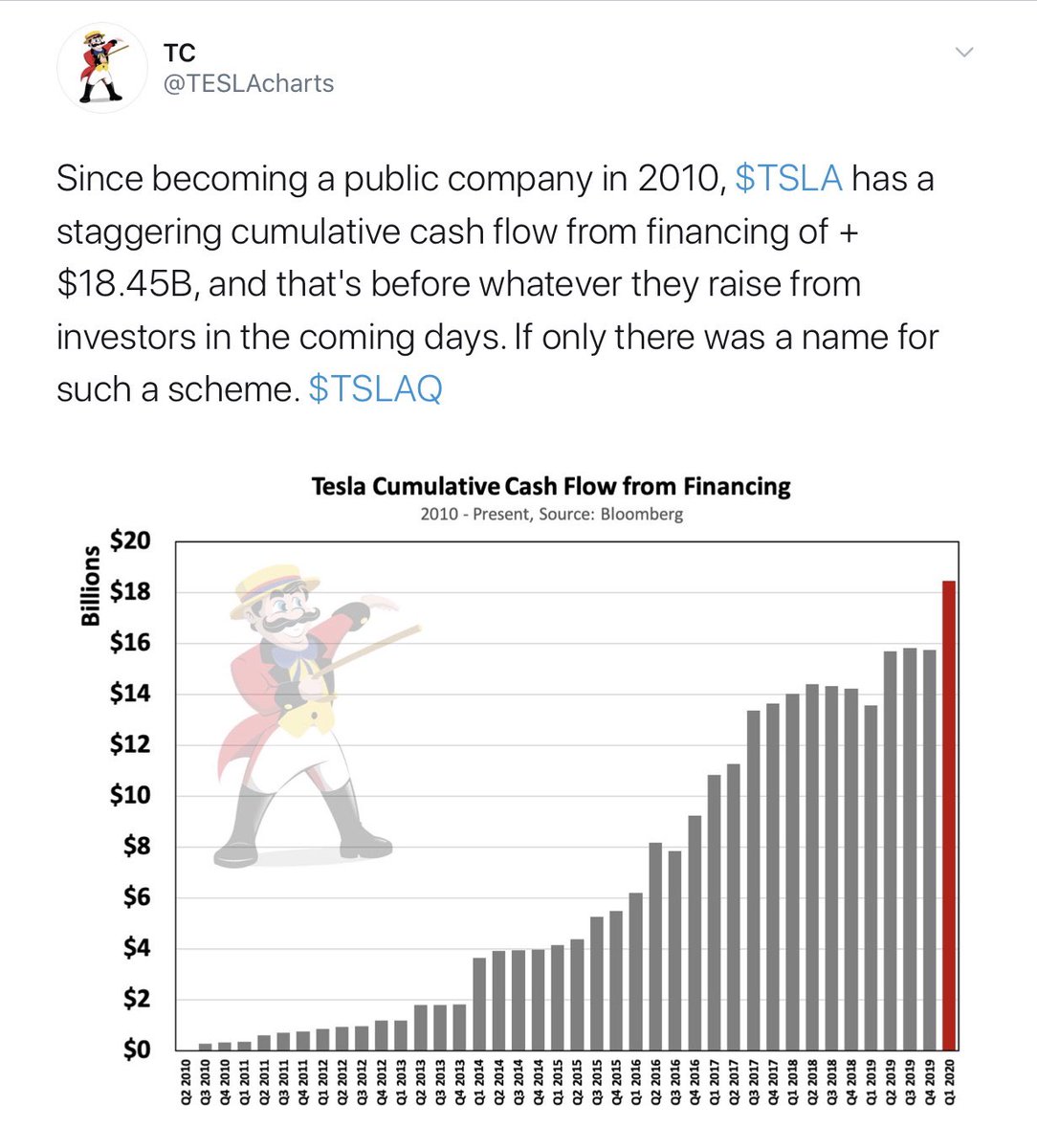

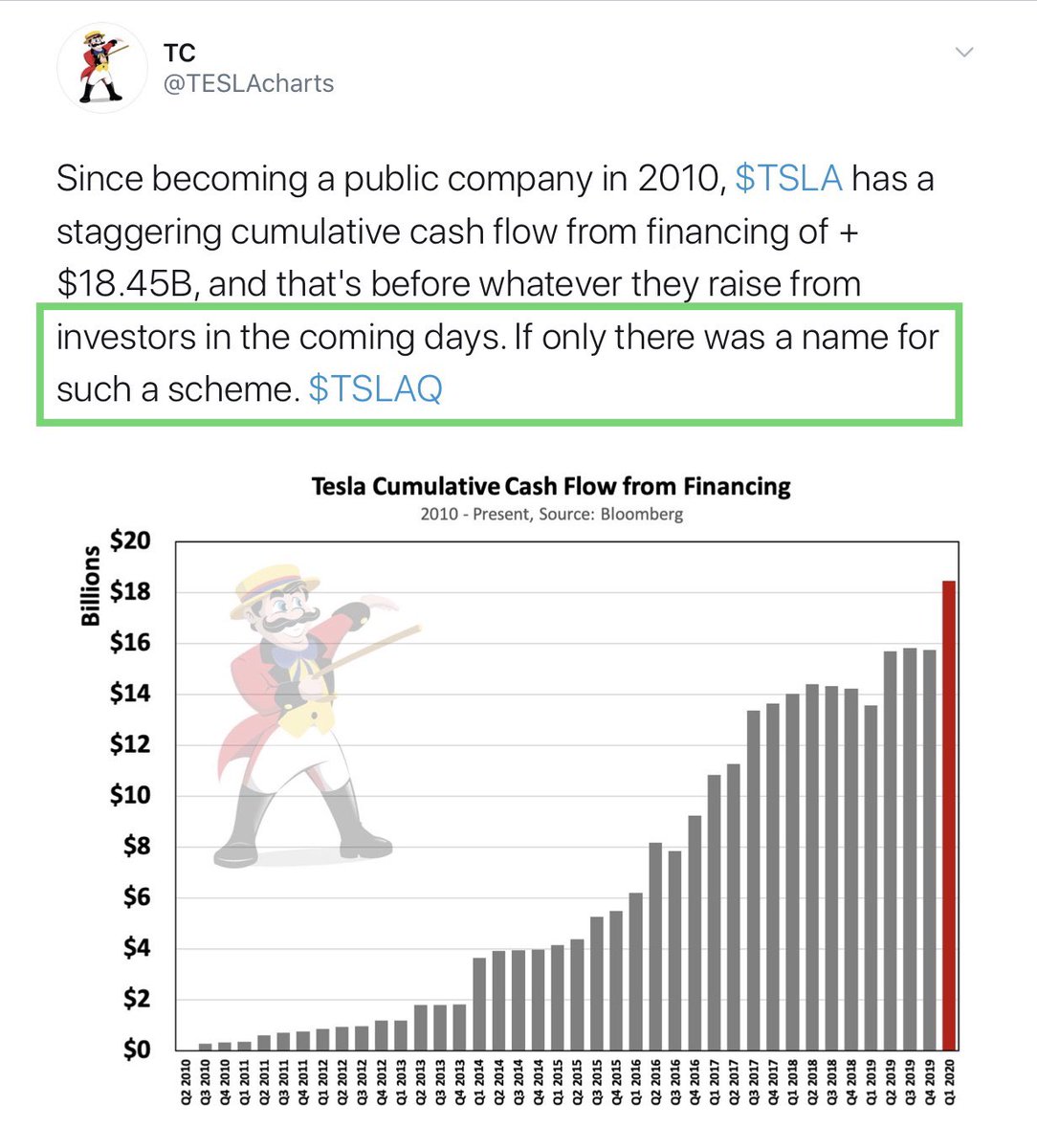

@TESLACharts loves to post images on Twitter that many interpret as attacks on TSLA

But sometimes he is really giving TSLA enormous credit

For example, he says that TSLA has raised Cash from Financing in the amount of $18.45 billion

@TESLACharts loves to post images on Twitter that many interpret as attacks on TSLA

But sometimes he is really giving TSLA enormous credit

For example, he says that TSLA has raised Cash from Financing in the amount of $18.45 billion

Let us assume that he and Bloomberg are correct with that number

- so what has TSLA accomplished by mobilising that $18.45 bn ?

