Relaxo Footwear has simply refused to relax!

A quick look at what #RELAXO has achieved over the years and what could be in store.

#JourneyOfAMultibagger

A quick look at what #RELAXO has achieved over the years and what could be in store.

#JourneyOfAMultibagger

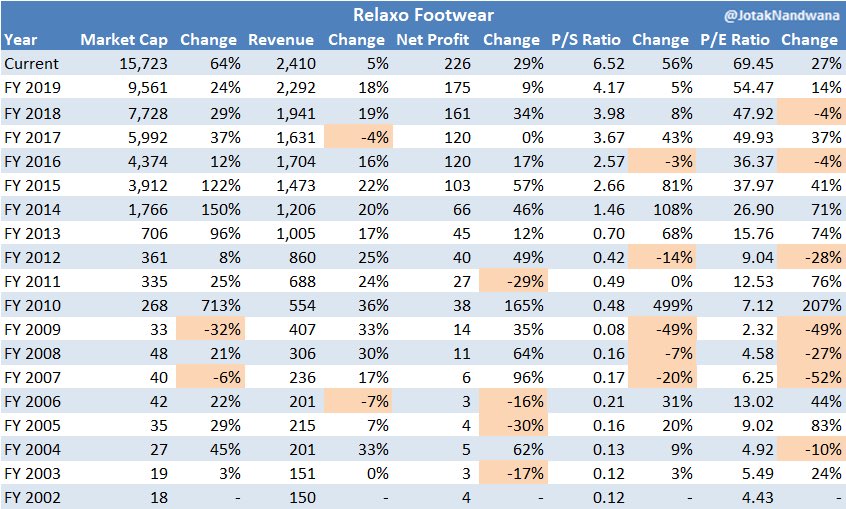

Since 2002, there has been only two fiscal years in which the company’s market cap declined.

Quite astonishing, considering P/E multiple contracted on seven occasions. That’s the power of earnings growth!

FY2002 net income was INR 4 cr, and by FY2020 it galloped to INR 226 cr

Quite astonishing, considering P/E multiple contracted on seven occasions. That’s the power of earnings growth!

FY2002 net income was INR 4 cr, and by FY2020 it galloped to INR 226 cr

It has gone up an astounding 873x in last 18 years, a CAGR of 45.7%. Of that 55.7x came from earnings growth while 15.7x was due to P/E multiple expansion.

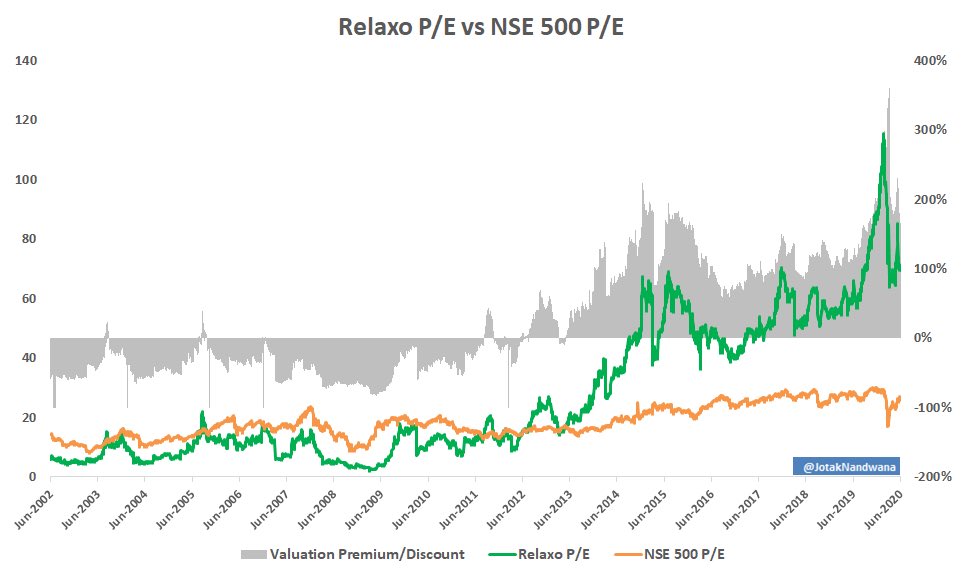

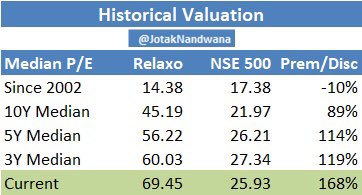

Over the last 10 years, the stock has mostly traded at a premium when compared with NSE 500 P/E multiple.

Read on Twitter

Read on Twitter