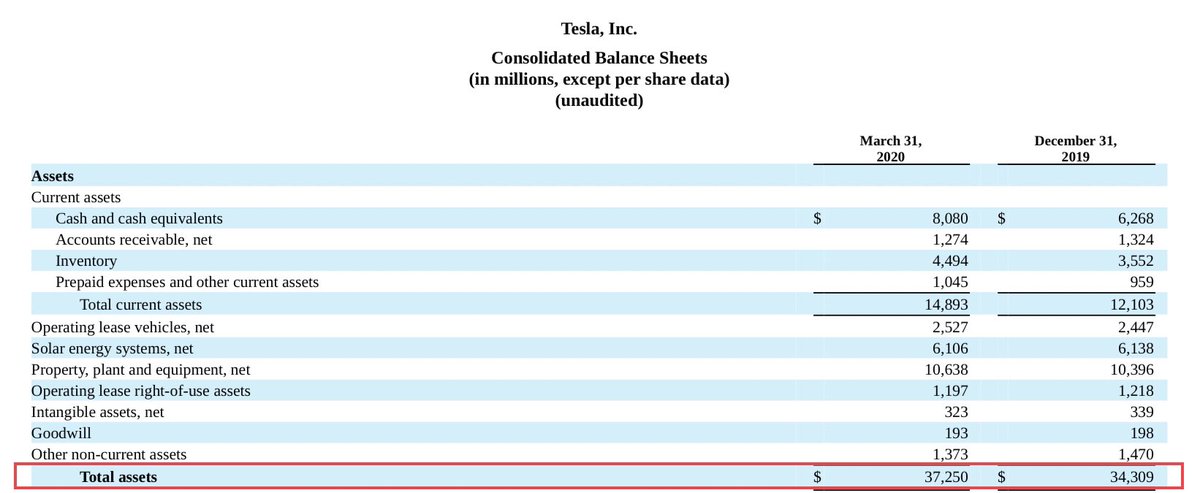

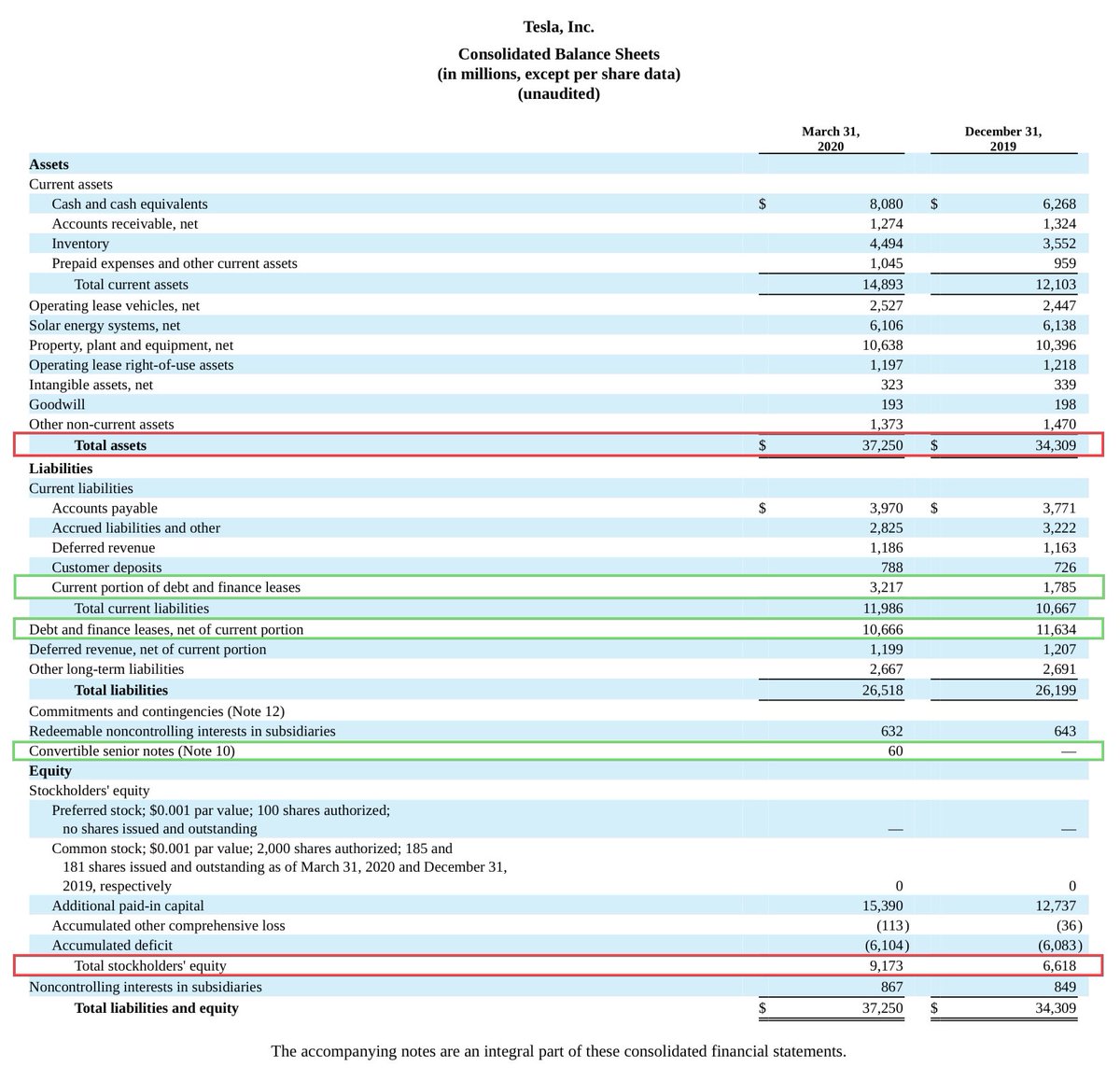

1. TSLA has built a business with $37.25 billion in assets

Which means that the company’s assets are now equal to 2.0x the Cash raised from Financing

- so what has TSLA accomplished by mobilising that $18.45 bn ?

1. TSLA has built a business with $37.25 billion in assets

Which means that the company’s assets are now equal to 2.0x the Cash raised from Financing

2. $8.1 billion of that money is sitting in Cash on the company’s Balance Sheet

3. $10.6 billion of that money is working hard as Property Plant and Equipment, net of depreciation

4. That’s $18.7 billion of the $18.45 billion Cash from Financing showing up right there

3. $10.6 billion of that money is working hard as Property Plant and Equipment, net of depreciation

4. That’s $18.7 billion of the $18.45 billion Cash from Financing showing up right there

5. But the company also has other very real working assets on that Balance Sheet, for example :

- $4.5 billion in Inventory

- $2.5 billion of Operating Lease Vehicles

- $1.3 billion of Accounts Receivable

= $8.3 billion

- $4.5 billion in Inventory

- $2.5 billion of Operating Lease Vehicles

- $1.3 billion of Accounts Receivable

= $8.3 billion

6. And at $0.51 billion there is almost nothing booked to Intangible Assets and Goodwill, unlike many companies with inflated Balance Sheets these days

7. At the same time, $13.94 billion of that $18.45 billion of Cash raised from Financing is clearly recorded as repayable capital in the form of Debt

8. And another $9.17 billion is sitting in the Shareholders Equity account

9. That gives a total of $23.11 billion of Financing

8. And another $9.17 billion is sitting in the Shareholders Equity account

9. That gives a total of $23.11 billion of Financing

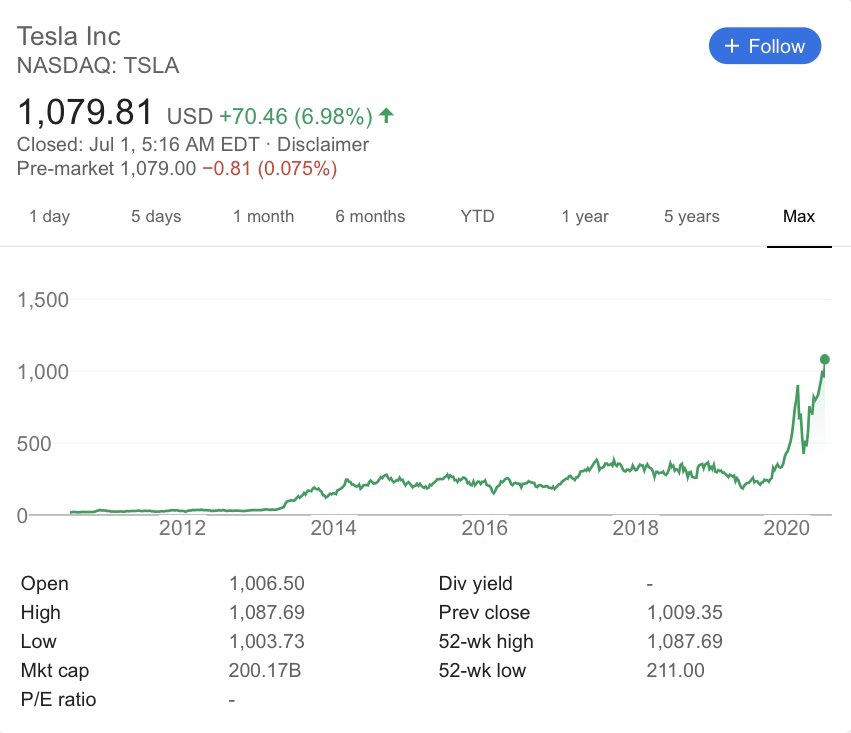

10. And from this $23.11 billion combined total of Debt + Equity the company has created a business that is now recognized to have an Equity Market Capitalization of $200.17 billion

11. Adding the Debt to the market value of the Equity gives Tesla an Enterprise Value of $223.28 billion

12. And so we may say two things clearly :

A. TSLA has transformed $15.93 billion of original Equity capital into $200.17 billion of shareholder value in terms of Market capital

- which is a 12.57x return

A. TSLA has transformed $15.93 billion of original Equity capital into $200.17 billion of shareholder value in terms of Market capital

- which is a 12.57x return

B. TSLA has transformed $23.11 billion of current Book Equity + Debt capital into $223.28 billion of Enterprise Value based on its current Equity Market Capitalization and book value of its Debt

- which is a 9.66x return

- which is a 9.66x return

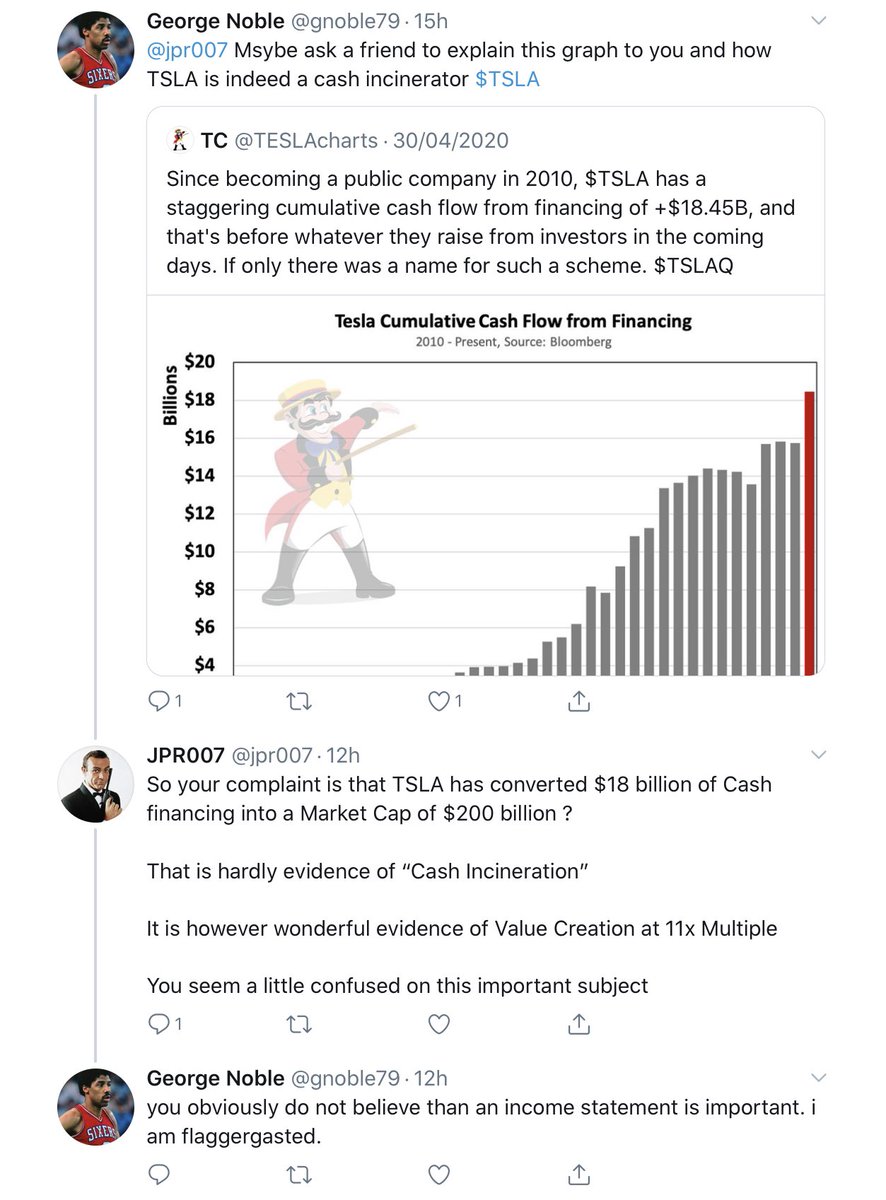

13. @TESLACharts begs ignorance of such things

- which is surprising as he claims to be a Financial Analyst

14. But this is what is normally referred to as “Capitalism”

- which is surprising as he claims to be a Financial Analyst

14. But this is what is normally referred to as “Capitalism”

15. His good friend The Famous Mr George Noble kindly asked for an explanation of this chart, which I have now provided

- he apparently believes that this chart is some kind of evidence of Cash Incineration

- which is not in fact the case

- he apparently believes that this chart is some kind of evidence of Cash Incineration

- which is not in fact the case

16. But Dear George does seem rather confused between Cash Flow Statements, Income Statements, and Balance Sheets

- and so by association we may assume that the same is true for @TESLACharts

- and so by association we may assume that the same is true for @TESLACharts

Read on Twitter

Read on Twitter